Futu News reported on December 23 that$NUOBIKAN (02635.HK)$The stock opened higher on the first day, surging nearly 300%. As of the time of writing, it is trading at HKD 319.8 per share. With a board lot of 50 shares and excluding handling fees, each lot yields a profit of HKD 11,990.

According to previous reports, in the last trading session, the stock closed at HKD 300.60 in the grey market, up 275.75%, with each lot consisting of 50 shares. Excluding handling fees, a profit of HKD 11,030 could be made per lot.

Additionally, according to previously disclosed information, during the public offering phase, Nobikant received subscriptions totaling 188.74 times the available shares. The final number of shares allocated for public offering was 378,700, accounting for approximately 10% of the total offering. A total of around 33,051 valid applications were received, with 3,852 processed applications, and the allocation ratio of applied shares per lot was approximately 3%.

Moreover, during the international placement phase, Nobikant received subscriptions amounting to 2.08 times the available shares. The final number of international placement shares was 3,407,900, representing 90% of the total offering.

Moreover, during the international placement phase, Nobikant received subscriptions amounting to 2.08 times the available shares. The final number of international placement shares was 3,407,900, representing 90% of the total offering.

Company Overview

Nobikai Technology, founded in 2015, focuses on advanced technologies such as artificial intelligence and digital twin, applying them in sectors like AI + transportation, AI + energy, and AI + urban governance. It primarily provides integrated hardware and software solutions based on AI industry models. The company’s independently developed NBK-INTARI artificial intelligence platform deeply empowers clients in the transportation, energy, and urban governance fields, enabling intelligent monitoring, detection, and operations.

According to CIC Consulting, based on the group’s rail transit-related power supply revenue in 2024, the company is the second-largest provider of AI + power supply inspection and monitoring systems in China, with a market share of approximately 5.9%. In terms of revenue, the AI + power supply inspection and monitoring solutions market accounted for about 2.2% of the AI + rail transit solutions industry in China in 2024. Based on the group’s rail transit revenue in 2024, the company ranked third among enterprises providing AI + inspection and monitoring solutions in China's rail transit industry, with a market share of approximately 1.8%.

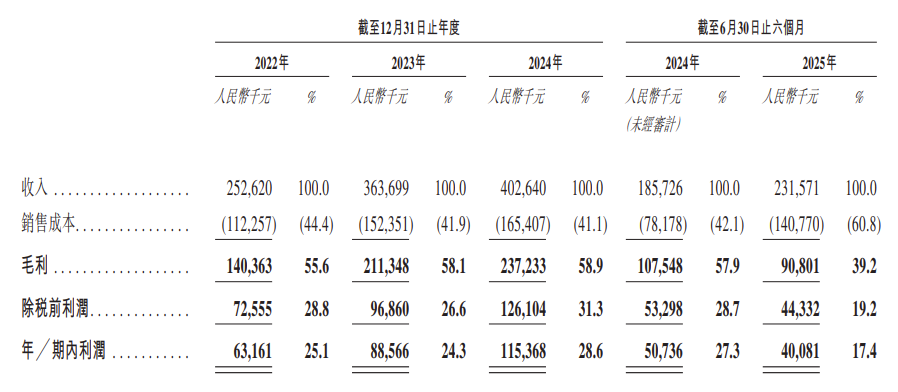

Financial Overview

In terms of financial performance, from 2022 to 2024, the company achieved revenues of RMB 253 million, RMB 364 million, and RMB 403 million respectively; annual profits were RMB 63.161 million, RMB 88.566 million, and RMB 115 million respectively. For the period ended June 30, 2025, the profit was RMB 40.081 million.

The prime season for subscribing to new shares has arrived! Use Futu to subscribe to new shares with 0 interest, 0 handling fees, and 0 cash subscription. Participants in the current promotion have the chance to waive one year’s fees for subscribing to new shares.Come and experience it now >>

Note: This activity is exclusively available to users in the Hong Kong region.

Editor/Vincent