Growth under control, inflation still sticky: The tug-of-war at a robust 4.3% growth rate continues into 2026.soft landingextends into 2026.

The U.S. economy (measured by GDP) expanded at its fastest pace in two years during the third quarter, supported by resilient consumer and business spending as well as relatively calmer trade policies compared to the second quarter. However, some economists quickly warned after the GDP release that this strong growth momentum is unlikely to persist until 2026, which to some extent impliesnonfarm payroll datathat the sudden surge in GDP against a backdrop of economic sluggishness, while reinforcing expectations of a 'soft landing,' has failed to confirm that the U.S. economy has fully entered the soft-landing trajectory long anticipated by Federal Reserve officials.

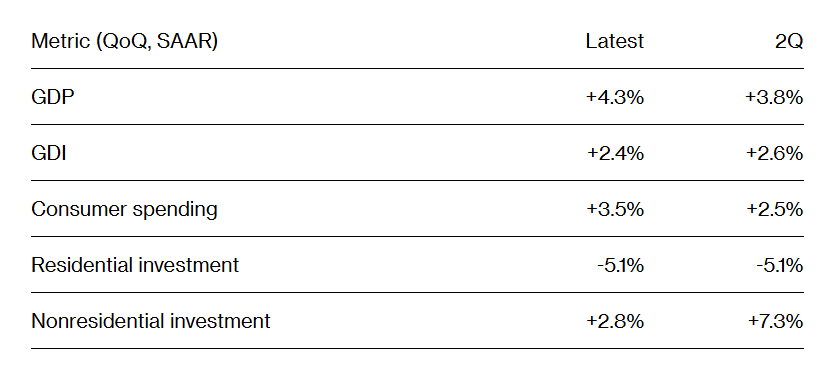

Data released by the Bureau of Economic Analysis (BEA) on Tuesday showed that the initial estimate for real (inflation-adjusted) gross domestic product (GDP) in the third quarter — a measure of the value of goods and services produced in the U.S. — grew at an annualized quarterly rate of 4.3%, significantly higher than the consensus forecast of 3.3% among economists. The previous quarter (Q2) saw a sequential growth of 3.8%, also strongly supported by household consumption expenditures.

The BEA had originally planned to release the preliminary GDP estimate on October 30, but the report was canceled due to the federal government shutdown. The agency typically publishes three estimates of quarterly growth — with GDP data being fine-tuned as more information becomes available — but during this period affected by the record-long shutdown, only two releases will occur. This means the next release of Q3 GDP may represent the final revised figure for the third quarter.

The BEA had originally planned to release the preliminary GDP estimate on October 30, but the report was canceled due to the federal government shutdown. The agency typically publishes three estimates of quarterly growth — with GDP data being fine-tuned as more information becomes available — but during this period affected by the record-long shutdown, only two releases will occur. This means the next release of Q3 GDP may represent the final revised figure for the third quarter.

Following the report's release, U.S. Treasury yields fell, and futures for the three major stock indices extended their declines, primarily due to the strong consumer spending-driven economic growth diminishing expectations of Federal Reserve rate cuts in 2026. However, the positive takeaway is that the narrative of a 'Goldilocks-style soft landing' for the U.S. economy remains coherent.

U.S. GDP expands beyond expectations, but economists caution: no cause for celebration.

This delayed 'report card' revealed that the U.S. economy — particularly consumer spending, which accounts for up to 70% of GDP calculations — maintained strong growth momentum in the middle of the year, highlighting continued consumer strength. Additionally, a reduction in some of President Donald Trump's most punitive tariffs compared to Q2 contributed to demand growth.

Although the government shutdown is expected to weigh on U.S. economic growth in the fourth quarter, economists generally anticipate a moderate rebound trend in 2026, driven by potential tax refunds received by households and the possibility of a Supreme Court ruling overturning Trump’s extensive global tariffs.

The Federal Reserve’s latest projections echo this assessment. In a press conference following the December monetary policy meeting, Federal Reserve Chair Jerome Powell pointed out that supportive fiscal policies, strong spending by tech giants on AI data centers, and resilient household consumption were key factors behind the Fed's expectation of faster U.S. economic growth next year. The latest FOMC dot plot indicates that Fed policymakers generally expect only one rate cut in 2026 after three consecutive cuts by the end of this year.

One reason some Fed officials are cautious about further significant reductions in borrowing costs is that inflation remains above their long-term target of 2%.

The inflation component of this latest GDP report shows that the Fed's preferred inflation gauge — the core Personal Consumption Expenditures Price Index (core PCE), which excludes food and energy — rose by 2.9% in Q3 on an annualized quarterly basis compared to the previous quarter, in line with expectations but up from the prior reading of 2.6%. The BEA has not yet rescheduled the specific release dates for the monthly PCE data for October or November.

The GDP data also showed that consumer spending, the main engine of U.S. economic growth, increased by 3.5% on an annualized quarterly basis, surpassing economists’ general expectation of 2.7%. This figure likely reflects robust service spending in the third quarter, including healthcare and international travel, while motor vehicle-related expenditures unexpectedly declined.

However, a weaker labor market and relatively high (and possibly temporary inflationary) cost-of-living pressures driven by Trump's tariff policies will pose obstacles for U.S. consumers in 2026. This combination has led to a more pronounced divergence in consumer spending across income groups—spending by middle- and low-income households is cooling, while affluent consumers continue to spend lavishly, bolstered by substantial wealth gains from the ongoing bull market in U.S. equities reaching new highs.

Business investment in the U.S. grew by 2.8% on an annualized quarterly basis in the third quarter, primarily driven by another strong quarter of heavy capital equipment spending, particularly in computer-related assets. Additionally, large-scale investments in AI data centers, which underpin AI computing power infrastructure, climbed to new record highs.

Another report released on Tuesday showed that orders for U.S. business equipment fell more than expected in October. Shipments of non-defense capital goods excluding aircraft (which are directly factored into the equipment investment component of GDP) were stronger than economists’ general expectations, indicating some momentum as the economy entered the fourth quarter.

Net exports contributed approximately 1.6 percentage points to GDP growth after experiencing volatility in the first half of the year. Goods and services produced outside the U.S. are subtracted when calculating GDP but are included when consumed. Both inventory and residential investment acted as drags on economic growth in the third quarter.

Due to distortions in GDP data this year caused by trade and inventory fluctuations, economists have increasingly focused on final sales to domestic private consumers, a metric that better reflects consumer demand and business investment. This indicator rose by 3%, marking the largest increase in a year.

Following the release of the GDP data, Diane Swonk, chief economist at KPMG, stated: 'This is the strongest six months of growth since the end of 2023, but it doesn’t feel that way to most people. Consumers are still spending, and investments in data centers are significant, yet we are in a very peculiar situation where the economy is growing without creating jobs.'

‘This report, which should have been released in October, is already outdated news. Moreover, markets expect economic growth in the fourth quarter to be extremely weak or even stagnant, so there is no cause for celebration,’ said Chris Rupkey, chief economist at FwdBonds, a financial markets research firm.

The narrative of a ‘soft landing’ for the U.S. economy has gained strength, but expectations for interest rate cuts have diminished.

Morgan Stanley’s outlook report for the U.S. economy in 2026 indicates that the OBBA tax cut legislation (referred to as the ‘Big and Beautiful’ bill) passed by the Trump administration in 2025 will strongly boost economic growth starting in 2026. Combined with price increases from Trump's tariff policies being ultimately confirmed as temporary inflationary disturbances until short-term inflation gradually dissipates, and the vigorous progress of tech giants such as Microsoft and Google in building AI data centers centered around AI computing power infrastructure, these factors will collectively drive the U.S. economy toward a ‘Goldilocks-style soft landing,’ characterized by moderate growth in the macroeconomic environment in 2026.

The so-called 'Goldilocks' macroeconomic environment refers to an ideal state where the U.S. economy is neither too hot nor too cold, maintaining moderate 'gentle growth' in GDP and consumer spending, along with long-term stability marked by a 'mild inflation trend,' while benchmark interest rates trend downward. In its latest U.S. economic outlook report, Morgan Stanley stated that it expects the U.S. economy to gradually emerge from a highly uncertain state by 2026 and return to this positive track of 'moderate growth.'

The latest Q3 GDP figures have indeed reinforced the 'soft landing' narrative; however, expectations for Federal Reserve interest rate cuts have notably cooled. Some Wall Street analysts have begun predicting that the Fed may pause its rate-cutting cycle for an extended period next year due to potential economic overheating. Following the release of the latest quarterly GDP and PCE data, interest rate futures traders have significantly tempered their expectations for Fed rate cuts. The 'CME FedWatch Tool' shows that the interest rate futures market has reduced its forecast for the number of Fed rate cuts in 2026 from three to two — likely occurring in March and September.

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/Stephen