Although these four companies operate in the same sector, their differentiated strategies have become quite clear: from pursuing a platform-oriented strategy with an all-inclusive ecosystem, to focusing on engineering capabilities for single-quarter profitability, to aligning with national-level computing power hubs through cluster-based approaches. Each company is capturing chip market share through distinct entry points.

Amid the intensifying global competition for computing power, China's GPU industry is experiencing a historic collective breakthrough.

Following the listing of Moore Threads on the STAR Market with a market value exceeding 300 billion yuan, MaxiTech quickly followed with a strong IPO. Meanwhile, Biren Technology has just passed the Hong Kong Stock Exchange’s hearing, and Tianshu Zhixin has submitted its prospectus, ready to go public—marking the convergence of the 'Big Four' domestic GPU companies in the capital markets.

Although these four companies operate in the same sector, their differentiated strategies have become quite clear: from pursuing a platform-oriented strategy with an all-inclusive ecosystem, to focusing on engineering capabilities for single-quarter profitability, to aligning with national-level computing power hubs through cluster-based approaches. Each company is capturing chip market share through distinct entry points.

Although these four companies operate in the same sector, their differentiated strategies have become quite clear: from pursuing a platform-oriented strategy with an all-inclusive ecosystem, to focusing on engineering capabilities for single-quarter profitability, to aligning with national-level computing power hubs through cluster-based approaches. Each company is capturing chip market share through distinct entry points.

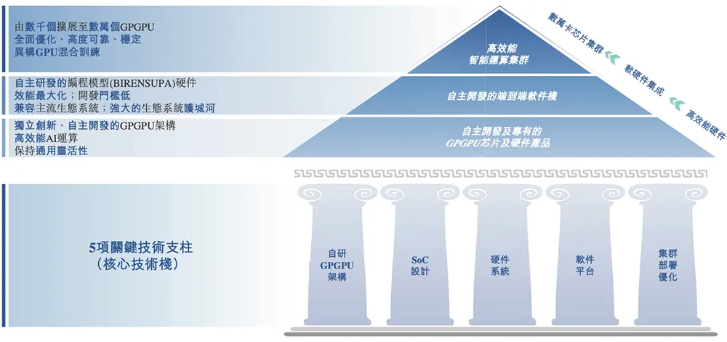

In this fierce competition, the differentiated competitive strategies of each company have become clear. Tianshu Zhixin leverages its first-mover advantage of 'earliest mass production, most stable supply,' supported by two mature product lines—Tiangē (training) and Zhikai (inference)—achieving diversified customer structures and steady revenue growth.

Moore Threads, which recently listed on the STAR Market, has raised the banner of 'ecosystem supremacy.' Its full-function GPU strategy based on the MUSA architecture penetrates both B-end and C-end markets. The company’s grand ecosystem layout, comparable to NVIDIA, alongside its market valuation exceeding 300 billion yuan, reflects the high expectations of investors regarding its platform-level value.

Meanwhile, the other two giants have demonstrated robust momentum in computational infrastructure and commercial efficiency. MaxiTech completed its impressive IPO with a market value of 200 billion yuan at an extraordinary pace and became the first among the Big Four to achieve quarterly profitability in Q2 2025, breaking the industry’s norm of sustained losses and leading as the fastest to monetize commercially.

By comparison, Biren Technology, which is set to become the 'first domestically produced GPU stock in Hong Kong,' boasts a strong backing from state-owned capital and demonstrates significant capabilities in large-scale cluster deployment and operator partnerships.

Tianshu Zhixin: First-mover Advantage + Full Product Line, Rapid Decline in Customer Concentration

As one of the earliest companies in China to embark on general-purpose GPU design, Tianshu Zhixin has solidified its stable position in the supply chain through its first-mover advantage of 'earliest mass production, most stable supply.' According to the prospectus, the company is the first in China to achieve dual mass production of 'training + inference' general-purpose GPUs and the first Chinese design firm to reach this milestone using a 7nm process.

The completeness of its product line constitutes Tianshu Zhixin’s core competitive moat. Currently, the company operates two mature product lines—Tiangē (training) and Zhikai (inference)—covering AI model training and inference scenarios, forming a complete portfolio of general-purpose GPU products. The company’s cumulative shipments have exceeded 53,000 units.

This dual-driven product strategy enables it to address the entire range of needs from complex model development to efficient production deployment. Financial data shows that over the past three and a half years, more than half of its revenue came from high-priced training series products, reflecting its competitiveness in the core computing power market.

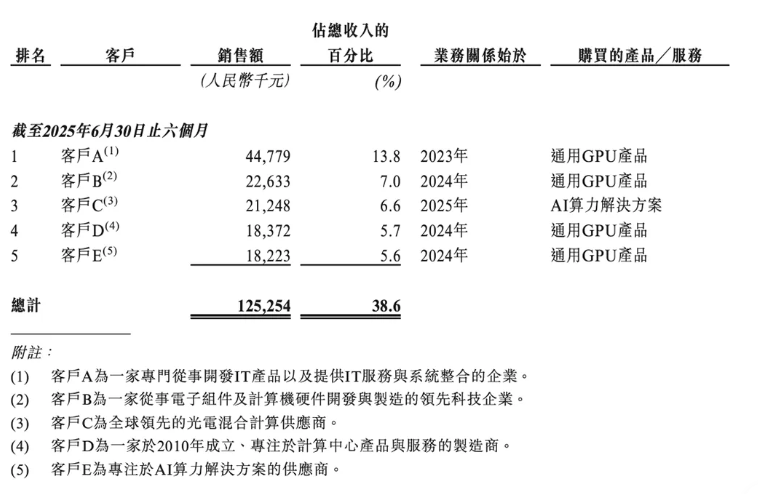

The prospectus shows that the company's revenue is experiencing rapid growth, with income reaching 324 million yuan in the first half of 2025, surpassing the full-year level of 2023. Meanwhile, the company's customer structure has significantly improved, reducing reliance on a single client. In 2022, the top five clients accounted for 94.2% of revenue, but by the first half of 2025, this proportion had dropped sharply to 38.6%. The total number of clients also increased from 22 to 106.

The rapid decline in customer concentration indicates that TianShu ZhiXin has shaken off its dependence on a few major early clients, and its product versatility and market recognition are rapidly penetrating across the entire industry. Additionally, more than one-third of the company’s R&D team has over a decade of experience, while its executive team includes senior experts from international giants such as NVIDIA and AMD, further ensuring the stability of technological iteration.

Moore Threads: Ecosystem First, Platform Value Promising

Moore Threads, which recently listed on the STAR Market, has entered the forefront of the sector with a market value exceeding 300 billion yuan. The market’s high valuation largely reflects the payment for its vast ecosystem potential.

Unlike manufacturers focusing solely on single computing scenarios, Moore Threads emphasizes a full-function GPU strategy. The company has launched four generations of GPUs based on its proprietary MUSA architecture, achieving a breakthrough where a single chip can simultaneously support AI computing, graphics rendering, and scientific computing. Its MTT S80 graphics card has approached NVIDIA's RTX 3060 in single-precision floating-point computing power, with some performance indicators reaching internationally advanced levels.

This full-function layout enables it to meet diverse needs ranging from AI computing to personal computers. According to the prospectus, the company sold five AI clusters in the first half of 2025, demonstrating its product competitiveness and substitution potential in key bottleneck areas like intelligent computing centers.

Although it has yet to turn profitable, Moore Threads has demonstrated strong growth momentum. The company forecasts that its revenue could reach up to 1.498 billion yuan in 2025, representing a year-on-year increase of over 240%, with gross margin improving to around 70%. According to its plan, the company expects to achieve profitability as early as 2027.

Investors’ high valuation of Moore Threads essentially reflects their confidence in its long-term ecosystem potential. As one of the few domestic GPU companies that simultaneously serve both B2B and B2C markets while supporting full computing precision, once an extensive application adaptation forms an ecosystem loop, its platform will exhibit significant amplification effects. This “ecosystem-first” approach mirrors the core growth logic of NVIDIA.

Biren Technology: Backed by National Support, Preferred Computing Power Hub

Biren Technology, which has passed the Hong Kong Stock Exchange listing hearing, has carved out a unique path deeply tied to the national-level computing power upgrade dividend.

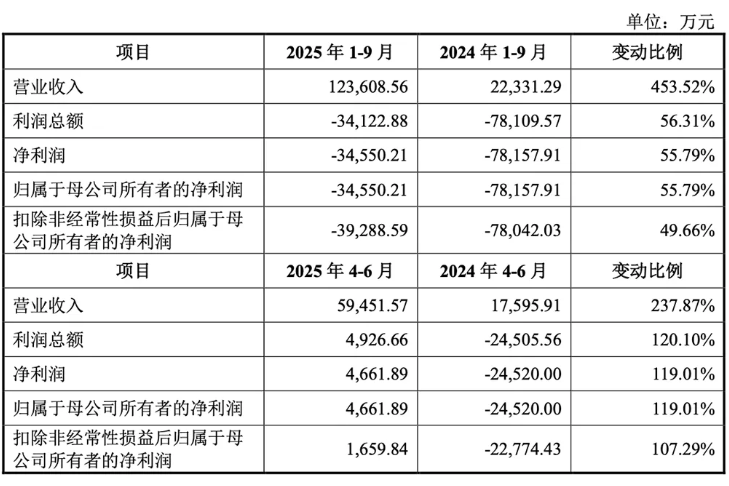

On December 17, according to the disclosure by the Hong Kong Stock Exchange, Biren Technology passed the hearing and is set to become the first "domestically produced GPU stock" in the Hong Kong market. The prospectus shows that the company's revenue climbed to RMB 337 million in 2024, with a two-year compound annual growth rate as high as 2500%.

The company boasts an impressive lineup of state-owned capital, including Shanghai Guotou XianDao Fund, Guangzhou Industrial Investment, and Ping An Group, among others. This shareholder background provides it with a natural advantage when undertaking national-level computing power hub and supercomputing center projects.

In terms of technological roadmap, Biren Technology focuses on large-scale clusters of thousands of GPUs, Chiplet (chiplet), and optical interconnect technologies, concentrating on addressing system-level challenges in large-scale computing power deployment. Data shows that in 2024, the company established deep partnerships with the three major telecom operators and successfully delivered a 1024-GPU intelligent computing cluster project worth RMB 180 million. This ability to deliver large-scale orders demonstrates the maturity of its products in carrier-grade high-reliability scenarios.

Although the revenue scale is still in the ramp-up phase, Biren Technology’s growth has been explosive, with a compound annual growth rate as high as 2500%. As the Biren series products deepen their application in AI model training and inference, especially in rapid adaptation to cutting-edge models like DeepSeek, Biren Technology is gradually establishing itself as a core supplier of computing infrastructure.

Muxi Corporation: Fastest commercialization speed, first to achieve quarterly profitability

Compared to the other three companies, Muxi Corporation exhibits exceptional engineering capabilities and commercialization speed. This company, which carries a strong AMD technical heritage, achieved a commercial breakthrough just four years after its founding, breaking the industry norm of continuous losses.

Information from December 17 shows that Muxi Corporation opened at RMB 700.00, surging 568.83% above the issue price, with its current market value reaching RMB 281.4 billion, making it the second domestically produced GPU company to go public after Moore Threads. Recognized as a national-level specialized and innovative “little giant,” its IPO process, from acceptance to listing, took less than six months.

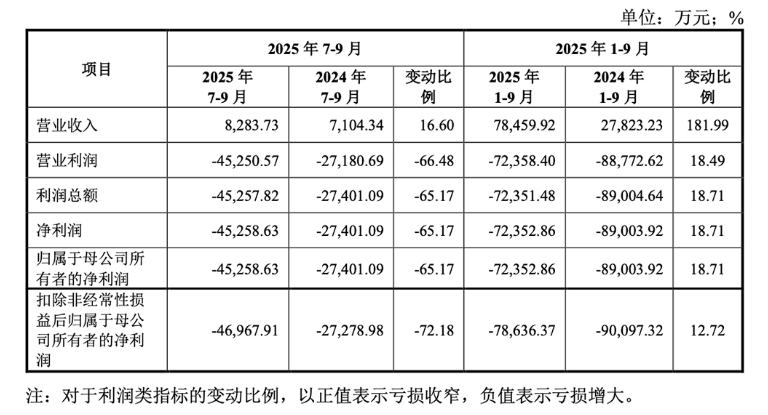

More crucially, Muxi Corporation has already reached a financial turning point – in the second quarter of 2025, the company reported net profit attributable to shareholders of RMB 46.6189 million, becoming the first of the four leading companies to achieve quarterly profitability. From January to September 2025, the loss narrowed significantly, with net profit reaching -RMB 346 million.

Muxi Corporation’s approach is pragmatic and highly efficient. Instead of merely chasing concepts, the company leveraged the strong product implementation capabilities of its AMD-based team to quickly roll out three major product lines covering AI computing, general-purpose computing, and graphics rendering. Not only did it achieve several-fold year-on-year revenue growth in the first half of 2025, but it also expects full-year revenue to exceed RMB 1.5 billion.

The company's efficient execution stems from its technical team background, with key executives Chen Weiliang, Peng Li, Yang Jian, and others having served long tenures at AMD Shanghai, possessing robust product engineering and implementation capabilities. This technical foundation has driven the rapid iteration of the three major product lines: the XiYun C600 chip, based on domestic supply chains, is expected to enter risk production by the end of the year, while the flagship XiYun C700 aims to compete with NVIDIA's H100. To date, the company’s cumulative GPU sales have exceeded 25,000 units, with deployments completed on multiple national and operator intelligent computing platforms.

Editor/jayden