Driven by geopolitical risks and global supply shortages, the precious metals market is experiencing a historic moment. Gold prices have broken above $4,500 per ounce for the first time, while platinum has reached a new all-time high above $2,300, with year-to-date gains exceeding 150%. Silver has surged past $70 and continues to rally sharply. Domestic platinum futures hit their upper trading limit, while silver and palladium futures on the Shanghai exchange soared. This bull market has been fueled by a combination of risk-aversion sentiment, central bank purchases, and 'currency devaluation trades.'

Precious metals are still in a sharp upward rally.

Driven by geopolitical risks, ongoing global supply shortages, and robust investment demand, prices of gold, silver, and platinum have once again surged to all-time highs.

$XAU/USD (XAUUSD.CFD)$ Prices have broken through USD 4,500 per ounce for the first time in history, with an increase of more than two-thirds year-to-date, on track for the best annual performance since 1979.

$XAU/USD (XAUUSD.CFD)$ Prices have broken through USD 4,500 per ounce for the first time in history, with an increase of more than two-thirds year-to-date, on track for the best annual performance since 1979.

$Platinum Futures (JAN6) (PLmain.US)$ Prices have also soared to a record high above USD 2,300 per ounce. This metal has risen for ten consecutive trading days, the longest streak since 2017, with a cumulative increase of over 150% year-to-date, potentially marking the best annual performance since Bloomberg began recording data in 1987.

$XAG/USD (XAGUSD.FX)$ Similarly, prices have surged past the USD 70 mark, with the uptrend continuing strongly.

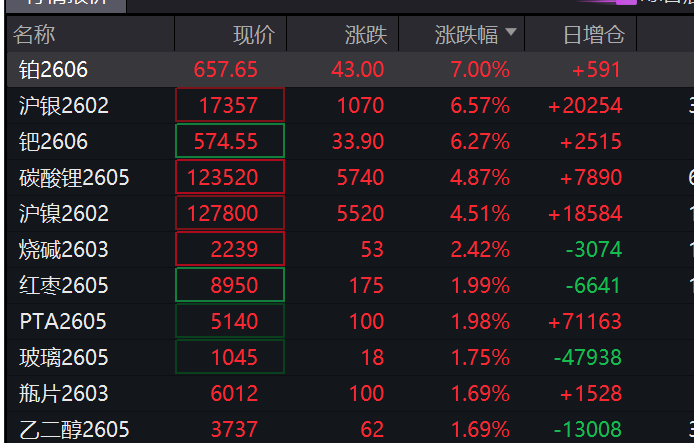

This dramatic surge is rapidly spilling over into global markets. After the opening of China's domestic commodity futures market, the main platinum futures contract hit the daily limit, while silver and palladium futures rose by more than 6% each.

Gold: A Confluence of Safe-Haven Demand and 'Currency Devaluation Trade'

Gold's strong performance this year is the result of multiple factors working together. Beyond the direct catalyst of geopolitical risks, deeper drivers stem from changes at the macroeconomic and policy levels.

According to the World Gold Council, sustained large-scale purchases by central banks worldwide have provided a solid foundation for this bull market. Meanwhile, funds continue to flow into gold ETFs, with total global holdings rising every month this year except for May. Among them, the SPDR Gold Trust, the world’s largest precious metals ETF managed by State Street, has seen its holdings increase by more than one-fifth this year.

Analysts note that President Trump's radical measures earlier this year aimed at reshaping the global trade system, along with his challenges to the Federal Reserve’s independence, have further fueled the rise in gold prices. Additionally, investors are actively engaging in what is known as the 'currency devaluation trade,' shifting toward hard assets like gold due to concerns that the ballooning global debt will erode the long-term value of sovereign bonds and their denominating currencies.

Notably, the chief economist of Muthoot Fincorp stated that inflows into gold ETFs in recent months have primarily come from retail investors, whose funds exhibit lower stickiness. This may imply that gold price volatility will remain at elevated levels. Nonetheless, multiple institutions remain optimistic about the outlook for gold prices. Goldman Sachs forecasts that gold will reach $4,900 per ounce in its baseline scenario for 2026 and believes there is greater upside risk.

Platinum: Price Surge Amid Supply Bottlenecks and Trade Risks

Unlike gold's safe-haven attributes, this round of platinum's sharp rise is more attributable to its own tight supply-demand fundamentals and potential trade policy risks.

According to Bloomberg, the platinum market is heading toward a third consecutive year of supply shortages due to disruptions in major producer South Africa. Meanwhile, high borrowing costs have led industrial users to prefer leasing rather than directly purchasing platinum, further exacerbating tightness in the spot market. Platinum is widely used in the automotive and jewelry industries, as well as in the production of chemicals, glass, and laboratory equipment.

Trade risks are another key variable. The market is closely watching the outcome of the Section 232 investigation in Washington, which could lead to tariffs or trade restrictions on platinum. To hedge against this risk, traders have already stored over 600,000 ounces of platinum in U.S. warehouses, a figure significantly higher than normal levels.

On the demand side, shipments of platinum to China have remained strong this year. Recently, in Guangzhou,Futures Exchange,the price of the newly listed platinum contract has risen significantly above other international benchmarks, further boosting market optimism about demand.

Silver: Structural Shortages Driven by Industrial and Investment Demand

In this broad-based rally across precious metals, silver's performance has also been notable, with its price increases driven by a dual impetus of investment demand and industrial demand.

From an investment perspective, global holdings of silver ETFs have continued to rise. In major consuming countries such as India, buyers have imported large quantities of silver, spurred by the Hindu festival of Diwali. This surge in demand once led to a supply squeeze in the London benchmark market.

From an industrial perspective, silver is deeply embedded in global supply chains and is widely used in electronics, solar panels, and medical device coatings, among other areas. According to data from the Silver Institute, global demand for silver has exceeded mine production for five consecutive years, reflecting a structural shortage.

Similar to platinum, silver also faces potential risks from trade barriers. Traders are awaiting the U.S. Department of Commerce's investigation results on whether imports of critical minerals pose a threat to national security, which could lead to tariffs being imposed on silver.

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO