Top News

The contest for the chairmanship of the Federal Reserve has intensified, with Wall Street and Washington witnessing 'undercurrents,' and Trump remaining 'undecided.'

The race to select the next Federal Reserve Chair within the Trump administration has reached a fever pitch. Leading contenders Kevin Hassett and Kevin Warsh both face questions about their independence and credibility, while Federal Reserve Governor Christopher Waller has emerged as a 'dark horse' with robust policy credentials. Meanwhile, Rick Rieder, a senior executive at BlackRock, is scheduled to be interviewed in the final week of December at Trump’s private club. Major Wall Street players are deeply involved in the maneuvering, with heavyweights such as JPMorgan CEO Jamie Dimon frequently engaging in discussions with the administration. The lobbying and competition among candidate camps continue to intensify.

Divisions within the Federal Reserve deepen as Harker suggests it is 'appropriate to pause' policy adjustments until inflation dynamics become clearer.

Beth Hammack, President of the Cleveland Federal Reserve Bank, stated that current monetary policy should remain on hold during the assessment of the impact of a cumulative 75-basis-point rate cut implemented in the first quarter. In an interview on the 'Focus This Week' podcast aired by The Wall Street Journal on Sunday, Hammack said: "Our current stance aligns with baseline expectations — we can maintain this position for some time until there is clearer evidence that inflation is reverting to target levels or that the labor market is showing more substantial weakening."

Beth Hammack, President of the Cleveland Federal Reserve Bank, stated that current monetary policy should remain on hold during the assessment of the impact of a cumulative 75-basis-point rate cut implemented in the first quarter. In an interview on the 'Focus This Week' podcast aired by The Wall Street Journal on Sunday, Hammack said: "Our current stance aligns with baseline expectations — we can maintain this position for some time until there is clearer evidence that inflation is reverting to target levels or that the labor market is showing more substantial weakening."

The Federal Reserve’s latest interest rate decision on December 10 encountered three dissenting votes, the highest number since 2019. Officials remain divided over the future path of interest rates, with some policymakers more concerned about a cooling labor market, while others believe the Fed should prioritize controlling inflation that remains above target. The summary of economic projections released after the meeting showed that six officials preferred keeping rates unchanged.

The U.S. Fully Accelerates Space Armament: Trump Sets the Tone for "Space Superiority," Followed by a $3.5 Billion Satellite Order

The United States is advancing the largest-scale militarization of space since the Cold War. On Thursday, President Trump signed an executive order prioritizing manned lunar landings, the establishment of a lunar base, and the defense of space weapons as national priorities. Subsequently, the Pentagon announced it had awarded $3.5 billion in military satellite contracts, marking an unprecedented integration of civilian space exploration with military strategy.

Following the policy announcement, the U.S. Space Development Agency announced that it had signed a $3.5 billion fixed-price contract with $Lockheed Martin (LMT.US)$ 、 $L3Harris Technologies (LHX.US)$ 、 $Northrop Grumman (NOC.US)$ and $Rocket Lab(RKLB.US)$ for the procurement of 72 infrared satellites to be used in missile warning, tracking, and defense systems. These satellites are scheduled for launch into low Earth orbit by 2029, enabling near-continuous global coverage.

BofA's Hartnett: Markets Focus on the Possibility of a Strong U.S. Stock Rally to 'Ring in the New Year,' with the Only Risk Being 'Excessive Market Optimism.'

Bank of America strategist Michael Hartnett noted in his latest outlook report that markets are preemptively betting on accelerated growth in 2026 driven by rate cuts, tax reductions, and tariff rollbacks, pushing weekly equity inflows to the second-highest level on record. While the firm remains optimistic about the outlook amid dual fiscal and monetary easing, its bull-bear indicator has hit an 8.5 contrarian sell signal, warning that market sentiment is overly optimistic and cautioning against structural risks and potential short-term corrections.

Nine U.S. pharmaceutical companies reach agreement with Trump, with more firms expected to follow.

U.S. President Donald Trump announced on Friday agreements with nine pharmaceutical companies, the latest in a series of related deals. These agreements aim to lower drug prices for some Americans in exchange for a three-year tariff moratorium. The latest commitments indicate that 14 of the 17 drugmakers Trump named earlier this summer have agreed to reduce prices for Medicaid programs serving low-income and disabled populations, offer discounted direct sales to consumers, and ensure that new drugs launched in the U.S. will match prices in overseas markets.

The companies that have currently reached agreements with the government include Genentech, a subsidiary of Roche Holding.Novartis AG (NVS.US) 、 $Bristol-Myers Squibb (BMY.US)$ 、 $Gilead Sciences (GILD.US)$ , Boehringer Ingelheim, $Amgen(AMGN.US)$ 、 $GlaxoSmithKline (GSK.US)$ 、 $Sanofi(SNY.US)$ and $Merck & Co (MRK.US)$ . These agreements are similar to the arrangements that Pfizer and AstraZeneca reached with the government earlier this year. The three companies that have not yet announced agreements with the government are $AbbVie (ABBV.US)$ 、 $Johnson & Johnson(JNJ.US)$ and $Regeneron Pharmaceuticals (REGN.US)$ . US Commerce Secretary Howard Lutnick hinted that the remaining three companies will announce similar agreements after the holidays. The US President plans to launch the 'TrumpRX' website in the new year to supply discounted medicines.

Explosive Scene! Unitree Robotics Performs at Wang Leehom's Concert, Even Elon Musk Praises 'Impressive'

Unitree robots have stepped out of the lab, donned silver sequined outfits, and directly headed to Wang Leehom's concert to 'steal the spotlight'! At the December 18th concert in Chengdu, six silver robots were neatly lined up, dancing rhythmically to the music beats, even performing high-difficulty flips. Subsequently, Tesla CEO Elon Musk reposted a related video on social media, commenting, 'Impressive.'

Indonesia, the World's Largest Nickel Producer, Signals Production Cuts

Under expectations that the world’s largest producer may tighten supply, nickel prices on the London Metal Exchange rose for a third consecutive trading day, continuing to rebound from an eight-month low. On Wednesday, nickel prices briefly fell below $14,200, hitting their lowest level since April this year. Indonesia has proposed plans to cut nickel ore production by 2026. According to the work plan and budget set by the Indonesian government for next year, the target for nickel ore production in 2026 is about 250 million tons, nearly one-third lower than the target of 379 million tons for 2025.

Chongqing Issues China’s First Official License Plate for L3-Level Autonomous Driving

On December 20, the first official license plate specifically for L3-level autonomous driving, 'Yu AD0001Z,' was issued in Chongqing by the Chongqing Municipal Public Security Bureau Traffic Management Corps. $Changan Automobile (000625.SZ)$ This marks Changan Automobile taking the lead as a pioneer, ushering in the era of L3-level autonomous driving. According to Xinhua News Agency, this signifies that Changan Automobile has become the first in China to enter the L3-level autonomous driving era. Currently, Changan's L3-level autonomous driving system has accumulated over 5 million kilometers of real-road testing in Chongqing.

U.S. Stock Market Recap

The three major indices collectively closed higher, with the Nasdaq rising more than 1% and NVIDIA gaining approximately 4%.

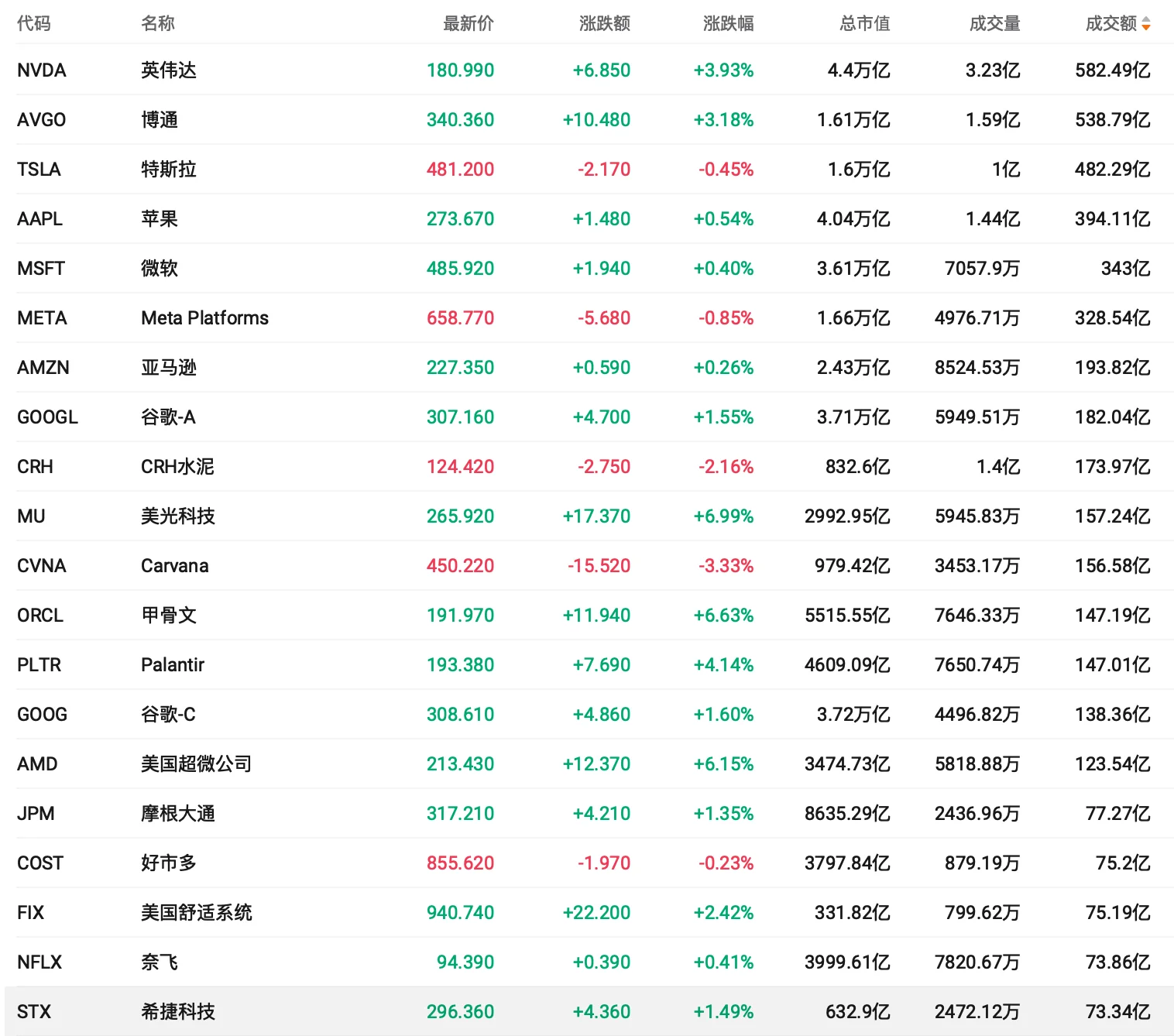

On Friday, driven by the strong performance of Oracle and NVIDIA, artificial intelligence (AI) concept stocks regained their footing, with the three major indices collectively closing higher for the second consecutive trading day. At the close, the Dow Jones Industrial Average rose 0.38%, the S&P 500 Index gained 0.88%, and the Nasdaq Composite Index increased by 1.31%.

Major technology stocks generally advanced, with NVIDIA up 3.93%, Apple rising 0.54%, Google increasing 1.55%, Microsoft gaining 0.40%, Amazon advancing 0.26%, Meta falling 0.85%, Tesla dropping 0.45%, Broadcom climbing 3.18%, Oracle surging 6.63%, Netflix edging up 0.41%, Micron Technology jumping 6.99%, and AMD rallying 6.15%.

Most popular Chinese concept stocks rose, with the Nasdaq China Golden Dragon Index up 0.86%. Alibaba increased by 1.68%, JD.com rose 0.07%, PDD Holdings gained 3.52%, NetEase climbed 1.54%, Baidu rose 2.76%, Nio increased by 1.22%, XPeng Motors surged 6.77%, Li Auto rose 5.07%, Bilibili gained 0.32%, Tencent Music fell 0.45%, and Pony AI jumped 11.78%.

Individual stock news

Ackman proposes a new plan for SpaceX's public listing: bypassing the traditional IPO process, eliminating underwriting fees, and allowing Tesla shareholders to participate first.

Billionaire Bill Ackman proposed taking SpaceX public through a Special Purpose Acquisition Rights Company (SPARC), an innovative structure that bypasses the traditional IPO process and grants Tesla shareholders priority investment rights. According to Ackman’s proposal, $Tesla (TSLA.US)$ each share will receive 0.5 SPARs, totaling approximately 1.723 billion SPARs. Each SPAR is convertible into two shares of SpaceX stock, implying a total of 3.446 billion shares. This structure eliminates underwriting fees, founder shares, and shareholder warrants while maintaining a 100% common equity capital structure. The key innovation of this structure lies in the complete elimination of underwriting fees, founder shares, and shareholder warrants.

Prediction markets bet on 'world's largest market cap': Google to directly challenge NVIDIA and Apple next year with AI chips.

Data from the prediction market Polymarket shows that Alphabet, the parent company of Google, has a 33% probability of becoming the world's most valuable company by market capitalization before December 2026, second only to NVIDIA’s 37%. The company currently boasts a market value of $3.7 trillion, ranking third globally behind NVIDIA and Apple. Analysts believe that Google, leveraging the strong performance of its large language model Gemini and custom AI chip TPU, is well-positioned to challenge the market dominance of NVIDIA and Apple.

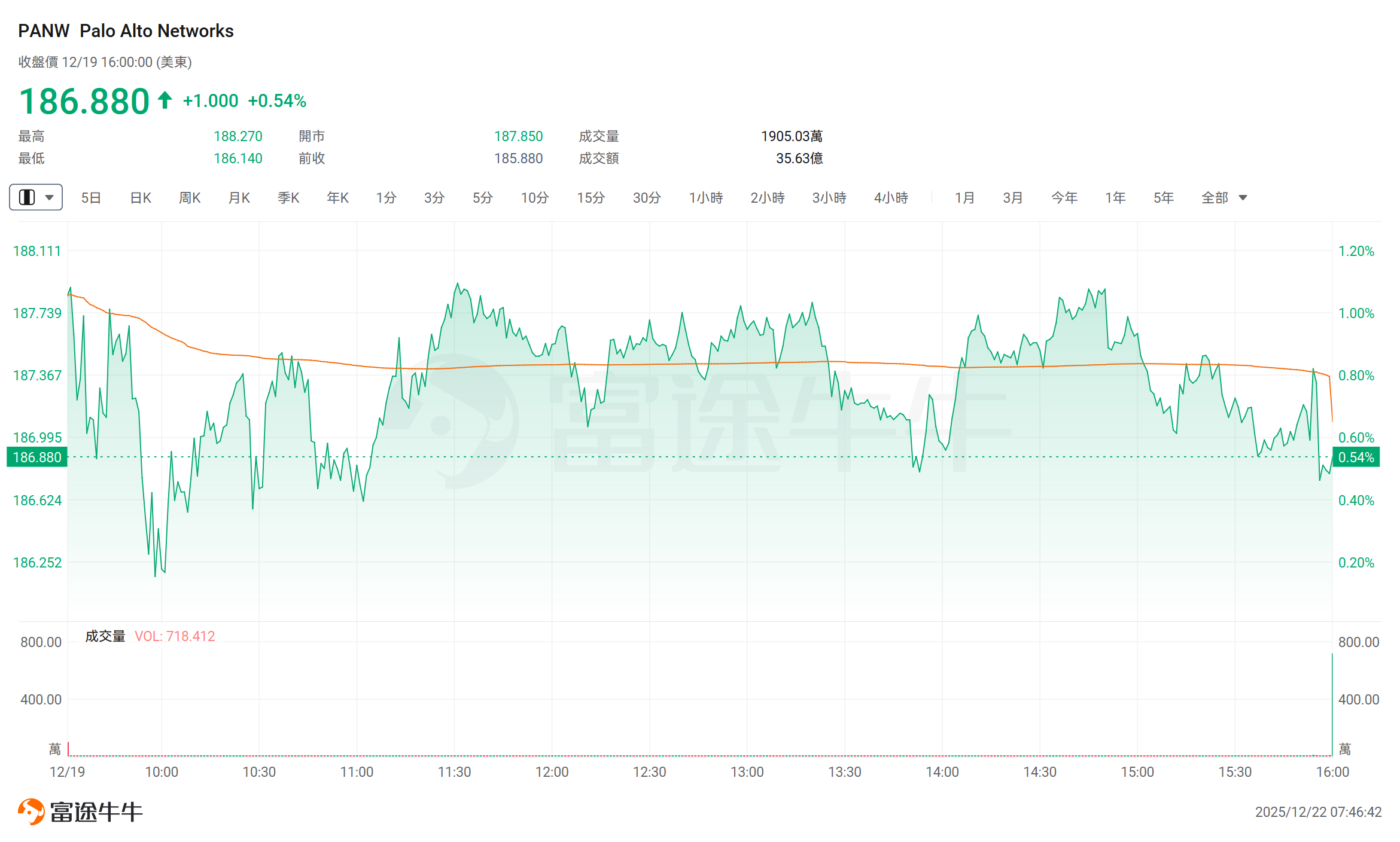

Google Cloud deepens cooperation with Palo Alto Networks, signing a nearly USD 10 billion AI security deal.

Google Cloud and the cybersecurity firm $Palo Alto Networks(PANW.US)$ A nearly $10 billion multi-year cooperation agreement was signed, marking the largest security services order in Google Cloud’s history. The partnership will focus on developing AI-driven security services to address new cyber threats brought about by generative AI. This collaboration not only strengthens Google Cloud’s competitive edge in AI cloud computing against Amazon and Microsoft but also provides critical support for Palo Alto Networks in the rapidly growing AI security market.

Top 20 by Trading Value

Market Outlook

Northbound capital added over HKD 1.1 billion worth of Tencent shares and purchased over HKD 1 billion worth of Alibaba shares while selling more than HKD 1 billion worth of China Mobile shares.

On December 19 (Friday), southbound funds net bought HKD 3.371 billion worth of Hong Kong stocks.

$Tencent (00700.HK)$、$Alibaba-W (09988.HK)$、$CNOOC Limited (00883.HK)$They were respectively net purchased at HKD 1.117 billion, HKD 1.049 billion, and HKD 217 million.

$China Mobile (00941.HK)$、$Horizonrobot-W(09660.HK)$、$SMIC (00981.HK)$Net sell-offs amounted to HKD 1.053 billion, HKD 162 million, and HKD 77.88 million, respectively.

Three departments issue the 'Price Conduct Rules for Internet Platforms'.

In order to improve the institutionalized price supervision mechanism for internet platforms, standardize related pricing practices, protect the legitimate rights and interests of consumers and operators, and promote innovation and healthy development in the platform economy, the National Development and Reform Commission, the State Administration for Market Regulation, and the Cyberspace Administration of China have formulated the 'Rules on Price Conduct for Internet Platforms'.

The rules state that operators within the platform who sell goods or provide services across different platforms are entitled to independently set prices in accordance with the law. Platform operators must not violate Article 35 of the E-Commerce Law of the People’s Republic of China by taking measures such as increasing fee rates, adding additional charges, deducting deposits, reducing subsidies or incentives, limiting traffic, downgrading search rankings, demoting algorithmic weighting, blocking stores, or delisting products or services, thereby imposing unreasonable restrictions or attaching unreasonable conditions on the pricing behavior of operators within the platform:

(1) Forcing or indirectly forcing operators within the platform to lower prices or promote through discounts, cash rebates, or similar methods;

(2) Forcing or indirectly forcing operators within the platform to ensure that prices for goods or services sold on the platform are not higher than those offered through other sales channels;

(3) Forcing or indirectly forcing operators within the platform to activate automatic price-matching, automatic price reduction, or similar systems;

(4) Other actions that restrict the independent pricing rights of operators within the platform.

China Shenhua announced 133.6 billionMergers and acquisitionsPlan

$China Shenhua (01088.HK)$ The company announced its intention to acquire 100% of Guoyuan Power, 100% of Xinjiang Energy, 100% of Chemical Company, 100% of Wuhai Energy, 100% of Pingzhuang Coal Industry, 41% of Shenyan Coal, 49% of Jinshen Energy, 100% of Baotou Mining, 100% of Shipping Company, 100% of Coal Marketing Company, and 100% of Port Company held by the National Energy Group through the issuance of A-shares and cash payments. Additionally, the listed company plans to issue A-shares to no more than 35 specific investors to raise complementary funds. The transaction is valued at RMB 133.598 billion.

Acceleration in the commercialization of L3 autonomous driving; Xiaomi Auto secures road test license

Following the Ministry of Industry and Information Technology's announcement of the first batch of L3 conditional autonomous driving vehicle access permits, another automaker has announced obtaining an L3 road test license. The latest reports indicate that information from 'The Annual Assessment Report on Autonomous Vehicles in Beijing (2024-2025)' shows, $Xiaomi Group-W(01810.HK)$ Xiaomi Auto has obtained an L3 autonomous driving road test license in Beijing and has been conducting regular L3 road tests. This testing license is primarily used for conditional autonomous driving tests on Beijing's intelligent connected vehicle expressway test sections, aiming to explore safer and smarter personal mobility services in the future.

Biren Technology, known as the 'First GPU Stock in Hong Kong,' sets its IPO price range with a maximum offering price of HKD 19.60 per share, expecting trading to commence on January 2.

$Biren Technology (06082.HK)$ In its announcement on the Hong Kong Stock Exchange, Biren Technology stated that the global offering comprises 247,692,800 H-shares (subject to adjustments based on the exercise of the over-allotment option), with a maximum offer price of HKD 19.60 per H-share. The pricing range is between HKD 17 to HKD 19.60 per share, and the stock code is '6082.' Trading of H-shares is expected to begin on January 2 next year.

Zhipu officially passed the Hong Kong Stock Exchange listing hearing.

Levermore Securities shows that Beijing Zhipu Huazhang Technology Co., Ltd. updated its post-hearing data set, indicating that the company’s IPO on the Hong Kong Stock Exchange has officially passed the hearing. The sole sponsor is CICC.

MiniMax has passed the Hong Kong Stock Exchange listing hearing.

On December 21, MiniMax, a general artificial intelligence company, published for the first time the prospectus in the version of its post-hearing data set, which is expected to set a record as the AI company with the shortest time from establishment to IPO. As of September 30, 2025, MiniMax had more than 212 million individual users across over 200 countries and regions, and over 130,000 enterprise customers in more than 100 countries. Its revenue for the first nine months of 2025 grew by more than 170% year-on-year, with overseas market income contributing over 70%. MiniMax has received investments and support from top-tier institutions such as miHoYo, Alibaba, Tencent, Xiaohongshu, Hillhouse, IDG, Sequoia, Matrix Partners, Ming Shi Capital, and Yunqi Partners. It is also currently the fastest-growing and highest-valued AI technology company.

Today's Focus

Keywords: China’s five-year and one-year Loan Prime Rate (LPR), UK Q3 GDP final reading, UK Q3 current account

In terms of economic data, attention can be paid to China's announced five-year and one-year Loan Prime Rates (LPR), as well as the UK's released third-quarter GDP final reading and current account data.

09:00 China December five-year Loan Prime Rate (LPR)

09:00 China December one-year Loan Prime Rate (LPR)

15:00 UK third-quarter GDP annualized rate final reading

15:00 UK third-quarter current account

In terms of financial events, a new round of price adjustment for refined oil products will commence domestically. The 19th session of the Standing Committee of the 14th National People's Congress will be held in Beijing from December 22 to 27.

![]()

Morning Reading by Niuniu:

The only success in life is to be able to live according to your own way.

— Howard Marks

![]() AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

Editor/KOKO