Source: Tencent Technology

Over the past year, an enigmatic phenomenon has spread within OpenAI: even though ChatGPT launched what could be called the 'strongest brain,' capable of winning gold medals in the International Mathematical Olympiad and dominating top programming competitions, ordinary users seem unimpressed.

According to foreign media reports and data released by OpenAI in September, the majority of users may only be asking relatively simple questions that do not require the use of resource-intensive reasoning models that take 'half a minute to think.'

This glaring data points to a profound crisis hidden beneath OpenAI's peak performance: a strategic expansion personally driven by CEO Sam Altman is causing deep-seated issues, including organizational fragmentation, resource dispersion due to multi-front operations, and a significant disconnect between technological direction and user needs. This is dragging its flagship product, ChatGPT, into a competitive quagmire.

This glaring data points to a profound crisis hidden beneath OpenAI's peak performance: a strategic expansion personally driven by CEO Sam Altman is causing deep-seated issues, including organizational fragmentation, resource dispersion due to multi-front operations, and a significant disconnect between technological direction and user needs. This is dragging its flagship product, ChatGPT, into a competitive quagmire.

01 Core Contradiction: The 'Performance Surplus' Gap Between Cutting-Edge Research and Mass Demand

The core contradiction within OpenAI stems from the growing divergence in objectives between its research division and product team.

Within the company, a relatively independent research team of over a thousand people has focused on pursuing 'reasoning models' and the ultimate goal of 'Artificial General Intelligence' (AGI). While these models excel at solving complex mathematical and scientific problems, they come at the cost of high computational expenses and slow response times, taking several seconds or even minutes to process a single query.

However, this is severely misaligned with the needs of ChatGPT’s hundreds of millions of mainstream users. As Peter Gostev, head of the AI evaluation agency LMArena, noted, 'OpenAI has placed its focus on 'science, math benchmarks, advanced mathematics, and programming contests,' but this seems mismatched with typical ChatGPT users.' He pointed out, 'Most ChatGPT users might only ask very simple questions, such as movie ratings or daily inquiries, which do not require the model to think for half an hour.'

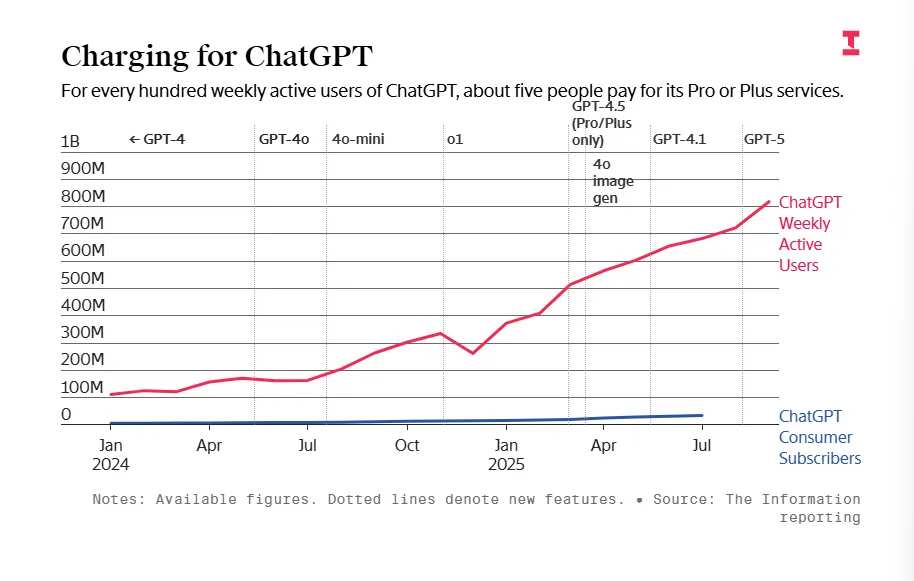

This 'performance surplus' directly led to setbacks at the product level. In early 2025, when OpenAI attempted to adapt its most advanced reasoning model for use in ChatGPT, its performance unexpectedly worsened. Even after being integrated in forms like 'thinking mode,' only a tiny fraction of nearly 900 million weekly active users utilized it frequently.

Even more embarrassingly, OpenAI internally discovered that even traditional non-reasoning models could experience performance degradation when integrated into the ChatGPT product due to conflicts with features like 'personalization.'

02, Multi-Front Operations: Altman’s 'Empire Ambition' and ChatGPT’s Resource Drain

While the core product faces a user experience gap, Altman has launched a dazzling array of 'multi-front operations.' Beyond ChatGPT, he is simultaneously advancing an ambitious set of projects including Sora video generation, music AI, AI web browsers, AI agents, consumer-grade hardware devices, robotics, and more.

These parallel new projects have continued to divert critical resources that should have been concentrated on ChatGPT. Several OpenAI researchers confirmed that the launch of some new directions objectively weakened the investment intensity aimed at enhancing ChatGPT’s mass-market appeal. The result has been an ironic situation: as external competition intensifies, OpenAI’s most crucial revenue engine is gradually 'hemorrhaging' in internal resource contention.

Even Fidji Simo, the Chief Executive Officer responsible for applications and product lines, had to admit that at OpenAI, 'the product itself is not the end goal.' At the cultural and decision-making levels, this company remains deeply dominated by its 'research-first' ethos.

This strategic dispersion appears especially perilous when confronting Google’s fierce counterattack. Leveraging its vast product ecosystem (Gmail, Chrome, YouTube, and other billions of user entry points), Google is seamlessly integrating AI capabilities into users’ existing workflows. As analysts noted, users are gravitating toward Gemini 'not just because it has a better model, but because they find this capability embedded in everything.' In contrast, ChatGPT largely remains an independent tool requiring active user access, facing significant user habit migration costs.

OpenAI’s wavering focus on image generation epitomizes internal strategic incoherence. Earlier in 2025, the company had downgraded the priority of image generation until Google released the explosively popular Nano Banana image generator in August, prompting a hurried refocus. According to employees, this even sparked disagreements between Altman and research director Mark Chen. This 'catch-up' reaction highlights decision-making delays and passivity caused by multi-front operations.

03, Growth Paradox: The Race Between Slowing User Growth and Commercial Monetization

OpenAI is facing a pivotal growth inflection point. The company set an ambitious target at the beginning of the year to reach one billion weekly active users within the year, but as of early December, its user count 'falls short of 900 million,' with clear signs of significantly slowing user growth.

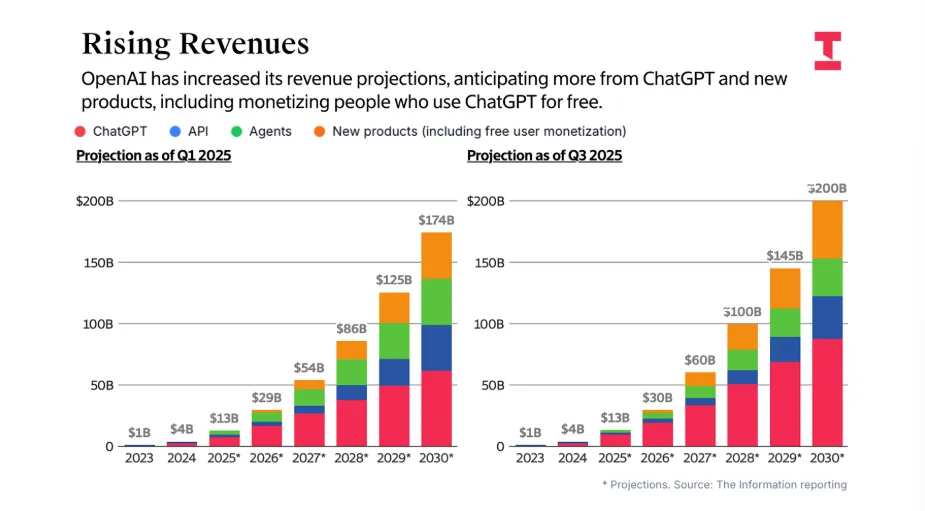

However, contrasting sharply with the slowdown in user growth, OpenAI has made astonishing progress in commercial monetization. Its annualized revenue surged from $6 billion in January to over $190 billion currently, primarily driven by subscriptions from individual and enterprise users. This financial performance puts the company on track to achieve its year-end annualized revenue target of $200 billion set in August, surpassing its 2025 revenue forecast of $130 billion. Based on this, the company is seeking financing at a valuation of $7.5 trillion, which is 50% higher than two months ago.

However, to achieve OpenAI's vision of $200 billion in revenue by 2030, the company must convert its weekly active users into daily active users to create more monetization opportunities. This includes planned advertising sales or taking a cut from transactions facilitated by chatbots.

Despite an OpenAI spokesperson stating that ChatGPT accounts for approximately 70% of global assistant usage and has become the most downloaded free app on the Apple App Store this year, its growth model reveals deeper contradictions: commercial success may come at the cost of slowing user growth. A strategy focused on extracting high subscription revenues from existing users could be undermining further expansion of its user base.

Moreover, with competitors like Google Gemini rapidly advancing in terms of user scale and ecosystem integration, if OpenAI cannot effectively address stagnating user growth, the impressive short-term financial results may conceal a long-term crisis of reaching market saturation.

04 Competition Siege: Google’s Counterattack and Ecosystem Disadvantage

The current perspective on whether ChatGPT can replace Google Search contrasts sharply with mainstream expectations from one or two years ago.

At that time, both OpenAI and Google executives believed that ChatGPT could effectively replace traditional search engines. However, Google quickly integrated AI-generated answer summaries at the top of search results. According to the company’s October 2023 report, this feature is driving 'meaningful' growth in search volume and revenue, as 'users are gradually realizing that Google can answer more types of questions.'

Google’s counterattacks in other areas have been equally precise and devastating. By 2025, Gemini experienced rapid growth: monthly active users increased from 450 million in July to 650 million, website traffic grew by 14.3% in a single month, while ChatGPT’s traffic declined for two consecutive months during the same period. More critically, Gemini’s average visit duration has surpassed ChatGPT since September.

Google’s success stems not only from model performance. Its Nano Banana Pro image generator became a sensation on social media due to its ability to generate 'readable and contextually relevant text,' while Gemini 3 earned widespread acclaim for its performance in complex business problems, writing, and coding. Analysts noted that users are switching to Gemini 'not just because the model is better, but because they find this capability integrated into everything.'

By contrast, OpenAI's ecosystem disadvantages are evident. Former employees have warned that if Google surpasses in raw performance and even offers Gemini for free, it could simultaneously cripple both OpenAI’s API and consumer subscription businesses. Although OpenAI is building its ecosystem through a partnership with Disney and by hiring Jony Ive, Apple's former design chief, its hardware devices will not hit the market for another two years, narrowing the available time window.

The next 'Red Alert' may coincide with Apple.

In response to the crisis, Altman raised a 'Red Code' alert in December. He explicitly requested reallocating resources back to core foundations such as ChatGPT and its reasoning capabilities, while postponing short-term revenue projects like advertising and e-commerce expansion. He aims to turn the situation around with a major product update by the end of January next year.

Meanwhile, OpenAI swiftly rolled out a series of countermeasures:

Released GPT-5.2 (internal codename Garlic) to reclaim the top position in multiple AI model performance benchmarks.

Launched a new image generation model to respond to competition from Google’s Nano Banana.

Reverted the model routing system so that free users would default to using the faster GPT-5.2 Instant.

However, these measures revealed deeper issues. The model routing system was withdrawn after only four months because it increased the proportion of free users utilizing inference models from less than 1% to 7%, significantly raising costs but negatively impacting daily active user metrics due to slow response times. This once again demonstrates that pure technological upgrades do not necessarily lead to product success.

In fact, this is not the first time OpenAI has raised a 'Red Code' alert. Chief Research Officer Mark Chen revealed that the company has used this mechanism multiple times before, but this instance lasted eight weeks, marking an emergency state “longer than ever before.”

Previously, this mechanism had been employed to address competitive threats such as DeepSeek and Anthropic’s release of Claude. However, Altman’s ambitions suggest that the company may face more moments requiring alerts in the future.

The current eight-week 'Code Red' initiative focuses on addressing competition from Google, but this may only be a prelude to a larger industrial conflict. While consolidating its advantages in software and models, Altman has begun laying out an ambitious hardware strategy, signaling a potential direct collision between OpenAI and another consumer electronics giant, Apple.

Altman firmly believes in the critical role of hardware devices in the popularization of AI. He has publicly set a highly disruptive goal: to develop an OpenAI device that could replace smartphones as the new standard for personal carry. To achieve this vision, in May this year, he hired Jony Ive, the former design soul of Apple, and acquired his startup, with the aim of jointly creating the next generation of AI hardware.

It is foreseeable that just as Google is launching a fierce counterattack against OpenAI at the software level, Apple will by no means sit idly by in what it considers its core hardware domain while challengers rise. This upcoming hardware battle will not only be a competition of product functionalities but also a contest for the right to define the paradigm of next-generation human-computer interaction.

06, Future Conundrum: An Ongoing Survival Battle

In addition to technology and product performance, OpenAI also faces challenges in other areas:

In terms of finance, despite OpenAI projecting its annualized revenue to exceed $19 billion, the company is 'burning through billions of dollars in cash each year' to cover staggering computing costs. Its planned $1.4 trillion infrastructure investment is an astronomical figure, making it imperative for ChatGPT to generate larger and more stable cash flows.

In the ecosystem domain, compared with giants like $Alphabet-C (GOOG.US)$ 、 $Microsoft (MSFT.US)$ 、 $Apple (AAPL.US)$ that possess mature software and hardware ecosystems, OpenAI is essentially still a 'model company.' It is attempting to build an ecosystem by partnering with Disney and hiring the former design chief of Apple to develop hardware, but this will take time, and competitors will not wait.

In the lucrative enterprise customer market, OpenAI seems to be losing more market share. According to a recent report by Menlo Ventures, its share has dropped to 27%, while Gemini has risen to 21%, and Anthropic leads with a 40% share.

Reviewing OpenAI's strategy, the crux of the issue lies in its inability to efficiently and focusedly convert its technological lead, achieved through a blitzkrieg, into sustainable product advantages and a user experience moat. Altman's simultaneous pursuit of AGI, hardware dreams, and a diversified product ecosystem has led to the dispersion of the company’s resources in key battles. Moreover, the pursuit of extreme 'reasoning' performance has created a mismatch with the core demands of the mass market for 'immediate, reliable, and easy-to-use' solutions, falling into the trap of 'performance overkill.'

"Code Red" represents an emergency stopgap and strategic retreat, but the path through the quagmire for ChatGPT is far from over. The fundamental question OpenAI needs to answer is: Is it a laboratory with the ultimate mission of AGI research, or a company aimed at capturing the AI product market? The answer to this question will determine whether it can navigate through the fierce competition from industry giants and maintain its pioneering role in this era.

As the lessons of Silicon Valley's history have shown, the battle between innovators and established giants often ends in a winner-takes-all scenario, with the losers relegated to a mere footnote in history. OpenAI now stands at such a critical crossroads that will decide its fate.

Editor /rice