The year 2025 is drawing to a close, marking a tumultuous period: from Trump's return to the White House at the beginning of the year, the disruption of global markets by U.S. tariffs in April, to the Federal Reserve’s pivot towards an easing path, and the capital frenzy ignited by artificial intelligence...

As we look ahead to 2026, how can we seize new opportunities? Subscribe to our special feature."2025 Year in Review", let us reflect on the past, consolidate experiences, and together embrace the next chapter.

Stock repurchase refers to the practice whereby listed companies use cash or other means to buy back a certain number of their outstanding shares from the stock market. This is an important institutional arrangement for companies to send positive signals and optimize their capital structure. In the U.S. stock market, stock repurchases have been a significant factor supporting the decade-long bull market.

This year, technology and financial giants have sparked a wave of capital repurchases, with the scale of share buybacks by U.S.-listed companies surpassing the $1 trillion mark at the fastest pace on record, becoming a key force driving the S&P 500 and Nasdaq indices to new highs consecutively.

This year, technology and financial giants have sparked a wave of capital repurchases, with the scale of share buybacks by U.S.-listed companies surpassing the $1 trillion mark at the fastest pace on record, becoming a key force driving the S&P 500 and Nasdaq indices to new highs consecutively.

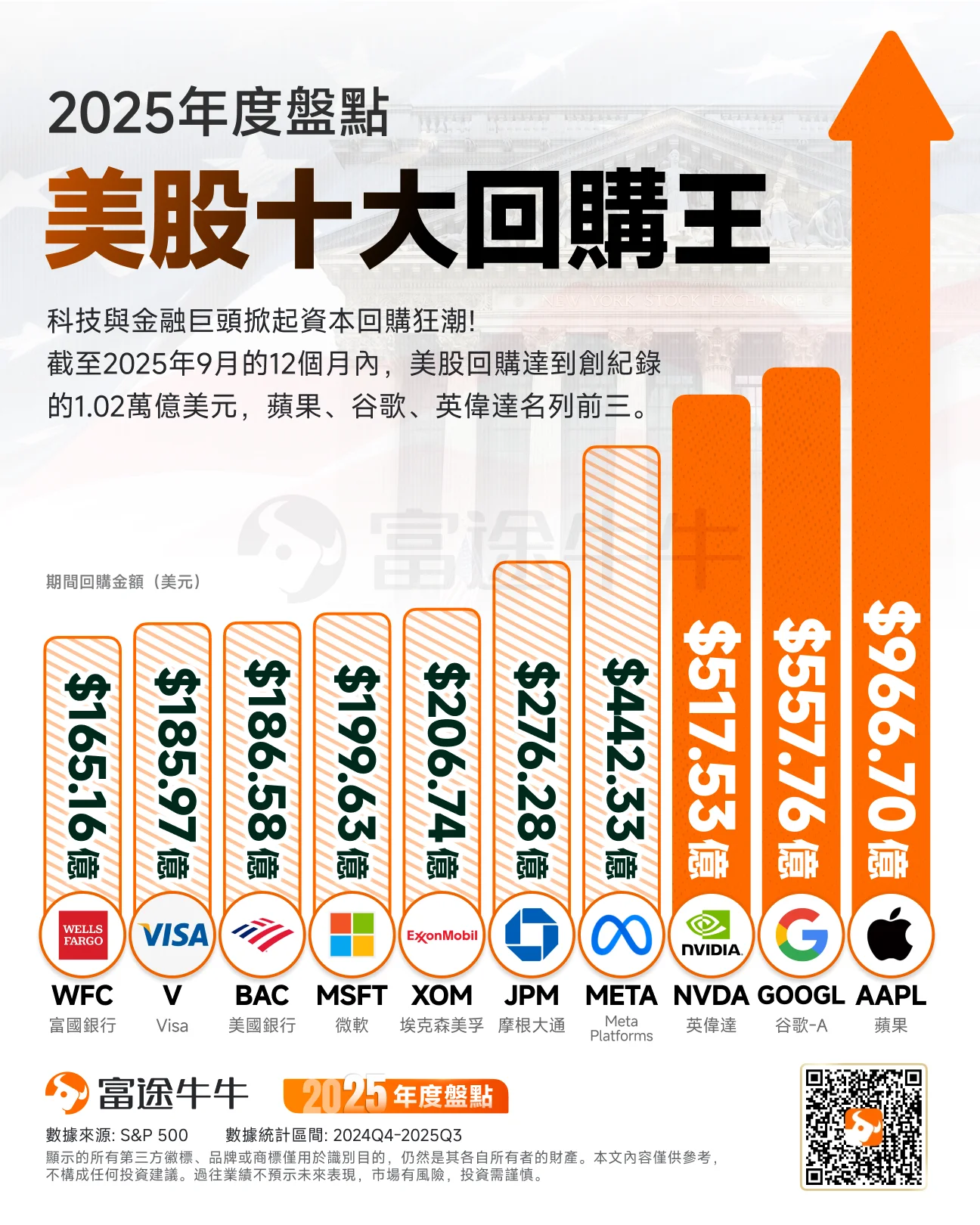

According to data from S&P Global, during the 12 months from Q4 2024 to Q3 2025, U.S. stock repurchases reached a record $1.02 trillion, marking an 11.1% year-on-year increase from $918.4 billion in the same period last year. The total repurchase amount in 2025 is expected to once again break last year's record high.

The pattern of stock repurchases in the U.S. equity market this year continues to be dominated by tech giants, with leading firms in the financial and energy sectors playing a supporting role. For example, tech giant $Apple (AAPL.US)$ 、 $Alphabet-C (GOOG.US)$ 、 $NVIDIA (NVDA.US)$ , financial giants $JPMorgan (JPM.US)$ 、 $Bank of America (BAC.US)$ , and energy giant $Exxon Mobil (XOM.US)$ are among the top ten companies on the list.

Futu News has compiled a list of 'Top 10 Companies with the Highest Stock Repurchase Amounts in the U.S. Market from Q4 2024 to Q3 2025' for fellow investors' reference.

Technology and financial giants spark a wave of capital repurchases, becoming the "ballast" of the market.

Since the beginning of this year, technology and financial giants have set off a wave of capital repurchases, a trend that has gradually become a core pillar supporting continuous new highs in the U.S. stock market.

In May, Apple announced a massive $100 billion share repurchase plan. Not to be outdone, Google launched a $70 billion stock repurchase program. The latest to join the repurchase frenzy is artificial intelligence chip giant NVIDIA, which announced a $60 billion stock repurchase plan after reporting its quarterly earnings in late August.

The financial sector was equally active, with some of the largest banks in the United States leading the wave of share repurchases. JPMorgan announced in July that it would repurchase $50 billion worth of its shares. Bank of America unveiled a $40 billion stock repurchase plan, while Morgan Stanley reauthorized a repurchase program of up to $20 billion.

While increasing capital expenditures to solidify their competitive edge in AI development, tech giants are also boosting share repurchases and dividends to satisfy shareholders. Specifically, during the 12 months from Q4 2024 to Q3 2025,$Apple (AAPL.US)$ Apple has cumulatively repurchased $96.67 billion worth of shares, firmly securing the top position in repurchase spending. According to S&P 500 statistics, Apple has spent approximately $755.231 billion on buybacks over the past decade, which has been a key factor driving its long-term stock price growth.

In addition to Apple, $Alphabet-C (GOOG.US)$ 、$NVIDIA (NVDA.US)$、 $Meta Platforms (META.US)$ 、 $Microsoft (MSFT.US)$ other companies have also ranked among the top ten in terms of repurchases. The majority of these tech giants' stock prices hit new highs in the second half of this year, with NVIDIA’s market capitalization surpassing the $5 trillion mark, making it the first company globally to achieve this milestone.

However, as the wave of buybacks continues to drive the stock market higher, it has drawn criticism from some members of the Trump administration. While companies generally justify buybacks as a natural outcome of having 'ample cash,' U.S. Treasury Secretary Bessent publicly criticized companies like Boeing on August 27, accusing them of engaging in 'massive buybacks instead of investing in R&D.'

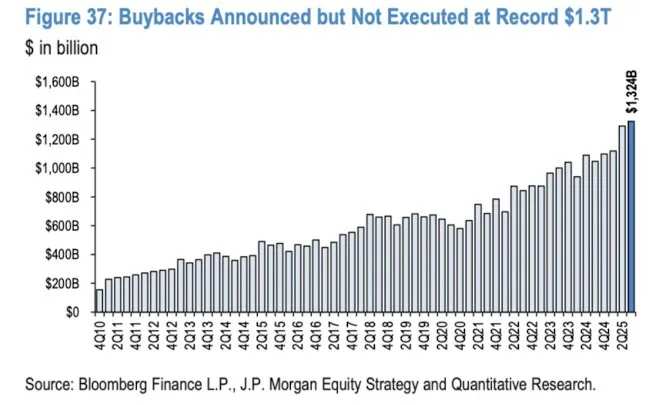

A JPMorgan research report noted that S&P 500 companies have consistently delivered strong performance by returning excess capital to investors through stock buybacks and dividends. Over the past decade, total shareholder returns grew from $905 billion to approximately $1.8 trillion (with an annual compound growth rate of about 7%). So far this year, the number of share repurchase announcements has reached record highs, with daily repurchase volumes averaging $40-50 billion, compared to approximately $40 billion per day in 2024. A slowdown in the execution pace of buybacks in recent quarters has led to an increase in the balance of 'unexecuted repurchases' to $1.3 trillion.

JPMorgan stated that stock repurchases in 2025 will primarily be funded by cash (86%). However, given multiple interest rate cuts expected over the next 12 months and higher capital expenditure announcements, we believe debt financing will play a larger role in next year's share repurchases. Notably, around 60% of repurchase announcements are concentrated among the top 20 companies, which are also heavily investing in artificial intelligence. Therefore, even though semiconductor manufacturers may ramp up their repurchases, the growth rate of buybacks is expected to moderate slightly.

Will Wall Street investment banks collectively predict a bull run for U.S. stocks, with the index reaching 8,000 points next year?

Despite U.S. equities currently trading near historical highs, Wall Street’s bullish sentiment remains strong as year-end approaches. Major investment banks have issued significantly higher S&P 500 target levels for 2026, compared to last Friday’s closing level of 6,834.5 points.

Citi set its 2026 S&P 500 target at 7,700 points, while forecasting that, under an optimistic scenario, the benchmark index could rise to 8,300 points. Similarly, Oppenheimer, Deutsche Bank, and Morgan Stanley projected targets of 8,100 points, 8,000 points, and 7,800 points, respectively. Additionally, UBS Group, Goldman Sachs, and JPMorgan all provided targets above 7,500 points. Even Bank of America, considered the least optimistic among major Wall Street firms, predicted that the S&P 500 would close around 7,100 points by December 2026.

The rationale behind this optimistic outlook includes factors such as liquidity easing from Federal Reserve rate cuts, AI-driven acceleration in corporate earnings growth, a soft landing for the U.S. economy, and the continuation of fiscal stimulus measures.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor /rice