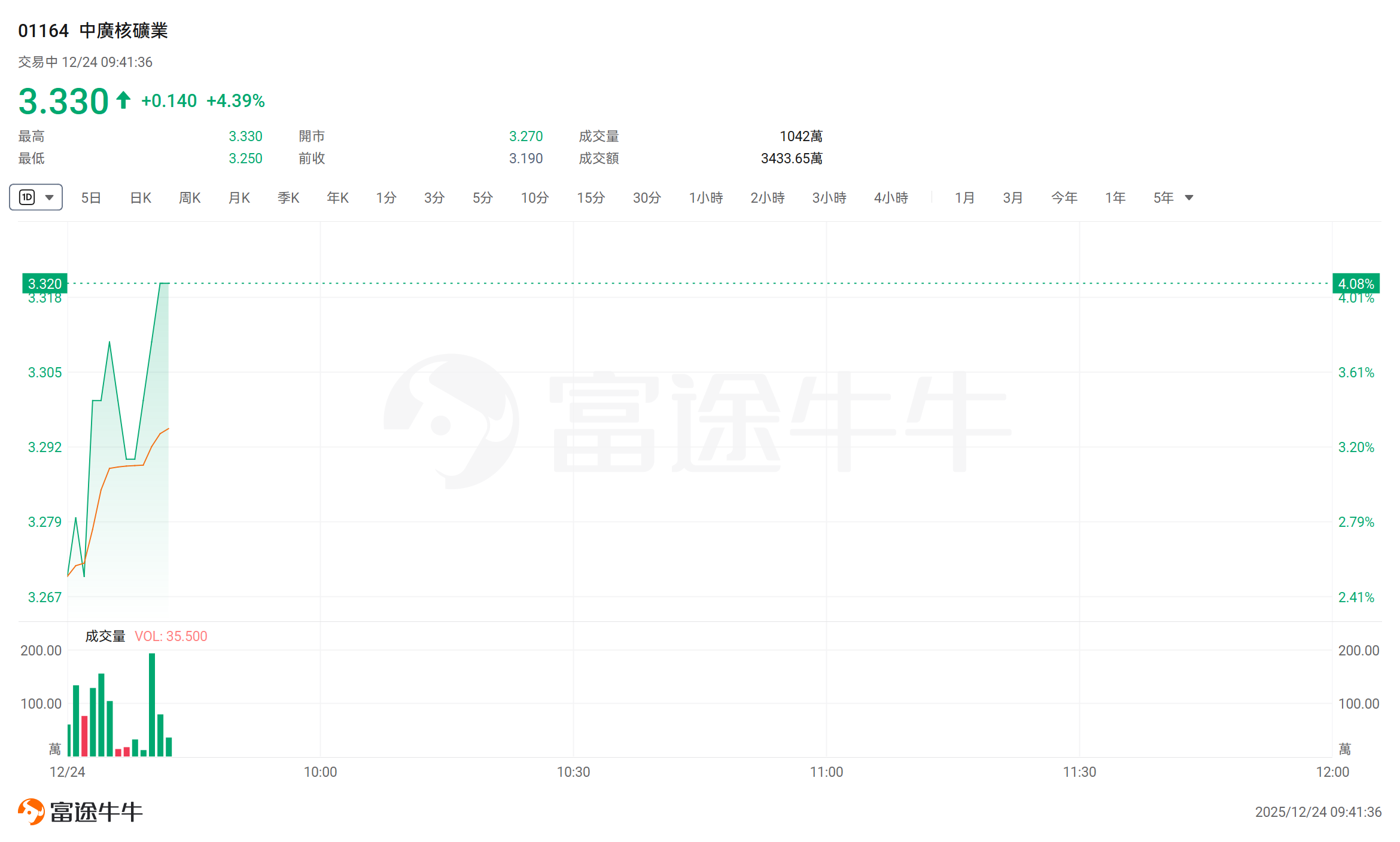

Today, $CGN MINING (01164.HK)$ The stock price rose more than 4% again. As of press time, it increased by 4.39%, trading at HKD 3.33 with a turnover of HKD 34.3365 million.

In terms of market news, Goldman Sachs' latest research report indicates that the spot uranium price is expected to rise to approximately USD 91 per pound by the end of 2026, representing an increase of at least 20% compared to the current level of around USD 76. Although different mechanisms drive the spot and long-term contract markets, the bank believes that prices in both markets face upward risks by 2026. The long-term contract price has risen from USD 80 per pound in August to USD 86 per pound. According to Goldman Sachs' model, the cumulative supply deficit for uranium will be approximately 13% between 2025 and 2035, further widening to 32% between 2025 and 2045.

A recent research report by Essence Securities International stated that the new trading framework will drive both revenue and profit growth for CGN Mining in the future. In early June, the company announced the related-party transaction price framework for 2026-2028 with the CGN Group. The new sales pricing structure changes from 40% base price + 60% spot price over the past three years to 30% base price + 70% spot price. Meanwhile, the base price has been significantly increased from USD 61.78/pound, USD 63.94/pound, and USD 66.17/pound to USD 94.22/pound, USD 98.08/pound, and USD 102.10/pound, respectively. It is expected that the company's future sales revenue and profits will achieve substantial growth.

Editor/KOKO

Editor/KOKO