![]() There's a surprise for options beginners at the end of the article!

There's a surprise for options beginners at the end of the article!

I. Overview of U.S. Stock Index Options

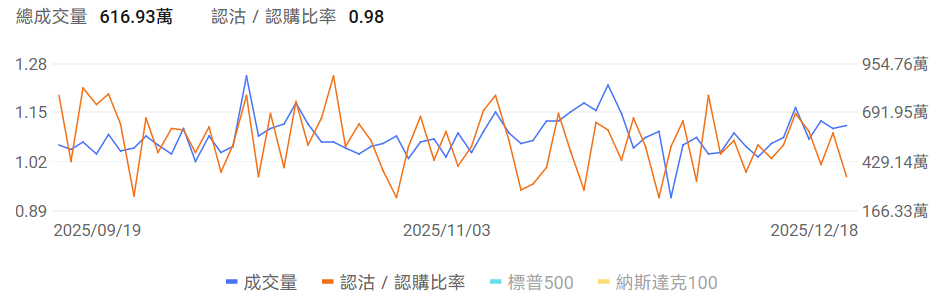

The trading volume in the U.S. stock index options market is currently on the rise, while the put/call ratio is declining.

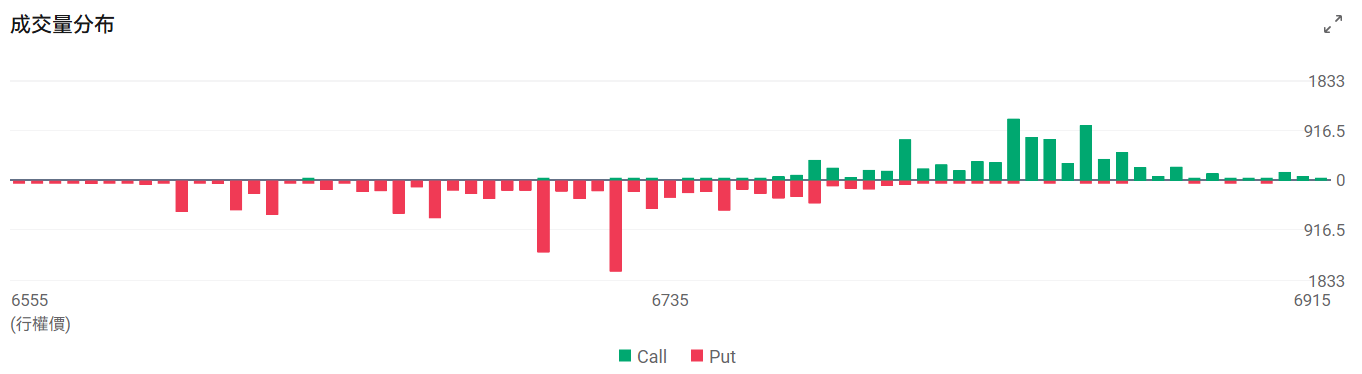

Options expiring today: $S&P 500 Index (.SPX.US)$ Option volume distribution: Discrepancy exists between Call and Put distributions, with the Put peak at 6720 points and the Call peak at 6830 points.

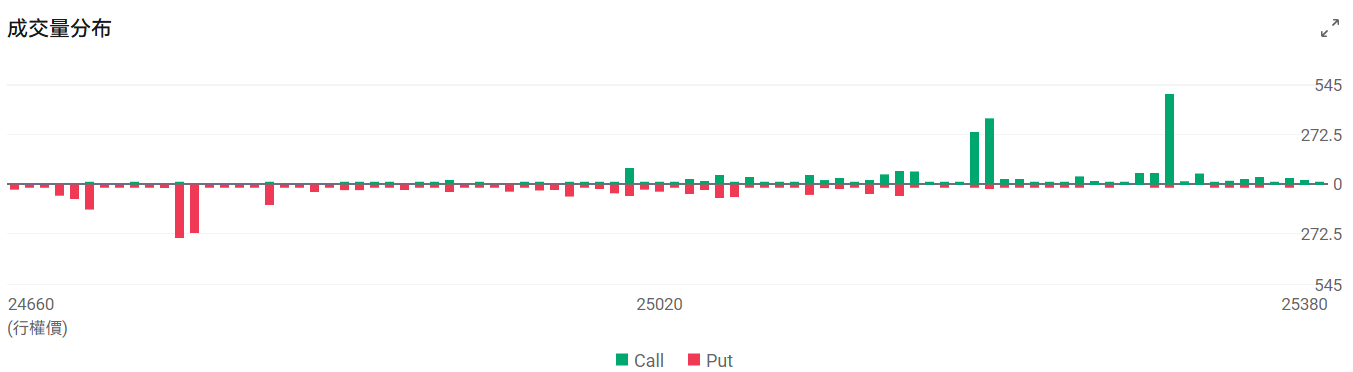

Options expiring today: $NASDAQ 100 Index (.NDX.US)$ Option volume distribution: The Call peak is at 25300, while the Put peak is at 24750 points.

Options expiring today: $NASDAQ 100 Index (.NDX.US)$ Option volume distribution: The Call peak is at 25300, while the Put peak is at 24750 points.

2. US Stock Options Trading Leaders

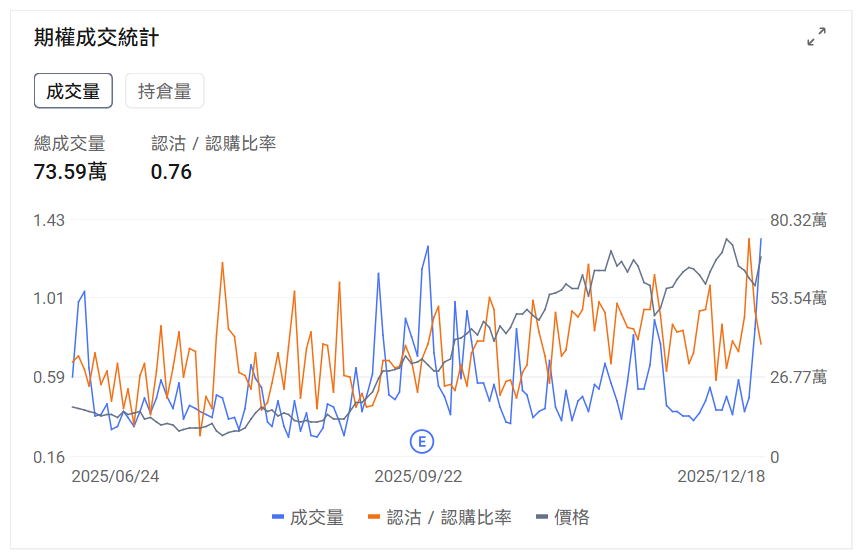

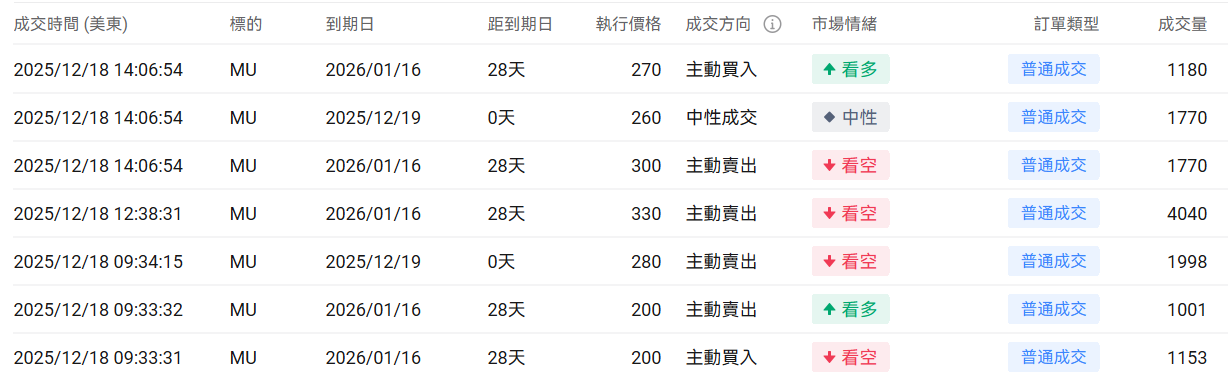

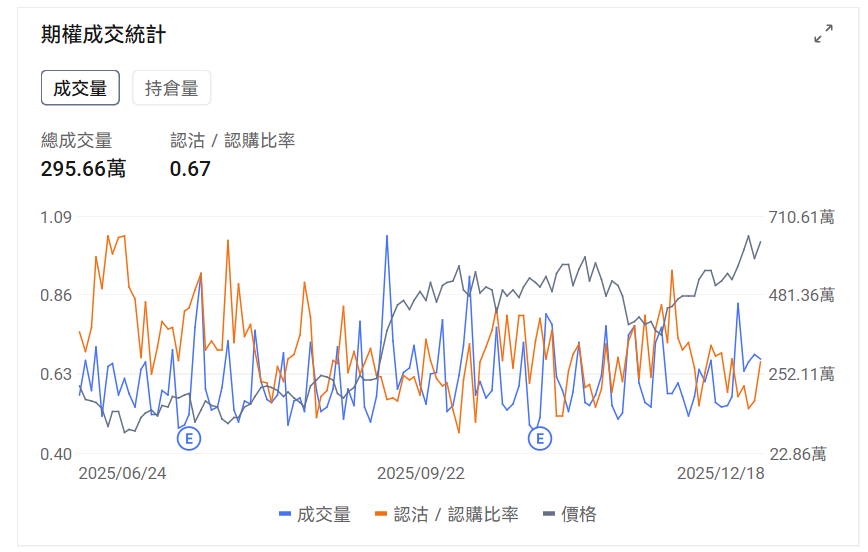

1、 $Micron Technology (MU.US)$ The previous trading day saw a rise of 10.21%, with the Put/Call ratio declining the day before and trading volume increasing.

Observing this week's CALL orders, multiple positions have doubled in gains.

Observing unusual large option trades, major investors showed balanced long-short positioning near the market close.

2、 $Tesla (TSLA.US)$ The previous trading day saw a rise of 3.45%, with the Put/Call ratio increasing the day before and trading volume remaining flat.

Observing this week's CALL orders, multiple positions have doubled in gains.

Observing unusual large option trades, major investors were predominantly bearish near the market close.

Top 10 Most Actively Traded US Stock Options

Top 10 most volatile US stock options (underlying market cap > USD 10 billion and options trading volume > 100,000 contracts)

3. US ETF Options Trading Volume Rankings

Top 10 US ETF options by trading volume

Top 10 US Equity ETFs by Implied Volatility (Criteria: Market Cap > USD 10 billion)

![]() Finally, Futu News brings a small benefit to fellow investors. Fellow investors are welcome to claim it.Beginner's Guide to Options

Finally, Futu News brings a small benefit to fellow investors. Fellow investors are welcome to claim it.Beginner's Guide to Options

This event is exclusively available to HK invited users. Click to learn more.Detailed rules of the event >>

![]() Market conditions are complex and volatile,Options StrategyOverwhelmed by numerous options and unsure how to choose? Futubull helps you build a portfolio in three simple steps,Options Strategymaking investing simple and efficient from now on!

Market conditions are complex and volatile,Options StrategyOverwhelmed by numerous options and unsure how to choose? Futubull helps you build a portfolio in three simple steps,Options Strategymaking investing simple and efficient from now on!

Risk Factors

An option is a contract that grants the holder the right, but not the obligation, to buy or sell an asset at a fixed price on a specific date or at any time before that date. The price of an option is influenced by various factors, including the current price of the underlying asset, the strike price, the time to expiration, andImplied Volatility。

Implied VolatilityIt reflects the market's expectation of volatility in options over a certain period. This data is derived inversely from the BS option pricing model and is generally regarded as an indicator of market sentiment. When investors anticipate greater volatility, they may be more willing to pay higher prices for options to hedge risks, thereby leading to a higherImplied Volatility。

Traders and investors useImplied Volatilityto evaluateoption pricethe attractiveness, identify potential mispricing, and manage risk exposure.

Disclaimer

This content does not constitute any offer, solicitation, recommendation, opinion, or guarantee regarding securities, financial products, or tools. The risk of loss in trading options can be substantial. Under certain circumstances, the losses you incur may exceed the initial margin amount deposited. Even if you set contingency orders, such as “stop-loss” or “limit” orders, they may not prevent losses. Market conditions may make it impossible to execute such orders. You may be required to deposit additional margin within a short period. If you fail to provide the required amount within the specified time, your open positions may be liquidated. Nevertheless, you will remain responsible for any shortfall in your account resulting from such liquidation. Therefore, before engaging in trading, you should thoroughly study and understand options and carefully consider whether such trading is suitable for you based on your financial situation and investment objectives. If you trade options, you should be familiar with the procedures for exercising options and the rights and obligations associated with exercising options and their expiration.

Editor/Lee