The year 2025 is drawing to a close, marking a tumultuous period: from Trump's return to the White House at the beginning of the year, the disruption of global markets by U.S. tariffs in April, to the Federal Reserve’s pivot towards an easing path, and the capital frenzy ignited by artificial intelligence...

As we look ahead to 2026, how can we seize new opportunities? Subscribe to our special feature."2025 Year in Review", let us reflect on the past, consolidate experiences, and together embrace the next chapter.

The act of a listed company repurchasing its issued or outstanding shares in the market according to prescribed procedures is referred to as a "share buyback." Globally, active share repurchases have gradually become a common practice for listed companies to demonstrate confidence, maintain their market value, and share the fruits of corporate development with investors. The Hong Kong stock market is no exception.

The scale of share buybacks in the Hong Kong stock market in 2025 has declined from the peak in 2024 but remains at the second-highest level since 2021, exhibiting characteristics of 'scale adjustment, structural optimization, and sector rotation.' Compared to previous years, the key differences in this year's buyback market are reflected in the shift of industry concentration from finance to technology and healthcare, a slight decrease in the proportion of buybacks by leading companies (though they still dominate), and a weakening of buyback momentum in the second half as market sentiment recovers.

The scale of share buybacks in the Hong Kong stock market in 2025 has declined from the peak in 2024 but remains at the second-highest level since 2021, exhibiting characteristics of 'scale adjustment, structural optimization, and sector rotation.' Compared to previous years, the key differences in this year's buyback market are reflected in the shift of industry concentration from finance to technology and healthcare, a slight decrease in the proportion of buybacks by leading companies (though they still dominate), and a weakening of buyback momentum in the second half as market sentiment recovers.

According to Wind data, as of December 19, 2025, a total of 259 Hong Kong-listed companies have implemented share buybacks, with a cumulative buyback amount reaching HKD 173.815 billion, of which 71 companies have repurchased more than HKD 100 million during the year.

So, among this year’s wave of share buybacks in the Hong Kong stock market, which companies have been the most 'generous'?

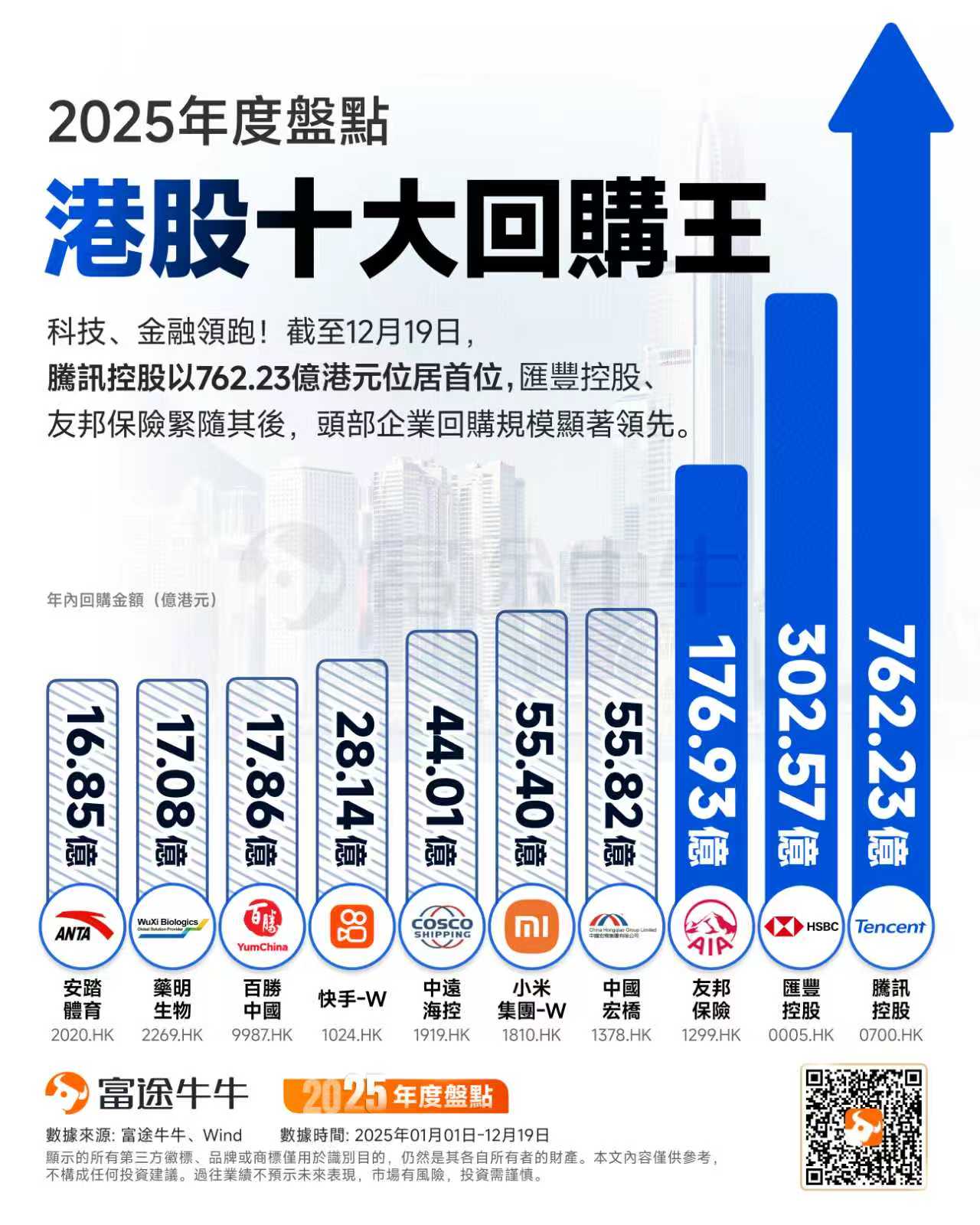

Futu News has compiled a list of the 'Top 10 Companies by Buyback Amount in the Hong Kong Stock Market in 2025' for fellow investors’ reference.

The leading effect of share buybacks in the Hong Kong stock market in 2025 remains significant, though concentration has slightly decreased compared to 2024. For example, 71 companies repurchased more than HKD 100 million in 2025, contributing 88% of the total buyback amount (compared to 92% in 2024).

Among the companies making large-scale share repurchases, most are industry leaders in sectors such as internet, finance, and pharmaceuticals, including tech giants $TENCENT (00700.HK)$ , financial giants $HSBC HOLDINGS (00005.HK)$ 、 $AIA (01299.HK)$ , and aluminum industry leader $CHINAHONGQIAO (01378.HK)$ as well as the global leader in container shipping and port operations $COSCO SHIP HOLD (01919.HK)$ etc.

Note: Alibaba’s share repurchases typically take place in the U.S. market.

Tencent retains its title as the 'King of Buybacks' in the Hong Kong stock market, with HSBC and AIA following closely behind.

Tencent has solidified its position as the top repurchaser in the Hong Kong stock market with a buyback amount of HKD 76.223 billion. Following closely are HSBC Holdings and AIA, with buyback amounts exceeding HKD 10 billion each, at HKD 30.257 billion and HKD 17.693 billion respectively. The buyback amounts of these three companies account for 71% of the total buyback amount in the Hong Kong stock market this year.

Specifically, Tencent has cumulatively repurchased 147 million shares this year, totaling HKD 76.223 billion, through 124 repurchase operations, averaging HKD 615 million per operation. The repurchase price range was between HKD 364.80 and HKD 683.00, with an average repurchase price of HKD 518.19.

Since the second half of the year (especially from November 18), Tencent has initiated a continuous repurchase mode, with daily repurchase amounts stabilizing around HKD 636 million. As the leading technology company in the Hong Kong stock market, Tencent's repurchases accounted for 44.5% of the total repurchase amount in the Hong Kong technology sector, making it the dominant force in the Hong Kong stock market repurchases. Additionally, the substantial repurchases have effectively alleviated the pressure of tech stock corrections since November, with the Hang Seng Tech Index showing significant recovery after hitting a low point in November.

This year, the Hong Kong stock market has performed well, with overall market sentiment seeing a notable boost. As of the time of writing, the Hang Seng Index has cumulatively increased by approximately 28%, while the Hang Seng Tech Index has risen by about 23%. Meanwhile, leading enterprises have maintained stable operations supported by strong fundamentals. Their large-scale repurchases have further conveyed positive signals to the market. Under the influence of multiple favorable factors, the share prices of companies that have consistently repurchased, such as Tencent and HSBC Holdings, have reached new highs this year.

Analysts pointed out that listed companies conducting cancellation-type repurchases can help optimize financial structures and increase earnings per share (EPS). During periods of market volatility, this action serves as an effective way to convey confidence to the market and stabilize expectations, also indicating that industrial capital views current valuations as potentially offering good value.

The Hong Kong stock market is expected to continue its recovery trend.

Looking ahead to 2026, CITIC Securities believes that the Hong Kong stock market will benefit from internal catalysts associated with the '15th Five-Year Plan,' as well as dual easing policies ('fiscal + monetary') from major external economies, particularly the United States and Japan.

From its own perspective, the Hong Kong stock market not only hosts a complete and high-quality AI industry chain within China (including infrastructure, software/hardware, and applications) but also benefits from an increasing number of quality A-share leading companies listing in Hong Kong. It is anticipated that the Hong Kong stock market will capitalize on liquidity spillover from domestic and overseas markets and ongoing catalytic effects of AI narratives. With the bottoming out and rebound of the Hong Kong stock market's fundamentals, coupled with its still pronounced valuation discount, the Hong Kong stock market is poised to experience a second wave of valuation recovery and further performance rebound in 2026.

Investors are advised to focus on five major medium- to long-term directions: the technology sector, including AI-related sub-sectors and consumer electronics; the broader healthcare sector, especially biotechnology; resource sectors benefiting from rising overseas inflation expectations combined with de-dollarization trends, including non-ferrous metals and rare earths; as domestic economic recovery continues, the relatively lagging and low-valued essential consumer goods sector is also expected to experience valuation recovery; and sectors benefiting from RMB appreciation, such as papermaking and aviation.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor /rice