The three major U.S. stock indexes closed collectively higher, $Dow Jones Index (.DJI.US)$ up 0.38%, $Nasdaq Composite Index (.IXIC.US)$ up 1.31%, $S&P 500 Index (.SPX.US)$ up 0.88%. Large-cap technology stocks generally rose, $NVIDIA (NVDA.US)$ Up nearly 4%, $Broadcom (AVGO.US)$ with a rise of over 3%, $Google-C (GOOG.US)$ with gains exceeding 1%. Cryptocurrency mining companies, semiconductors, metals, and mining sectors led the gains, $USA Gold Corporation (USAU.US)$ Surging over 11%, $Hut 8(HUT.US)$ Surging over 14%, $世纪铝业(CENX.US)$ Surged over 7%, $Micron Technology (MU.US)$ 、 $Advanced Micro Devices (AMD.US)$ 、 $Circle(CRCL.US)$ Surging over 6%, $Super Micro Computer (SMCI.US)$ rising over 5%,$Americas Silver Corporation (USAS.US)$ Up nearly 4%, $Dell Technologies (DELL.US)$ 、 $Coinbase(COIN.US)$ with gains exceeding 2%. Multi-line insurance, footwear and apparel, and real estate development sectors were among the top decliners, Nike (NKE.US) falling more than 10%, $Berkshire Hathaway-B (BRK.B.US)$ Down more than 1%.

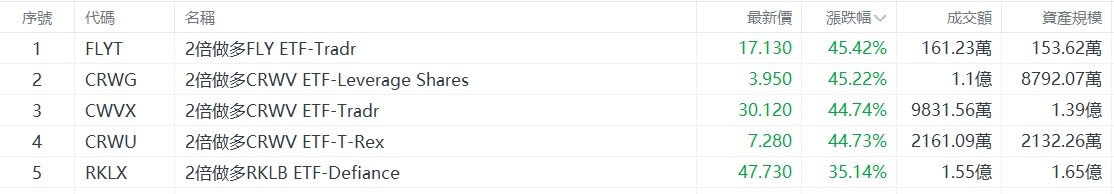

Top 5 Gainers in U.S. Equity ETFs

The $2x Leveraged FLY ETF-Tradr (FLYT.US) rising 45.42%, with a trading volume of $1.6123 million.

$2x Leverage Long CRWV ETF-Leverage Shares (CRWG.US)$ rising 45.22%, with a trading volume of $110 million.

$2x Leverage Long CRWV ETF-Leverage Shares (CRWG.US)$ rising 45.22%, with a trading volume of $110 million.

$2x Leverage Long CRWV ETF-Tradr (CWVX.US)$ Up 44.74%, with a trading volume of $98.32 million.

$2x Leverage Long CRWV ETF-T-Rex (CRWU.US)$ Up 44.73%, with a trading volume of $21.61 million.

CoreWeave recently joined the 'Genesis Program'.

$2x Leverage RKLB ETF-Defiance (RKLX.US)$ Up 35.14%, with a trading volume of $155.00 million.

On December 19 EST, Rocket Lab announced an $816 million agreement with the U.S. Space Development Agency.

Top 5 Decliners on US Stock ETFs

$2x Inverse CRWV ETF-T-REX(CORD.US)$ Down 45.10%, with a trading volume of $91.29 million.

$2x Leverage Short RKLB ETF - Defiance (RKLZ.US) Down 35.51%, with a trading volume of $31.34 million.

$2x Inverse BMNR ETF-Defiance (BMNZ.US)$ Down 21.81%, with a trading volume of $121.00 million.

$T-Rex 2X Inverse Ether Daily Target ETF(ETQ.US)$ Down 16.34%, with a trading volume of $1.01 million.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) Down 15.88%, with a trading volume of $31.19 million.

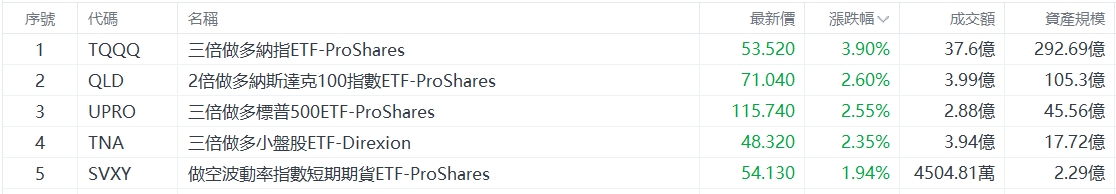

Top 5 Gainers in U.S. Large-Cap Index ETFs

$ProShares UltraPro QQQ (TQQQ.US)$ Up 3.90%, with a turnover of $3.76 billion.

ProShares Ultra QQQ (QLD.US), which provides 2x daily leverage to the Nasdaq 100 Index, Up 2.60%, with a turnover of $399 million.

$ProShares UltraPro S&P 500 (UPRO.US)$ Up 2.55%, with a turnover of $288 million.

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Up 2.35%, with a turnover of $3.94 billion.

ProShares Short VIX Short-Term Futures ETF (SVXY.US) Up 1.94%, with a turnover of $45.0481 million.

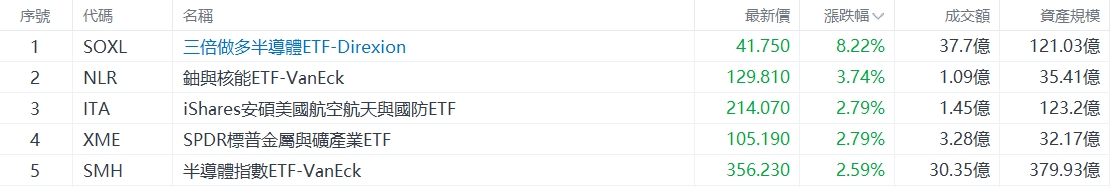

Top 5 Industry ETF Gainers

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Up 8.22%, with a turnover of $3.77 billion.

$VanEck Uranium+Nuclear Energy ETF (NLR.US)$ Up 3.74%, with a turnover of $1.09 billion.

$iShares U.S. Aerospace & Defense ETF (ITA.US)$ Up 2.79%, with a turnover of $1.45 billion.

$SPDR S&P Metals and Mining ETF (XME.US)$ Up 2.79%, with a turnover of $3.28 billion.

$Semiconductor Index ETF-VanEck (SMH.US)$ Up 2.59%, with a trading volume of $3.035 billion.

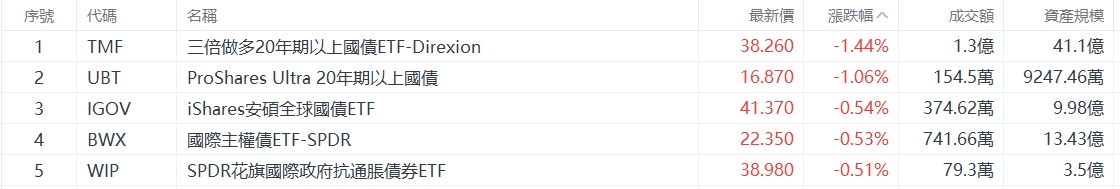

Top 5 Decliners in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Down 1.44%, with a trading volume of $130 million.

ProShares Ultra 20+ Year Treasury (UBT.US) Down 1.06%, with a trading volume of $1.545 million.

$iShares Global Treasury Bond ETF (IGOV.US)$ Down 0.54%, with a trading volume of $3.7462 million.

$International Sovereign Bond ETF-SPDR(BWX.US)$ Down 0.53%, with a trading volume of $7.4166 million.

$SPDR Citi International Government Inflation-Protected Bond ETF (WIP.US)$ Down 0.51%, with a trading volume of $0.793 million.

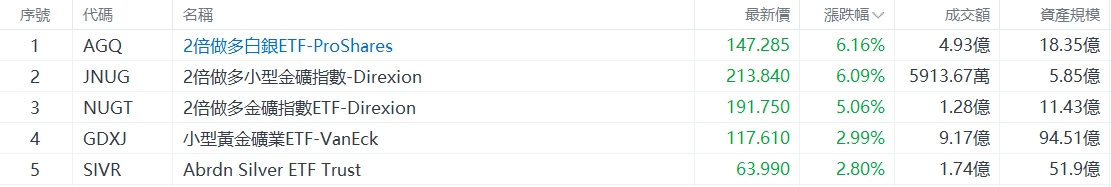

Top 5 Gainers in Commodity ETFs

$ProShares Ultra Silver ETF (AGQ.US)$ Up 6.16%, with a trading volume of $493 million.

Spot silver reached a new high, peaking at $67.465 per ounce.

$2x Leveraged Junior Gold Miners ETF - Direxion (JNUG.US) Up 6.09%, with a trading volume of $59.1367 million.

$2x Leveraged Gold Miners ETF - Direxion (NUGT.US) Up 5.06%, with a trading volume of $128 million.

VanEck Junior Gold Miners ETF (GDXJ.US) Up 2.99%, with a trading volume of $917 million.

$Abrdn Silver ETF Trust(SIVR.US)$ Up 2.80%, with a turnover of $174 million.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Liam