Morgan Stanley's latest report suggests that the humanoid robotics market will remain highly active in 2026, but a significant gap between hype and scalable practical value should be carefully monitored. The industry faces risks of a pullback due to the technical challenges in development and consolidation among startups. Additionally, the gap between China and the U.S. is widening at an accelerated pace—China is solidifying its lead by leveraging its manufacturing strengths, while short-term U.S. policy support appears insufficient to reverse this trend.

On December 19, Morgan Stanley pointed out in its latest research report that although the market enthusiasm for humanoid robots will continue to rise in 2026, investors need to be wary of the significant gap between 'dancing robots' and those with scalable practical value.

The bank believes that short-term market speculation will persist, but the industry may soon face a correction due to the difficulty of developing physical AI, manufacturing obstacles, and the reshuffling of startups.

In terms of specific market catalysts, the release of Tesla Optimus Gen 3 and potential announcements by tech giants entering the robotics field will be key highlights at the beginning of 2026. According to Politico, the U.S. government is planning to introduce new policies to accelerate the development of the domestic robotics industry, with Commerce Secretary Lutnick and the Trump administration reportedly set to 'go all out' in supporting this sector. Potential executive orders may not be limited to tax subsidies but aim to incentivize private investment through various means to address competition.

In terms of specific market catalysts, the release of Tesla Optimus Gen 3 and potential announcements by tech giants entering the robotics field will be key highlights at the beginning of 2026. According to Politico, the U.S. government is planning to introduce new policies to accelerate the development of the domestic robotics industry, with Commerce Secretary Lutnick and the Trump administration reportedly set to 'go all out' in supporting this sector. Potential executive orders may not be limited to tax subsidies but aim to incentivize private investment through various means to address competition.

Despite the U.S. attempting to exert policy influence, Morgan Stanley emphasized that the gap between China and the U.S. in this field is widening at an accelerating pace. Leveraging its almost uncontested manufacturing advantages, China continues to consolidate its leading position, with 'embodied intelligence' listed as one of the six breakthrough industries in China’s 15th Five-Year Plan recommendations. Nevertheless, Li Chao, spokesperson for China's National Development and Reform Commission, warned of the risk of a 'bubble' in the industry, noting that while significant capital inflows have occurred, verified real-world application cases remain scarce.

In terms of market performance, the Humanoid 100 Index compiled by Morgan Stanley has risen 25% since its inception in February 2025, outperforming the S&P 500, MSCI Europe, and MSCI China indices. As global robotics companies transition from laboratories to real-world applications, the divergence between winners and laggards will become increasingly apparent, with capital and talent concentrating on firms demonstrating the strongest internal AI capabilities and manufacturing expertise.

Continuation of Short-Term Speculation vs. Technological Reality

Morgan Stanley analysts cautioned that while enthusiasm for humanoid robots will emerge in waves throughout 2026, investors should focus on the broader picture.

In the short term, developments such as the release of Tesla Optimus Gen 3, technological breakthroughs in hardware and AI, and major tech companies’ statements on physical AI will further elevate market sentiment. However, the industry may subsequently experience a 'reset,' primarily due to growing awareness of the challenges in developing physical AI models, manufacturing hurdles, and the consolidation pressure faced by startups.

Regarding technological maturity, the bank specifically advised investors to exercise caution regarding 'autonomy.' Achieving full autonomy in humanoid robots is extremely challenging. Unless a demonstration is explicitly labeled as 'autonomous,' investors should assume it involves teleoperation. Using teleoperation for data collection and training is a necessary step toward autonomous robots, but this does not necessarily indicate a red flag—it simply means that 2026 is not yet the year to assume robots possess full autonomy.

Tech Giants Enter the Field and U.S. Policy Shift

2026 will not only be a battleground for startups but also a pivotal year for tech giants to compete for new growth opportunities.

Morgan Stanley predicts that at least one major technology company or leading AI lab (such as $Meta Platforms (META.US)$ , $Alphabet-A (GOOGL.US)$ , $Apple (AAPL.US)$ , $Amazon (AMZN.US)$ , OpenAI, etc.) will officially announce plans to build robots. As these companies seek new potential total addressable markets (TAM) to justify their AI-driven high valuations, entering the robotics hardware sector has become a high-probability event.

At the policy level, according to Politico, Lutnick and the current U.S. administration are evidently seeking to accelerate the development of the American robotics industry through potential executive orders. Regardless of whether the final policy outcome involves tax incentives, government procurement, or regulatory changes, it is anticipated that the U.S. government will use multiple channels to signal support for the domestic robotics industry.

This mirrors actions taken over the past year in the rare earths and drone sectors, aiming to incentivize private investment and technological development.

China's Consolidation of Manufacturing Advantages and Regulatory Warnings

Despite increased policy support in the United States, Morgan Stanley notes that China continues to consolidate its leadership position by leveraging its core advantage—manufacturing. Currently, nearly every major Chinese automobile and consumer electronics company is linked in some way to humanoid robots or AI-enabled robotics.

Meanwhile, Chinese regulators have taken notice of signs of overheating in the industry.

In response to media inquiries about a potential “cooling” of the industry, Li Chao, spokesperson for the National Development and Reform Commission, stated that for all emerging industries, including the humanoid robotics sector, it is essential to balance growth speed with the potential for “bubbles.” The field already includes over 150 companies, despite having few practical application cases so far, while significant investment has flooded in. Further guidelines are expected to be issued in the upcoming 15th Five-Year Plan.

Financing Trends and Latest Corporate Developments

The primary market remained active from late 2025 to early 2026.

According to Bloomberg, Physical Intelligence, an AI robotics startup, raised $600 million at a valuation of $5.6 billion, led by CapitalG under Alphabet. Meanwhile, Reuters reported that Skild AI is in talks with SoftBank and $NVIDIA (NVDA.US)$ to secure funding of over $1 billion at a valuation of approximately $14 billion. Additionally, Deep Robotics, a competitor of Unitree, has raised about $70 million.

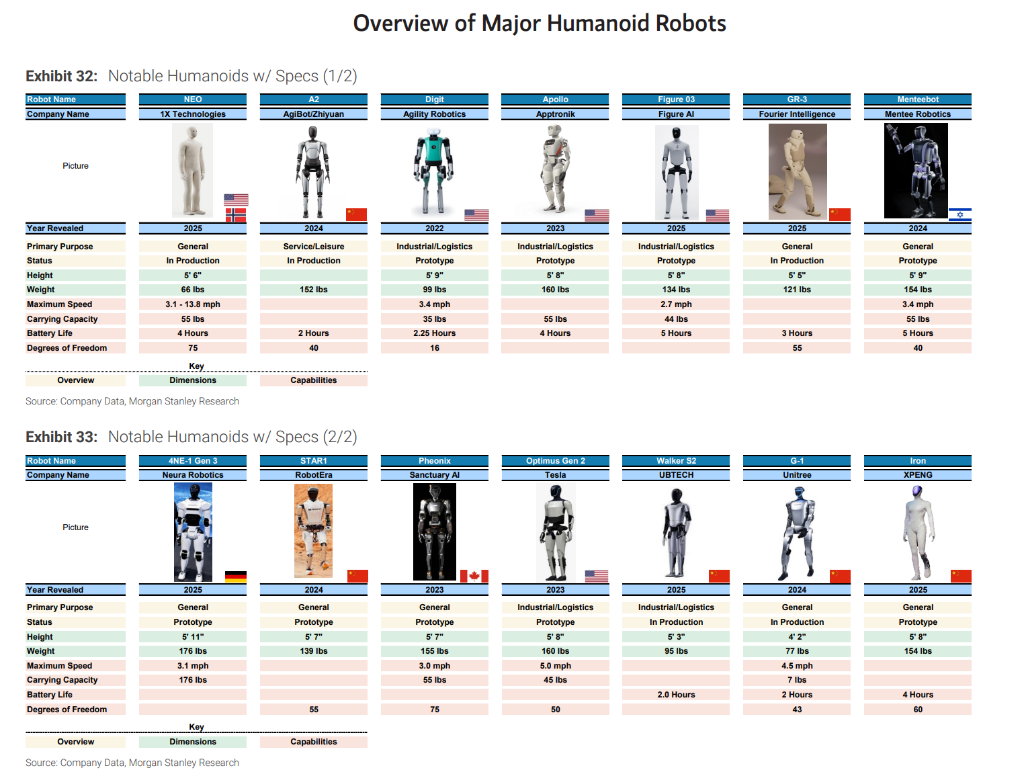

On the product front, major manufacturers have been actively making moves. Tesla showcased an upgraded version of its Optimus hardware, with videos demonstrating its smooth running capabilities in a lab setting, featuring articulated toes, laying the groundwork for the Gen 3 release expected in early 2026. Midea Group introduced MIRO U, a 'super humanoid robot' equipped with six arms, designed to increase factory output by approximately 30% through multitasking. Meanwhile, Norwegian company 1X announced a deal with EQT Ventures to deliver 10,000 NEO humanoid robots to factories and warehouses, marking a significant expansion of its application scenarios from home use to industrial settings.

Long-term Market Outlook

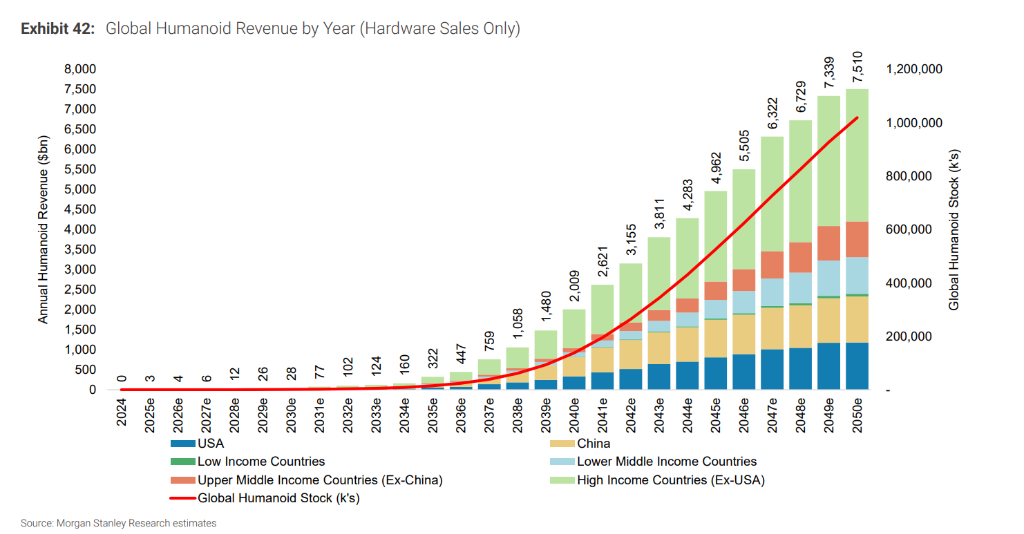

Morgan Stanley maintained its substantial long-term market forecast for the industry. According to the bank's global robotics model, annual revenue in the global humanoid robotics market could reach $7.5 trillion by 2050. Assuming a replacement cycle of six years and a decline in average selling prices as supply chains mature, it is projected that around 24.4 million humanoid robots will be adopted globally by 2036, increasing to one billion units by 2050.

In high-income countries, the average selling price of humanoid robots is expected to drop from $200,000 in 2024 to approximately $75,000 by 2050. In middle- and low-income countries, benefiting from mass production and localized supply chains, the average price is anticipated to be even lower, decreasing from around $50,000 currently to about $21,000 by 2050, significantly promoting widespread adoption and application on a global scale.

Editor/KOKO