Futu News reported on December 22 that $QINGSONG HEALTH (02661.HK)$ The grey market price has surged by 85.1%, reaching HKD 41.98 per share. With a minimum lot size of 200 shares, excluding handling fees, investors can make a profit of HKD 3,860 per lot.

Source of market data: Futu Securities

Company Overview

Easy Health provides digital integrated health services and health insurance solutions in China. According to data from the Frost & Sullivan report, the company ranks tenth in China's digital integrated health services and health insurance services market by revenue in 2024. Specifically, according to the same source, Easy Health ranks seventh in China’s digital health services market by revenue in 2024. The company is committed to providing accessible, precise, and affordable health solutions to offer protection and support to those in need.

Easy Health provides digital integrated health services and health insurance solutions in China. According to data from the Frost & Sullivan report, the company ranks tenth in China's digital integrated health services and health insurance services market by revenue in 2024. Specifically, according to the same source, Easy Health ranks seventh in China’s digital health services market by revenue in 2024. The company is committed to providing accessible, precise, and affordable health solutions to offer protection and support to those in need.

The company serves users seeking comprehensive health solutions with health-related services, including promotional activities and consultations related to early disease screening, health check-ups and consultations, medical appointment services, and the sale of health supplements. All users are individuals who can access the company’s services through its WeChat Official Account, mini-programs, Enterprise WeChat accounts, and website. As an integral part of the company’s services, it also empowers industry participants to create high-quality scientific content in the form of digital marketing and promotes public health initiatives, ultimately empowering key participants in the industry value chain, including medical institutions, practitioners, and researchers.

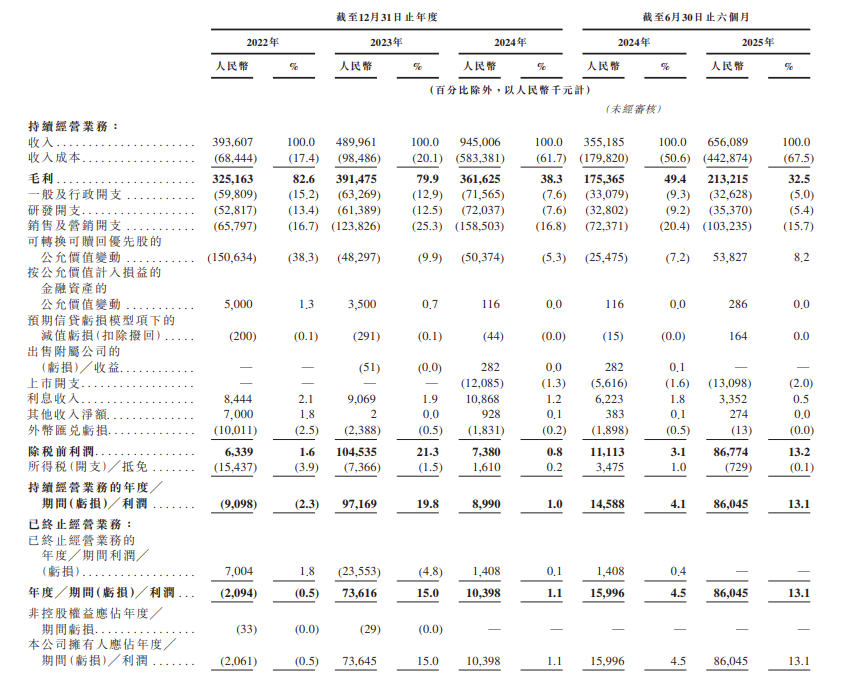

Financial Overview

In terms of financial performance, the company’s revenue for the years 2022, 2023, and 2024, as well as for the six months ended June 30, 2024, and June 30, 2025, amounted to RMB 393.6 million, RMB 490 million, RMB 945 million, RMB 355.2 million, and RMB 656.1 million, respectively. The company recorded profits from continuing operations during the periods of 2023 and 2024, as well as for the six months ended June 30, 2024, and June 30, 2025, amounting to RMB 97.2 million, RMB 9 million, RMB 14.6 million, and RMB 86 million, respectively. For the years 2022, 2023, and 2024, as well as for the six months ended June 30, 2024, and June 30, 2025, the company’s adjusted net profits were RMB 149.2 million, RMB 146.6 million, RMB 84.4 million, RMB 46 million, and RMB 51.2 million, respectively.

Futu's dark pool platform is reliable and does not crash, supporting market orders for rapid execution. Over 850,000 people use Futu to subscribe to new stock offerings, gaining an edge in the dark pool, with faster buying and selling capabilities.Come and experience it now >>

Editor/Jamie