Futu News reported on December 23 that $HANXBIO-B (03378.HK)$ The stock opened lower on its first day, falling by 9.69%. As of the time of writing, it was trading at HKD 28.9, with a total market capitalization of HKD 3.937 billion.

Source of market data: Futu Securities

According to previous reports, on the last trading day, Hansi Aitai’s grey market closed up 2.06% at HKD 32.66, with a turnover exceeding HKD 41 million. Each lot contains 100 shares. Excluding handling fees, each lot yielded a profit of HKD 66.

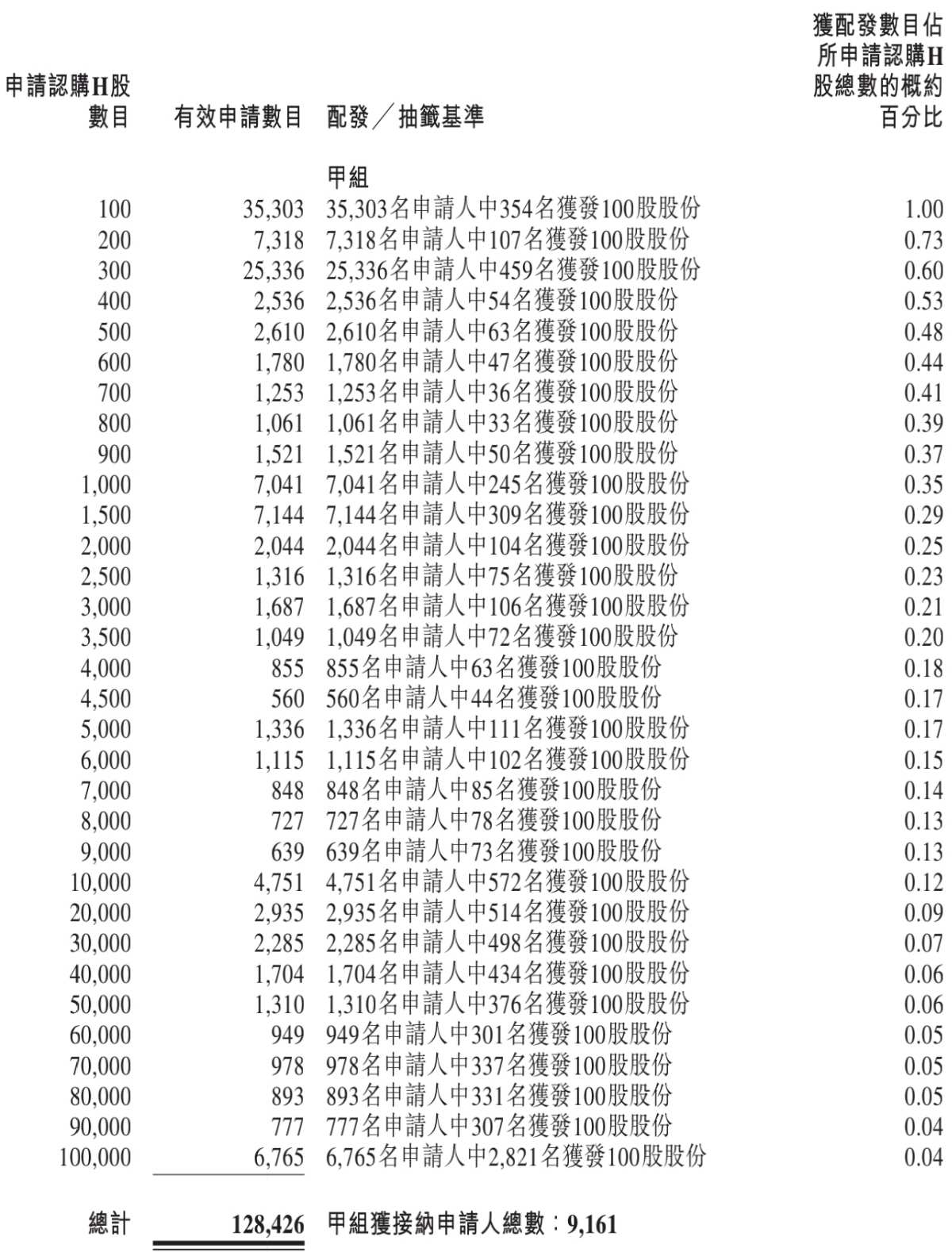

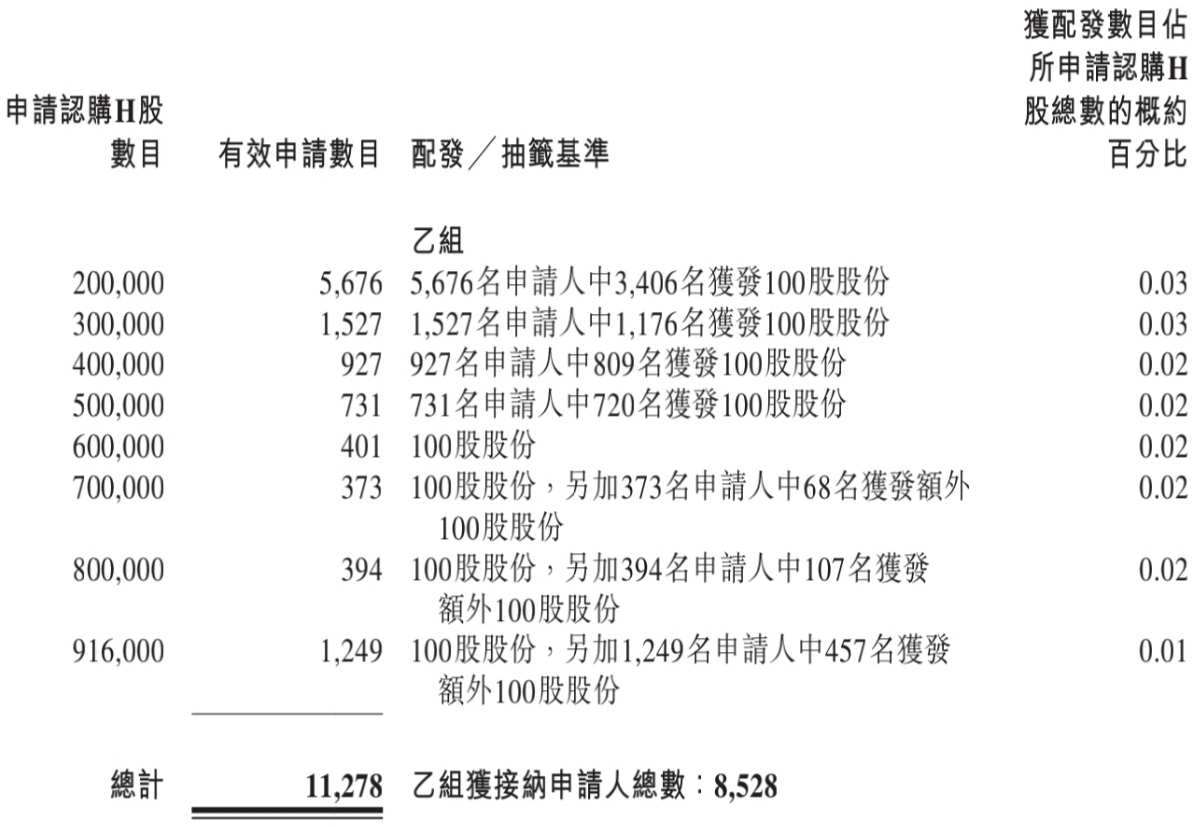

During the public offering phase, Hansi Aitai received subscriptions totaling 3,074.09 times the available shares. The final number of shares allocated for public offering amounted to 1.8321 million shares, representing approximately 10% of the total shares offered. A total of approximately 139,700 valid applications were received, with 17,689 applications processed. The percentage of subscribed shares allocated per lot relative to the total applied-for shares was approximately 1%.

During the public offering phase, Hansi Aitai received subscriptions totaling 3,074.09 times the available shares. The final number of shares allocated for public offering amounted to 1.8321 million shares, representing approximately 10% of the total shares offered. A total of approximately 139,700 valid applications were received, with 17,689 applications processed. The percentage of subscribed shares allocated per lot relative to the total applied-for shares was approximately 1%.

Additionally, during the international placement phase, Hansi Aitai received subscriptions totaling 5.78 times the available shares. The final number of shares allocated for international placement amounted to 16.4889 million shares, equivalent to 90% of the total shares offered. Futu Information has compiled the relevant data in the table below:

Company Overview

Hengshi Aite is a biotechnology company with proprietary expertise and experience in structural biology, translational medicine, and clinical development. Since 2016, the company has developed a product pipeline comprising one core product and nine other pipeline candidates: (i) three clinical-stage drug candidates targeting oncology, including its core product HX009 and key products HX301 and HX044; and (ii) seven preclinical-stage candidates, including antibody-drug conjugates, bispecific antibodies, and monoclonal antibodies for autoimmune and oncology markets.

Financial Overview

In terms of financial performance, Hengshi Aite has not generated revenue. To expand business operations, the majority of its funding has been allocated to research and development costs, other expenses, administrative expenses, and interest expenses. For the fiscal years 2023 and 2024, as well as the first eight months of 2025, the respective R&D expenditures were RMB 46.663 million, RMB 74.721 million, and RMB 56.178 million, accounting for 73.0%, 61.8%, and 67.2% of total operating expenses during those periods, respectively.

The prime season for subscribing to new shares has arrived! Use Futu to subscribe to new shares with 0 interest, 0 handling fees, and 0 cash subscription. Participants in the current promotion have the chance to waive one year’s fees for subscribing to new shares.Come and experience it now >>

Note: This activity is exclusively available to users in the Hong Kong region.

Editor/Afina