As 2025 draws to a close, the divergence within the U.S. crypto sector is striking.$Bitcoin (BTC.CC)$Contrary to the expectations of aggressive bulls, prices did not continue to hit new highs but instead became more stable amid institutional adoption.

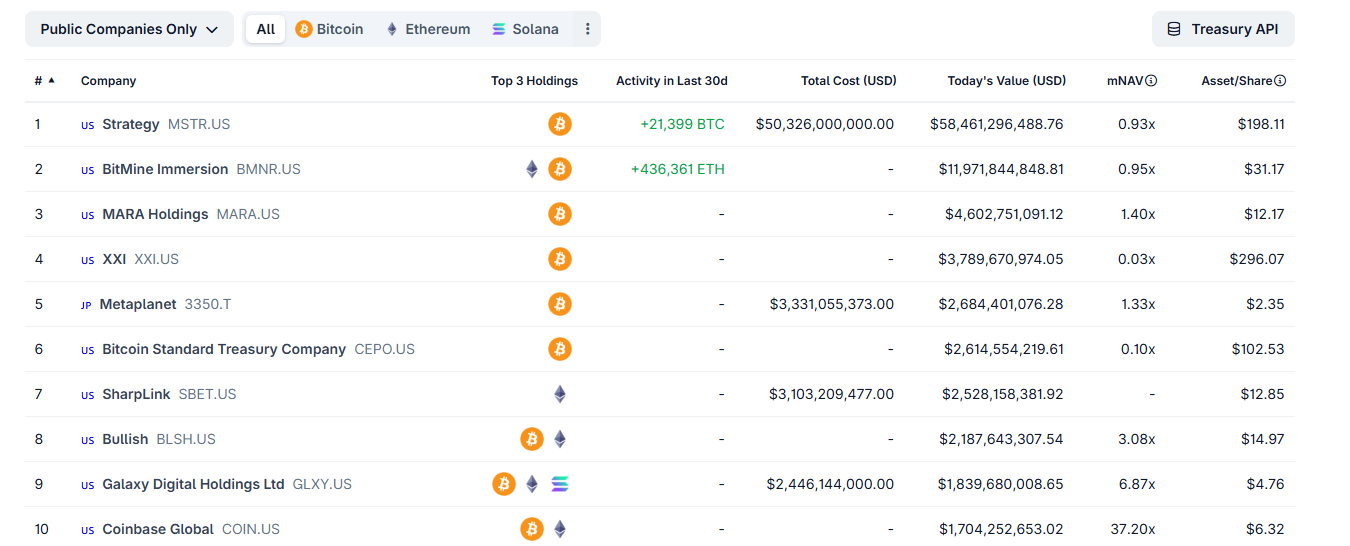

The失效 of the crypto "beta" effect has dimmed the prospects for Strategy-led Bitcoin reserve companies like MSTR. At the start of the year,$Ethereum (ETH.CC)$spot ETF liquidity surged, and the cross-border implementation of stablecoins gained traction. Ethereum, recognized as "digital oil," attracted inflation-hedging demand and became an asset reserve for over 50 mid-sized and small tech companies, with Bitmine Immersion Technologies (BMNR) emerging as the leader in Ethereum reserve strategies.

Meanwhile, $Figure Technology Solutions(FIGR.US)$ 、$Circle(CRCL.US)$、 $Bullish(BLSH.US)$ major crypto unicorns集中上市, surging on their first trading day and setting the stage for a vibrant year of U.S.-listed crypto IPOs in 2025.

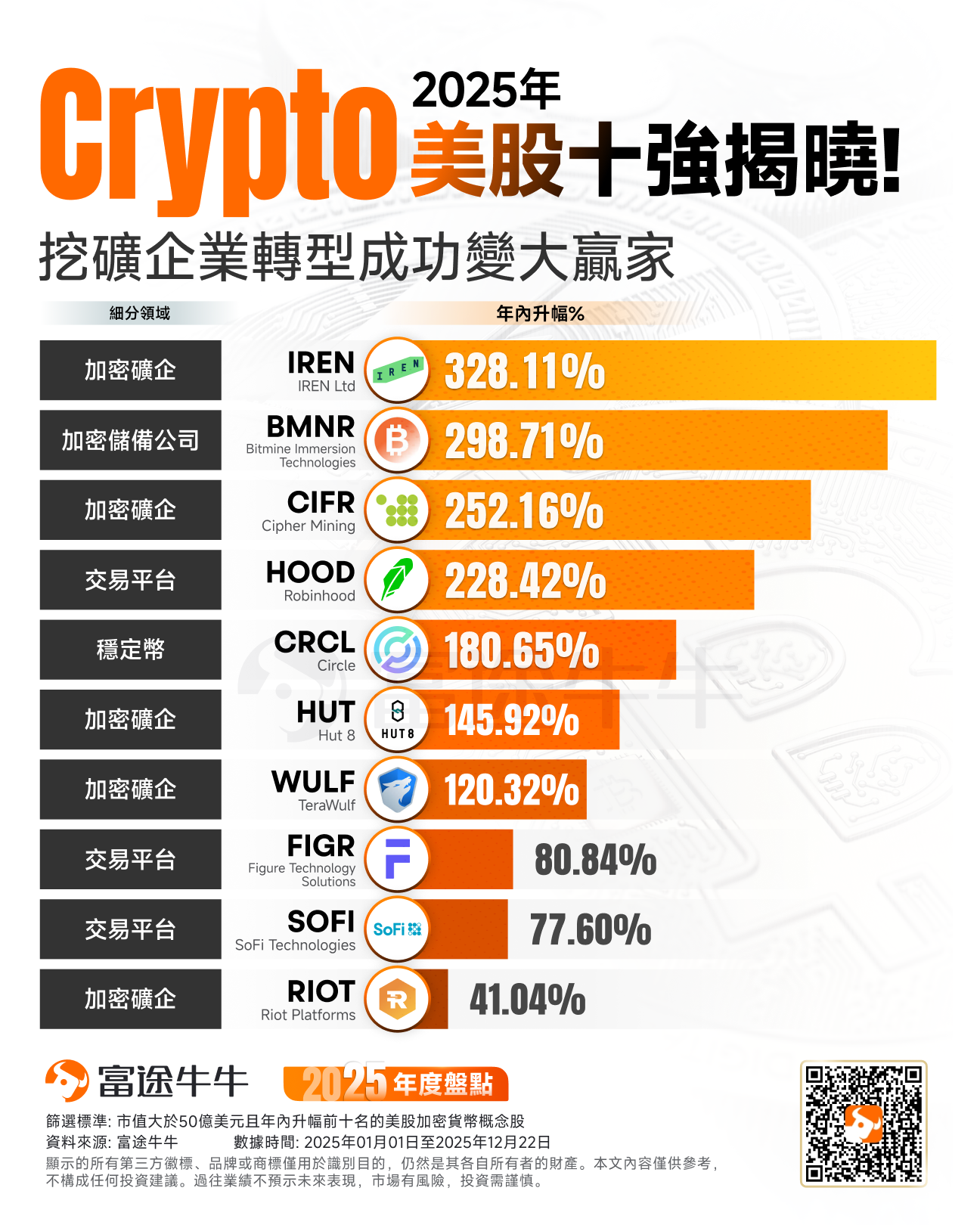

Surprisingly, after losing the crypto "beta" gains, mining firms that pivoted to data center operations outperformed most other crypto assets, even surpassing$NVIDIA (NVDA.US)$。

Surprisingly, after losing the crypto "beta" gains, mining firms that pivoted to data center operations outperformed most other crypto assets, even surpassing$NVIDIA (NVDA.US)$。

Looking back at 2025, the US stock market$加密货币概念股(LIST20010.US)$What stories have emerged?

I. The Discount of Faith: The Prolonged Decline of BTC Reserve Company MSTR

For MSTR in 2025, $Strategy(MSTR.US)$ has been an extremely challenging year for shareholders. Despite Bitcoin reaching new highs twice, MSTR's stock price continued to decline in the second half of the year. The core reason for MSTR's decline lies in the significant contraction of its NAV premium; by 2025, when Bitcoin spot ETFs become widespread, paying a high premium to hold MSTR will have lost its appeal. Additionally, its debt-financed Bitcoin purchase leverage model imposes heavy interest burdens during periods of stagnant cryptocurrency prices, suppressing valuations.

In contrast to MSTR's quagmire,$Bitmine Immersion Technologies(BMNR.US)$ emerged as the biggest dark horse among US crypto-related stocks in 2025, with its sharp rise within the year primarily driven by a strategic transformation mid-year. Following the joining of Tom Lee, founder of Fundstrat, to the board of directors, the company fully pivoted to an ETH reserve strategy, aggressively targeting the acquisition of 5% of Ethereum's global circulating supply, precisely capturing the explosive growth红利 of the Ethereum ecosystem. This upgrade to MSTR's 'reserve asset' narrative brought about a significant valuation boost.

As of this writing, BMNR's holdings of Ethereum have exceeded 4 million tokens, with an asset valuation surpassing $11 billion. The key to BMNR's outperformance lies in its multidimensional model: generating stable on-chain yields through staking (with plans to launch the MAVAN network in 2026), which supports the stock price during volatile periods. In November, it became the first large-cap crypto reserve company to initiate dividends (at $0.01 per share). However, Ethereum’s lackluster performance in the second half of the year, coupled with the disappearance of the 'crypto beta effect,' also led to a sluggish performance in BMNR's stock price.

II. The Migration of Computational Power: Mining Companies Transform into Data Centers, 'Forced' to Outperform

The biggest surprise in the US crypto sector in 2025 comes from those Bitcoin mining companies once regarded as 'laborers.' Since the beginning of this year,$IREN Ltd(IREN.US)$、$Cipher Mining(CIFR.US)$and$TeraWulf(WULF.US)$their stock price increases have outperformed the vast majority of crypto assets, even surpassing NVIDIA.

Bitcoin mining itself is not highly profitable. After the 2025 Bitcoin halving, the 'hash price' fell to a historical low, making pure mining operations almost unprofitable. IREN, CIFR, and WULF outperformed the market primarily due to these three companies decisively transforming their power infrastructure and cooling systems originally used for mining to serve AI and high-performance computing (HPC).

$IREN Ltd(IREN.US)$ In 2025, delivered impressive results, successfully signing$Microsoft(MSFT.US)$a five-year GPU cloud service contract worth $9.7 billion. To support this contract, IREN also established close supply chain cooperation with $Dell Technologies (DELL.US)$ and $NVIDIA (NVDA.US)$ .

$Cipher Mining(CIFR.US)$ and $TeraWulf(WULF.US)$ 's performance was equally strong after joining Google's blockchain. The former signed a 10-year AI hosting agreement with AI computing platform Fluidstack, valued at an estimated $830 million and secured by Google’s $173 million credit guarantee to significantly reduce default risk. The latter completed its deep transformation and signed a 25-year long-term lease agreement, valued at $9.5 billion. $Google-C (GOOG.US)$Not only providing a $1.3 billion debt credit endorsement, but also acquiring approximately 8% equity.

In contrast$MARA Holdings(MARA.US)$The once-leading mining company performed poorly in 2025. MARA did not transform and was mainly constrained by its historical burdens. The company adopted a light asset and management-focused model, and its self-built mining facilities were designed specifically for ASIC miners, which could not meet the stringent requirements for stability and heat dissipation of AI servers. The strategic hesitation of MARA's management left the company stranded on the beach during the great migration of computing power. MARA's stock price languished, vividly illustrating how path dependence often leads companies to miss opportunities during technological iteration cycles.

Three, the victory of traffic: Robinhood and SoFi defeat Coinbase

In the field of trading platforms, the winners of 2025 belong to$Robinhood(HOOD.US)$ and $SoFi Technologies(SOFI.US)$These two are from financial technology players, rather than the most "pure" exchanges.$Coinbase(COIN.US)$and "geeks"$Block(XYZ.US)$ 。

$Coinbase(COIN.US)$In 2025, it faces an extremely awkward situation: a game of existing stocks. Although Coinbase remains a benchmark for compliance, the activity level of pure cryptocurrency trading users has significantly declined in a year lacking new asset issuances. Coinbase's high trading fees led to user loss in 2025, as institutional clients increasingly bypassed exchanges through over-the-counter (OTC) trading or ETFs, resulting in the core revenue pillar of Coinbase being hollowed out.

The outperformance of Robinhood and SoFi Technologies can be attributed to the logic of an "ecosystem loop." By 2025, individual investors prefer to complete all operations within a single app: buying U.S. stocks, maintaining high-interest savings, and regularly investing in Bitcoin. Robinhood's launch of the "universal asset account" in 2025 allows users to trade cryptocurrencies using their stock holdings as collateral, which is irresistibly appealing to retail investors due to the enhanced capital efficiency.

SoFi Technologies leverages its banking license advantage by integrating cryptocurrency trading into everyday financial management scenarios. While waiting for opportunities in the crypto market, SoFi users can earn substantial interest on their idle funds, whereas Coinbase users' funds remain unproductive.

The rise in share prices of Robinhood and SoFi Technologies reflects the market's recognition of the "financial super-app" model. Block (block.xyz) appeared lost in 2025 as Jack Dorsey remained overly focused on building a Bitcoin-centric ecosystem (e.g., the TBD project), neglecting the broader applicability of Cash App as a payment tool. This led Block to lose market share in both payments and cryptocurrency sectors.

IV. The Roller Coaster of Stablecoins: Circle’s Decline After Its Moment of Glory

$Circle(CRCL.US)$ Going public in 2025 marked a high point in crypto history, with its stock price surging 180% in the first two months post-IPO, driven by a significant increase in USDC’s market share during that year.

The final implementation of the EU’s MiCA regulation and the U.S. stablecoin regulatory framework prompted institutional funds to migrate en masse from USDT to the more compliant USDC. Circle is not only a stablecoin issuer but also regarded by Wall Street as a "digital central bank with internet speed."

After peaking, Circle’s stock price began a six-month decline, primarily triggered by the Federal Reserve.

Circle’s business model is highly singular, relying heavily on interest income—users deposit dollars in exchange for $USDCoin(USDC.CC)$ , and Circle invests the dollar reserves in short-term U.S. Treasuries to earn interest. In the second half of 2025, the Federal Reserve initiated a series of rate cuts, causing Treasury yields to fall and further narrowing Circle’s profit outlook.

The issuance scale of USDC continues to grow, yet the profit generated per unit of USD is shrinking. The market has realized that Circle is essentially a "money market fund" constrained by macro interest rates. With the retreat of interest rate dividends, Circle must seek new growth points, such as payment processing fees or on-chain service fees. However, the growth rates of these new businesses are far from sufficient to offset the decline in interest income. The pullback in Circle’s stock price reflects the market’s adjustment of its valuation model from a "high-growth tech stock" to a "cyclical financial stock."

Conclusion and Outlook

Looking back at 2025, Bitcoin holders may feel a sense of disappointment as the annual return underperformed $Nasdaq Composite Index (.IXIC.US)$ , lagging far behind gold. From another perspective, $Bitcoin (BTC.CC)$ the annualized volatility dropped to its historical low. This 'boredom' is precisely a sign of asset maturation.

Looking ahead to 2026, the logic behind the U.S. crypto sector will continue to evolve:

$加密储备概念(LIST23920.US)$ Companies will face critical survival tests. If cryptocurrencies like Bitcoin fail to experience an unexpected surge in 2026, single-asset reserve models like Strategy's will become unsustainable. The market may compel these companies to transition into actively managed crypto asset funds or reward shareholders through dividends.

Crypto trading platforms will accelerate their evolution into comprehensive financial service providers, with diversified business becoming the key to breaking through. Leading exchanges will further align with the compliance systems of traditional brokerages by acquiring additional derivative licenses to expand their business scope. The era of relying solely on spot trading fees is over, and finding new growth areas within the compliance framework will become an industry consensus. Both Coinbase and Robinhood have coincidentally set their sights on predictive markets, an emerging high-frequency track, seeking new trading scenarios beyond traditional assets.

$Stablecoin Concept (LIST23702.US)$ The issuer’s battleground will shift from 'interest' to 'circulation.' For Circle’s stock price to return to its peak, it must demonstrate that USDC can be widely adopted as a high-frequency payment tool, rather than merely an interest-bearing asset. The year 2026 will be the true test for Web3 payments.$Visa(V.US)$and$MasterCard (MA.US)$in terms of status.

In the face of this structural shift in crypto-related stocks, investors need to shed their blind faith in crypto assets and scrutinize each balance sheet with stricter financial standards. In this new era of 'crypto+', identifying companies with strong self-sustaining business capabilities and regulatory compliance premiums will be the core strategy for the coming year.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

![]() How to choose cryptocurrency concept stocks? Open Futubull > Market >U.S. stocks/Hong Kong stocks> Investment Themes > Cryptocurrency Concept Stocks to select your desired stocks!

How to choose cryptocurrency concept stocks? Open Futubull > Market >U.S. stocks/Hong Kong stocks> Investment Themes > Cryptocurrency Concept Stocks to select your desired stocks!

Editor/Rocky