The recent rapid appreciation of the renminbi has been attributed by the market to the 'year-end foreign exchange settlement wave.' However, a report by Shenwan Hongyuan pointed out that during the fastest period of appreciation in October-November, the settlement ratio of banks did not rise but fell, and multiple market indicators showed no characteristics of a settlement wave.

The report argues that this round of appreciation was initially driven primarily by the central bank's counter-cyclical adjustment guidance, while more recently it has been synchronized with the weakening of the US dollar. Although seasonal settlement patterns may still provide support in January, risks of a rebound in the US dollar and the central bank’s intention to 'smooth' exchange rate fluctuations could impact the pace at which the renminbi breaks through the '7' level.

Since mid-October, the Renminbi has significantly appreciated against the backdrop of a slight depreciation of the US dollar. Market participants attribute this asymmetric rally to the year-end foreign exchange conversion wave, referring to the year-end concentration of corporate sales of foreign exchange earnings which bolstered the currency's strength.

However, the latest report from Shenwan Hongyuan indicates that the main driver of the recent Renminbi appreciation is not the year-end FX conversion wave as widely perceived by the market, but rather stems more from proactive adjustments by the central bank and changes in the external US dollar environment.

However, the latest report from Shenwan Hongyuan indicates that the main driver of the recent Renminbi appreciation is not the year-end FX conversion wave as widely perceived by the market, but rather stems more from proactive adjustments by the central bank and changes in the external US dollar environment.

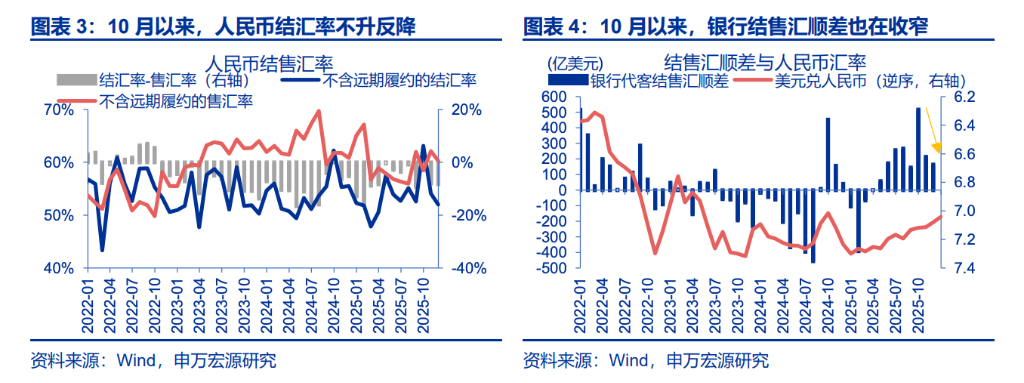

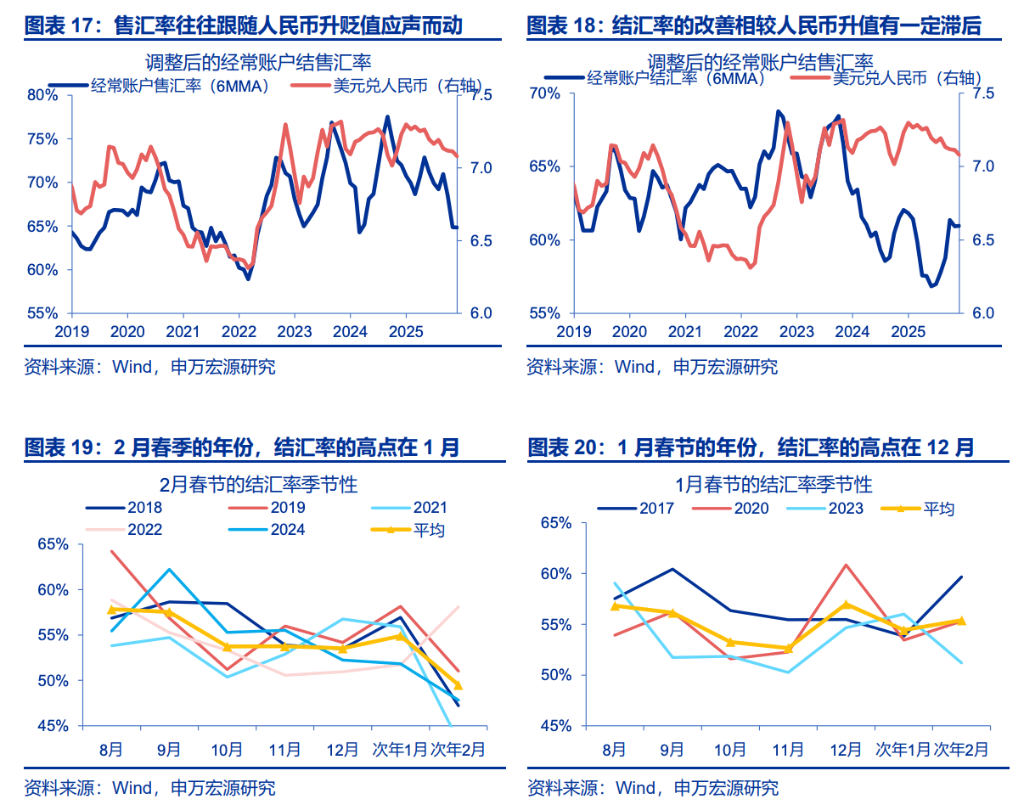

The report highlights that the core indicator reflecting corporate FX conversion willingness—the banks' agency FX settlement ratio (excluding forward settlements)—after reaching a high of 63.1% in September, fell significantly for two consecutive months in October and November, dropping to 54.1% and 52.0%, respectively. This indicates that during the phase of fastest Renminbi appreciation, actual corporate FX conversion willingness not only failed to strengthen but weakened considerably.

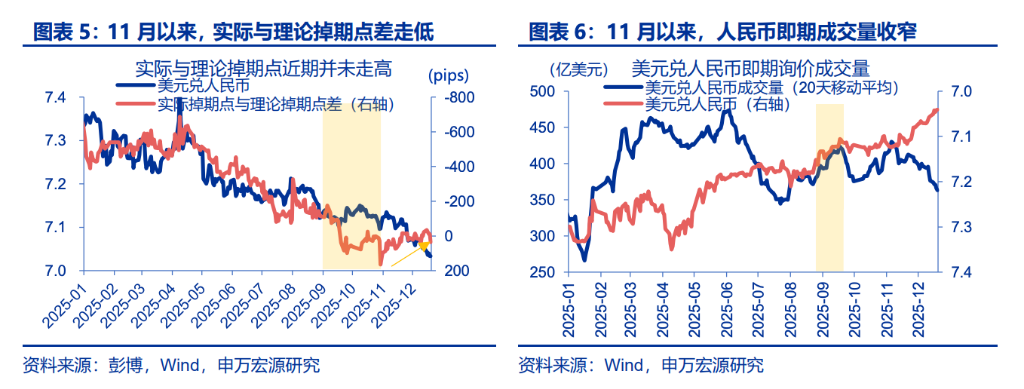

Furthermore, several high-frequency market indicators corroborate this assessment. If there were indeed a large influx of FX conversion funds, the forex market would typically exhibit characteristics such as rising swap points, widening onshore-offshore spreads, and increased spot trading volumes. However, the actual situation was quite the opposite: relevant swap spreads continued to narrow, Renminbi trading volumes contracted, and the onshore-offshore spread did not widen. These micro-signals suggest that the appreciation from late October to November was closely related to the guidance provided by the central bank’s counter-cyclical adjustment factor; whereas the trend since December has shown higher synchronicity with the weakness of the US Dollar Index itself.

Recent appreciation is not driven by FX conversion; the weakening of the US dollar may still provide support.

FX settlement ratio data disproves the 'year-end FX conversion wave.' Despite the rapid appreciation of the Renminbi, SAFE data shows that after the FX settlement ratio reached a high of 63.1% in September, it consecutively dropped to 54.1% in October and 52.0% in November, while the net settlement ratio fell from 4.6% in September to -8.3% in November. The surplus in banks’ agency FX settlement and sales also narrowed from $51.8 billion in September to $16.4 billion in November.

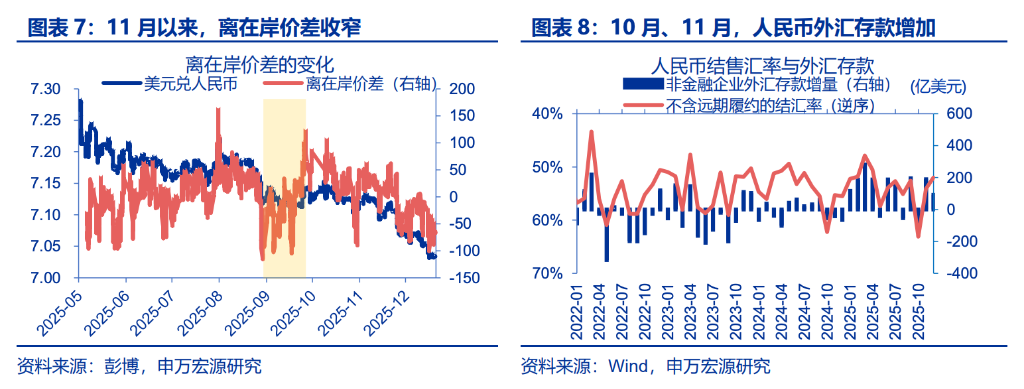

Multi-dimensional auxiliary indicators show no acceleration in FX conversion. Historical experience suggests that an FX conversion wave is usually accompanied by four major features: rising swap points, increased inquiry-based trading volumes, widening onshore-offshore spreads, and declining foreign exchange deposits. However, the actual situation since November has been quite the opposite—swap spreads dropped from 97 pips to 36 pips, Renminbi spot inquiry-based trading volumes shrank from $45.3 billion to $25.3 billion, the onshore-offshore spread narrowed, and foreign exchange deposits still increased by $9.2 billion in November.

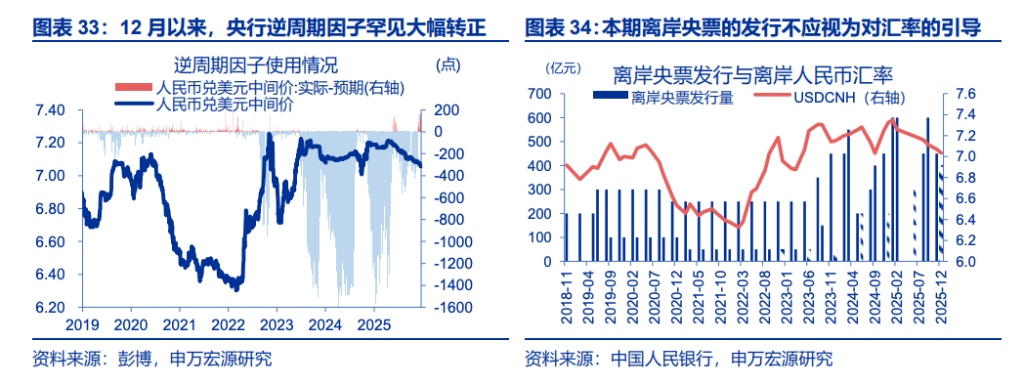

The true drivers are the central bank’s counter-cyclical adjustments and the weakening of the US dollar. An analysis of the Renminbi appreciation in phases during 2025 reveals the following: from mid-October to late November, under the 'three-price convergence' background, the central bank restarted the counter-cyclical factor, and the continuously adjusted midpoint guided the appreciation; since December, the US dollar has weakened again, and the one-month dynamic correlation between the Renminbi and the US dollar quickly rebounded to 0.95, indicating that the exchange rate movement has returned to being predominantly influenced by the US dollar.

The 'year-end FX conversion' pattern holds partially true: trade-related FX conversion increases, but improvements in the FX settlement ratio lag behind.

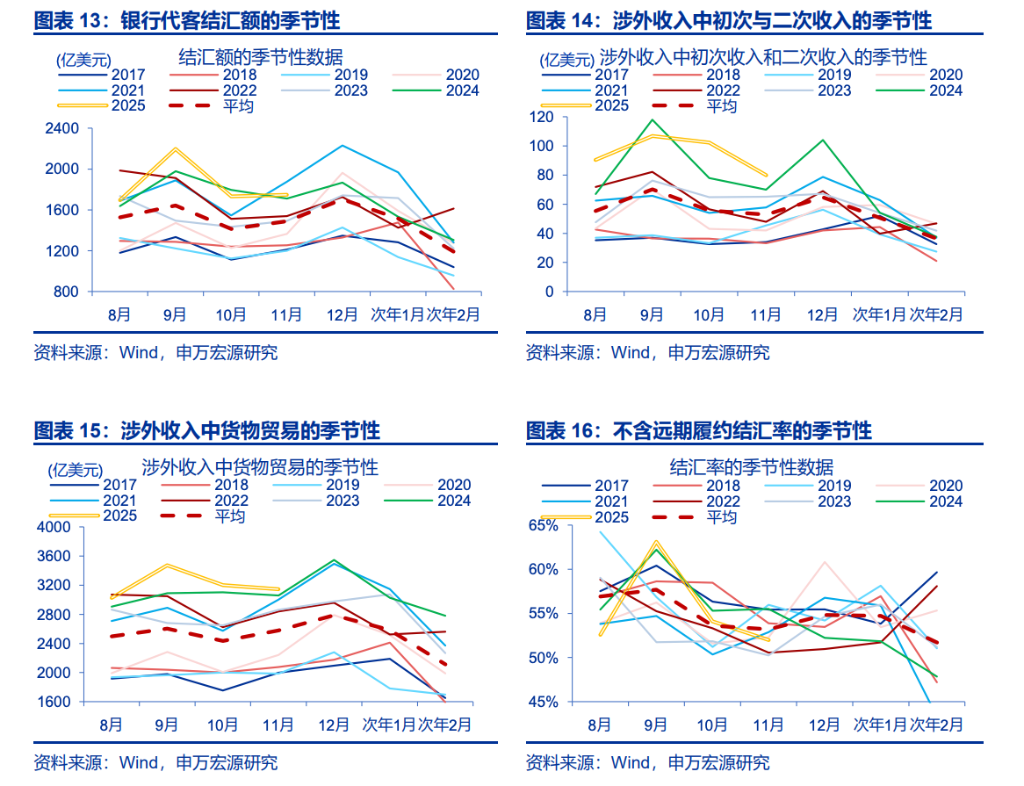

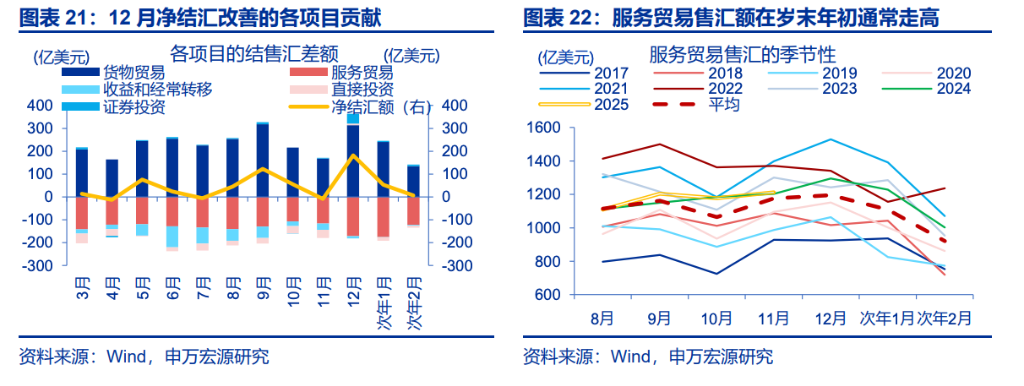

There is indeed a regular increase in trade-related FX conversion in December. Data since 2017 shows that the fourth-quarter agency FX settlement volume at banks tends to grow, with average settlement volumes for October, November, and December at $141.4 billion, $148.9 billion, and $170.4 billion, respectively. The growth in FX settlement mainly stems from three aspects: first, export receipts concentratedly arrive in the fourth quarter, with December goods trade-related foreign income averaging $279 billion, the highest for the year; second, primary and secondary income in early December significantly grows due to financial settlements and dividend demands; third, the FX settlement ratio slightly rises in December, though this characteristic is less pronounced.

The improvement in the settlement exchange rate tends to lag by 1-2 quarters. Historical data shows that whenever the renminbi strengthens, the selling exchange rate often drops immediately; however, the improvement in the settlement exchange rate usually lags by 1-2 quarters. This is because speculators react quickly, while traders can hedge exchange rate risks through hedging contracts and typically accelerate settlements only after the renminbi has been appreciating for 1-2 quarters.

The timing of the Spring Festival impacts the peak period of foreign exchange settlement. In years when the Spring Festival falls in February, significant improvements in the settlement exchange rate are postponed to January of the following year; whereas in years with a January Spring Festival, the settlement peak occurs in December. The Spring Festival in 2026 will be in February, indicating that settlement improvements may extend into January.

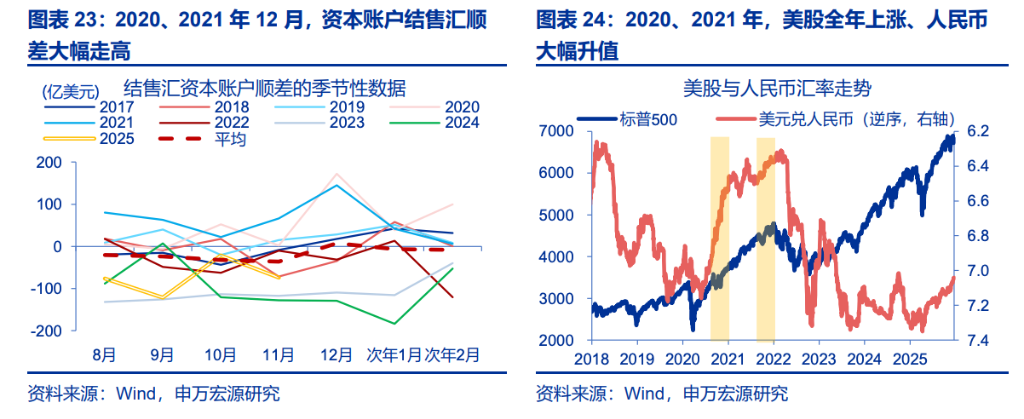

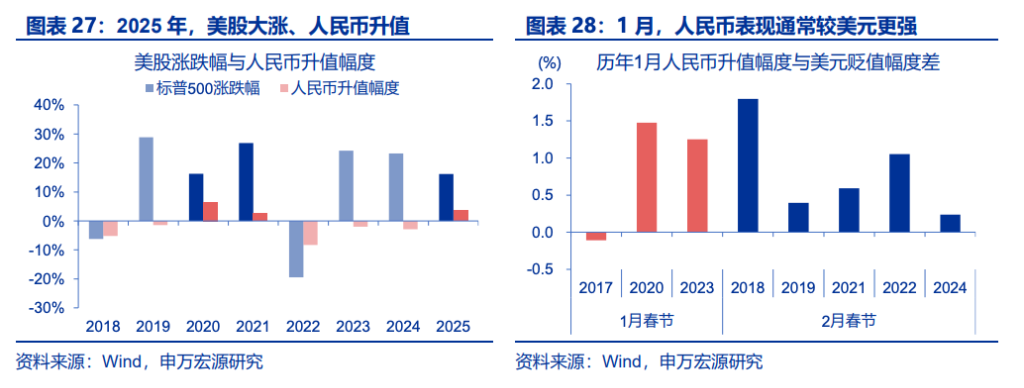

Net settlement also requires attention to foreign exchange transactions in service trade, capital accounts, and others. Service trade sales are a major drag, related to the renewal of individual foreign exchange quotas at the end of the year and beginning of the next. Although capital accounts show some year-end effects on average, this is primarily due to substantial securities investment settlements in December 2020 and 2021. The December 2020 and 2021 securities account settlements might be linked to the strong annual rise in U.S. stocks and the significant appreciation of the renminbi during those periods.

Breaking '7' has support but requires guarding against three major risks.

The 'delayed' wave of settlements may still provide some support for short-term renminbi appreciation. Historical experience indicates that after two consecutive quarters of renminbi appreciation, the settlement exchange rate tends to improve. As of 2025, the 'pending settlement demand,' estimated by subtracting net settlement from the trade surplus, is second only to the same period in 2024. Non-financial enterprises’ foreign currency deposit balances have exceeded those of February 2022, reaching a record high of USD 561.8 billion. Meanwhile, the U.S. stock market surged 16.2% in 2025, and the renminbi appreciated by 3.7%, similar to conditions in 2020 and 2021, suggesting potential improvement in securities account settlements. Historical data indicates that under the support of settlement waves, the renminbi exchange rate in January could appreciate approximately 0.8% more than changes in the U.S. Dollar Index.

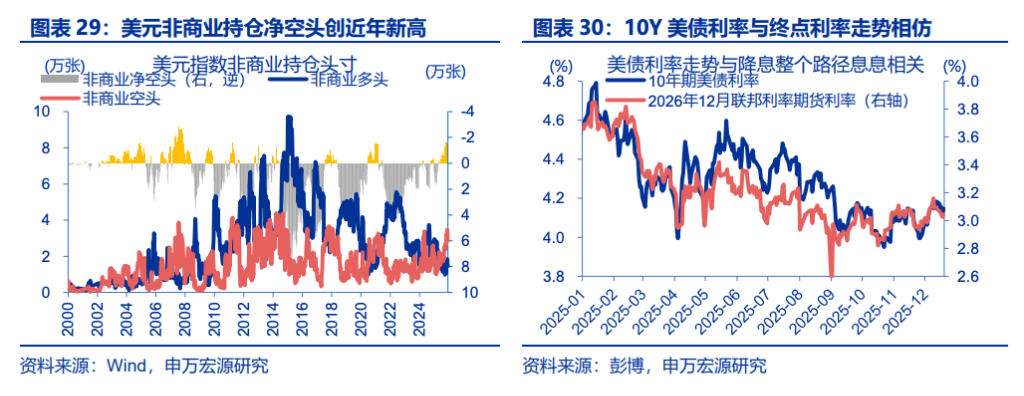

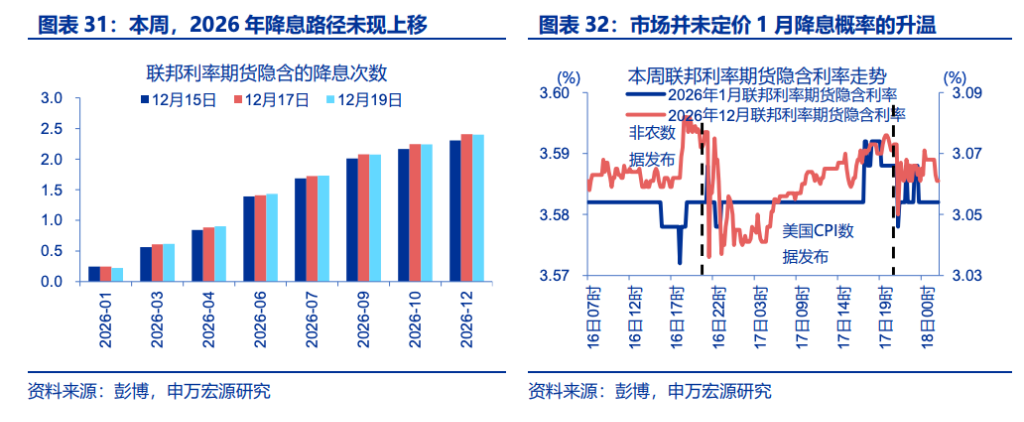

The risk of a rebound in the U.S. dollar cannot be ignored. Current non-commercial short interest in the U.S. dollar has reached a new high since 2008, posing a reversal risk due to extreme short positions. Although recent U.S. non-farm payroll figures weakened and CPI was significantly below expectations, the credibility of November labor and inflation data is low (due to government shutdowns affecting household survey response rates at just 64%, and CPI using a rare 'carryover method' interpolation), which did not increase the probability of a January interest rate cut. If the anticipated January rate cut fails to materialize, the U.S. dollar may see a minor rebound.

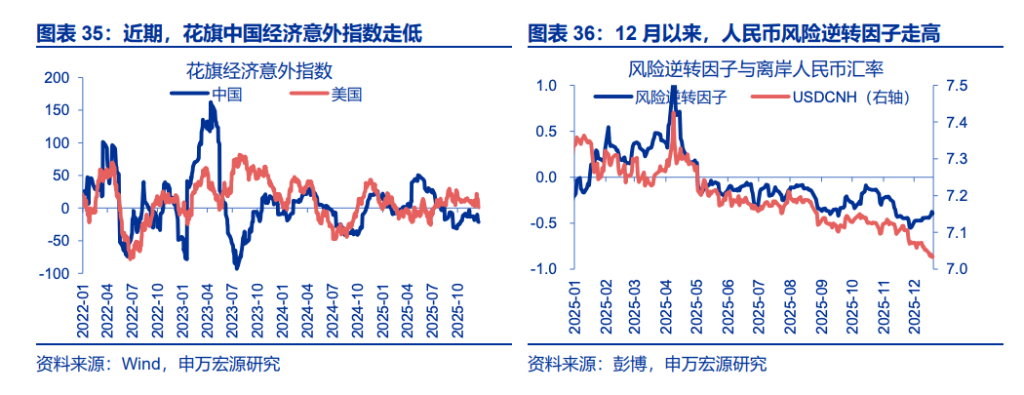

The central bank's efforts to 'smooth out' excessive exchange rate volatility will also influence the pace of rapid renminbi appreciation. Since the end of November 2025, amid rapid renminbi appreciation, the central bank swiftly exited its countercyclical factor, with the midpoint fixings even significantly weaker than offshore and onshore rates. As of December 19, the actual midpoint for USD/CNY was 172 points higher than the theoretical midpoint, marking the largest deviation since 2022, signaling that the central bank does not intend to guide an overly rapid renminbi appreciation. Additionally, factors such as the decline in Citi's China Economic Surprise Index, lower-than-expected January economic performance, and rising renminbi risk reversal factors should also be monitored.

Editor/melody