The year 2025 is drawing to a close, marking a tumultuous period: from Trump's return to the White House at the beginning of the year, the disruption of global markets by U.S. tariffs in April, to the Federal Reserve’s pivot towards an easing path, and the capital frenzy ignited by artificial intelligence...

As we look ahead to 2026, how can we seize new opportunities? Subscribe to our special feature."2025 Year in Review", let us reflect on the past, consolidate experiences, and together embrace the next chapter.

As 2025 draws to a close, looking back at the past year, the U.S. stock market has maintained strong momentum amidst volatility and fervor, with the three major indices repeatedly hitting new all-time highs. As of December 22, $Dow Jones Industrial Average (.DJI.US)$ the year-to-date increase has been nearly 14%, $Nasdaq Composite Index (.IXIC.US)$ surged over 21%, $S&P 500 Index (.SPX.US)$ rose nearly 17%.

"Tariffs" and "rate cuts" became the main themes of capital flows throughout the year. Following Trump's return to the White House, fluctuations in tariff policies once sent shivers through the market, leading to the prevalence of "TACO trades." However, after China and the U.S. officially reached an agreement on November 10, 2025, trade tensions temporarily entered a stable phase. At the interest rate meetings in September, October, and December, the Federal Reserve cut rates consecutively three times, marking the middle-to-late stage of this monetary easing cycle.

"Tariffs" and "rate cuts" became the main themes of capital flows throughout the year. Following Trump's return to the White House, fluctuations in tariff policies once sent shivers through the market, leading to the prevalence of "TACO trades." However, after China and the U.S. officially reached an agreement on November 10, 2025, trade tensions temporarily entered a stable phase. At the interest rate meetings in September, October, and December, the Federal Reserve cut rates consecutively three times, marking the middle-to-late stage of this monetary easing cycle.

According to statistics, as of last Friday, except for the real estate sector, all other 11 major sectors of the U.S. stock market have achieved gains. Notably, the materials sector soared 38% year-to-date, while the communication services sector followed closely with a 30% increase. Meanwhile, AI narratives continued to dominate market trends, with the technology sector recording approximately 22% growth year-to-date.

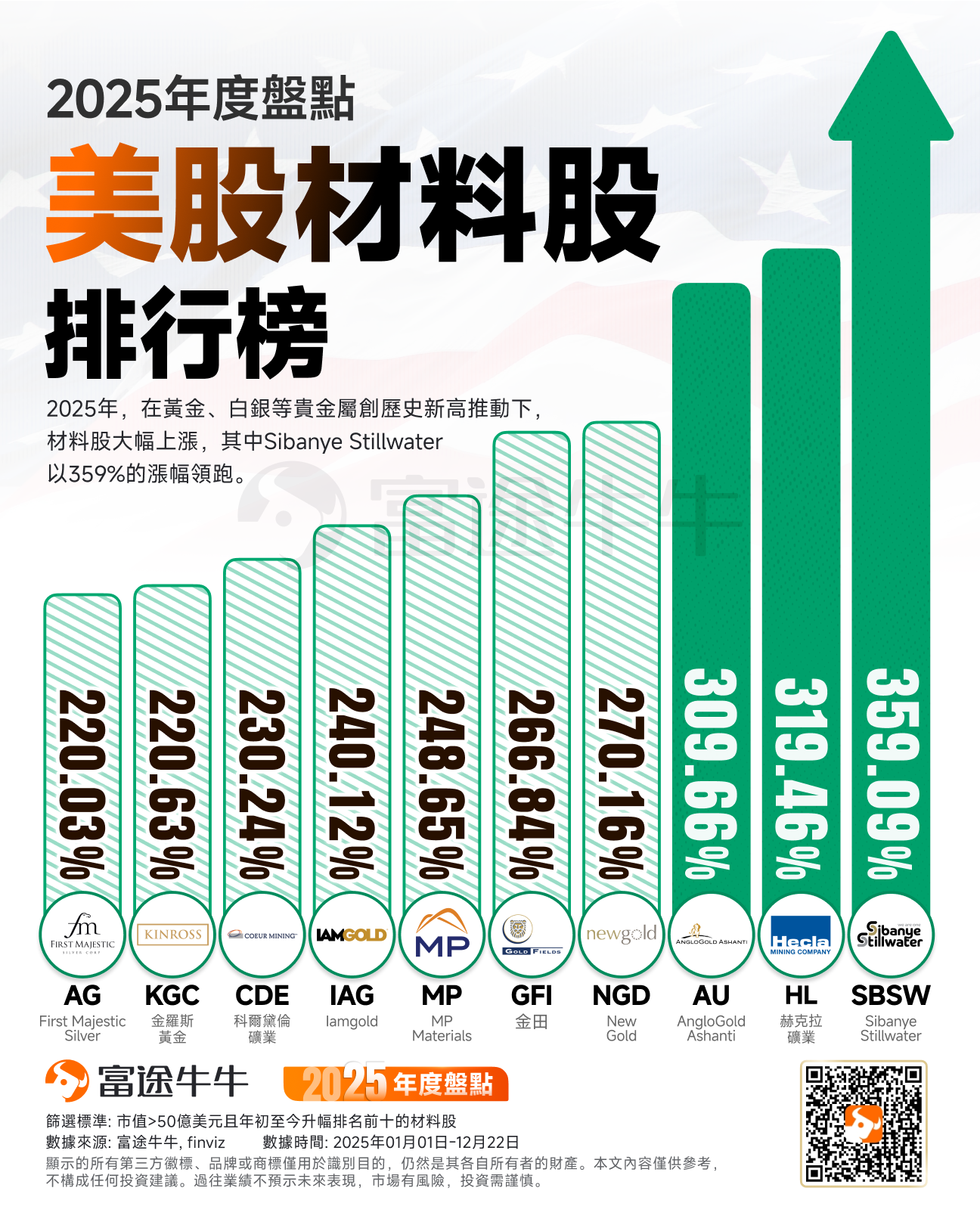

Precious metal stocks have outperformed within the materials sector. 2025 has been a bull market for precious metals, with both gold and silver reaching new all-time highs; silver led the gains with an increase of over 140% year-to-date, while gold rose by approximately 70%.

Driven by the record highs in precious metals such as gold and silver, related stocks experienced significant increases. Among them, $Sibanye Stillwater (SBSW.US)$ led the precious metals sector with an increase of approximately 360%, $Hecla Mining (HL.US)$ followed closely behind with gains exceeding 320%. In the gold sector, $AngloGold Ashanti (AU.US)$ Surging nearly 310%, $New Gold (NGD.US)$ 、 $Gold Fields (GFI.US)$ rose approximately 270%, $Coeur Mining (CDE.US)$ up more than 230%, $Kinross Gold (KGC.US)$ up over 220%; silver stocks $First Majestic Silver (AG.US)$ have risen more than 220% year-to-date.

Moreover, U.S.-listed rare earth concept stocks have performed remarkably well this year. In its effort to rebuild the rare earth supply chain, the U.S. government has actively invested in and provided financial support to domestic rare earth companies, with rare earth-related stocks $MP Materials (MP.US)$ having surged nearly 250% year-to-date.

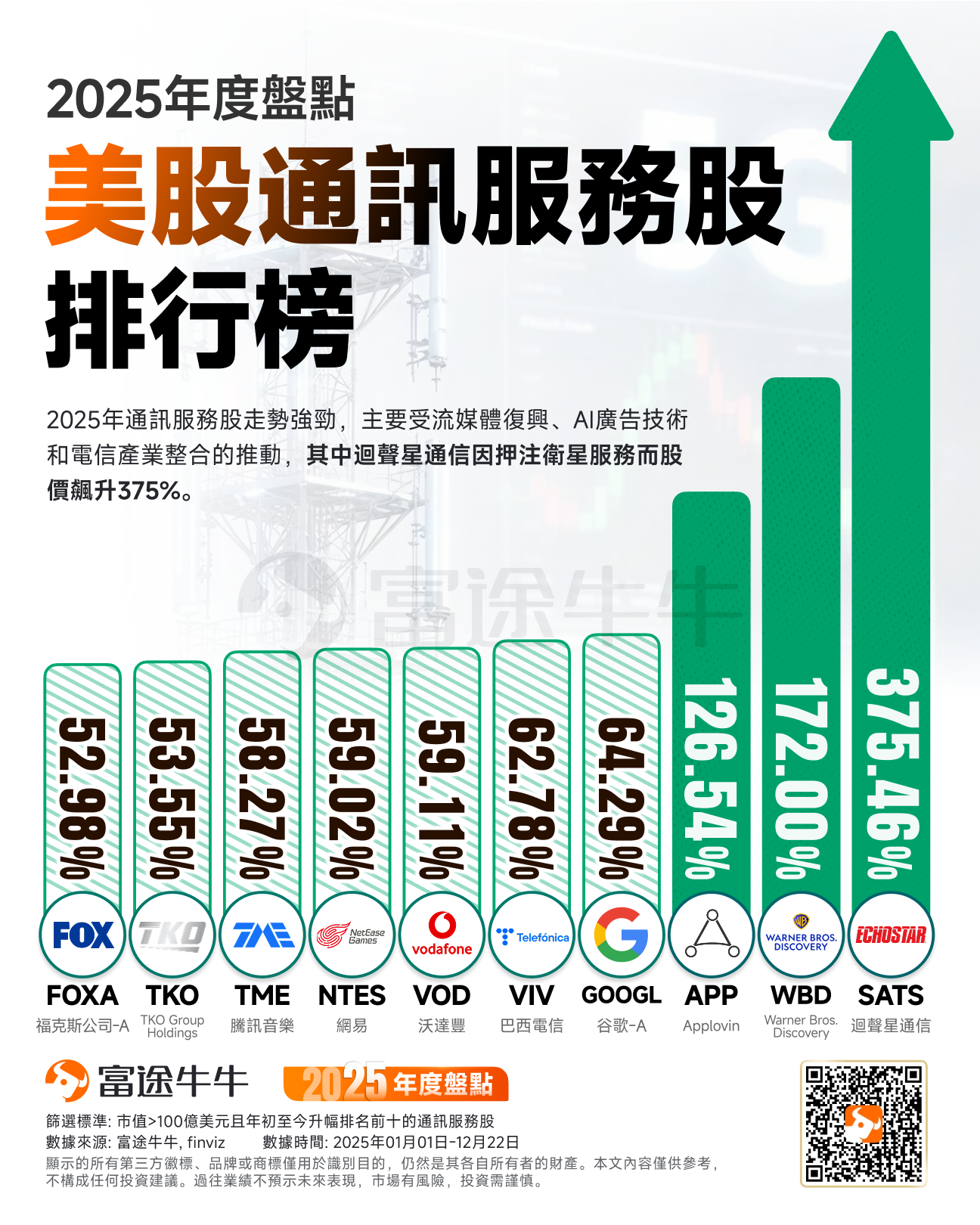

The communications services sector showed strong performance in 2025, driven by the resurgence of streaming services, advancements in AI-driven advertising technologies, and consolidation within the telecommunications industry. Among them, a long-established American satellite service provider $EchoStar (SATS.US)$ soared an impressive 375% year-to-date, leading the pack; due to$Netflix (NFLX.US)$Warner Bros Discovery, a streaming enterprise, is in fierce competition with Paramount for acquisitions, $Warner Bros Discovery (WBD.US)$ with a surge of over 172% year-to-date; AI advertising giant $Applovin (APP.US)$ continues its strong momentum from last year, rising over 126% year-to-date.

Moreover, the AI narrative remains the focal point of the U.S. equity market in 2025, with the technology sector recording a gain of approximately 22% this year. From the stunning debut of Sora at the beginning of the year to the phenomenal popularity of "Nano Banana" at year-end, the market focus is shifting from the "OpenAI chain" to the "Google chain," and from pure computing power accumulation to concerns over shortages of electricity and storage capacity. $Alphabet-A (GOOGL.US)$ with a rise of over 64% year-to-date, marking the largest increase among the 'Magnificent Seven' in the U.S. stock market; $NVIDIA (NVDA.US)$ rose nearly 37%.

However, beneath the prosperity, concerns are gradually emerging. Discussions about 'circular transactions' and an 'AI bubble' involving companies like OpenAI are heating up. Investors are no longer blindly buying into the capital expenditure narratives of tech giants, instead focusing on the actual implementation and commercial returns of AI applications.

Institutional Outlook on U.S. Stock Market Trends for 2026

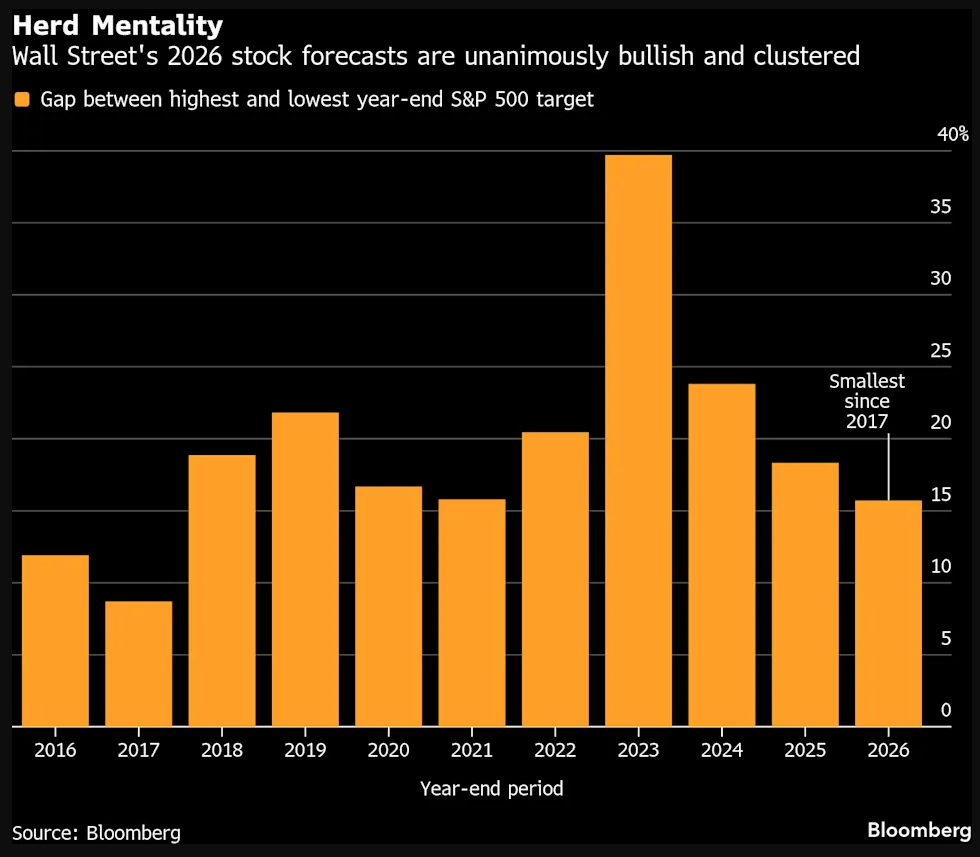

According to data compiled by Bloomberg, year-end target forecasts by major institutional sell-side strategists for $S&P 500 Index (.SPX.US)$ show the most concentrated distribution in nearly a decade. Among them, Oppenheimer's forecast is the highest at 8100 points, while Stifel Nicolaus & Co.'s forecast is the lowest at 7000 points, with an annual expectation gap of only 16%. Strategists on average expect the U.S. stock market to rise by approximately 11% in 2026.

Michael Wilson, Morgan Stanley's chief U.S. equity strategist, raised the year-end target for the S&P 500 index in 2026 to 7800 points. Morgan Stanley believes that a "policy trifecta" of fiscal policy, monetary policy, and deregulation will create a rare procyclical combination by 2026, providing a favorable environment for risk assets. Meanwhile, the AI-related capital expenditure cycle is still in its early stages and is expected to provide continuous momentum for corporate earnings.

Michael Hartnett, a Bank of America strategist, stated in his outlook report that the market has begun positioning itself in anticipation of robust economic growth in 2026. Investors widely expect that measures such as interest rate cuts, tax reductions, and tariff reductions will collectively drive an acceleration in corporate earnings.

Blackrock noted in its outlook that AI will continue to be the dominant theme in the market in 2026. However, elevated speculative trading and leveraged operations may exacerbate market volatility, and investors should prepare for potentially turbulent conditions.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/jayden