The US November CPI showed a superficial cooling, but Barclays and Morgan Stanley warned that the data was distorted by technical factors such as Black Friday promotions, missing rent components, and 'carryover effects,' potentially underestimating the actual figures. Wall Street believes the data is insufficient to trigger an immediate shift in the Fed's policy stance, with the probability of a January rate cut being extremely low. Attention remains on December employment and inflation data, maintaining expectations for rate cuts in March and June 2026.

Although the US November CPI data showed a further cooling of inflation, major Wall Street investment banks warned that the data was significantly affected by technical distortions and statistical biases, making it difficult to accurately reflect price trends. Analysts at institutions including Barclays and Morgan Stanley believe that this 'noisy' report is insufficient to drive the Federal Reserve to alter its policy stance in the short term.

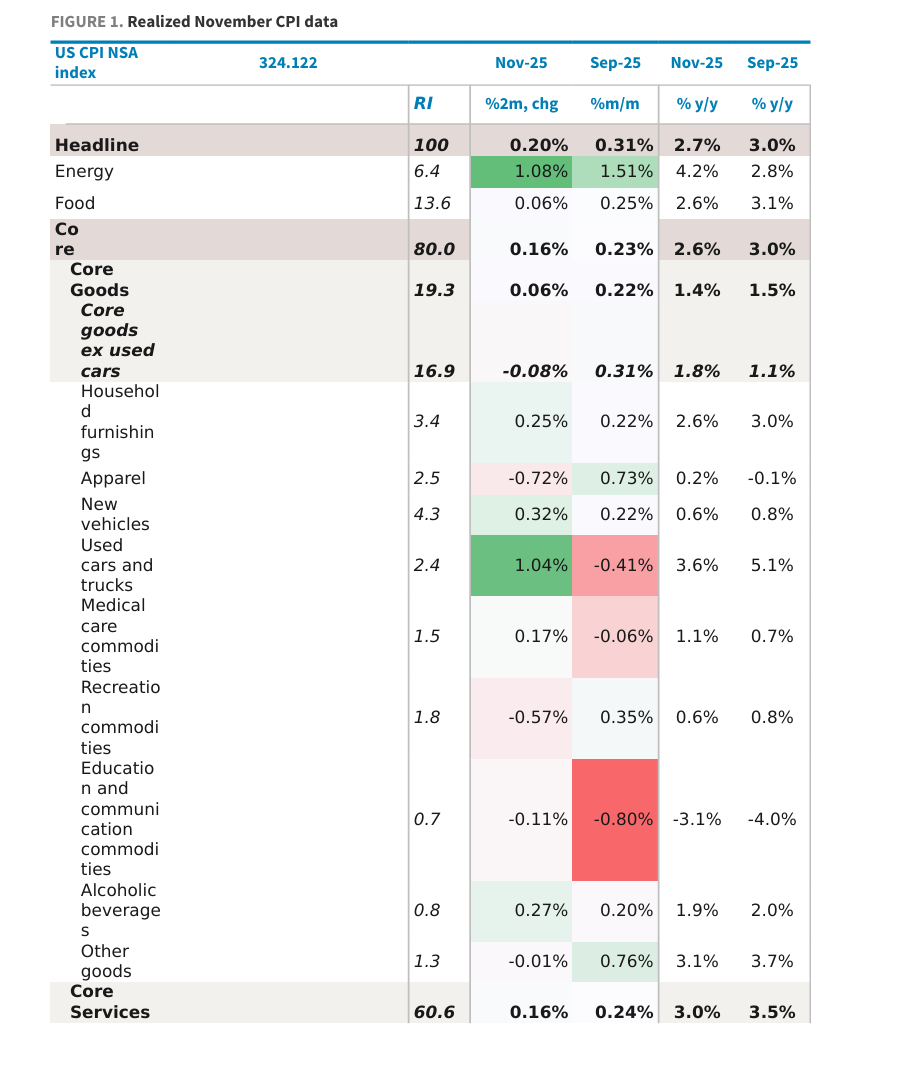

According to Storm Chasing Trading Desk, the core CPI for November in the US recorded growth of only 0.16% (based on bimonthly changes from September to November), with the year-on-year growth rate dropping to 2.6%, significantly below market expectations of 3.0%. Data from Michael T Gapen's team at Morgan Stanley also showed that the average monthly increase in core CPI for October and November was just 0.08%, far lower than the previous expectation of 0.28%.

Despite the weak headline figures, analysts believe that the timing of data collection and the method used to handle missing data artificially depressed inflation numbers. Estimates from Pooja Sriram’s team at Barclays suggest that due to price collection concentrated during the Black Friday promotional period, combined with issues in the calculation methodology for housing rent data, the actual reading of November’s core CPI may have been subject to a downward bias of approximately 20-25 basis points.

Despite the weak headline figures, analysts believe that the timing of data collection and the method used to handle missing data artificially depressed inflation numbers. Estimates from Pooja Sriram’s team at Barclays suggest that due to price collection concentrated during the Black Friday promotional period, combined with issues in the calculation methodology for housing rent data, the actual reading of November’s core CPI may have been subject to a downward bias of approximately 20-25 basis points.

Given the various measurement issues in the data, Wall Street generally believes that the Federal Reserve will not overreact to it. Barclays noted that the threshold for the Federal Open Market Committee (FOMC) to change its policy consensus remains high, and policymakers will focus more on the upcoming employment and inflation data for December rather than this distorted report. The bank maintains its forecast that the Fed will cut interest rates in March and June 2026, considering a rate cut in January highly unlikely.

Data Distortion and Downward Bias

The biggest controversy surrounding this CPI report lies in the technical interference during the data collection and processing process. Morgan Stanley stated outright in its report that this was a 'noisy' dataset, pointing out that the Bureau of Labor Statistics (BLS) may have applied a 'carry forward' approach to handle some missing data categories, effectively assuming a 0% inflation rate, which led to an unexpectedly low reading.

Barclays further dissected the two core factors contributing to the bias. First is the issue of timing in price collection. The report noted that due to specific constraints, price collection was limited to the second half of November, coinciding with the Black Friday promotional period. Historical data indicates that import prices during the promotional period are typically about 1% lower than in the first half of the month. Barclays estimated that this alone could lead to an underestimation of core CPI by 10-15 basis points.

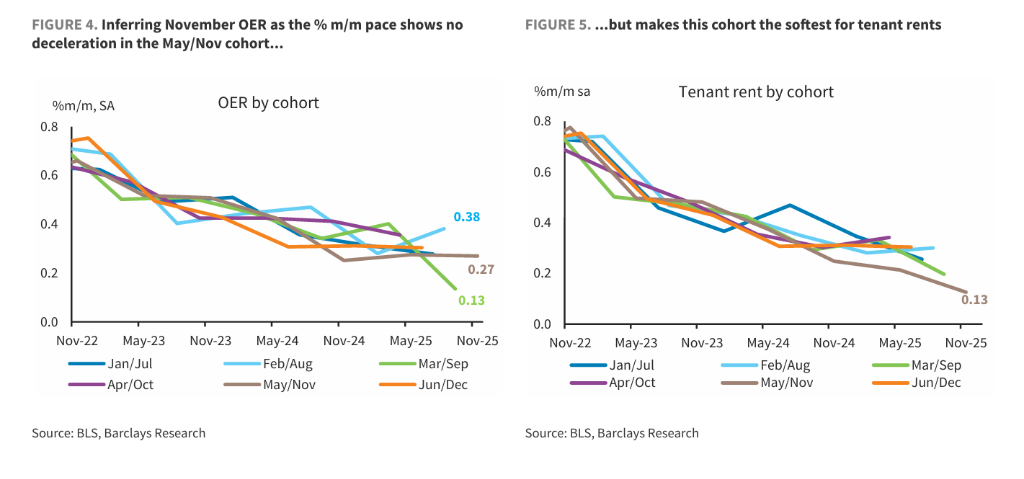

The second issue is the lack of rental data. Due to the absence of rental and Owners’ Equivalent Rent (OER) data for October, the statistics bureau might have assumed zero growth in rents during calculations. This statistical 'gap-filling' caused distortion in bimonthly data comparisons and may continue to affect data calculations up until April 2026.

Doubts Over Weakness in Housing and Services

Sub-item data revealed that the sharp drop in housing and services inflation was key to lowering the overall figures, but the authenticity of this trend has been questioned. According to Morgan Stanley, core services inflation was significantly lower than expected, primarily dragged down by extremely weak readings in primary residential rents and OER.

According to Barclays' data, rents in the report rose by only 0.13%, while OER increased by 0.27% (bi-monthly growth). This implies that the average monthly rent increase for October and November was merely 6 basis points. Analysts expressed significant skepticism, stating that even considering the cooling trend in market rents, this figure is notably below a reasonable level, further confirming the view that the statistical methodology has a downward bias.

Moreover, core services excluding housing also showed weakness. Airline ticket prices fell sharply by 6.6% over two months, while health insurance services dropped by 2.9%. Morgan Stanley pointed out that if this deceleration in health insurance CPI persists, it could imply downside pressure of more than 1 basis point per month on this component before April next year.

The policy threshold was not triggered.

Although the inflation data seemingly provided justification for rate cuts, Wall Street analysts warned investors against overinterpreting the figures. Barclays adopted a cautious stance, arguing that due to numerous measurement issues, the report fails to offer a clear signal on the inflation trajectory for the FOMC.

In its research note, Barclays emphasized that the threshold for a rate cut at the Federal Reserve’s January 28 meeting remains high. Swing voters on the committee will look to the December employment and inflation data, scheduled for release in January, to obtain more reliable economic signals.

Based on an assessment of “data noise,” Barclays maintained its baseline forecast unchanged, expecting the Federal Reserve to implement two rate cuts in 2026, in March and June, followed by stable rates until the end of 2027. Morgan Stanley, while lowering its short-term inflation forecast, similarly cautioned that if technical factors were the primary cause of the current softness, December’s inflation data might show a re-acceleration.

Editor/Doris