Top News

Before the market opened on Tuesday, the U.S. released Q3 PCE, GDP, and consumer data:

The preliminary reading of the U.S. Q3 PCE price index, seasonally adjusted annual rate, was 2.8%, in line with expectations of 2.8%, compared to a previous value of 2.1%. The preliminary reading of the U.S. Q3 core PCE price index, seasonally adjusted annual rate, was 2.9%, meeting expectations of 2.9%, versus a prior value of 2.6%.

The initial value of the seasonally adjusted annual rate of real personal consumption expenditures in the US for the third quarter was 3.5%, compared to an expected 2.7% and a previous value of 2.5%.

The preliminary annualized quarterly rate of real GDP growth in the U.S. for the third quarter was 4.3%, compared to an expected 3.3% and a previous value of 3.8%.

The preliminary annualized quarterly rate of real GDP growth in the U.S. for the third quarter was 4.3%, compared to an expected 3.3% and a previous value of 3.8%.

Following the announcement, losses on the three major futures indexes widened, with Dow futures down 0.13%, Nasdaq futures down 0.17%, and S&P 500 futures down 0.11%.

$明星科技股(LIST2518.US)$ There were mixed movements before the market opened, $Tesla (TSLA.US)$ 、 $Apple(AAPL.US)$ Slight increase.

$热门中概股(LIST2517.US)$ Mixed performance. $PDD Holdings (PDD.US)$ 、 $New Oriental Education & Technology Group (EDU.US)$ rising over 1%, $XPeng Motors (XPEV.US)$ Down more than 1%.

Gold, silver, and copper all hit new highs, $黄金(LIST2110.US)$ 、 $Silver (LIST2093.US)$ 、 $Copper (LIST2510.US)$ Concept stocks generally rose pre-market.

$太空概念(LIST2556.US)$ A pullback. $Sidus Space(SIDU.US)$ Fell nearly 40%, $Intuitive Machines(LUNR.US)$ dropping over 7%.

BTC fell more than 2% intraday, $加密货币概念股(LIST20010.US)$ Widespread declines.

Amid a 'storage crunch,' Apple's supply chain dynamics are shifting, with Samsung reportedly set to monopolize 70% of the DRAM for the iPhone 17.

According to reports, due to the rapid rise in memory chip prices, Apple will increase the proportion of its iPhone memory chips sourced from Samsung; this shift is expected to result in Samsung supplying approximately 60% to 70% of the low-power DRAM for the iPhone 17. Consolidating a larger share of orders with Samsung will help Apple secure more predictable chip deliveries while potentially reducing costs through economies of scale.

Novo-Nordisk A/S’s oral weight-loss pill receives FDA approval, intensifying the 'weight-loss drug battle' with Eli Lilly and Co into a new phase.

Before the market opened on Tuesday, $诺和诺德(NVO.US)$ The company’s stock surged over 8% after the U.S. Food and Drug Administration (FDA) approved its weight-loss pill, giving it a competitive edge in the rapidly evolving obesity treatment market. This approval places Novo-Nordisk A/S at the forefront of the race to develop potent oral weight-loss medications as the company works to reclaim market share lost to $Eli Lilly and Co (LLY.US)$ its competitors.

Novo-Nordisk A/S faced significant supply chain challenges when it launched its injectable drug Wegovy in 2021, but the company stated that it is much better prepared this time around. CEO Mike Doustdar said in November that the company has 'more than enough tablets' and will 'spare no effort' in bringing the product to market.

Software issues prompt Amazon’s Zoox to recall vehicles again, reigniting concerns over autonomous driving safety.

The U.S. National Highway Traffic Safety Administration (NHTSA) announced on Tuesday that $Amazon(AMZN.US)$ Amazon’s autonomous driving division Zoox is recalling 332 vehicles in the United States due to an error in its Autonomous Driving System (ADS) software. The NHTSA stated that the recalled Zoox vehicles are those equipped with ADS software versions released prior to December 19.

When these vehicles approach or are at intersections, they may cross the yellow center line, potentially moving into or stopping in front of oncoming traffic, significantly increasing the risk of collision. The agency further noted that Zoox has provided a free update to the ADS software for the affected vehicles. This follows a previous recall in May this year involving 270 vehicles.

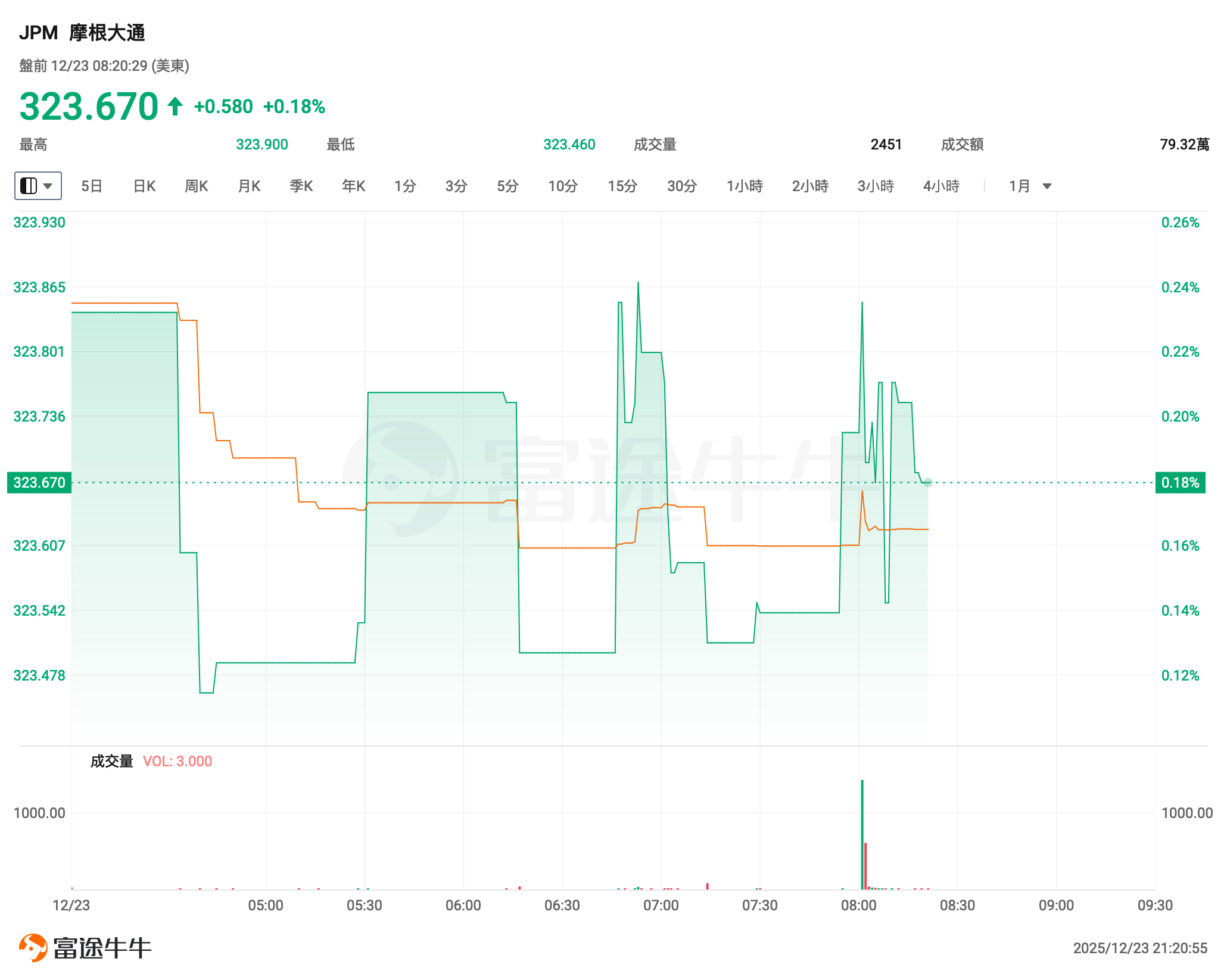

From Caution to Entry: JPMorgan (JPM.US) Plans Cryptocurrency Trading Services

According to sources familiar with the matter, $JPMorgan (JPM.US)$ JPMorgan is considering offering cryptocurrency trading services to institutional clients, underscoring the growing involvement of Wall Street banks in the digital asset space. According to reports, JPMorgan is conducting a comprehensive review of its market operations to explore potential service offerings aimed at expanding its footprint in the cryptocurrency market. These services could span various areas including spot trading and derivatives trading.

However, related efforts are still in the preliminary exploration stage, and the formulation of specific plans will depend on whether there is sufficient market demand to support the launch of any particular product. If this initiative is ultimately implemented, it will become another key milestone in the process of digital assets being adopted at a broader institutional level.

Another Million Users in Just 47 Days! Musk’s Satellite Internet Business Growth Takes Off

Starlink, the satellite internet business under Elon Musk, announced that its global active user base has surpassed 9 million. Notably, the time required to achieve each new milestone in user growth continues to shorten, with the latest 1 million users added in just 47 days. Musk remarked on the difficulty of the achievement but also emphasized that the next phase of exponential growth is imminent.

Alphabet Makes Major Push into AI Data Centers: Acquires Clean Energy Provider Intersect for $4.75 Billion, 'Green' Solution to Power Shortages

Google (GOOGL.US) has agreed to acquire clean energy developer Intersect Power LLC for $4.75 billion in cash plus existing debt, marking one of the tech giant’s largest deals to significantly expand its AI data center capacity.

This acquisition aims to provide more electricity for Google, under Alphabet, to meet the demands of its data centers. Due to factors such as artificial intelligence, the aging U.S. power grid is struggling to cope with a surge in electricity demand not seen in decades. It was previously reported that Google gained a minority stake in the energy supplier last year through collaboration with Intersect to build large power plants near data center campuses.

Wells Fargo & Co follows peers in expanding into options clearing, with potential onboarding of major market makers like Citadel by 2026.

As customer demand for options clearing services continues to grow, Wells Fargo & Co (WFC.US) the Global Markets division is actively expanding its presence in this area. Wells Fargo & Co will follow industry peers such as Goldman Sachs by using its own capital to provide clearing guarantees for client options trades, acting as a key intermediary between clients and clearinghouses; however, the ultimate market share it can capture remains to be seen.

It is understood that this plan is still in the early stages of preliminary development. Notably, as early as June this year, Wells Fargo shed the regulatory burden that had previously capped its asset size at $1.95 trillion.

Faraday Future Intelligent Electric Inc. continues to rise pre-market; the company may unveil a new robotics product early next year.

$Faraday Future Intelligent Electric Inc.(FFAI.US)$ ) continues to rise pre-market; the stock surged nearly 10% yesterday. In terms of developments, on December 22, a video showing the rollout of the FX Super One pre-production vehicle at FF's AI-Factory California in Hanford, California, unexpectedly revealed the presence of a robot.

Jia Yueting, founder and co-CEO of Faraday Future, revealed that he will release his New Year outlook on January 4. Faraday Future will also host its FF Shareholders' Day on January 7 during CES in Las Vegas, where it will make significant announcements regarding an upgrade to its Bridge Strategy and host a private event for new product categories. At the Shareholders' Day, Jia will also announce a comprehensive production, sales, delivery, service, and ramp-up plan and timeline for the Super One, along with a five-year business plan execution roadmap. Market analysts suggest that the new product tied to the Bridge Strategy, which FF will unveil during CES, is highly likely to be a robot.

Sony rebounds approximately 3% pre-market, potentially halting a six-day losing streak after acquiring Snoopy for CAD 630 million.

$Sony (SONY.US)$ Sony rebounds about 3% pre-market, as the stock has been on a sustained downtrend, recording a sixth consecutive day of losses. In terms of news, Sony Corporation acquired a 41% stake in Peanuts Holdings, the company that owns the copyright to Charles Schulz's "Peanuts" comic strip (featuring characters such as Snoopy and Charlie Brown), from Canadian children's entertainment company WildBrain for CAD 630 million. This transaction increases Sony Group’s ownership stake, which has been incrementally growing since 2018, to 80%, with the Schulz family retaining the remaining 20%.

ZIM Integrated Shipping rises nearly 9% pre-market after receiving multiple acquisition proposals.

$ZIM Integrated Shipping (ZIM.US)$ Shares rose nearly 9% pre-market following news that after the market close on December 22, ZIM Integrated Shipping issued an announcement disclosing updates on its strategic review process: Over the past several months, the board of directors received multiple acquisition proposals from strategic investors to purchase all outstanding common shares of the company. The board is currently evaluating these proposals.

Competition intensifies! Flutter's FanDuel rapidly launches a prediction market application, fully competing with DraftKings.

As tech giants such as NVIDIA, Oracle, and SoftBank Group have successively reached massive deals with OpenAI, a leading artificial intelligence (AI) company, OpenAI CEO Sam Altman recently stated that more such transactions are currently in the works. $DraftKings(DKNG.US)$A few days after launching the prediction market application, its competitor FanDuel also announced the official launch of its similar product in five states in the United States. The application, named "FanDuel Predicts," will allow users to place bets on the outcomes of sports events, cultural events, and financial indicators through a prediction market trading platform, thereby complementing the company's existing sports betting products.

As $Flutter Entertainment(FLUT.US)$ 's U.S.-based online gambling division, FanDuel has launched this app in collaboration with derivatives exchange operator $CME Group(CME.US)$Cooperatively launched this application.

Strategy Whale Halts Purchases, Stockpiles $2.2 Billion Cash to Brace for Crypto Winter

Bitcoin Whale $Strategy(MSTR.US)$ increased its cash reserves to $2.19 billion over the past week and paused Bitcoin purchases. The world's largest digital asset reserve company appears to be preparing for a prolonged cryptocurrency winter. According to a filing with the U.S. Securities and Exchange Commission (SEC) on Monday, Strategy raised $748 million through the sale of common stock during the seven days ending December 21. In the two preceding weeks, the company had purchased approximately $2 billion worth of Bitcoin, bringing its total Bitcoin holdings to around $60 billion.

Earlier this month, Strategy established a $1.4 billion reserve to cover future dividend and interest payments, aiming to alleviate market concerns that it might be forced to sell Bitcoin if token prices continue to decline. It is reported that the free cash flow generated by the company's software business is insufficient to cover dividends or interest payments. TD Cowen analyst Lance Vitanza pointed out that Strategy has approximately $824 million in annual interest and dividend payments.

$Huntington Ingalls Industries (HII.US)$Pre-market rose nearly 2%, after U.S. President Trump announced plans to build new types of warships.

U.S. macroeconomics

Trump’s "Christmas-extended break" causes minor disruptions: U.S. stocks remain in trading, but the disclosure system is shut down.

The "Christmas five-day holiday" temporarily established by Trump unexpectedly created a special window in the U.S. stock market—trading continues without interruption, but the SEC's core disclosure system EDGAR has suspended operations; during this Wednesday to Friday period, U.S. listed companies will be unable to submit key documents such as 8-Ks, executive trades, and changes in major shareholders.

Trump boasts about the success of his tariff policy? Economists unanimously refute: harmful to the economy with no benefits!

In an effort to convince American voters that the U.S. economy is improving ahead of the midterm elections, Trump recently highlighted reductions in the trade deficit and increased tariff revenues as major economic achievements since taking office during a national address.

However, economists seem to disagree with this claim. Wayne Winegarden, a senior fellow in business and economics at the Pacific Research Institute, a free-market think tank, warned that a smaller trade deficit and record tariff revenues might, at best, be poor indicators of overall economic health and, at worst, signs of underlying economic issues.

J.P. Morgan: Assuming the Federal Reserve cuts interest rates two more times next year, the forecast for the S&P 500 index target by the end of next year is 7,500 points.

J.P. Morgan released the "2026 U.S. Stock Market Outlook," pointing out that the investment focus for 2026 will primarily revolve around several core themes, including long-term growth driven by artificial intelligence (AI) and data center expansion, the tailwinds from infrastructure construction and electrification, as well as the ongoing trend of companies pursuing high-quality growth and operational resilience. The report suggests that investors should pay particular attention to companies that possess strong pricing power, long-term growth momentum, robust balance sheets, and can benefit from structural trends such as data center expansion and infrastructure investment.

The firm predicts that the S&P 500 index will reach a target of 7,500 points by the end of 2026, and expects that profits will maintain growth above trend for at least the next two years (with earnings per share expected to be $315 in 2026 and $355 in 2027, while the market generally expects $309 and $352, respectively). This outlook is based on the assumption from JPMorgan's economics department that the Federal Reserve will cut interest rates two more times before entering a long-term policy pause. However, if improvements in inflation lead to further rate cuts by the Federal Reserve, the S&P 500 index is expected to break through 8,000 points.

Post-rate cut statement statistics: Fed officials generally believe that 'interest rates should decrease, but the issue lies in the timing and magnitude.'

A Morgan Stanley report notes that while the Federal Reserve is united on the direction of rate cuts, significant divisions have emerged regarding timing and magnitude, forming two distinct camps: the dovish faction, represented by Mester and Waller, advocates front-loading rate cuts, citing notable labor market weakness; meanwhile, the hawkish group, led by Bostic and Goolsbee, favors cautious observation, concerned about persistent inflation. Upcoming employment data, particularly trends in unemployment rates, will serve as a critical signal in determining which side’s view will shape future policy paths and influence market expectations for rate cuts.

Bank of America CEO: The marginal impact of AI is strong and may become a new engine for the U.S. economy.

Bank of America CEO Brian Moynihan said on Monday that the surge in artificial intelligence (AI) investment this year could have a greater impact on the U.S. economy. "AI investment has been building momentum this year and may become a larger contributing factor next year and beyond," Moynihan said in an interview.

"The role of AI is becoming increasingly evident. Although (economic growth) cannot be entirely attributed to AI, it is having a quite strong marginal impact." He pointed out that Bank of America expects the domestic economy to grow by 2.4% next year, which is an acceleration compared to the approximately 2% growth rate in 2025. Moynihan acknowledged that the labor market continues to soften, but he believes this is more of a normalization trend.

Goldman Sachs: The AI gap between China and the US has narrowed to '3-6 months,' while DouBao’s mobile app heralds a 'shift in the application traffic landscape.'

Goldman Sachs believes that the gap between Chinese AI models and top U.S. models has narrowed to 3-6 months. Additionally, the report suggests that the introduction of AI assistants such as ByteDance’s DouBao mobile assistant may indicate a fundamental shift in the mobile application traffic landscape.

Goldman Sachs is optimistic about the cloud computing and data center sectors, as well as beneficiaries of the full AI stack. It is projected that leading Chinese cloud service providers will further increase their capital expenditure to RMB 500 billion by 2026, representing a 20% growth from the estimated over RMB 400 billion in 2025. Among this, the share of domestic chips and computing power is expected to rise significantly from 20-30% in 2025 to 40% in 2026.

"Santa Claus sends you home": The Trump administration raises the voluntary return bonus to three times, accelerating large-scale deportations.

The Trump administration announced that if illegal immigrants agree to voluntarily leave the United States by the end of this year, they will receive a $3,000 bonus and travel expenses paid by the government. This is the latest measure introduced by the U.S. government to accelerate mass deportations and reduce enforcement costs. According to a statement from the Department of Homeland Security, undocumented immigrants who apply for voluntary departure through the "CBP Home" app will have their travel arrangements and costs covered by the Department of Homeland Security and may be exempt from civil fines they could face for overstaying.

The subsidy amount of $3,000 this time is three times the amount announced in May this year ($1,000). This policy is part of an accelerated deportation action during the year-end holiday period. The Department of Homeland Security warned illegal residents in a tweet posted on platform X: "Santa Claus is going to send you home (GOING HO HO HOME)."

Bank of America survey: Fund managers are nearly "fully invested" going into the new year, with cash levels dropping to a historic low of 3.3%.

According to the latest fund manager survey by Bank of America, cash levels among fund managers have significantly dropped to 3.3% of assets under management, setting a new historical low. At the same time, investor confidence in economic growth, stocks, and commodities is soaring, with these two types of assets, which typically perform well during periods of economic expansion, reaching their highest exposure since February 2022.

Surging Gold, Silver, Platinum, and Palladium: Is the Global 'Currency Devaluation Trade' Making a Comeback?

Earlier this year, when the concept of "currency devaluation trading" first emerged in the market, Robin J Brooks, former Chief Economist of the Institute of International Finance and currently a senior fellow at the Brookings Institution, held multiple meetings to discuss whether such trading truly existed. However, this week, following another synchronized surge in gold, silver, platinum, and palladium, he stated in a column published on Tuesday that the question no longer requires debate!

In just four months since the Federal Reserve's Jackson Hole Symposium in August, silver prices have surged by 76%, palladium by 65%, and platinum by an astonishing 45%. Meanwhile, gold, which has fueled the frenzied rise in precious metals, has lagged recently with a “mere” 30% increase.

LME copper surpasses USD 12,000 per tonne for the first time in history.

On Tuesday evening, London copper futures, which had been on a nearly month-long upward trajectory, powerfully breached the key level of $12,000 per ton, setting a new historical high. With an annual gain nearing 38%, London copper is poised to record its largest yearly increase since 2009. This wave of "copper rush" has been driven by anticipated growth in demand for electric vehicles and AI data centers, coupled with frequent accidents at major copper mines, a weak-dollar cycle, and concerns over Trump-related tariffs.

Is uranium the 'next gold'? Goldman Sachs: The supply deficit will widen to 32%, with at least a 20% upside potential by the end of next year.

Goldman Sachs stated that driven by the acceleration of global nuclear power construction and reactor life extensions, the uranium supply gap is expected to widen to 32% between 2025 and 2045. Structural shortages will drive prices higher, with spot prices projected to reach $91 by the end of 2026, indicating at least a 20% increase. The long-term contract market has already shown signs of 'lower volumes and rising prices,' reflecting tightening supply and demand.

The US dollar is on track for its worst annual performance in eight years, sparking debate on Wall Street: will it continue to fall next year?

As the renminbi approaches the 7.0 mark against the US dollar nearing year-end, the exchange rate has once again become a hot topic among many domestic investors in their daily discussions. On Wall Street, there is also considerable debate about the specific trajectory of the US dollar next year—many investors believe that with the acceleration of global economic growth and further easing by the Federal Reserve, the depreciation trend of the dollar may continue into next year.

Bond issuance scales approach record highs! AI infrastructure burns cash as U.S. corporate debt soars to $1.7 trillion.

AI infrastructure financing has driven the issuance of investment-grade corporate bonds in the U.S. to approach $1.7 trillion. Giants such as Meta and Oracle have aggressively borrowed, with AI-related financing accounting for 30% of net issuance. Facing a maturity peak in 2026 and merger and acquisition demands, the market anticipates that issuance will reach new highs. However, concerns over returns have also raised worries about credit default risks.

Report: ByteDance plans capital expenditure of 160 billion yuan in 2026, half to be invested in AI chips

According to reports, ByteDance's preliminary plan for capital expenditure in 2026 amounts to 160 billion yuan, an increase from this year’s 150 billion yuan. The investment focus will be on AI infrastructure construction, with approximately half of the funds allocated to the procurement of advanced chips for developing AI models and applications.

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

22:15: U.S. October Industrial Production MoM (%)

23:00: U.S. December Conference Board Consumer Confidence Index

Next day at 02:00 AM: U.S. Total Rig Count as of December 26 (number of rigs)

Next day at 05:30 AM: U.S. API Crude Oil Inventory Change for the Week Ending December 19 (in million barrels)

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/Doris