Top News

Before the market opened on Friday, the three major futures indexes rose collectively, with the Dow Jones futures up 0.01%, Nasdaq futures rising 0.28%, and S&P 500 futures gaining 0.16%.

$明星科技股(LIST2518.US)$ Most stocks rose before the market opened, $Oracle (ORCL.US)$ surging over 4%, $Micron Technology (MU.US)$ Up more than 1%,$Tesla (TSLA.US)$ 、 $Advanced Micro Devices (AMD.US)$ 、 $NVIDIA (NVDA.US)$ rising nearly 1%.

$热门中概股(LIST2517.US)$ Pre-market trading higher, $PDD Holdings (PDD.US)$ rose nearly 8%. $XPeng Motors (XPEV.US)$ up over 5%, $Pony AI (PONY.US)$、 $Li Auto(LI.US)$ Up more than 2%,$Alibaba(BABA.US)$ 、 $Baidu(BIDU.US)$ 、 $Nio (NIO.US)$ Surged over 1%.

$加密货币概念股(LIST20010.US)$ Gains were widespread in pre-market trading. $Bitmine Immersion Technologies(BMNR.US)$rose more than 6%, $Strategy(MSTR.US)$ 、 $IREN Ltd(IREN.US)$ with a rise of over 3%, $Coinbase(COIN.US)$ 、 $Robinhood(HOOD.US)$ 、 $Circle(CRCL.US)$ Rose more than 2%.

$加密货币概念股(LIST20010.US)$ Gains were widespread in pre-market trading. $Bitmine Immersion Technologies(BMNR.US)$rose more than 6%, $Strategy(MSTR.US)$ 、 $IREN Ltd(IREN.US)$ with a rise of over 3%, $Coinbase(COIN.US)$ 、 $Robinhood(HOOD.US)$ 、 $Circle(CRCL.US)$ Rose more than 2%.

$NVIDIA Portfolio Concept (LIST20882.US)$ Pre-market trading higher, $CoreWeave(CRWV.US)$ rising nearly 5%, $Applied Digital(APLD.US)$ with a rise of over 3%, $NEBIUS(NBIS.US)$ with gains nearing 3%.

$太空概念(LIST2556.US)$ Gains in pre-market trading, $AST SpaceMobile(ASTS.US)$ 、 $EchoStar Communications (SATS.US)$ with a rise of over 3%, $Rocket Lab(RKLB.US)$ 、 $Planet Labs PBC(PL.US)$ Rose more than 2%.

Tech giants collectively respond! Microsoft, Google, and 24 other companies join the U.S. 'Genesis' AI initiative.

According to reports, 24 leading artificial intelligence (AI) companies have signed agreements to join the "Genesis Initiative" launched by the U.S. federal government. This effort, driven by the Trump administration, aims to accelerate the practical application of emerging AI technologies in scientific exploration and energy projects. A White House statement revealed that OpenAI, $Microsoft(MSFT.US)$ 、 $NVIDIA (NVDA.US)$ 、 $Amazon(AMZN.US)$ AWS, and Google (GOOGL.US) have all taken substantive actions: some have signed memorandums of understanding with the government, others are collaborating with the Department of Energy or national laboratories, and additional companies have explicitly expressed their intent to participate.

Altman: Computing power is the biggest bottleneck for revenue; if computing power doubles, revenue will double as well.

In a recent one-on-one interview on the "Big Technology Podcast," OpenAI's CEO Sam Altman systematically addressed the most pressing questions from the public across three dimensions: business, product, and infrastructure. Altman frankly stated that OpenAI is still in a "compute-constrained" state — where computing power is not a cost burden but a hard constraint determining whether demand can be converted into revenue. "If computing power doubles, revenue would nearly double as well," he remarked. In his view, the true focus of competition has shifted from model parameter contests to who can first establish sufficiently robust computing power and platforms.

Oracle shares rose in pre-market trading as details of TikTok's U.S. solution were unveiled, with Michigan approving its data center power supply plan.

$Oracle (ORCL.US)$ Shares surged over 4% in pre-market trading after the company received approval, alongside OpenAI, for the power supply of their data center in Michigan. Additionally, it was reported that TikTok’s parent company, ByteDance, signed an agreement with three investors, including Oracle, to form a U.S.-based joint venture to continue operating TikTok's business in the United States.

Nike's Q2 net profit fell by more than 30%, with continued pressure on its Greater China operations.

Nike (NKE.US) Shares dropped over 10% in pre-market trading after the company released its fiscal 2026 second-quarter results. Net sales amounted to $12.43 billion, up 1% year-over-year, surpassing market expectations of $12.22 billion. Net profit declined 32% year-over-year to $792 million, with earnings per share at 53 cents, also exceeding market expectations of 38 cents. Gross margin decreased by 3% to 40.6%, primarily due to increased tariffs in North America. Revenue in Greater China fell 17% year-over-year to $1.7 billion, with EBIT shrinking significantly by 49% during the period.

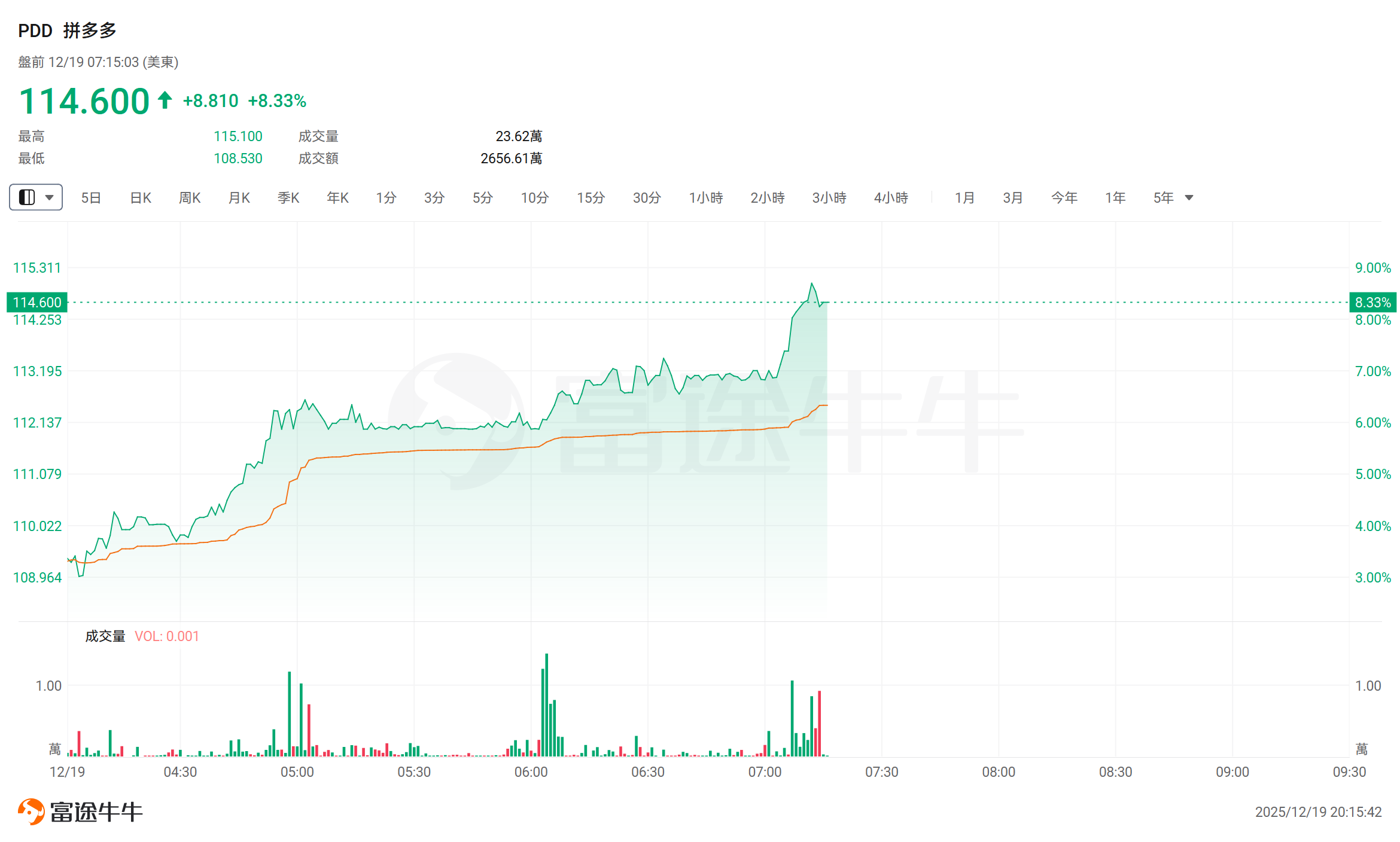

PDD Holdings shares surged in pre-market trading after announcing an upgrade to its governance structure, implementing a co-chairman system.

$PDD Holdings (PDD.US)$ Shares rose over 8% in pre-market trading after the group’s annual general meeting announced an upgrade to its governance structure, adopting a co-chairman system. With board approval, Zhao Jiazhen was appointed as co-chairman, serving alongside Chen Lei as co-chairman and co-CEO. At the meeting, PDD Holdings also announced two senior management appointments: Wang Mi was named Senior Vice President of Engineering, and Li Jiong was appointed Chief Financial Officer.

At the meeting, Zhao Jiapeng stated that in the next phase, the company’s strategy will be more focused. After repeated discussions, it has anchored China's supply chain as the core of its business development moving forward. The company will continue to pursue high-quality development, fully committing to the high-quality and branding of China’s supply chain, achieving a reinvention of the platform, and driving a leap in the value of the ecosystem. The company will concentrate its resources, finances, and efforts on upgrading and reinventing the supply chain, achieving an overall upgrade in the supply chain's operational model. High quality and branding are the directions, and it is believed that the next three years will present an opportunity to recreate another PDD Holdings.

Wall Street Hails Micron Technology Earnings Report: One of the Biggest Surprises in U.S. Chip History

$Micron Technology (MU.US)$ Shares rose over 1% in pre-market trading. The company's financial results for the last fiscal quarter and its guidance for the coming year exceeded analysts' expectations. Wall Street analysts have praised Micron Technology's performance as one of the biggest surprises in the semiconductor sector. Analysts at Morgan Stanley wrote, “Aside from NVIDIA, this could be the largest revenue/net profit growth in the history of the U.S. semiconductor industry.” The bank reiterated Micron Technology as its top pick and raised its target price to $350, implying an upside potential of approximately 38%.

XPeng Motors shares rose over 5% in pre-market trading after a senior executive revealed that L3 autonomous driving capabilities are expected to be fully implemented by the first quarter of next year.

$XPeng Motors (XPEV.US)$ Shares rose over 5% in pre-market trading. Recent reports indicate that XPeng Motors has obtained an L3 autonomous driving road test license in Guangzhou and has initiated regular L3 road tests. Vice President of XPeng Motors 'Thomas Electric Train' posted on Weibo, stating, “Looking forward to the surprise in the first quarter of next year when full implementation occurs. In fact, some individuals may experience this version officially even earlier.” An institutional report pointed out that with the successive launches of MONA M03, the new P7, and the Super Range Extender X9, the company has entered a robust product cycle, establishing a dual-energy strategy of “pure electric + range extender” and planning to further capture niche market share. Meanwhile, the company has upgraded its strategy to become a global technology firm. Four key applications related to ‘Physical AI’ were announced, including XPeng’s second-generation VLA, XPeng Robotaxi, the all-new IRON, and the Huitian Flight System, all of which are expected to enter mass production by 2026.

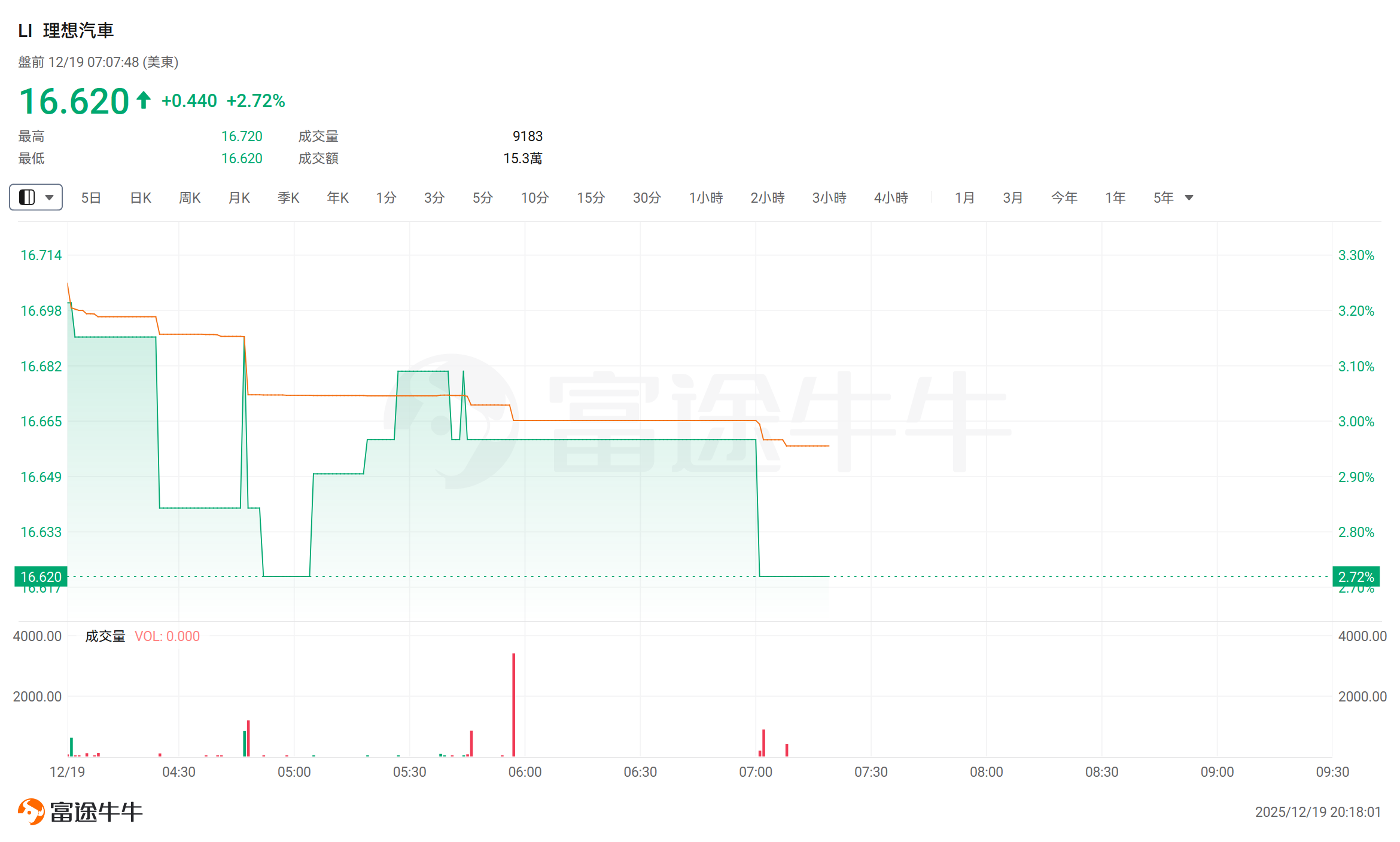

Li Auto shares rose in pre-market trading amid reports that the company is establishing an AI research center in Silicon Valley.

$Li Auto(LI.US)$ Shares rose nearly 3% in pre-market trading. According to market sources citing insiders, Li Auto is formally establishing an AI research center in Silicon Valley. Li Auto already has a small R&D team in North America supporting chip R&D and other intelligent-related work. This move aims to upgrade the Silicon Valley team into a genuine research and development center. It is reported that the expansion of Li Auto’s Silicon Valley R&D center will primarily focus on assisted driving, aiming to recruit high-end algorithm talent with expertise in cutting-edge intelligence technologies.

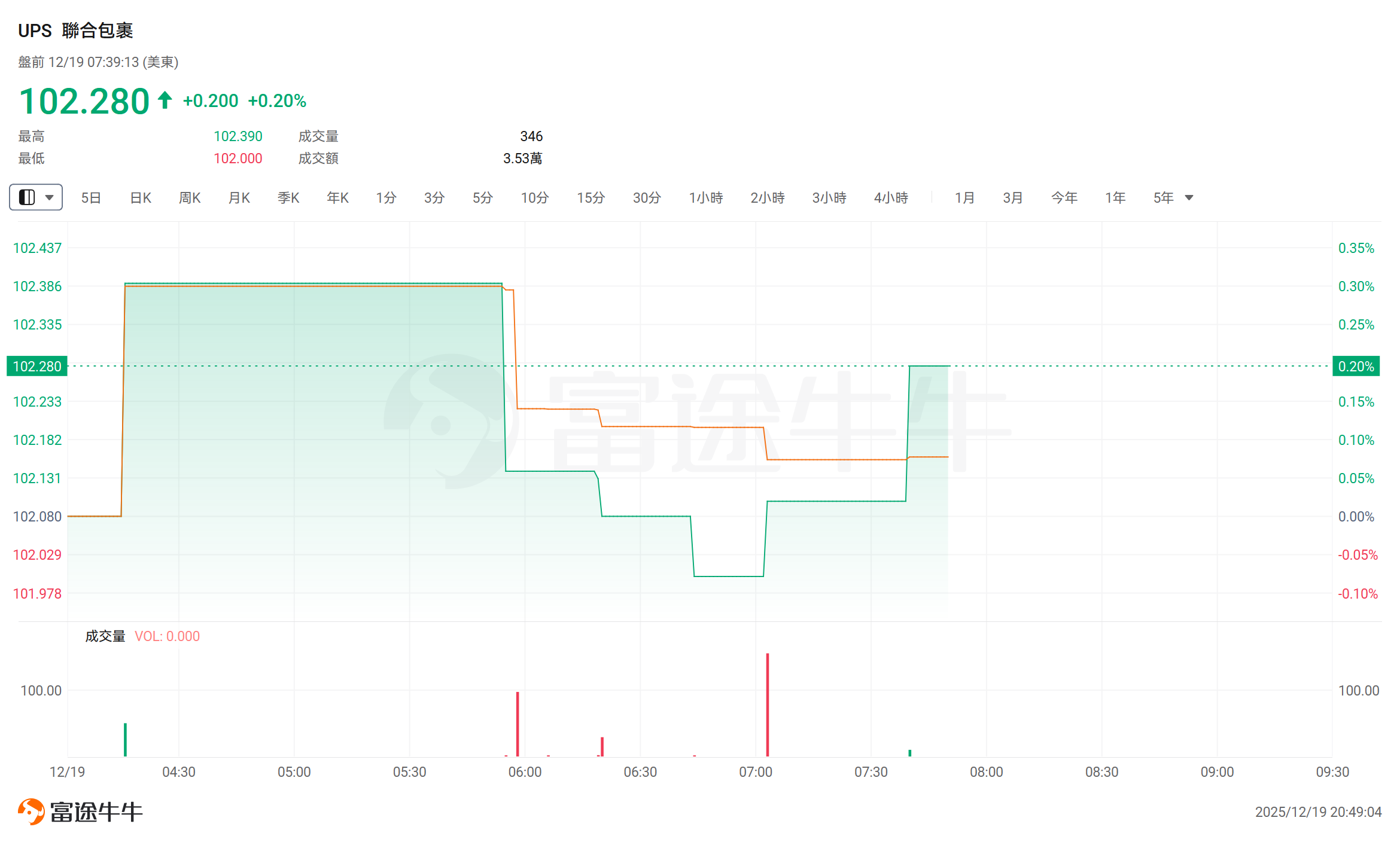

‘Barometer of the U.S. Economy’ FedEx Reports 31% Surge in Operating Profit, Raises Outlook

FedEx (FDX.US) Total sales for the second fiscal quarter of 2026 amounted to approximately USD 23.5 billion, representing a year-over-year increase of 7%, surpassing market expectations of USD 22.9 billion. GAAP operating profit reached USD 1.378 billion, marking a 31% year-over-year increase, while GAAP net profit stood at USD 956 million, up 29% year-over-year. Adjusted earnings per share (EPS) were USD 4.82, significantly higher than USD 4.05 in the same period last year and exceeding market expectations of USD 4.12.

Meanwhile, the company raised its earnings outlook for the fiscal year 2026, now projecting full-year adjusted earnings per share to range between $17.80 and $19. The midpoint of this range exceeds market expectations of $18.28. The company also anticipates that annual sales will grow by 5%-6% (up from the previous forecast of 4%-6%), surpassing market expectations of approximately 4%. This indicates that as domestic demand in the U.S. continues to improve, the company's efforts to cut costs and streamline its logistics and distribution network are yielding positive results.

Global macro

Waller Receives Interview with Trump, Focuses Discussion on Job Market; Bowman Presumed Out of Contention

According to CNBC, senior U.S. government officials revealed that Federal Reserve Governor Christopher Waller had a "productive interview" with President Trump regarding the position of Fed Chair. The two engaged in an in-depth discussion on the labor market and strategies for boosting job growth. The meeting took place at the presidential residence and concluded shortly before Trump's national address on economic issues on Wednesday evening. U.S. Treasury Secretary Bessent, White House Chief of Staff Williams, and Deputy Chief of Staff Scavino were also present during the interview.

Officials stated that Rick Rieder of Blackrock will be interviewed at Mar-a-Lago during the final week of this year. They also mentioned that Federal Reserve Governor Michelle Bowman is no longer a candidate for the position. Officials noted that Waller’s conversation with Trump about employment demonstrates that external concerns and criticisms—namely, that the president is merely seeking a candidate who would yield to his wishes on interest rates—are unfounded. They emphasized that the economic topics discussed during the interviews with candidates were wide-ranging.

Today Marks the Largest Options Expiry in History!

As the third Friday of December, today also marks one of the four 'quadruple witching days' of the year: a day when a large number of index options, individual stock options, index futures, and futures options on indices expire simultaneously. According to Goldman Sachs, over USD 7.1 trillion in notional option exposure will expire this Friday, with approximately USD 5 trillion related to $S&P 500 Index (.SPX.US)$ , and about USD 880 billion tied to individual stocks. Goldman Sachs noted that the 'quadruple witching day' in December is typically the largest event of its kind in a year, and this one is expected to surpass all previous records.

Wall Street Commentary on November CPI: Significant Data Discrepancy Unlikely to Prompt Fed Policy Shift

The US November CPI showed a superficial cooling, but Barclays and Morgan Stanley warned that the data was distorted by technical factors such as Black Friday promotions, missing rent components, and 'carryover effects,' potentially underestimating the actual figures. Wall Street believes the data is insufficient to trigger an immediate shift in the Fed's policy stance, with the probability of a January rate cut being extremely low. Attention remains on December employment and inflation data, maintaining expectations for rate cuts in March and June 2026.

9:0 Unanimous Vote! Bank of Japan Raises Rates by 25 Basis Points as Expected

The Bank of Japan (BOJ) announced on Friday a 25-basis-point interest rate hike, increasing the uncollateralized overnight call rate to 0.75%, reaching its highest level since 1995. The decision was announced after a two-day policy meeting and was unanimously approved with a 9:0 vote, fully aligning with market expectations. The BOJ stated that core inflation remains on a moderate upward trend, with price movements consistent with the projections outlined in the second half of the year. Despite the increase in nominal interest rates, the central bank expects real interest rates to remain significantly negative, indicating that overall financial conditions will continue to be accommodative. In its policy statement, the BOJ emphasized that if economic and price forecasts align with current assessments, further rate hikes are expected.

Goldman Sachs 2026 Commodity Outlook: Bullish on Gold to $4,900, Oil May Face Headwinds

Goldman Sachs released a 2026 commodity report on Thursday, stating that gold is projected to rise to $4,900 per ounce next year, supported by structural central bank demand and anticipated Federal Reserve rate cuts. Goldman Sachs forecasts that copper prices will stabilize in 2026, remaining the most favored industrial metal over the long term. As for oil, Goldman believes that given the visible global oil inventory increases, international oil prices are likely to decline in 2026.

UBS Outlook for U.S. Stocks in 2026: Focus on Trump-Related Developments and AI-Related Trading

UBS's trading division recently released a research report forecasting the outlook for 2026, predicting that U.S. equities will experience a bumpy upward trajectory with more pullbacks than usual. However, investors should seize these pullback opportunities to increase exposure to select sectors that benefit from an accelerating economic recovery and broadening market breadth. Additionally, UBS discussed two core factors that influenced market performance this year and will remain crucial next year: first, developments related to U.S. President Trump, particularly the midterm elections; second, artificial intelligence-related trading.

Overall, UBS provided four recommendations for trading in the coming year: 1) Regional Bank ETF (KRE) — the purest play on market breadth expansion; 2) a positive outlook for the consumer sector; 3) the U.S. real estate sector — a key issue in the midterm elections; 4) mid-cap stocks are entering a new era.

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

21:30 FOMC permanent voter and New York Fed President Williams gives an interview with CNBC

23:00 Final reading of the University of Michigan Consumer Sentiment Index for December in the U.S.

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO