The year 2025 is drawing to a close, marking a tumultuous period: from Trump's return to the White House at the beginning of the year, the disruption of global markets by U.S. tariffs in April, to the Federal Reserve’s pivot towards an easing path, and the capital frenzy ignited by artificial intelligence...

As we look ahead to 2026, how can we seize new opportunities? Subscribe to our special feature."2025 Year in Review", let us reflect on the past, consolidate experiences, and together embrace the next chapter.

As 2025 quietly approaches its end, looking back at the tumultuous and frenzied year, the U.S. stock market continued its upward momentum, with the three major indices frequently hitting new historical highs. Among them, the Nasdaq is considered a representative index for tech stocks and growth stocks $Nasdaq Composite Index (.IXIC.US)$ , surging over 22% this year, while $Dow Jones Industrial Average (.DJI.US)$ rose nearly 14%. $S&P 500 Index (.SPX.US)$ Rose over 17%.

This year, the AI narrative remained one of the guiding themes for the U.S. stock market. From the impressive debut of Sora at the beginning of the year to the phenomenal explosion of 'Nano Banana' at the end of the year, the market focus has shifted from the 'OpenAI chain' to the 'Google chain,' moving away from sheer computational power accumulation to concerns about shortages in electricity and storage capacity. As of December 23, $Alphabet-A (GOOGL.US)$ soared over 66%, recording the largest gain among the 'Magnificent Seven' in the U.S. stock market, $NVIDIA (NVDA.US)$with an increase of over 40%.

This year, the AI narrative remained one of the guiding themes for the U.S. stock market. From the impressive debut of Sora at the beginning of the year to the phenomenal explosion of 'Nano Banana' at the end of the year, the market focus has shifted from the 'OpenAI chain' to the 'Google chain,' moving away from sheer computational power accumulation to concerns about shortages in electricity and storage capacity. As of December 23, $Alphabet-A (GOOGL.US)$ soared over 66%, recording the largest gain among the 'Magnificent Seven' in the U.S. stock market, $NVIDIA (NVDA.US)$with an increase of over 40%.

However, beneath the prosperity, concerns are gradually emerging. Discussions about 'circular transactions' and an 'AI bubble' involving companies like OpenAI are heating up. Investors are no longer blindly buying into the capital expenditure narratives of tech giants, instead focusing on the actual implementation and commercial returns of AI applications.

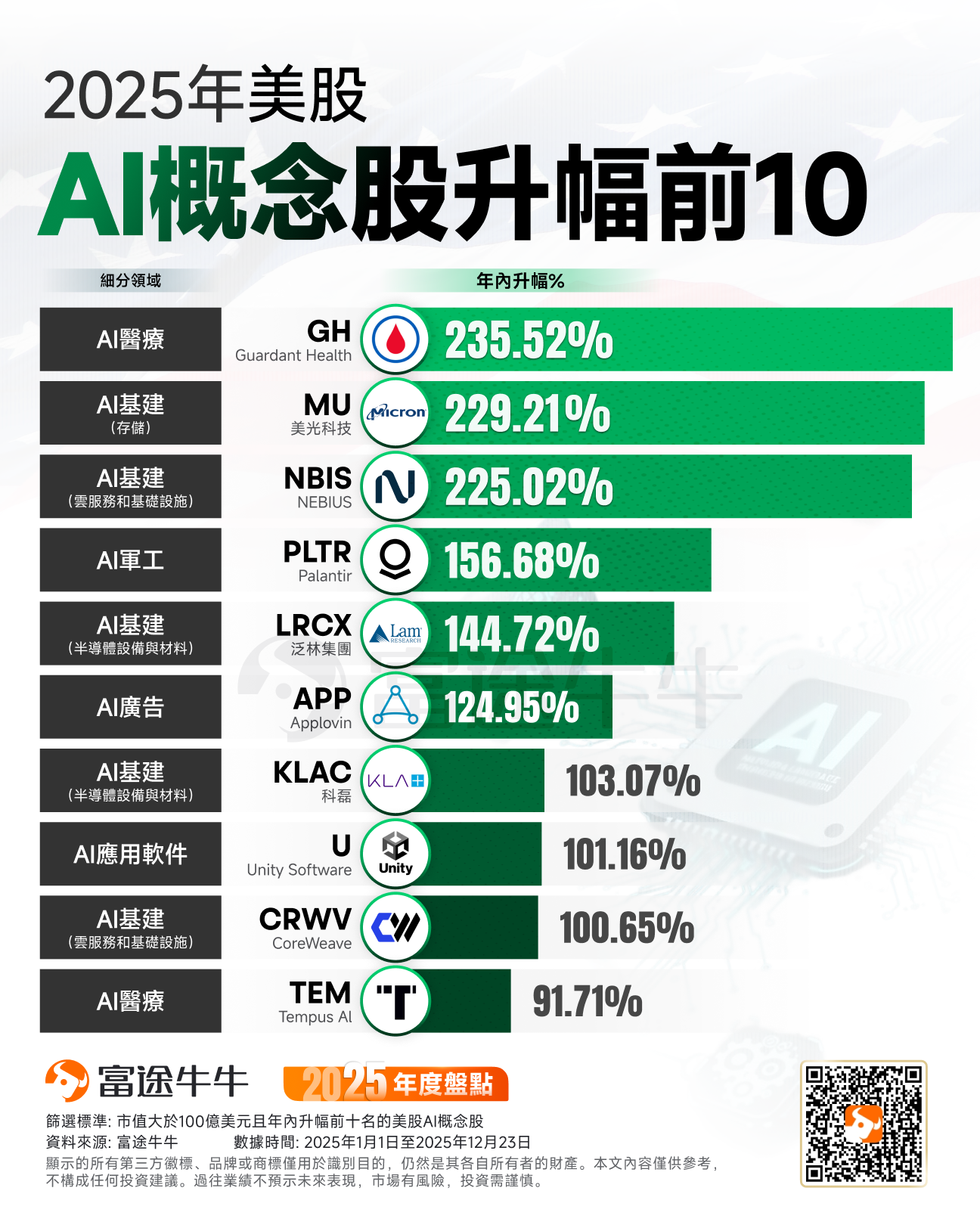

AI-related stocks showed robust growth momentum in both software and hardware sectors. The wave of AI-driven data center construction benefited NVIDIA's portfolio-related stocks as well. $NEBIUS (NBIS.US)$ spiked over 225% this year, $CoreWeave (CRWV.US)$ surged over 100%; semiconductor equipment stocks like $Lam Research (LRCX.US)$ rose nearly 145% this year, $KLA Corp (KLAC.US)$ Surging over 100%.

At the same time, with AI large models driving exponential growth in data generation and processing speeds, a shortage of memory chips has emerged, leading to continuously rising product prices, and the industry is entering a 'super cycle.' Memory chip giant $Micron Technology (MU.US)$ soars nearly 230% year-to-date.

JPMorgan predicts that the memory chip sector is experiencing the longest boom cycle in history, with leading companies’ market capitalizations approaching $1 trillion this year and set to surge to $1.5 trillion by 2027, marking an increase of over 50%. High Bandwidth Memory (HBM) demand continues to encroach on traditional DRAM production capacity, with AI inference consuming three times as much memory as training. The supply-demand gap is expected to persist until 2027. Additionally, DRAM prices are projected to soar by 53% in the fiscal year 2026, with robust enterprise demand fully offsetting consumer-side pressures.

In software, AI application software stocks $Palantir (PLTR.US)$ rise nearly 157% year-to-date, $Applovin (APP.US)$ increase nearly 125%, $Unity Software (U.US)$ and surge over 100%. Moreover, AI healthcare concept stock $Guardant Health (GH.US)$ skyrockets over 235% year-to-date, $Tempus AI (TEM.US)$ Surged over 90%.

Electricity is one of the major bottlenecks constraining the construction of AI data centers. According to a recent report by Morgan Stanley, as the development of AI infrastructure accelerates, electricity demand from U.S. data centers is rising significantly. By 2028, there is expected to be a power shortfall of up to 44 gigawatts, equivalent to the output of 44 nuclear power plants. Nuclear energy stocks have garnered substantial attention this year, $Centrus Energy (LEU.US)$ 、 $Oklo Inc (OKLO.US)$ soaring over 280% year-to-date, $Energy Fuels (UUUU.US)$ with cumulative gains nearing 200%, $GE Vernova (GEV.US)$ Surging over 100%.

In May this year, President Trump signed a series of executive orders related to nuclear energy, including comprehensive reforms of the U.S. Nuclear Regulatory Commission and modifications to regulatory processes to expedite testing of nuclear reactors. The aim is to triple current nuclear power generation within the next 25 years. Meanwhile, tech giants such as Alphabet, Amazon, Meta, and Microsoft are investing billions of dollars to restart old nuclear plants, upgrade existing facilities, and deploy new reactor technologies to meet the electricity demands of AI data centers.

Following the formal signing by the Trump administration of an executive order aimed at establishing dominance in space, along with the finalization of key appointments within regulatory bodies, the U.S. space industry—from emerging rocket companies to established defense contractors—is experiencing an unprecedented valuation reassessment. Goldman Sachs noted that the executive order lays the groundwork for expanding U.S. presence in space and developing a commercial space economy, directly benefiting launch service providers and related defense contractors.

Investor enthusiasm is directly reflected in asset prices. Driven by favorable policies, capital inflows into the space sector are accelerating. By the end of 2025, the total market value of the top 19 publicly listed space companies on U.S. exchanges reached $131 billion, compared to just $45 billion a year earlier—an increase of nearly threefold. U.S. space-related stocks $Planet Labs PBC (PL.US)$surged over 413% year-to-date, $EchoStar (SATS.US)$ while others soared over 366%. $AST SpaceMobile (ASTS.US)$ 、 $AST SpaceMobile (ASTS.US)$ The increases all exceeded 300%.

Institutional Outlook on Tech Stocks for 2026

The team of Dan Ives from Wedbush Securities, a well-known Wall Street investment bank, released the 'Top Ten Technology Predictions for 2026'.

1. As the second, third, and fourth-order derivative effects of the AI revolution gradually take shape in software, chips, and infrastructure, technology stocks will rise by more than 20% in 2026.

2、 $Tesla (TSLA.US)$ Tesla will successfully launch Robotaxi in more than 30 cities and begin mass production of Cybercab by 2026, officially ushering in what Elon Musk and his team call the 'true era of autonomous driving.' Wedbush’s base-case valuation for Tesla is $600 per share, with a bull-case scenario at $800.

3、 $Apple (AAPL.US)$ and $Alphabet-A (GOOGL.US)$ / $Alphabet-C (GOOG.US)$ Apple will announce a formal AI partnership around Gemini, which will finally establish a genuine AI strategy for Apple. This collaboration will ultimately be rolled out as a subscription service within the Apple ecosystem, propelling Apple to achieve a market capitalization of $5 trillion by 2026, with a corresponding stock price near $340.

4. In the view of Ives' team, $NEBIUS (NBIS.US)$ CoreWeave is the best AI infrastructure M&A target and will be acquired by a hyperscale cloud vendor by 2026. $Microsoft (MSFT.US)$ Microsoft, Alphabet (Google's parent company), and Amazon are the most likely buyers.

5. The cybersecurity sector will become one of the best-performing sub-sectors in the technology space (amidst M&A activity), with companies like CrowdStrike and Palo Alto Networks leading the way. $CrowdStrike (CRWD.US)$ and $Palo Alto Networks (PANW.US)$ It is their most favored cybersecurity investment target.

6. Despite current market skepticism about $Oracle (ORCL.US)$ Sentiment leans negative, but expectations are that the company will successfully achieve its data center construction goals, begin converting its substantial RPO (Remaining Performance Obligation) backlog, and see its stock price reach $250 by 2026.

7. The Trump administration will make an equity investment in a quantum computing company.$IonQ Inc (IONQ.US)$ and $Rigetti Computing (RGTI.US)$is the most likely candidate.

As more enterprises accelerate their AI strategy through Azure and Microsoft, Microsoft will enter its optimal growth phase by 2026. Microsoft is expected to be the best-performing cloud software company in 2026.

9. “AI Godfather” Jensen Huang and his leadership at $NVIDIA (NVDA.US)$ will continue to maintain its dominant position in AI chips globally. Wall Street remains significantly underestimating NVIDIA’s demand drivers for 2026, with Wedbush's bull case target price set at $275.

10、 $Palantir (PLTR.US)$ is expected to expand its success in commercial AI through AIP (Artificial Intelligence Platform products) by 2026, becoming one of the core software leaders in the AI revolution, advancing toward a $1 trillion market capitalization within the next two to three years. (Note: The company’s latest market cap exceeds $460 billion.)

However, as 2026 approaches, an increasing number of industry insiders seem to be embracing a theme: the tech giants that have propped up the bull market in recent years may no longer dominate the market next year…

Several Wall Street giants, including Goldman Sachs, Bank of America, and Morgan Stanley, recently stated in their annual reviews and outlooks that growing market skepticism about high valuations of popular AI technology stocks and whether massive AI investments will yield substantial returns is driving attention toward traditional cyclical sectors such as industrials and energy, as well as small- and mid-cap stocks, rather than highly valued companies like NVIDIA and Amazon, which sit at the epicenter of the 'AI bubble.'

Wall Street’s top strategists believe the 'great rotation' away from popular AI technology stocks will extend into 2026. Leading Wall Street institutions predict this major shift across styles such as old-school value stocks, small- and mid-caps, cyclical stocks, and sectors beyond technology, suggesting that non-AI tech stocks could outperform these tech giants in terms of full-year investment returns.

Goldman Sachs stated that the global equity market has already exhibited a clear trend of broadening sector gains and rotation in 2025, a trend that will continue to strengthen in 2026, breaking the previous market concentration in AI technology stocks. Consequently, non-U.S. and non-tech sectors will continue to perform strongly under this rotational dynamic in 2026. Strategists at Morgan Stanley emphasized that, under the investment theme of a 'soft landing of the U.S. economy + rolling recovery' in 2026, cyclical stocks (particularly in heavy cyclical industries such as industrials, financials, consumer discretionary, and healthcare) are expected to benefit comprehensively, outperforming their average benchmark performance over the past two to three years significantly.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/jayden