The three major U.S. stock indexes closed collectively higher, each recording a fourth consecutive daily gain. $Nasdaq Composite Index (.IXIC.US)$ Up 0.57%,$S&P 500 Index (.SPX.US)$Up 0.46%, $Dow Jones Index (.DJI.US)$ Up 0.16%. Notably, the S&P 500 Index closed at a new high.

Most large-cap technology stocks rose.$NVIDIA (NVDA.US)$has risen more than 3%. $Google-C (GOOG.US)$ 、$Amazon(AMZN.US)$Up more than 1%, $Meta Platforms(META.US)$ 、 $Apple(AAPL.US)$ 、$Microsoft(MSFT.US)$、$Netflix (NFLX.US)$Slightly higher;$Tesla (TSLA.US)$、 $Intel (INTC.US)$ Slightly lower.

Top 5 Gainers in U.S. Equity ETFs

$DB Gold Double Short ETN (DZZ.US)$ Up 20.56%, with a trading volume of USD 1.2368 million.

$DB Gold Double Short ETN (DZZ.US)$ Up 20.56%, with a trading volume of USD 1.2368 million.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) Up 18.64%, with a trading volume of USD 63.3175 million.

ProShares Ultra Bloomberg Natural Gas ETF (BOIL.US) Up 14.81%, with a trading volume of USD 263 million.

$2x Leverage NVO ETF-Defiance (NVOX.US) Up 14.65%, with a trading volume of USD 76.8359 million.

In terms of market news, on Monday, December 22, the U.S. Food and Drug Administration (FDA) approved the first GLP-1 class oral weight-loss drug by Danish pharmaceutical giant $诺和诺德(NVO.US)$Novo-Nordisk A/S. This new medication is an oral version of its star injectable product Wegovy, offering a new option for millions of obesity patients seeking more convenient treatment solutions. Following this news, Novo-Nordisk A/S surged over 7%.

$2x Inverse RGTI ETF - Defiance (RGTZ.US) up 12.42%, with a trading volume of $135 million.

In market news, some quantum computing related stocks declined, with QBTS dropping over 9% and RGTI falling over 6%.

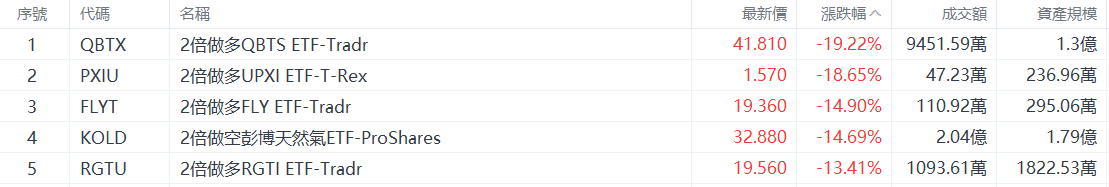

Top 5 Decliners on US Stock ETFs

$2x Leverage QBTS ETF-Tradr(QBTX.US)$ down 19.22%, with a trading volume of $94.52 million.

$2x Long UPXI ETF-T-Rex (PXIU.US) down 18.65%, with a trading volume of $472,300.

The $2x Leveraged FLY ETF-Tradr (FLYT.US) down 14.90%, with a trading volume of $1.11 million.

$2 times short Bloomberg Natural Gas ETF-ProShares (KOLD.US) down 14.69%, with a trading volume of $204 million.

$2x Leveraged Long RGTI ETF-Tradr (RGTU.US)$ down 13.41%, with a trading volume of $10.94 million.

Top 5 Gainers in U.S. Large-Cap Index ETFs

$Direxion Daily Small Cap Bear 3X Shares ETF (TZA.US)$ up 1.88%, with a trading volume of $495 million.

$ProShares UltraPro QQQ (TQQQ.US)$ Increased by 1.40%, with a turnover of USD 2.573 billion.

$ProShares UltraPro S&P 500 (UPRO.US)$ Increased by 1.37%, with a turnover of USD 315 million.

$ProShares UltraShort Russell 2000 ETF (TWM.US)$ Increased by 1.28%, with a turnover of USD 10.5203 million.

ProShares Ultra QQQ (QLD.US), which provides 2x daily leverage to the Nasdaq 100 Index, Increased by 0.95%, with a turnover of USD 2.74 billion.

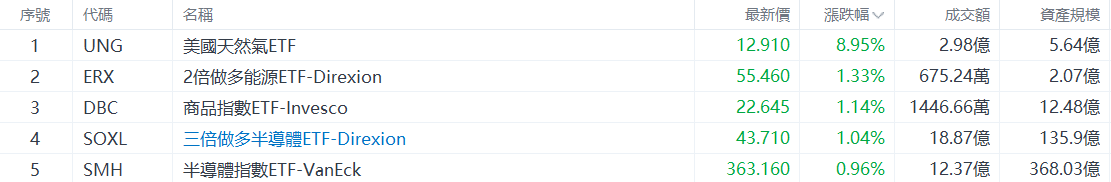

Top 5 Industry ETF Gainers

$US Natural Gas ETF (UNG.US)$ Increased by 8.95%, with a turnover of USD 2.98 billion.

$2x Leveraged Energy ETF-Direxion (ERX.US)$ Increased by 1.33%, with a turnover of USD 6.7524 million.

$Commodity Index ETF - Invesco (DBC.US)$ Increased by 1.14%, with a turnover of USD 14.4666 million.

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Increased by 1.04%, with a turnover of USD 1.887 billion.

$Semiconductor Index ETF-VanEck (SMH.US)$ Increased by 0.96%, with a turnover of USD 1.237 billion.

Top 5 Increases in Bond ETFs

$iShares Global Treasury Bond ETF (IGOV.US)$ Increased by 0.65%, with a turnover of USD 10.0928 million.

$Invesco International Corporate Bond ETF (PICB.US)$ Increased by 0.55%, with a trading volume of USD 2.49 million.

$SPDR Citi International Government Inflation-Protected Bond ETF (WIP.US)$ Increased by 0.54%, with a trading volume of USD 1.34 million.

$International Sovereign Bond ETF-SPDR(BWX.US)$ Increased by 0.47%, with a trading volume of USD 8.53 million.

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Increased by 0.46%, with a trading volume of USD 213 million.

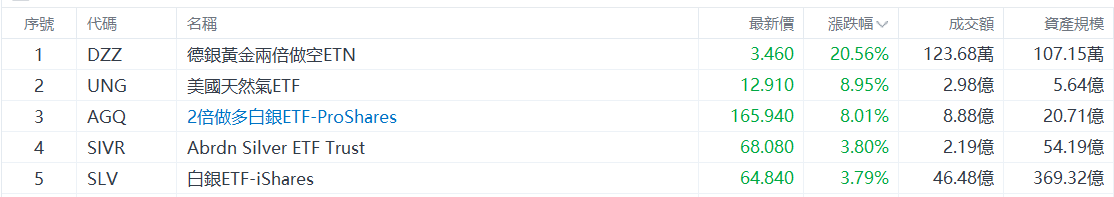

Top 5 Gainers in Commodity ETFs

$DB Gold Double Short ETN (DZZ.US)$ Up 20.56%, with a trading volume of USD 1.2368 million.

$US Natural Gas ETF (UNG.US)$ Increased by 8.95%, with a turnover of USD 2.98 billion.

$ProShares Ultra Silver ETF (AGQ.US)$ Increased by 8.01%, with a trading volume of USD 888 million.

$Abrdn Silver ETF Trust(SIVR.US)$ Increased by 3.80%, with a trading volume of USD 219 million.

$iShares Silver Trust (SLV.US)$ Increased by 3.79%, with a trading volume of USD 4.65 billion.

In market news, silver prices hit another record high as spot silver surged past USD 71.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen