"Bitcoin Whale" Strategy has increased its cash reserves to $2.19 billion over the past week and suspended Bitcoin purchases. The world's largest digital asset reserve company appears to be preparing for a prolonged cryptocurrency winter.

According to Zhitong Finance APP, "Bitcoin Whale" $Strategy (MSTR.US)$has increased its cash reserves to $2.19 billion over the past week and suspended Bitcoin purchases. The world's largest digital asset reserve company appears to be preparing for a prolonged cryptocurrency winter. According to a filing with the U.S. Securities and Exchange Commission (SEC) on Monday, Strategy raised $748 million through the sale of common shares in the seven days ending December 21. In the two weeks prior, the company had purchased approximately $2 billion worth of Bitcoin, bringing its total Bitcoin holdings to around $60 billion.

Earlier this month, Strategy established a $1.4 billion reserve to cover future dividend and interest payments, aiming to alleviate market concerns that it might be forced to sell Bitcoin if token prices continue to decline. It is reported that the free cash flow generated by the company's software business is insufficient to cover dividends or interest payments. TD Cowen analyst Lance Vitanza pointed out that Strategy has approximately $824 million in annual interest and dividend payments.

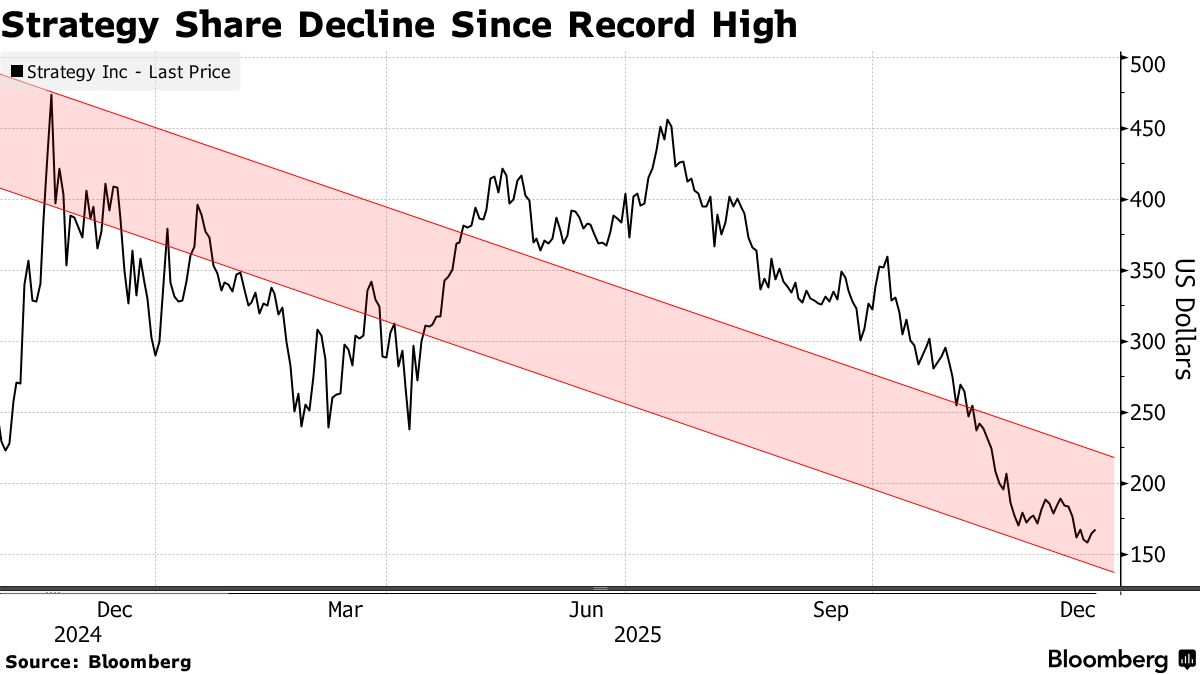

Data shows that since hitting an all-time high in early October, Bitcoin has fallen by about 30%. During the same period, Strategy's stock price plummeted by more than 50%. According to data from the company’s website, its key valuation metric, mNAV (the ratio of the company’s enterprise value to the value of its Bitcoin holdings), was approximately 1.1 on Monday. This serves as a reminder that investors remain concerned that this metric, which once enjoyed a significant premium, may soon turn negative.

Data shows that since hitting an all-time high in early October, Bitcoin has fallen by about 30%. During the same period, Strategy's stock price plummeted by more than 50%. According to data from the company’s website, its key valuation metric, mNAV (the ratio of the company’s enterprise value to the value of its Bitcoin holdings), was approximately 1.1 on Monday. This serves as a reminder that investors remain concerned that this metric, which once enjoyed a significant premium, may soon turn negative.

Notably, index provider MSCI is considering excluding companies holding Bitcoin or other digital assets as treasury assets from its indices and has sought opinions from the investment community on the matter. MSCI stated: "MSCI proposes to exclude companies with digital asset holdings accounting for 50% or more of total assets from the MSCI Global Investable Market Index Series." The consultation period will last until December 31, and the final decision will be announced by January 15, 2026.

This means Strategy could face the risk of being removed from mainstream indices such as MSCI. Currently, Strategy is a constituent stock of the Nasdaq 100 Index, MSCI USA Index, and MSCI World Index. Analysts at JPMorgan noted in a report released in November that approximately $9 billion of Strategy's total market capitalization may exist in the form of passive holdings through exchange-traded funds (ETFs) and mutual funds linked to major benchmark indices. Analysts warned: "If MSCI proceeds with the exclusion plan, it could lead to $2.8 billion in outflows for Strategy... If other index providers follow MSCI's lead and remove the company from all other equity indices, outflows could reach $8.8 billion."

Following Bitcoin’s sharp rise in early October, when it hit a record peak above $126,000, its price plummeted dramatically like a cliff. This sudden turn of events caught bulls off guard, leaving the crypto asset market struggling to stabilize and falling into turmoil. During this period, trading volume remained persistently low, investor confidence was shaken, and many chose to exit the Bitcoin ETF market. Meanwhile, the derivatives market exhibited a cautious wait-and-see stance, lacking active willingness to bet on a price rebound. As a result, Bitcoin may experience its fourth annual decline in history this year, and the first without being accompanied by major scandals or industry collapses.

Meanwhile, Bitcoin is approaching a critical test at year-end. The options market shows that approximately $23 billion worth of Bitcoin options contracts are set to expire this Friday, potentially amplifying market volatility on top of already elevated fluctuations. From the options structure, market sentiment remains notably bearish. Forster noted that Bitcoin’s 30-day implied volatility has rebounded to near 45%, while the options skew remains around -5%, indicating significantly higher demand for downside protection compared to upside bets. Longer-term skews also remain in negative territory, suggesting traders are preparing for continued downside risks into the first and second quarters of 2026.

Jurrien Timmer, Head of Global Macro Research at Fidelity, previously wrote that Bitcoin may have completed the upward phase of its four-year halving cycle, with the $125,000 peak reached in October largely aligning with historical cycle tops. He pointed out that historically, "Bitcoin winters" typically last about a year, and 2026 may become a "consolidation year," with key support zones around $65,000–$75,000. However, he still emphasized that he remains a long-term Bitcoin bull.

Editor /rice