Top News

Fed Chair candidate Hassett: The US is far behind other central banks in terms of interest rate cuts.

The U.S. Department of Commerce reported on Tuesday that the real GDP in Q3 grew significantly by 4.3%, marking the fastest growth rate in two years and surpassing the Dow Jones market expectation of 3.2%. Hassett attributed 1.5 percentage points of this growth to President Trump's tariff policy, which reduced the U.S. trade deficit. Hassett emphasized that the AI boom is driving economic growth while exerting downward pressure on inflation. "If we maintain a 4% GDP growth rate into the new year, monthly job growth will return to the range of 100,000 to 150,000," he said. "If you look at central banks around the world, the U.S. is far behind in terms of interest rate cuts." Hassett’s remarks underscore the divergence between the White House and the Federal Reserve regarding the pace of monetary policy.

Bessent: The Federal Reserve has room to adjust the 2% inflation target, and ranges such as 1.5%-2.5% or 1%-3% are worth discussing.

U.S. Treasury Secretary Bessent supports revisiting the Federal Reserve's inflation target after inflation has steadily declined back to 2%. Bessent suggests that once the inflation target is re-anchored, it could be discussed whether to shift it to a range, such as 1.5%-2.5% or 1%-3%. Acknowledging public concerns over the cost of living, Bessent stated, "We understand that the American people are experiencing significant hardship," attributing this to the high price levels during the Biden administration.

U.S. Treasury Secretary Bessent supports revisiting the Federal Reserve's inflation target after inflation has steadily declined back to 2%. Bessent suggests that once the inflation target is re-anchored, it could be discussed whether to shift it to a range, such as 1.5%-2.5% or 1%-3%. Acknowledging public concerns over the cost of living, Bessent stated, "We understand that the American people are experiencing significant hardship," attributing this to the high price levels during the Biden administration.

Trump criticizes the 'good news, no rally' anomaly in the market and warns that dissenters should not be allowed to lead the Federal Reserve.

U.S. President Donald Trump praised the Q3 GDP data on social media, noting that the GDP growth rate reached 4.2%, far exceeding the expected 2.5%. However, the market reaction has been unusual: in the past, good news would boost the market, but now it often leads to flat or declining stock prices—as Wall Street always fears that good news might immediately trigger interest rate hikes to prevent "potential" inflation. Trump stated, "This makes it harder for us to recreate the booming markets of the nation’s rise. A strong market itself does not cause inflation—wrong policies do. I hope the newly appointed Fed Chair will cut rates when the market is performing well, rather than suppress it without reason. I want to see a market like we haven’t seen in decades: one that rises when it should rise and falls when it should fall—a market that ought to be, and once was."

U.S. consumer confidence has fallen for five consecutive months, matching the longest losing streak since 2008.

The US economic data reveals a notable divergence characterized by 'weak consumer sentiment and moderate business sentiment.' The persistent softness in the consumer confidence index reflects households' deep concerns about prices and employment, with large-ticket consumption trending toward caution. Meanwhile, although the Richmond Fed Manufacturing Index remains in contractionary territory, it has significantly rebounded from -15 to -7. Moreover, businesses’ expectations indices for the next six months regarding business conditions, orders, and employment have all surged to high positive levels, indicating that market participants are rapidly building confidence in the medium-term outlook.

The U.S. Plans Tariffs on Chinese Semiconductor Products Starting in 2027

The U.S. claims that China engages in unfair trade practices in the semiconductor sector, but no additional tariffs will be imposed on chips imported from China until at least mid-2027. The Office of the United States Trade Representative (USTR) announced on Tuesday the results of an almost year-long investigation into China’s chip industry, stating that imposing tariffs on Chinese semiconductors is an appropriate measure. The initial tariff level will be set at 0% and will increase to a separately announced rate starting June 23, 2027, after an 18-month period. The tariff rate will be announced at least 30 days in advance. The USTR statement noted that China’s actions to secure dominance in the semiconductor industry have placed burdens or restrictions on U.S. commerce, justifying U.S. action.

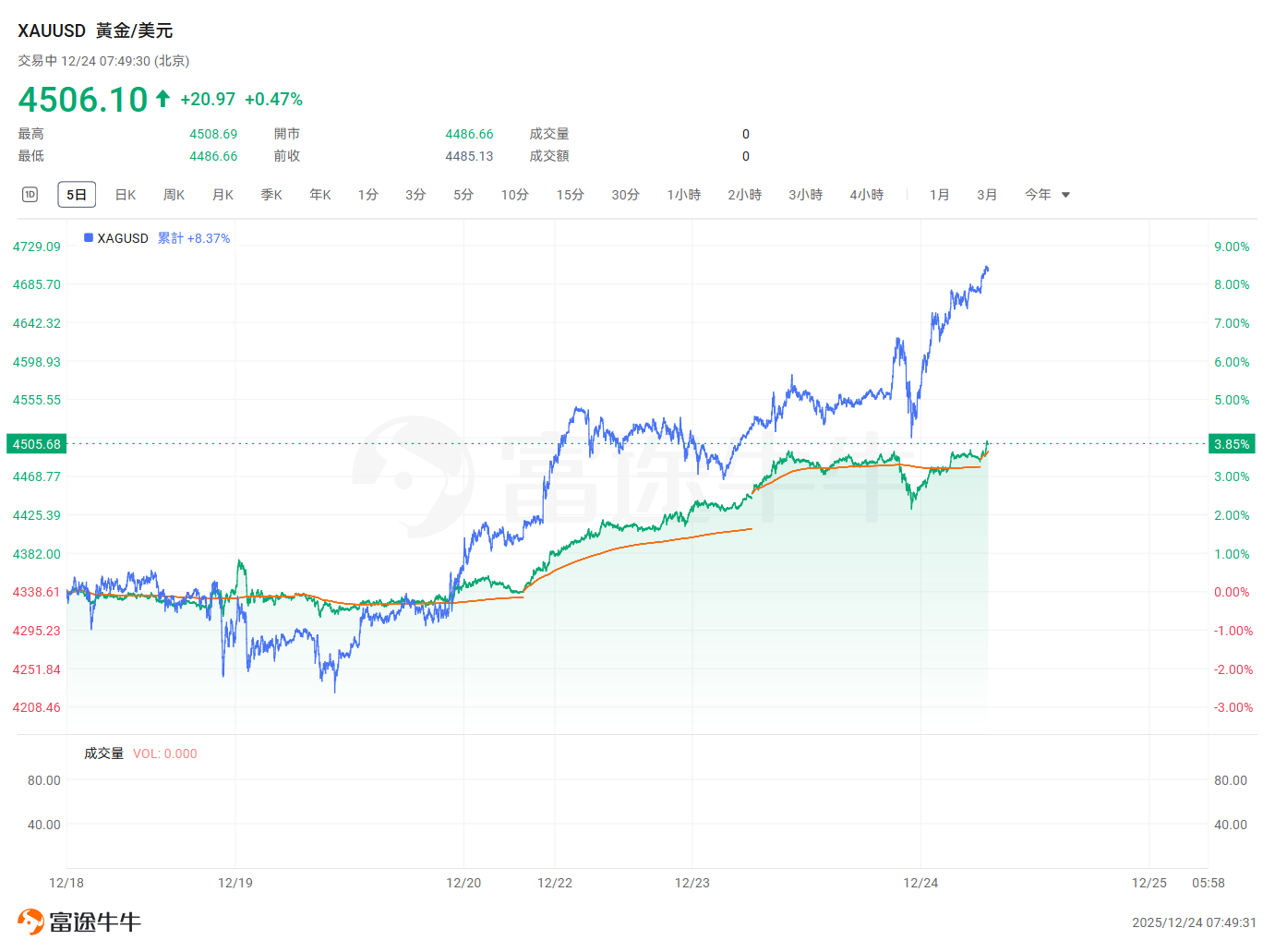

Silver Surpasses $71 Mark for the First Time; Gold Breaks Above $4,500 as Precious Metals Bull Market Continues to Expand

Amid escalating geopolitical tensions and expectations of further interest rate cuts by the Federal Reserve, gold and silver prices surged to new all-time highs. On Tuesday (December 24), during the Asian morning session, spot gold prices broke above $4,500 per ounce, with intraday gains reaching 0.47%, continuously setting new records.

U.S. Stock Market Recap

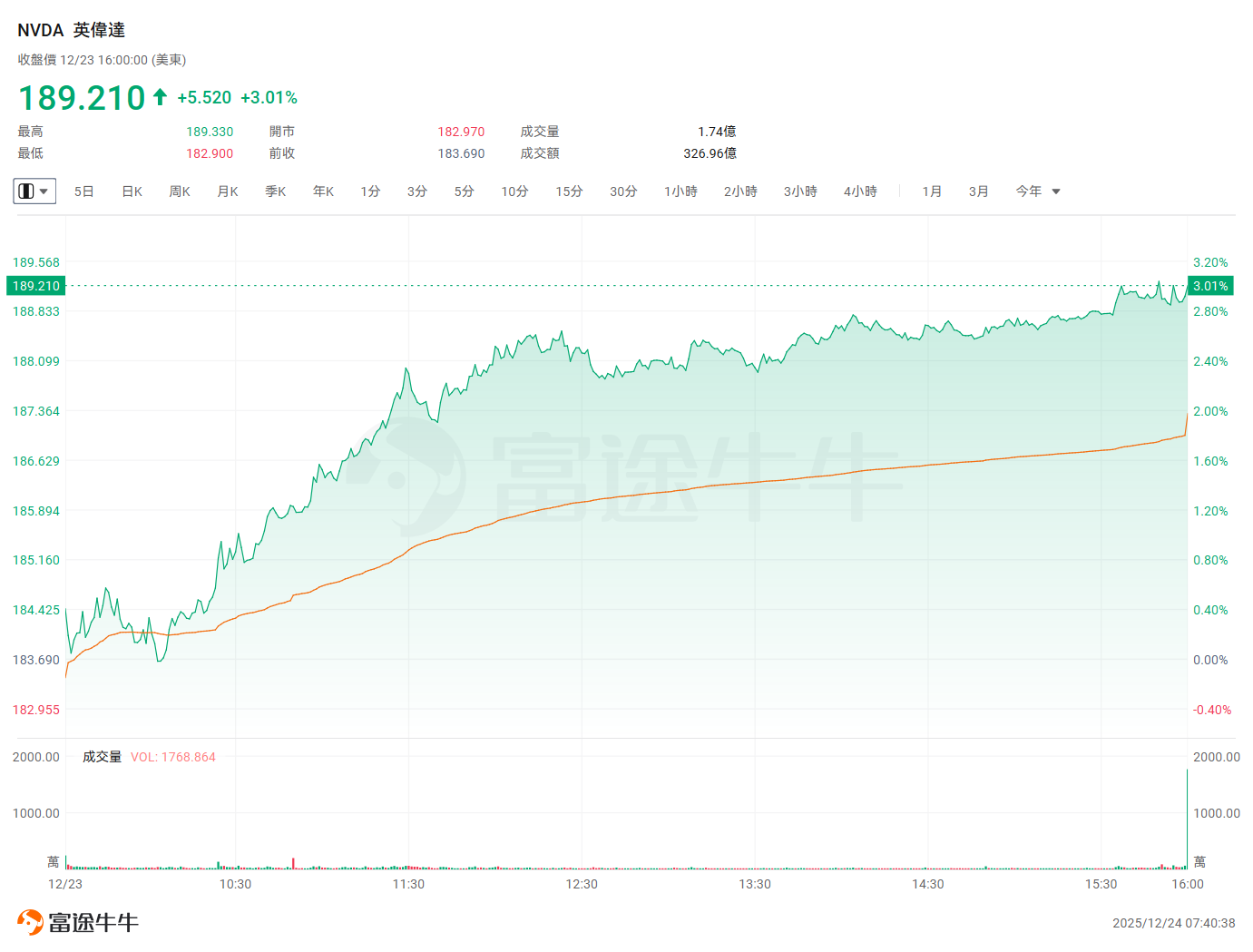

S&P 500 Closes at New High After Four-Day Winning Streak, NVIDIA Rises 3% Leading Seven Giants Higher

On Tuesday (December 23), U.S. stocks continued to strengthen throughout the trading session, with all three major indices posting gains for the fourth consecutive day. The S&P 500 closed at a new high, rising 0.46% to 6,909.79 points, surpassing its December 11 record. The Dow Jones Industrial Average gained 0.16% to close at 48,442.41 points, while the Nasdaq Composite Index rose 0.57% to end at 23,561.84 points.

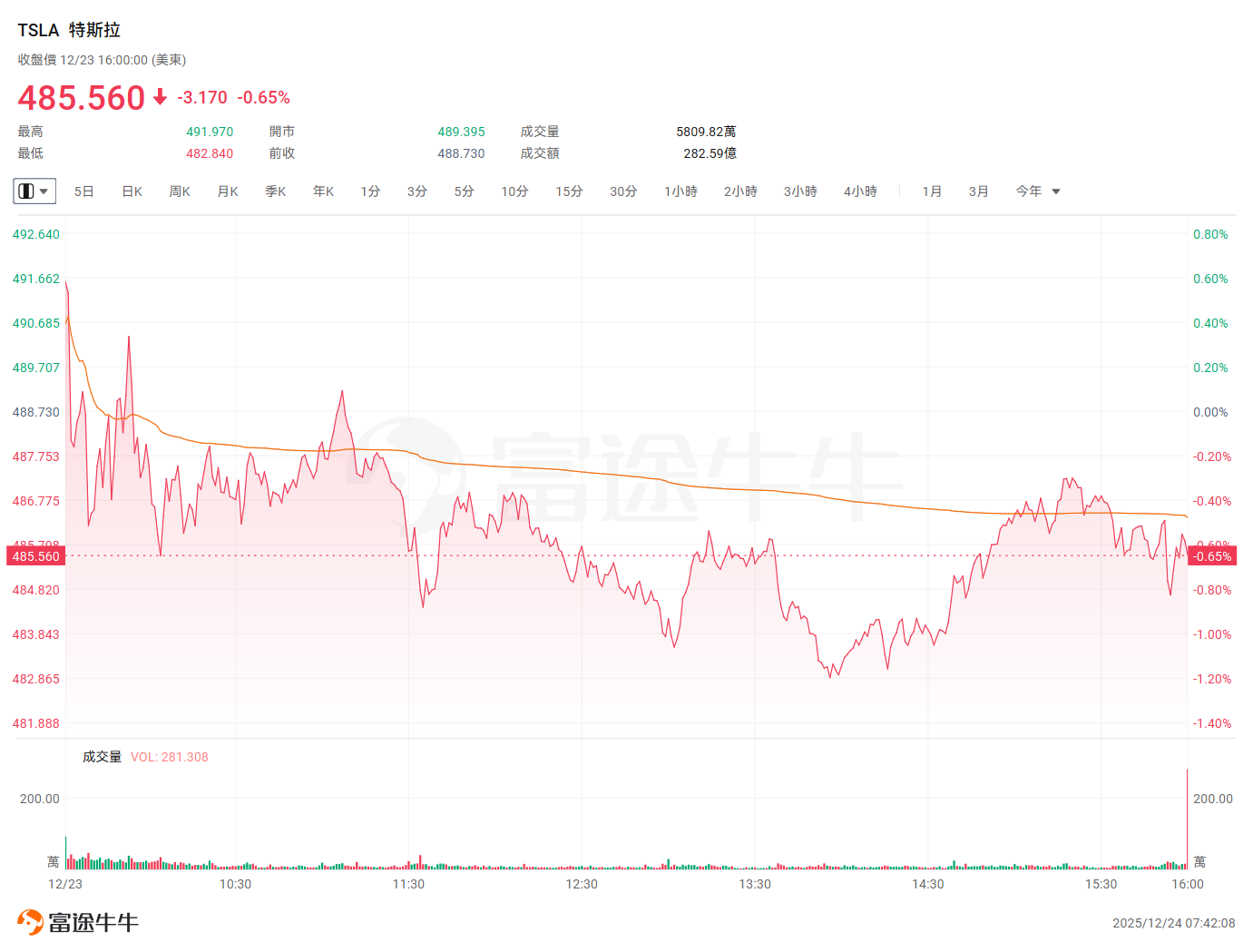

$明星科技股(LIST2518.US)$ Most stocks closed higher, with NVIDIA up 3.01%, reaching its highest level since November 17, and its total market capitalization surpassing $4.6 trillion. Apple rose 0.56%, Google C gained 1.39%, Microsoft increased by 0.44%, Amazon climbed 1.62%, Meta advanced 0.52%, Broadcom surged 2.3%, and Tesla declined 0.65%.

$热门中概股(LIST2517.US)$ Most stocks closed lower, with GDS Holdings down 3.11%, Pony AI falling 3.01%, Nio dropping 2.2%, Li Auto declining 1.71%, XPeng Motors slipping 1.60%, Tencent Music losing 0.9%, Baidu dipping 0.47%, and JD.com edging down 0.03%. TAL Education Group rose 0.54%, New Oriental gained 0.34%, Alibaba advanced 0.18%, and PDD Holdings climbed 0.13%.

$Copper (LIST2510.US)$ Concept stocks performed strongly, with Freeport-McMoRan rising 2.49% and Ero Copper up 2.01%. During the trading session, LME copper futures surpassed $12,000 per tonne for the first time in history, marking a significant milestone for this key industrial metal.

Individual stock news

NVIDIA closed 3% higher after announcing plans to deliver H200 chips to Chinese customers before the Lunar New Year.

According to reports by Global Times citing Reuters, multiple insiders revealed that $NVIDIA (NVDA.US)$ NVIDIA has informed its Chinese customers of plans to deliver its second-most powerful artificial intelligence (AI) chip, the H200, by mid-February next year, ahead of the Chinese Lunar New Year. Two of the sources stated that NVIDIA intends to fulfill the initial orders using existing inventory, with an estimated shipment of 5,000 to 10,000 chip modules, equivalent to approximately 40,000 to 80,000 H200 chips. However, Reuters noted that there remains significant uncertainty regarding the successful delivery of the H200 chips, as no procurement orders for the H200 have yet been approved by Chinese authorities.

Google rose 1.4% after reports emerged that it plans to launch new AI-powered smart glasses by 2026.

According to a report by Bloomberg columnist Parmy Olson on the 23rd, $Google-C (GOOG.US)$ Google is planning to launch new AI-powered smart glasses in 2026, aiming to differentiate itself from competitors like Meta through 'world model' technology. The glasses, co-developed with Samsung, will go beyond merely describing scenes captured by cameras; they are designed to understand three-dimensional space, relationships between physical objects, and environmental dynamics. This marks a pivotal attempt by Hassabis in the product domain, which could reshape Google’s past reputation in the smart glasses market and establish new industry standards.

Broadcom insiders sell over $100 million worth of shares as CEO further reduces stake.

According to a filing with the U.S. Securities and Exchange Commission (SEC), $Broadcom (AVGO.US)$Broadcom CEO and President Hock Tan sold 130,000 shares, cashing out approximately $42.38 million. Regulatory filings show that the transaction was executed on December 18 and disclosed on December 22 through a Form 4 filing, reducing Tan's direct holdings to approximately 595,638 shares. This sale represents the latest in a series of stock disposals by Tan and other executives this year. Including previous transactions, Broadcom insiders have cumulatively sold over $100 million worth of shares in 2023.

ServiceNow fell 1.48% after announcing plans to acquire cybersecurity startup Armis for approximately $7.75 billion.

$ServiceNow(NOW.US)$ announced an all-cash transaction to acquire cybersecurity startup Armis, with the deal valued at approximately USD 7.75 billion. The statement noted that the transaction is expected to close in the second half of next year, funded by a combination of cash and debt. ServiceNow stated that this acquisitionMergers and acquisitions will significantly enhance its cybersecurity capabilities in the age of artificial intelligence and expand the total addressable market for its security and risk solutions to more than three times its current size.

Tesla's November sales in Europe declined nearly 12%

Data released on Tuesday showed that $Tesla (TSLA.US)$ sales in Europe continued to decline in November, while its Chinese competitor $BYD (01211.HK)$ while sales in the region recorded strong year-over-year growth, with market share steadily increasing. Data from the European Automobile Manufacturers Association (ACEA) showed that Tesla’s sales in the EU, the European Free Trade Association, and the UK fell by 11.8% year-over-year in November, to 22,801 units. Tesla's market share in Europe also dropped to 2.1% in November from 2.5% a year earlier, but rebounded slightly from the dismal 0.6% in the previous month (October).

Alibaba open-sources new image model; institutions claim AI large models drive robust demand for computing power

According to media reports, $Alibaba(BABA.US)$ released an open-source image generation model, Qwen-Image-Layered, achieving Photoshop-level layer understanding and image generation within the model for the first time. The new Qwen model adopts a proprietary innovative architecture capable of “decomposing” images into multiple layers, similar to how professional designers use Photoshop to create and edit layered images. This allows for near-zero drift precision editing of AI-generated images, thoroughly addressing consistency issues in AI image generation and accelerating the practical application of large models in professional design fields.

China’s domestic AI ecosystem is forming an accelerating internal cycle: new model releases – compatibility with domestic chips – optimization of large models, with both software and hardware evolving in synergy. A research report from CITIC Securities suggests that AI large models are still undergoing continuous iteration and upgrades, with competition far from over, driving robust demand for computing power. They remain optimistic about the AI computing power sector, recommending continued focus on North American supply chains while also emphasizing domestic developments.

$UiPath(PATH.US)$ rallied after-hours as S&P Dow Jones Indices announced that UiPath would be added to the S&P MidCap 400 Index and Viasat Media Group would join the S&P SmallCap 600 Index.

Top 20 by Trading Value

Market Outlook

Northbound capital increased Alibaba's position by over HKD 1.3 billion, reduced China Mobile's position by nearly HKD 2 billion, and sold Tencent shares worth nearly HKD 1.1 billion.

On Tuesday, December 23, southbound funds recorded a net purchase of HK$611 million worth of Hong Kong stocks.

$Alibaba-W (09988.HK)$、$Meituan-W(03690.HK)$、$Zijin Mining (02899.HK)$They respectively achieved net inflows of HK$1.36 billion, HK$223 million, and HK$112 million;

$China Mobile (00941.HK)$、$Tencent (00700.HK)$、$Kuaishou-W (01024.HK)$They were respectively subject to net outflows of HK$1.975 billion, HK$1.088 billion, and HK$174 million.

JD.com's Latest Response to 'Warehouse Theft': Paris Warehouse Resumes Normal Operations

On the evening of December 23, $JD.com-SW (09618.HK)$ JD.com announced that on December 22 Beijing time, its warehouse in the Paris region of France was subject to theft. Local police have initiated an investigation. JD.com stated that the warehouse has resumed normal operations, and the “significant loss figures” disclosed by certain parties deviate significantly from the actual situation. Previously, reports citing foreign media claimed that a warehouse of JD.com located in Seine-Saint-Denis, France, was burglarized, with more than 50,000 units of 3C digital devices (including mobile phones, computers, and tablets) stolen, valued at approximately €37 million, equivalent to RMB 306 million.

Sunac China: Full Completion of Offshore Debt Restructuring

$Sunac China (01918.HK)$ The company announced the completion of its comprehensive offshore debt restructuring, with the effective date of the restructuring confirmed as December 23, 2025. Approximately USD 9.6 billion of the company’s existing debt has been fully discharged and waived. In return, the company issued Mandatory Convertible Bond 1 and Mandatory Convertible Bond 2 to the scheme creditors on the effective date of the restructuring in accordance with the terms of the plan.

SMIC Raises Prices for Some Production Capacity by Approximately 10%

Information obtained from multiple sources confirms that $SMIC (00981.HK)$ SMIC has implemented price increases for some production capacity, with the increase being approximately 10%. Some companies have indicated that the price hikes are expected to take effect soon. However, due to previously low prices for memory products, wafer manufacturers had already taken the lead in raising prices for them. Regarding the reasons behind SMIC's price hike, semiconductor industry insiders noted that rising raw material costs are one of the contributing factors. Additionally, Taiwan Semiconductor’s confirmation of integrating 8-inch production capacity and plans to shut down certain production lines by the end of 2027 may also trigger expectations of further price increases among wafer manufacturers.

Zhou Liu Fu Responds to Stock Price Fluctuations: Unaware of the Cause, Business Operations Remain Normal and Stable

$Zhou Liu Fu (06168.HK)$ The Hong Kong Stock Exchange announcement stated that the board of directors noted unusual fluctuations in the company’s H-share price recently. After making reasonable inquiries, the board confirmed that, as of the date of this announcement, it is not aware of any reasons for the share price fluctuations, or any information that needs to be disclosed to avoid creating a false market in the company's securities, or any insider information required to be disclosed under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). As of the date of this announcement, the board confirmed that the group’s business operations remain normal and stable, core businesses are proceeding smoothly, and there are no significant matters that require disclosure which have drawn the attention of the board or the company's management.

Kuaishou: The live streaming feature on the Kuaishou app has gradually resumed normal service.

$Kuaishou-W (01024.HK)$ In an announcement made at noon yesterday, the company stated that the live streaming feature on its Kuaishou app was subjected to a cyberattack around 22:00 on December 22, 2025. The company immediately activated its emergency response plan, and after full efforts in handling the situation and system restoration, the live streaming function on the Kuaishou app has gradually returned to normal service. Other services on the Kuaishou app were not affected. The company strictly adheres to compliance standards and firmly opposes any illegal content or behavior. The company strongly condemns the criminal activities associated with black and gray industries, has reported the matter to the public security authorities and relevant departments, and will take other appropriate legal remedies as necessary to protect the interests of the company and its shareholders. Additionally, on December 23, Kuaishou repurchased 2.7176 million shares at prices ranging from HKD 63.700 to HKD 64.650 per share, amounting to a total repurchase value of HKD 174 million, bringing the cumulative repurchases for the year to HKD 3.018 billion.

Today's Focus

Keywords: Early closure of US stock market on Christmas Eve, half-day trading in Hong Kong stocks, US initial jobless claims, Bank of Japan October monetary policy meeting

In terms of economic data, attention can be paid to the US initial jobless claims and weekly EIA crude oil inventories.

21:30 US initial jobless claims for the week ending December 20 (in ten thousand people)

23:30 US EIA crude oil inventory for the week ending December 19 (in million barrels), US EIA Cushing, Oklahoma crude oil inventory for the week ending December 19 (in million barrels), US EIA Strategic Petroleum Reserve inventory for the week ending December 19 (in million barrels)

In terms of financial events, the Bank of Japan will release the minutes of the October monetary policy meeting, and the Bank of Canada will publish the minutes of its monetary policy meeting.

07:50 Bank of Japan releases the minutes of the October monetary policy meeting

In terms of market holidays, the Hong Kong stock market and Singapore stock market will be closed in the afternoon; U.S. stocks will close three hours early, with trading hours from 22:30 to 02:00 Beijing time, and after-hours trading from 02:00 to 06:00 the next day. The U.S. stock overnight session (Beijing time December 24, 09:00–17:00) will operate normally.

![]()

Morning Reading by Niuniu:

No matter when, I always have the patience to wait for the market to reach what I call the 'key point,' and only then do I begin to trade. In my operations, as long as I follow this principle, I always make money.

— Jesse Livermore

![]() AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

Editor/Rocky