①This year, the G10 central banks have collectively implemented 32 interest rate cuts, with a cumulative easing magnitude of 850 basis points. This marks the highest number of rate cuts since 2008 and the most substantial easing effort since 2009; ②Some analysts expect that the monetary policies of these major central banks may experience a significant turning point in 2026. They noted that multiple G10 central banks have recently shown a noticeable shift in tone, signaling potential future interest rate hikes.

In 2025, central banks of major developed economies worldwide are implementing interest rate cuts at the fastest pace and largest scale seen since the financial crisis, while policymakers in developing countries are also accelerating their accommodative measures.

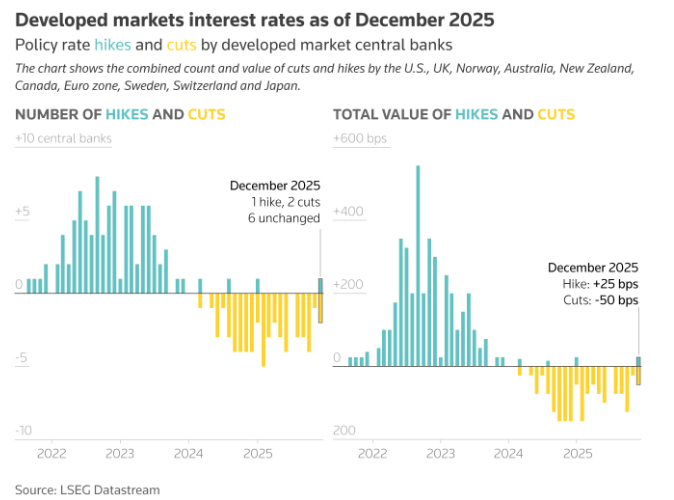

Among the G10 central banks, which represent the ten most actively traded currencies globally, nine have lowered their benchmark interest rates in 2025. The G10 central banks include the Federal Reserve, European Central Bank, Bank of England, Reserve Bank of Australia, Reserve Bank of New Zealand, Bank of Canada, Sveriges Riksbank, Norges Bank, and Swiss National Bank.

This year, these central banks have collectively implemented 32 interest rate cuts, with a cumulative easing magnitude of 850 basis points. This marks the highest number of rate cuts since 2008 and the most substantial easing effort since 2009.

This year, these central banks have collectively implemented 32 interest rate cuts, with a cumulative easing magnitude of 850 basis points. This marks the highest number of rate cuts since 2008 and the most substantial easing effort since 2009.

This stands in stark contrast to 2022-2023, when surging energy prices driven by the Russia-Ukraine conflict prompted policymakers across countries to raise interest rates in response to inflationary pressures.

The Bank of Japan was the sole exception among the G10 central banks this year, having raised interest rates twice—once at the beginning and again toward the end of the year.

Policy Tone Shift Before 2026

Some analysts anticipate that the monetary policies of these major central banks could undergo a significant turning point in 2026. They highlighted that several G10 central banks—particularly the Bank of Canada and Reserve Bank of Australia—have already demonstrated a clear shift in tone, hinting at the possibility of future interest rate hikes.

James Rossiter, Head of Global Macro Strategy at TD Securities, stated: "We believe the European Central Bank will raise interest rates next year, and both the Reserve Bank of Australia and the Bank of Canada will approach raising rates."

Meanwhile, the Federal Reserve is grappling with the complex interplay between labor market dynamics and inflationary trends.

Luis Oganes, Head of Global Macro Research at JPMorgan, pointed out, "During 2025, the Federal Reserve either maintained interest rates or cut them at every meeting, with no discussion of rate hikes. However, this situation may change in 2026, particularly in the second half of the year when more pronounced two-way risks are expected to emerge."

Monthly data also reveals a weakening momentum in easing policies. Among the nine G10 central banks that held meetings in December, only the Federal Reserve and the Bank of England implemented rate cuts, while the Bank of Japan opted for a rate hike.

Emerging market central banks continue their spree of rate cuts.

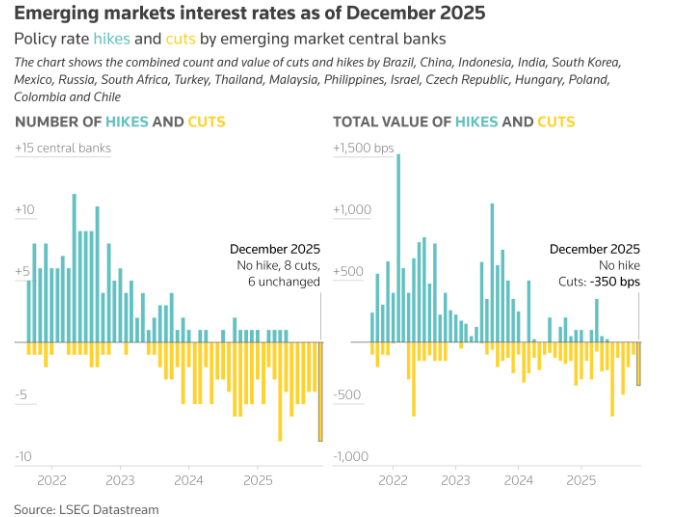

By contrast, in emerging markets, rate cuts remained concentrated in December.

Among the 18 developing economies surveyed by the industry, eight of the 14 central banks that held meetings this month implemented rate cuts, totaling a reduction of 350 basis points — including the central banks of Turkey, Russia, India, Mexico, Thailand, the Philippines, Poland, and Chile.

This wave of rate cuts at year-end brought the total reduction in interest rates for emerging economies in 2025 to 3,085 basis points (across 51 actions), far exceeding the 2,160 basis points in 2024 and marking the largest easing effort since at least the onset of the pandemic in 2021.

Giulia Pellegrini, Managing Director at Allianz Global Investors, noted, 'Inflation control in emerging markets has been more robust, even outperforming developed economies, thanks to more proactive measures by policymakers.'

On the other hand, the cumulative interest rate hikes by emerging market central banks this year amounted to 625 basis points, less than half of the 1,450 basis points of tightening seen in 2024.

Analysts expect emerging economies to further ease policies next year.

Elina Theodorakopoulou, Managing Director at Manulife Asset Management, stated, 'Many emerging markets still have the conditions to initiate a rate-cutting cycle — countries such as Brazil and Hungary may take the lead, while others are likely to extend their rate-cutting cycles.'

![]() Stay ahead with the latest financial updates and discover investment opportunities early! Open Futubull > Market > US Stocks >Economic Calendar/Selected macroeconomic data, seize the investment opportunity!

Stay ahead with the latest financial updates and discover investment opportunities early! Open Futubull > Market > US Stocks >Economic Calendar/Selected macroeconomic data, seize the investment opportunity!

Editor/KOKO