Asian equity, currency, and bond markets have flourished across the board with remarkable breadth. Institutions believe this is not a short-term rebound but rather the beginning of a long-term revaluation.

Asia is reclaiming its peak position. This year, the region's stock markets have outperformed those of the United States and Europe, credit markets are robust, currencies continue to appreciate, and investors anticipate this momentum will extend through 2026.

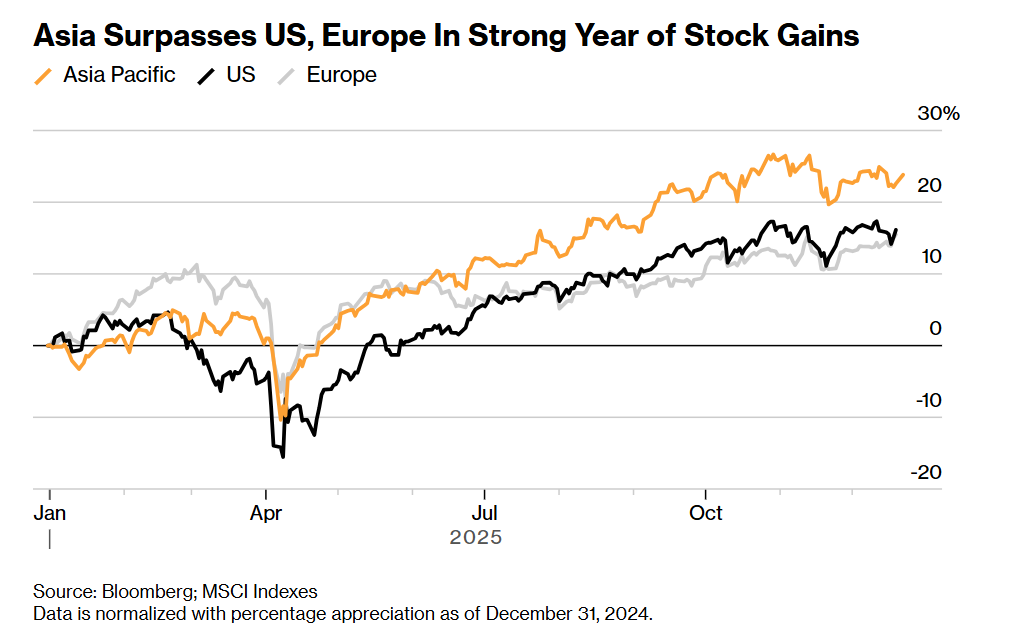

In dollar terms, the MSCI Asia Pacific Index, which includes dividends, has risen 27% this year. This marks the first time since 2020 that Asian stock markets have outperformed both U.S. and European benchmark indices within the same year.

Asian stock markets have shown strong performance this year, with gains surpassing those of U.S. and European markets.

This recovery reflects the growing appeal of Asia to investors seeking higher growth as economic momentum in Europe and the U.S. slows. A weaker dollar has made Asian assets more attractive, while the region’s deep integration with transformative global technologies has further enhanced its investment value.

This recovery reflects the growing appeal of Asia to investors seeking higher growth as economic momentum in Europe and the U.S. slows. A weaker dollar has made Asian assets more attractive, while the region’s deep integration with transformative global technologies has further enhanced its investment value.

"The strong performance of the Asian market is not merely a cyclical rebound—it reflects the convergence of global growth and policy momentum, providing a solid growth trajectory for the region heading into 2026," said Hebe Chen, Senior Market Analyst at Vantage Global. "Although the U.S. continues to dominate the top end of the technology supply chain, Asia—particularly China, Taiwan, South Korea, and Japan—has now become a core hub for critical segments of the artificial intelligence value chain, often without the valuation pressures seen in the U.S."

The breadth of this rally has been remarkable. Japan, South Korea, Taiwan, and mainland China’s stock markets have all achieved double-digit growth this year. $Korea Composite Index (.KOSPI.KR)$It surged by 71%, making it one of the best-performing major markets globally.

In China, driven by the boom in artificial intelligence, the stock market is experiencing its strongest year since 2020. Breakthroughs in DeepSeek's AI technology have helped reignite investor interest in the country's tech sector.

Jonathan Armitage, Chief Investment Officer at Colonial First State, Australia’s leading wealth management and pension service provider, stated that renewed focus on China’s tech sector reinforces the asset manager’s optimistic outlook for emerging market equities through 2026.

Of course, this rally comes with risks. A resurgence in the strength of the dollar could erode returns for foreign investors. There are also concerns that the rally in AI-related tech stocks has shown signs of crowded trading, which could lead to price corrections if growth slows or market sentiment shifts.

Even so, some investors suggest these risks do not alter the broader trend. The region’s cross-asset rally is viewed as the early stage of a long-term revaluation cycle—a period where market valuations are adjusted upward amid improving growth prospects.

"Compared to the United States and Europe, Asia has stronger and more diversified growth engines. For Asia, 2025 appears to be the beginning of a long-term valuation re-rating cycle rather than its peak," said Chen Xibei of Vantage Point.

Investor interest is spreading beyond a few large markets, with Vietnam emerging as a popular choice. The country’s stock market has risen approximately 38% this year, with some investors believing the rally could continue.

"We are most optimistic about Vietnam, where the market combines attractive valuations and growth characteristics," said Nick Ferres, Chief Investment Officer at Vantage Point Asset Management, headquartered in Singapore.

Foreign Exchange and Credit Markets

A weakening US dollar has increased the value of Asian assets for dollar-based investors, making returns more attractive, while most Asian currencies have also strengthened.

The offshore Chinese yuan is near its highest level in over a year, while the Australian dollar and New Zealand dollar have risen as traders begin pricing in expectations of tighter monetary policy. Additionally, the Malaysian ringgit and Thai baht have gained nearly 10%.

"Despite ongoing volatility related to tariffs, Asian foreign exchange markets have performed well overall,"$Bank of New York Mellon (BK.US)$said Wee Khoon Chong, Senior Asia-Pacific Market Strategist. "A weaker dollar, resilient regional trade growth, and optimism driven by artificial intelligence have fueled the performance of Asian markets this year, with the trend expected to continue into 2026."

Optimism has also extended to the corporate bond market. The index for Asia dollar-denominated investment-grade bonds has outperformed its U.S. counterpart and is on track for its largest annual gain since 2019. Spreads remain slightly above the historical lows touched in November, while high-yield spreads have stayed near the seven-year low reached in September.

"What we are discussing is a market with relatively high credit quality, particularly within the investment-grade segment, supported by strong fundamentals," said Omar Slim, Co-Head of Asian Fixed Income at PineBridge Investments.

Slim noted that defaults in the region are rare, while bond issuance remains "at manageable levels and is being met with strong demand from an expanding pool of capital."