Top News

Trump's 'handpicked' board member Milan: Risk of recession if the Federal Reserve does not continue to cut interest rates next year.

Milan said on Monday, "I don’t think there will be a recession in the short term," but rising unemployment should prompt the Federal Reserve to continue cutting interest rates; the unemployment rate may have risen beyond expected levels, thus the data could push the Fed towards a dovish stance. He reiterated that if no one is appointed by the end of January, he will continue to serve as a Fed governor. Other Fed officials who spoke recently were more cautious than Milan, including next year’s voter Hamaker, who advocated for a pause in rate cuts in an interview published last Sunday.

Could fiscal stimulus backfire? Former BOJ official warns: rate hikes may exceed expectations, with interest rates reaching 1.5%.

Makoto Sakurai, a former member of the Bank of Japan’s Policy Board, said on Monday that during the remainder of Governor Kazuo Ueda’s term until early 2028, the central bank might raise interest rates three more times, pushing rates up to 1.5%. He also warned that the government’s aggressive fiscal spending plans could backfire by exacerbating inflation. Makoto Sakurai expects the Bank of Japan’s next rate hike to occur in June or July next year, at which point rates will rise to 1.0%. The exact timing of the rate hike will depend on the strength of the U.S. economy and the latest developments in domestic wages and prices in Japan.

Makoto Sakurai, a former member of the Bank of Japan’s Policy Board, said on Monday that during the remainder of Governor Kazuo Ueda’s term until early 2028, the central bank might raise interest rates three more times, pushing rates up to 1.5%. He also warned that the government’s aggressive fiscal spending plans could backfire by exacerbating inflation. Makoto Sakurai expects the Bank of Japan’s next rate hike to occur in June or July next year, at which point rates will rise to 1.0%. The exact timing of the rate hike will depend on the strength of the U.S. economy and the latest developments in domestic wages and prices in Japan.

Expectations of interest rate cuts and geopolitical tensions have driven capital towards precious metals, with both gold and silver hitting new all-time highs.

$黄金/美元(XAUUSD.CFD)$Up 2.43% on Monday, currently gaining 0.43%, with a high of $4,467.63.$Silver/USD (XAGUSD.FX)$ Gaining 2.77% yesterday, prices reached a high of $69.36. Both gold and silver prices hit record highs, surging 70% and 139% respectively year-to-date, set to mark their largest annual gains since 1979.

Analysts attribute the latest rally to traders betting that the Federal Reserve will cut interest rates twice in 2026, while President Trump has publicly advocated for a more accommodative monetary policy. Lower interest rates typically support precious metals, which do not pay interest. Meanwhile, geopolitical risks have also reinforced the safe-haven appeal of gold and silver. Investors have played a key role in the upward movement of gold prices, partly due to what is known as “devaluation trades” — concerns over mounting debt levels worldwide have led to funds exiting sovereign bonds and their denominated currencies, shifting allocations into gold. Goldman Sachs and other banks predict that gold prices will continue to rise through 2026, with a base-case scenario of $4,900 per ounce, and greater upside risks. The bank noted that ETF investors are beginning to compete with central banks for limited physical supplies.

Bank of America CEO: The economic boost from AI is gradually becoming evident.

Bank of America CEO Brian Moynihan said on Monday that AI investments are gradually “gaining momentum,” providing significant marginal support to the U.S. economy and are expected to amplify their impact in the coming years. The bank forecasts that the U.S. economy will remain robust next year, despite some slowdown in the labor market, with overall risks remaining manageable. He noted that even if the AI sector experiences a temporary pullback, its impact on the broader macroeconomy would be relatively limited.

Chinese stocks receive another bullish call! Goldman Sachs: The rally will continue into next year, with potential for a 38% increase by the end of 2027.

Benefiting from investors reassessing the value of China’s tech sector and favorable inflows of household savings into the stock market, Chinese equities have rebounded strongly this year. Goldman Sachs’ latest forecast suggests that Chinese stocks will extend their rally into 2026. Analysts at Goldman Sachs believe that China’s equity market cycle is transitioning from 'expectation-driven' to 'earnings-driven,' where earnings realization and modest valuation expansion will become the core drivers of returns. The report notes that corporate earnings in China could grow by 14% next year and by another 12% in 2027, while valuation expansion may reach around 10%. Goldman Sachs analysts reiterated that the Chinese stock market could rise by another 38% by the end of 2027.

Asset management giant Apollo shifts to 'risk-off mode': hoarding cash, deleveraging, and waiting for 'trouble to strike'?

Apollo CEO warns of inflated asset prices and escalating geopolitical risks. The company has significantly increased its cash reserves, reduced leverage, sold off high-risk assets such as AI loans and CLOs, and its insurance arm has cut CLO exposure to $20 billion. Apollo also cautioned that offshore regulatory arbitrage could trigger systemic risks in the insurance market, and the firm is preparing for potential market turbulence ahead.

U.S. Stock Market Recap

The three major indexes extended their winning streak to three days, with the Nasdaq up 0.52% and AI-related stocks performing strongly as Micron Technology surged over 4%.

On Monday, U.S. stocks opened higher and closed on a positive note, with all three major indexes posting gains for the third consecutive day. At the close, the Dow Jones Industrial Average rose 0.47%, the S&P 500 gained 0.64%, and the Nasdaq Composite Index advanced 0.52%.

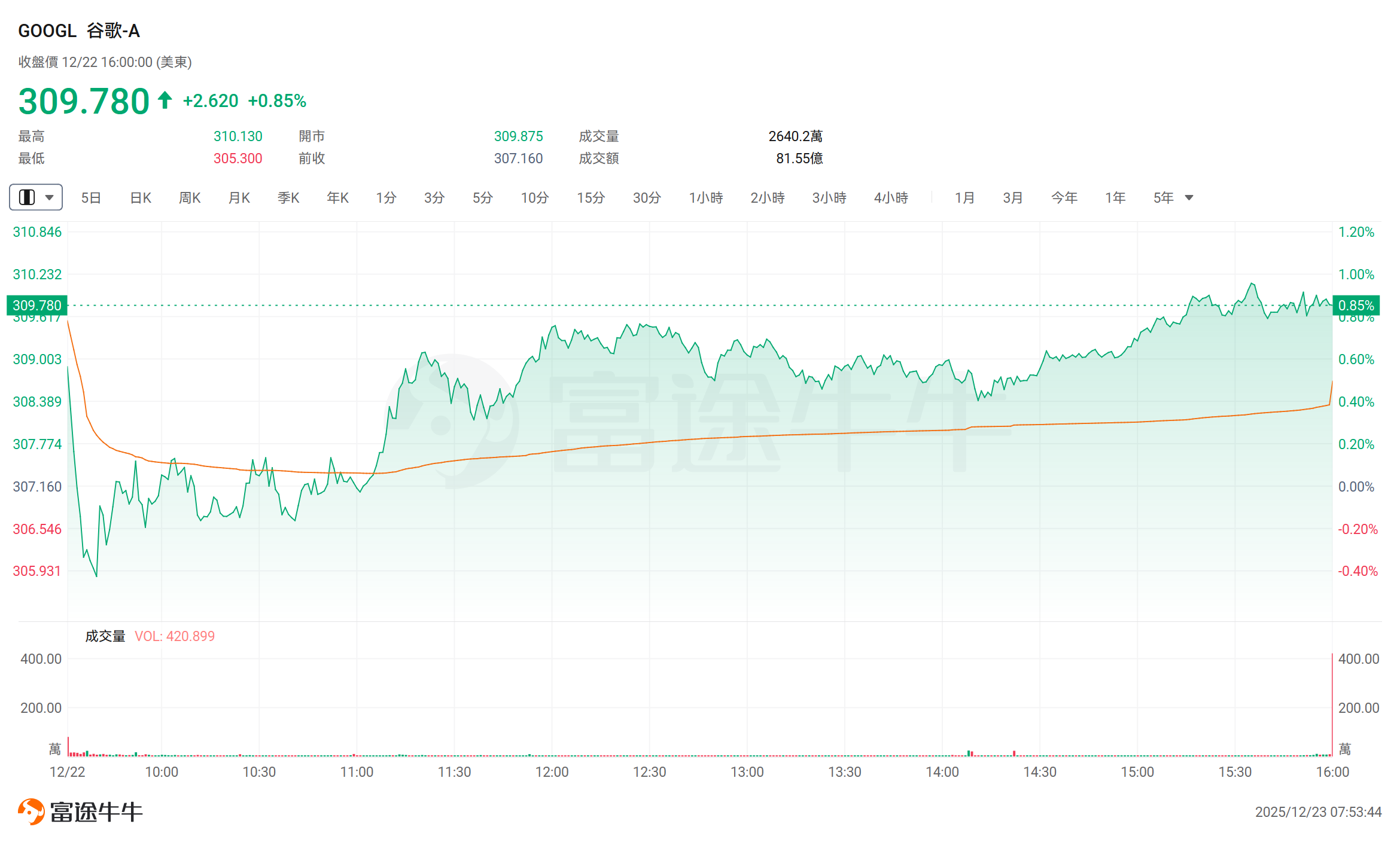

Most large-cap tech stocks closed higher, with Tesla up 1.56%, NVIDIA gaining 1.49%, Apple falling 0.99%, Alphabet A rising 0.85%, Microsoft declining 0.21%, Amazon advancing 0.48%, Meta Platforms increasing 0.41%, and Broadcom climbing 0.51%.

The Philadelphia Semiconductor Index rose 1.1%, with 24 of its 30 components closing higher. Astera Labs surged 5%, Micron Technology climbed 4.01%; Intel fell 1.22%, Rambus dropped 1.18%, and Arm Holdings declined 0.65%.

The solar energy sector performed strongly, with Turbo Energy rising 10.99%, Sunrun gaining 10.84%, and Canadian Solar climbing 10.78%. First Solar advanced 6.6%, reaching a new closing high since June 2024.

Individual stock news

Report: NVIDIA's GB300 shipments could reach 55,000 units next year, with Vera Rubin200 expected to ship in Q4 next year.

The latest market forecasts indicate that $NVIDIA (NVDA.US)$ Shipments of GB300 AI server racks are expected to reach 55,000 units next year, representing a 129% year-on-year increase, primarily driven by giants such as Microsoft and Meta. More notably, the next-generation Vera Rubin 200 platform is projected to begin shipments in the fourth quarter of next year, providing sustained growth momentum for supply chain manufacturers like Hon Hai Precision Industry (Foxconn) and Quanta Computer. Some suppliers have visibility on orders extending as far as 2027. Additionally, NVIDIA plans to commence shipments of its H200 chips to China by mid-February.

Tesla's stock price approaches $500, hitting a new high, as Musk's compensation case turns around and FSD gains steady traction.

$Tesla (TSLA.US)$ Tesla closed up 1.56%, hitting a new all-time high of $498.83 during the session. Its market capitalization reached $1.63 trillion, surpassing Broadcom's $1.62 trillion, allowing it to re-enter the ranks of the seven most valuable publicly traded companies in the U.S. Analysts attribute part of Tesla's recent stock surge to a significant legal victory achieved by its CEO, Elon Musk—Delaware's Supreme Court last week reinstated Musk's 2018 compensation package, which was once valued at $56 billion.

Additionally, a large-scale power outage occurred in San Francisco over the weekend, causing Google (GOOGL.US) Waymo’s autonomous ride-hailing services to be suspended. Social media showed images of vehicles stranded at intersections or even in the middle of roads. Meanwhile, Tesla vehicles powered by the Full Self-Driving (FSD) system operated normally during the outage in San Francisco. Elon Musk also tweeted that Tesla’s Robotaxi service was unaffected by the power outage in San Francisco.

Alphabet invests $4.75 billion to acquire Intersect

On Monday, Google (GOOGL.US) Alphabet, the parent company, announced that it has reached a definitive agreement to acquire data center and energy infrastructure company Intersect for $4.75 billion in cash while also assuming its related debt.

The U.S. FDA approves the first GLP-1 oral tablet Wegovy®, driving Novo-Nordisk A/S shares to soar after-hours

Danish pharmaceutical company $诺和诺德(NVO.US)$ Shares surged nearly 12% after-hours. Novo-Nordisk A/S announced that the U.S. Food and Drug Administration (FDA) has approved Wegovy® oral tablets (once-daily oral semaglutide 25 mg) for long-term weight management in overweight individuals and to reduce the risk of major adverse cardiovascular events.

AI cloud business undervalued? Wells Fargo: Market pessimism overdone, Oracle has 50% upside potential.

$Oracle (ORCL.US)$ Shares closed 3.34% higher. A report by Wells Fargo & Co highlighted that Oracle's stock could rise by nearly 50%, with a target price of $285, driven by its robust AI cloud infrastructure potential. The bank emphasized that Oracle’s undervalued exposure to AI cloud services will be a key catalyst for the bullish outlook. Analysts noted that accelerated adoption of AI applications would present significant upside potential for the stock.

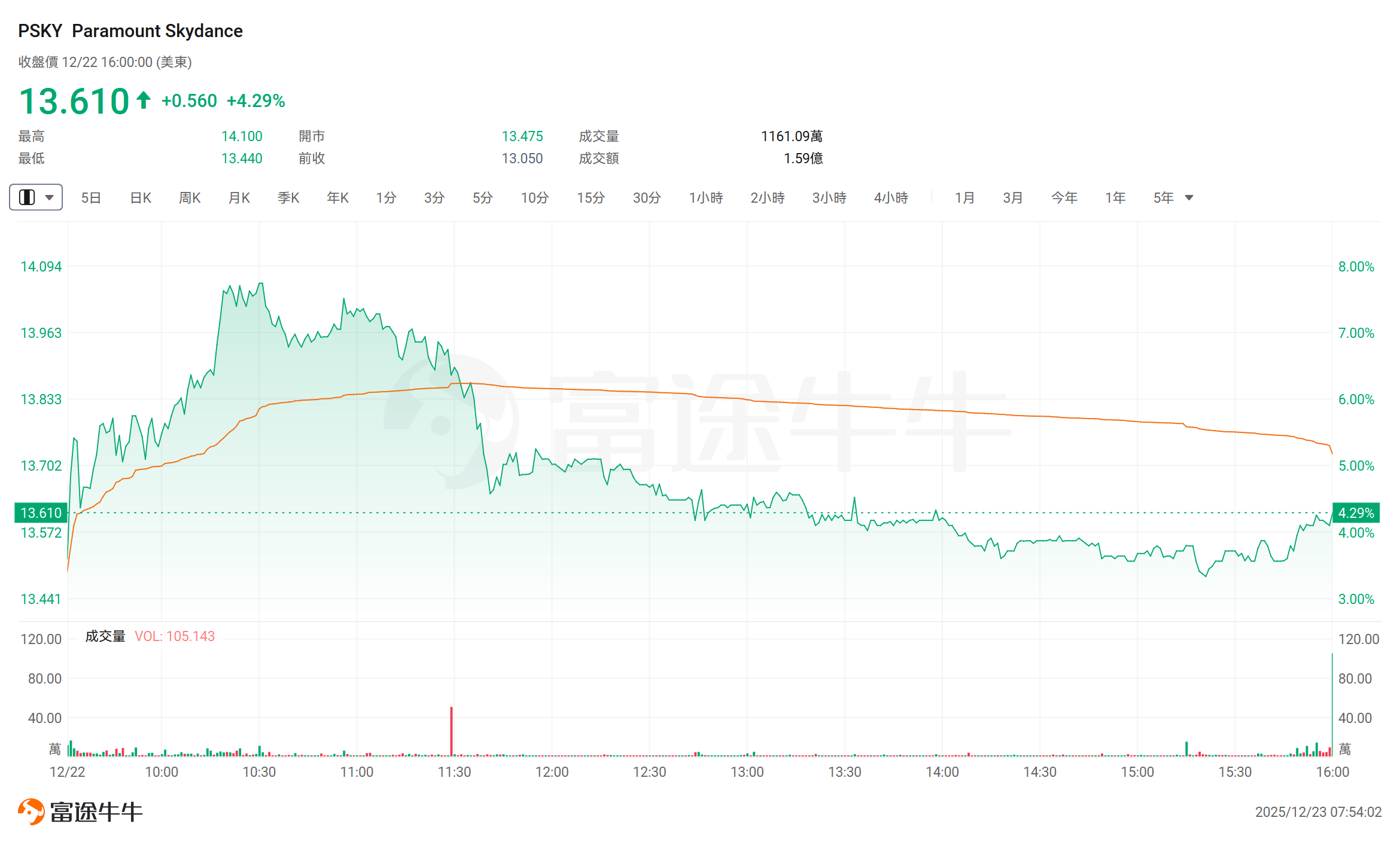

Larry Ellison to personally guarantee Paramount’s bid for Warner Bros.

$Paramount Skydance(PSKY.US)$ Revised its offer to acquire Warner Bros. Discovery, including $Oracle (ORCL.US)$ a personal financial guarantee from Chairman Larry Ellison, aiming to outbid Netflix’s competitive offer. According to a statement released on Monday, Ellison, one of the world’s wealthiest individuals, agreed to provide an irrevocable personal guarantee for $40.4 billion in equity financing for Paramount’s proposed acquisition of Warner Bros. Ellison (whose son David Ellison is the current CEO of Paramount) agreed not to revoke the Ellison Family Trust or transfer assets adversely affecting the trust before the transaction is completed. Paramount’s offer price of $30 per share remains unchanged.

Uber Technologies, Lyft, and Baidu will launch a trial operation of autonomous taxis in the UK.

$Uber Technologies(UBER.US)$ and $Lyft Inc(LYFT.US)$ stated on Monday that it has reached a partnership with Chinese tech giant $Baidu(BIDU.US)$ Reached a partnership to launch a pilot project for autonomous taxis (Robotaxis) in the UK next year. Under the agreement, Baidu’s Apollo Go RT6 autonomous vehicles will be integrated into Uber Technologies and Lyft Inc’s transportation networks in London by 2026. This marks the first direct competition between leading US and Chinese autonomous driving companies in a core European capital city, following Alphabet’s Waymo launching supervised testing in London.

Honeywell lowers Q4 sales forecast

$Honeywell (HON.US)$ Adjusted earnings per share for the fourth quarter are expected to be $2.48–$2.58, down from the previous estimate of $2.52–$2.62; adjusted sales for the fourth quarter are projected at $9.8 billion–$10 billion, compared with the earlier forecast of $10.1 billion–$10.3 billion.

Top 20 by Trading Value

Market Outlook

Northbound funds purchased over HKD 3.1 billion worth of Hong Kong stocks, adding more than HKD 700 million in SMIC shares while selling over HKD 500 million in China Mobile shares.

On Monday, December 22, southbound funds net purchased HKD 3.126 billion worth of Hong Kong stocks.

$SMIC (00981.HK)$、$Xiaomi Group-W(01810.HK)$、$Tencent (00700.HK)$Net purchases amounted to HKD 731 million, HKD 687 million, and HKD 597 million, respectively.

$China Mobile (00941.HK)$、$Alibaba-W (09988.HK)$、$Pop Mart (09992.HK)$Were net sold HKD 5.79 billion, HKD 5.2 billion, and HKD 25.45 million, respectively.

A large amount of pornographic content appeared in live streaming rooms. Kuaishou: Under gray and black industry attacks, currently undergoing repairs, and a police report has been filed.

Regarding the platform's abnormal situation on the evening of December 22, $Kuaishou-W (01024.HK)$ The company responded that around 22:00 that night, the platform was attacked by gray and black industry forces. Emergency measures are being implemented to address the issue. The platform firmly resists non-compliant content. Relevant updates have been reported to the appropriate authorities, and a police report has been filed.

Vanke’s RMB 2 billion bond extension plan not approved; grace period extended to 30 trading days

On December 22, $Vanke Enterprise (02202.HK)$ The result of the bondholder meeting for the RMB 2 billion bond extension was announced. Proposal 2 (adjustment of principal and interest payment arrangements) was rejected with 78.3% opposing votes, but Proposals 1 and 3 were passed. The grace period for this medium-term note has been extended from 5 working days to 30 trading days. Vanke has committed that the repayment order for this bond will not be inferior to subsequent maturing bonds, and no principal payments will be made to subsequent bonds until this bond is fully repaid. Industry insiders believe this move buys Vanke more time to manage its debt, and bondholders remain optimistic about timely repayment.

Sanhua forecasts net profit of RMB 3.874 billion to RMB 4.649 billion for 2025, representing year-on-year growth of 25%-50%.

$Sanhua (02050.HK)$ For the period from January 1, 2025, to December 31, 2025, net profit attributable to shareholders of the listed company is expected to range from RMB 3.874 billion to RMB 4.649 billion, marking an increase of 5.00%-50.00% compared to RMB 3.099 billion in the previous year. Regarding the significant forecasted profit growth, Sanhua stated that the synergy between its two major business segments provided solid support for the company's annual performance growth. In the refrigeration, air conditioning, and electrical components business, Sanhua continues to demonstrate its dominance as an industry leader. As the company’s second growth curve, the automotive components business (especially in the field of new energy vehicle thermal management) performed particularly impressively.

Report: Chipmaker Biren Technology’s Hong Kong IPO retail portion oversubscribed 47 times

According to the Sing Tao Daily, Biren Technology began accepting subscriptions for its Hong Kong Initial Public Offering (IPO) on Monday, with the first-day margin financing already oversubscribed by nearly 47 times. The company plans to issue 247.7 million shares, set to raise up to HKD 4.85 billion.

Cathay Pacific expects to achieve consecutive annual profit growth for the first time in a decade.

$Cathay Pacific (00293.HK)$ The company stated on Monday in a filing that net profit for 2025 is expected to exceed the previous year’s level, marking the first consecutive annual profit growth in a decade. The airline noted that profits are anticipated to surpass the HKD 9.88 billion (USD 1.3 billion) recorded the prior year, driven by strong performance in the second half, continued improvement in the financial results of its affiliates, and a one-off gain from an unnamed supplier.

Today's Focus

Keywords: Multiple core U.S. Q3 economic data, RBA Minutes, Canadian GDP

Regarding economic data, attention can be paid to key economic indicators such as U.S. Q3 real GDP, initial Q3 real personal consumption expenditure (PCE) growth rate. The U.S. government will update the July-September PCE data when it releases the Q3 GDP report on December 23.

21:30 U.S. Q3 Real GDP Annualized Initial Growth Rate

21:30 U.S. Q3 Real Personal Consumption Expenditure (PCE) Initial Growth Rate

21:30 U.S. Q3 Core PCE Price Index Annualized Initial Growth Rate

21:30 U.S. October Durable Goods Orders Monthly Growth Rate

21:30 Canada October GDP Monthly Growth Rate

22:15 U.S. November Industrial Production Monthly Growth Rate

23:00 US December Conference Board Consumer Confidence Index, US December Richmond Fed Manufacturing Index

![]()

Morning Reading by Niuniu:

The winning rule of the stock market is: do not buy laggard stocks, do not buy mediocre stocks, and focus entirely on leading stocks.

— Peter Lynch

![]() AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

Editor/KOKO