The year 2025 is drawing to a close, marking a tumultuous period: from Trump's return to the White House at the beginning of the year, the disruption of global markets by U.S. tariffs in April, to the Federal Reserve’s pivot towards an easing path, and the capital frenzy ignited by artificial intelligence...

As we look ahead to 2026, how can we seize new opportunities? Subscribe to our special feature."2025 Year in Review", let us reflect on the past, consolidate experiences, and together embrace the next chapter.

Looking back at 2025, the Hong Kong stock market demonstrated strong resilience amid multiple uncertainties, charting a slow and volatile upward trend. As of December 22, the three major indices have all risen by more than 20% year-to-date, with $Hang Seng Index (800000.HK)$ a cumulative increase of nearly 29%, $Hang Seng TECH Index (800700.HK)$ rising by nearly 24%.

The Hong Kong stock market started the year on a positive note, steadily rising for two consecutive months. However, it experienced a significant downturn between late March and mid-April due to the unexpected tariff actions by the Trump administration, which also impacted global markets. As China and the U.S. gradually resolved their differences through multiple rounds of negotiations, coupled with substantial inflows from southbound funds providing robust support, market confidence was gradually restored, and Hong Kong stocks resumed their upward trajectory. In the fourth quarter, Hong Kong stocks shifted to a volatile pattern, starting a correction in mid-October, with market volatility notably increasing. November saw overall sideways movement, while adjustments deepened further in December.

The Hong Kong stock market started the year on a positive note, steadily rising for two consecutive months. However, it experienced a significant downturn between late March and mid-April due to the unexpected tariff actions by the Trump administration, which also impacted global markets. As China and the U.S. gradually resolved their differences through multiple rounds of negotiations, coupled with substantial inflows from southbound funds providing robust support, market confidence was gradually restored, and Hong Kong stocks resumed their upward trajectory. In the fourth quarter, Hong Kong stocks shifted to a volatile pattern, starting a correction in mid-October, with market volatility notably increasing. November saw overall sideways movement, while adjustments deepened further in December.

In terms of sectors, this year has seen remarkable gains in the materials sector driven by record highs in precious metals such as gold and silver. The sector surged nearly 160% year-to-date, with precious metals and non-ferrous metal stocks becoming focal points in the market. The healthcare sector also performed exceptionally well, rising over 64% year-to-date, driven by industry recovery and favorable policy measures, leading to a valuation rebound in innovative drug stocks. Additionally, the financial and information technology sectors followed closely behind, both gaining approximately 40%.

Within the materials sector, gold stocks stood out. Amidst geopolitical tensions and concerns about global inflation, gold'ssafe-haven assetsappeal significantly increased. Year-to-date, spot gold has risen over 70%, nearing a historic high of $4,500. Hong Kong-listed gold stocks followed the rise in gold prices, $CHINAGOLDINTL (02099.HK)$ soaring over 300% year-to-date, $SD GOLD (01787.HK)$ 、 $ZHAOJIN MINING (01818.HK)$ with gains of nearly 200%.

Additionally, other non-ferrous metals such as silver, platinum, copper, cobalt, and lithium also witnessed strong performances. Among non-ferrous metal stocks, $CMOC (03993.HK)$ Surging over 280% within the year, $MMG (01208.HK)$ 、$JIANGXI COPPER (00358.HK)$ Rising approximately 240%, $CHINFMINING (01258.HK)$ Increasing more than 210%, $CHINAHONGQIAO (01378.HK)$ Approaching a 200% increase.

The pharmaceuticals and biotechnology industry in 2025 has shown multiple positive signals, with the healthcare sector of Hong Kong stocks rising over 64% within the year. Institutions note that China's innovative drug companies, after nearly a decade of development, have entered a phase of dense harvest from their pipelines. Multiple innovative research achievements from domestic pharmaceutical enterprises have been successfully implemented, and the outbound business development (BD) of innovative drugs is proceeding steadily. $3SBIO (01530.HK)$ Soaring nearly 350% within the year, $ASCLETIS-B (01672.HK)$ Rising over 310%, $SKB BIO-B (06990.HK)$ Increasing more than 150%, $HANSOH PHARMA (03692.HK)$ 、 $INNOVENT BIO (01801.HK)$ All rising over 120%.

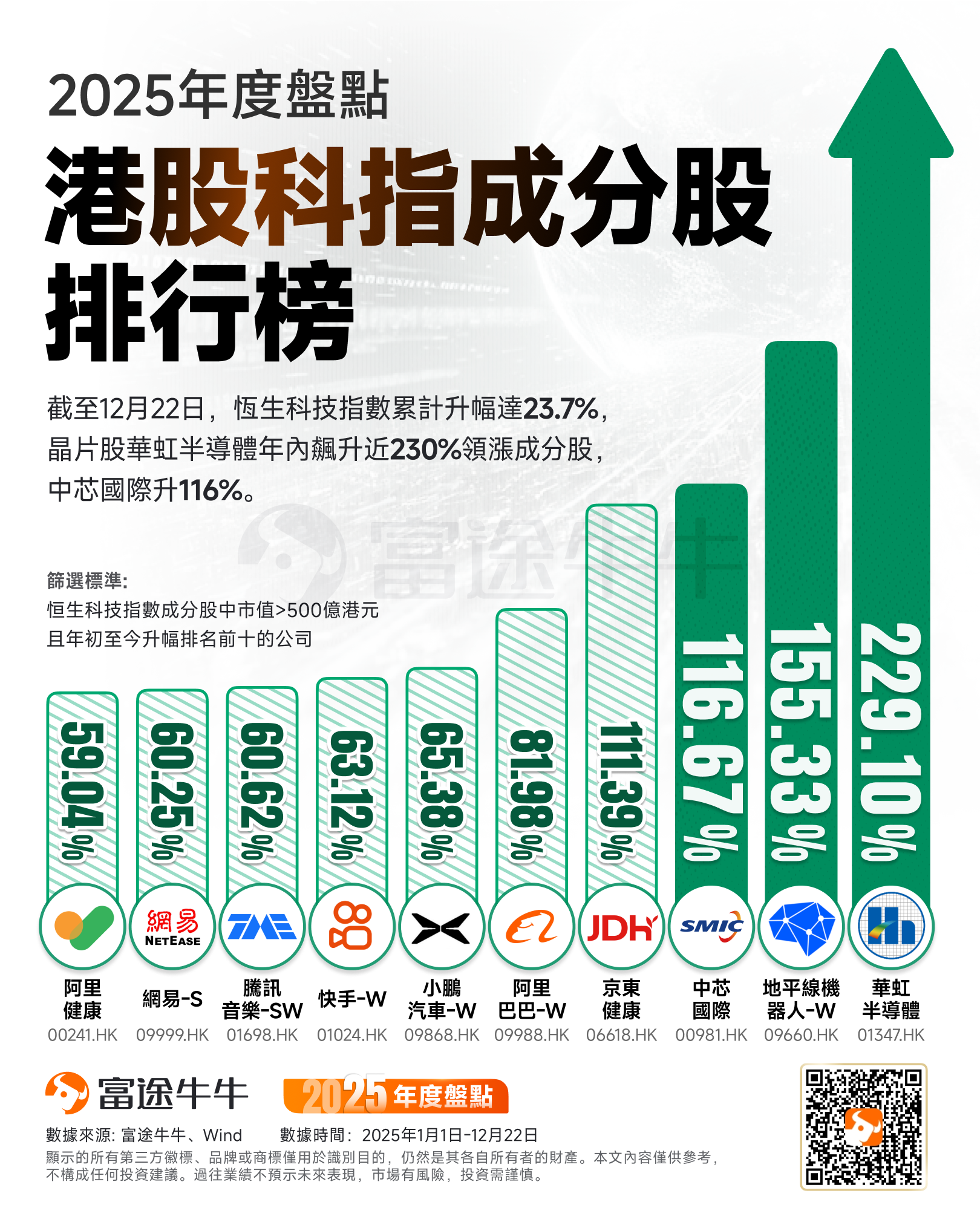

Among the constituent stocks of the Hang Seng Tech Index, chip stocks performed the most outstandingly, $HUA HONG SEMI (01347.HK)$Increased by nearly 230% this year, leading the tech index.$SMIC (00981.HK)$The cumulative increase has exceeded 110%. The humanoid robot industry is receiving a lot of attention, and robot concept stocks.$HORIZONROBOT-W (09660.HK)$In the year, it has risen by over 150%. In addition,$BABA-W (09988.HK)$Rising over 80% within the year, leading the major internet giants,$KUAISHOU-W (01024.HK)$ 、 $NetEase (NTES.US)$All increased by over 60%.

Institutions Outlook on Hong Kong Stock Market Trends in 2026

Looking ahead to 2026, both buy-side and sell-side institutions have optimistic expectations for the performance of Hong Kong stocks. Several institutions believe that, driven by multiple factors such as improved liquidity and corporate profit recovery, Hong Kong stocks are likely to continue their upward trend, with the market driving logic possibly shifting from valuation recovery to profit growth.

CITIC Securities believes that Hong Kong stocks will benefit from the internal "14th Five-Year Plan" catalyst, as well as the "fiscal + monetary" dual easing policies of major external economies, especially the United States and Japan. From its own perspective, Hong Kong stocks not only have a complete domestic high-quality AI industry chain (including infrastructure, software and hardware, and applications), but also an increasing number of high-quality leading A-share companies listing in Hong Kong. It is expected that Hong Kong stocks will benefit from the spillover of liquidity from domestic and foreign markets and the continuous catalyst of the AI narrative. As the fundamentals of Hong Kong stocks rebound from the bottom, coupled with their still significant valuation discount, the Hong Kong stock market is expected to welcome a second round of valuation repair and further performance recovery in 2026.

Investors are advised to focus on five major medium- to long-term directions: the technology sector, including AI-related sub-sectors and consumer electronics; the broader healthcare sector, especially biotechnology; resource sectors benefiting from rising overseas inflation expectations combined with de-dollarization trends, including non-ferrous metals and rare earths; as domestic economic recovery continues, the relatively lagging and low-valued essential consumer goods sector is also expected to experience valuation recovery; and sectors benefiting from RMB appreciation, such as papermaking and aviation.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/jayden