Top News

At 9:30 a.m. EST on Wednesday, the U.S. initial jobless claims for the week ending December 20 were released:

The number of initial jobless claims in the US for the week ending December 20 was 214,000, compared to an expected 224,000 and a previous value of 224,000.

Following the release of the initial jobless claims data, spot gold and the U.S. Dollar Index (DXY) showed little movement in the short term, while U.S. stock index futures remained stable.

$明星科技股(LIST2518.US)$ There were mixed movements before the market opened, $Intel (INTC.US)$ Dropped more than 2%.

$明星科技股(LIST2518.US)$ There were mixed movements before the market opened, $Intel (INTC.US)$ Dropped more than 2%.

$热门中概股(LIST2517.US)$ There were mixed movements before the market opened, $KE Holdings (BEKE.US)$ Rose more than 2%.

$Biotechnology(LIST2069.US)$ Sector leads pre-market gains. $Indaptus Therapeutics(INDP.US)$ Surged over 58%, $Repare Therapeutics(RPTX.US)$ Rose over 21%, $Agios Pharmaceuticals(AGIO.US)$ 、 $Citius Pharmaceuticals(CTXR.US)$ Surging over 11%, $Omeros Corporation (OMER.US)$ Surging over 16%.

$太空概念(LIST2556.US)$ Gains were widespread in pre-market trading. $Sidus Space(SIDU.US)$ Surged more than 15%, $Redwire(RDW.US)$ 、$AST SpaceMobile(ASTS.US)$rose nearly 3%.

Intel shares plunged over 5% in pre-market trading after reports emerged that NVIDIA had suspended testing of its 18A process technology.

$Intel (INTC.US)$ Shares dropped nearly 3% in pre-market trading. According to media reports citing insiders, NVIDIA has suspended testing of Intel's 18A process technology. Some experts suggested that Lip-Bu Tan’s recent meeting with Trump at the White House was a 'lifeline' for Intel. However, sources close to Intel questioned whether Lip-Bu Tan possesses the technical expertise necessary to drive manufacturing success. A U.S. Department of Commerce official stated that the U.S. government has given Intel a chance to succeed, but it is not 'too strategically important to fail.'

Senior technology analyst: NVIDIA is really undervalued.

Bernstein’s research report pointed out, $NVIDIA (NVDA.US)$ The valuation has fallen to a historical low, with forward P/E dropping below 25x, representing a rare discount relative to the semiconductor industry. Despite the recent stock stagnation, earnings estimates have continued to rise, and new architectures such as Blackwell are on the horizon. Analysts consider this an excellent buying opportunity, with a price target of $275.

Sales Continue to Decline, Stock Price Hits New High: Why is Tesla Being 'Forgiven' by the Market?

Despite $Tesla (TSLA.US)$ Electric vehicle sales are expected to fall short of expectations again, yet its share price remains near historical highs due to investors and analysts focusing on future AI-driven growth.

According to FactSet consensus estimates, Tesla is expected to report Q4 vehicle deliveries of 449,000 units, bringing full-year EV deliveries to approximately 1.6 million. This suggests Tesla is heading toward a second consecutive year of declining sales. In a recent note to investors, Deutsche Bank analysts wrote: “However, perhaps more importantly, the narrative around the robotaxi remains strong.” Tesla plans to roll out a fully autonomous ride-hailing network across the U.S. The company is also developing a custom robotaxi model, expected to enter production next year.

In addition to robotaxis, Tesla is also developing humanoid robots and custom artificial intelligence chips to power its technology and data centers. Both the robots and chips are expected to enter production in 2026.

JPMorgan: The delivery cycle for the iPhone 17 has significantly shortened, indicating a notable cooling in demand.

JPMorgan analysts noted, $Apple(AAPL.US)$ Lead times for the iPhone 17 series have begun to shorten, indicating cooling demand for the new iPhone; demand for all versions of the iPhone 17 series has slowed, with particularly notable declines in lead times for base models, which have shortened by six days compared to a week ago.

What exactly is the key to Google's successful turnaround in the ever-changing landscape of the U.S. AI industry this year?

$Google-C (GOOG.US)$Achieving a significant leap in artificial intelligence by 2025, it was still considered by Wall Street to be lagging behind OpenAI at the beginning of the year, but now it has forced OpenAI to sound the "red alert"; Google's success can be summarized in three aspects: a solid technological foundation, a mature ecosystem, and the correct choices made by the decision-makers, which may also provide a development direction for other artificial intelligence companies.

Meta is facing antitrust pressure in Italy, and WhatsApp's terms may be restricted.

On Wednesday, the Italian antitrust authority (AGCM) ordered$Meta Platforms(META.US)$The suspension of certain contractual clauses may exclude competitors' AI chatbots from WhatsApp. Currently, the agency is investigating the alleged abuse of market dominance by this American tech giant.

A spokesperson for Meta stated that this decision "has fundamental flaws" and indicated that the emergence of AI chatbots "has put pressure on our systems that they were not designed to handle from the beginning." The spokesperson added, "We will appeal."

Traditional Energy Giant's 'Breakaway': BP PLC Sells 65% Stake in Century-Old Brand Castrol for $6 Billion

European traditional energy giant $BP PLC (BP.US)$It has agreed to sell a majority stake in its Castrol lubricants division to the well-known American investment firm Stonepeak Partners, with the sale expected to raise approximately $6 billion.

Castrol, a lubricants business under BP, is a century-old lubricant brand of the British Empire, holding an important position in automotive and industrial applications, as well as in the global energy industry's value chain. BP's divestment of a significant portion of its stake in Castrol signifies that this energy giant is essentially abandoning its century-old lubricants business in hopes of raising substantial cash to reduce debt and turn around years of poor performance.

Sanofi invested $2.2 billion to acquire Denali Therapeutics, expanding its vaccine business footprint, with the latter's stock surging over 38% in pre-market trading.

$Sanofi(SNY.US)$Agreed to acquire for approximately $2.2 billion.$德纳维制药(DVAX.US)$The aim is to expand its current vaccine product line, which is centered around the influenza vaccine business. According to a statement released by Sanofi on Wednesday, it will acquire Denali Therapeutics, headquartered in Emeryville, California, for a cash price of $15.50 per share. This offer represents a 39% premium over Denali Therapeutics' closing price on Tuesday.

Through this acquisition, the French pharmaceutical giant will gain access to an already marketed hepatitis B vaccine in the United States, as well as an experimental shingles vaccine currently in early-stage human trials. Sanofi stated that this move will strengthen its market positioning in the adult vaccination field. Currently, Sanofi's vaccine portfolio covers multiple indications, including influenza, respiratory syncytial virus, meningitis, and pertussis.

On Monday, it surged by 371%, then plummeted by 59% on Tuesday! On Wednesday, it rose over 12% in pre-market trading. This "space concept" new stock has attracted all attention, operating the world's only commercial supersonic fleet.

Newly listed space concept stock $Starfighters Space(FJET.US)$ has experienced significant stock price volatility recently, surging 371% on Monday before plummeting nearly 60% on Tuesday. Market analysis suggests that the low float and speculative business prospects are the primary reasons for the extreme fluctuations in the stock price. The company operates the world's only commercial supersonic fleet and, despite raising $40 million through its IPO, financial data shows it has had no operating revenue in the past three years.

Honda Motor to Acquire LG's US Battery Assets for $2.9 Billion

$Honda Motor (HMC.US)$ will acquire LG Energy Solution’s facilities and other assets at a joint venture battery plant located in Ohio, USA, for approximately 4.2 trillion Korean won (about $2.9 billion). This move comes amid a slowdown in the US electric vehicle market, which continues to impact the global EV supply chain. In regulatory filings submitted on Wednesday, LG stated that the transaction is expected to be completed by the end of February. This step is aimed at improving operational efficiency. To offset recent setbacks, LG Energy Solution is accelerating its expansion into energy storage systems and continuing the construction of two additional battery production lines in Arizona and Michigan.

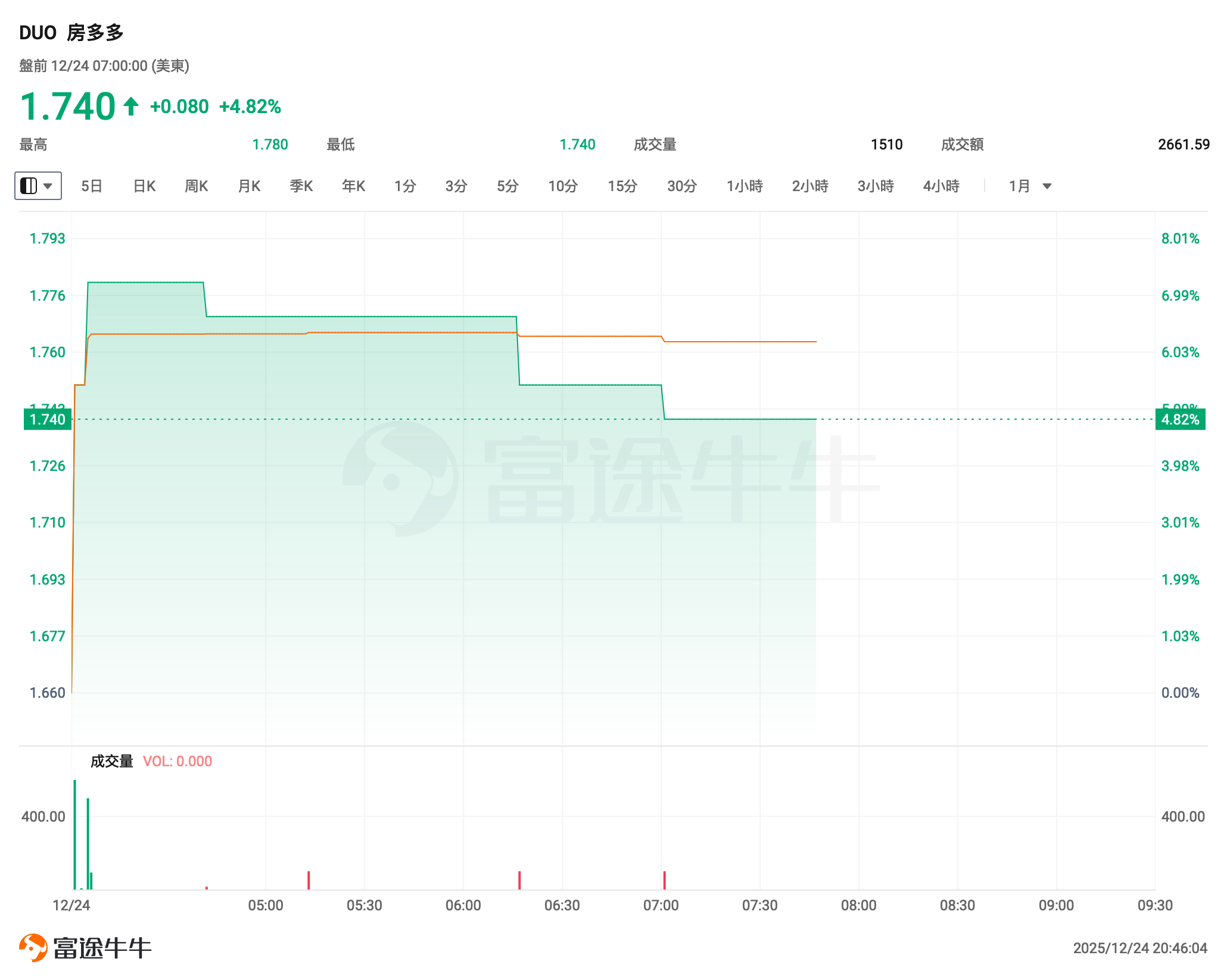

Fangdd Network pre-market rose nearly 5%, as Beijing adjusts housing purchase restrictions.

Beijing adjusts housing purchase restrictions; real estate operator $Fangdd Network(DUO.US)$ 、 $KE Holdings (BEKE.US)$ saw pre-market gains of 4.8% and 1.7%, respectively. According to an announcement, four departments—the Beijing Municipal Commission of Housing and Urban-Rural Development, the Beijing Development and Reform Commission, the People's Bank of China's Beijing branch, and the Beijing Housing Provident Fund Management Center—jointly issued the 'Notice on Further Optimizing and Adjusting Real Estate Policies in Beijing,' effective December 24, 2025. The policy relaxes home purchase conditions for non-Beijing residents, supports multi-child families' housing needs, and allows eligible Beijing-based multi-child families to buy up to three properties within the Fifth Ring Road. Additionally, the minimum down payment ratio was reduced from no less than 30% to no less than 25%.

Zai Lab pre-market rose over 4%, while its H-share surged over 6%, following the approval and launch of a major new drug in China.

Zai Lab (09688.HK) The Hong Kong-listed shares closed more than 6% higher today, driving $Zai Lab (ZLAB.US)$U.S. stocks rose more than 4% in pre-market trading. On the news front, Zai Lab recently announced that China's National Medical Products Administration has approved the new drug application for Tonomilin Tris Chloride Capsules (Kaijie Le) for the treatment of adult schizophrenia. This is the first schizophrenia therapy with a completely new mechanism of action to be approved in over 70 years, marking a fundamental breakthrough in schizophrenia treatment.

Nike shares rose more than 2% in pre-market trading after Apple CEO Tim Cook 'bought the dip' by purchasing 50,000 shares.

Nike (NKE.US) Shares rose more than 2% in pre-market trading. Filings show that after Nike plummeted over 10% last Friday due to weaker-than-expected earnings reports, Cook purchased 50,000 shares of Nike stock at an average price of $58.97 per share on Monday, with a total transaction value nearing $3 million.

In addition, Bank of America Securities recently published a research report reiterating its 'Buy' rating on Nike. It highlighted that the second-quarter results showed positive performance in the North American market and the running category. While there is disappointment about the longer-than-expected time required for Nike’s business transformation in China, improvements are already evident in other markets.

Space concept stocks$Sidus Space(SIDU.US)$Shares surged more than 14% in pre-market trading after the company announced an equity financing initiative to support growth.

$UiPath(PATH.US)$Shares climbed nearly 8% in pre-market trading. On the news front, UiPath was included as a component of the S&P MidCap 400 Index, effective before the market opens on January 6.

U.S. macroeconomics

After four consecutive gains, the U.S. stock market is set to enter a quiet Christmas Eve; will the 'Santa Claus Rally' kick off tonight?

Every Christmas, investors pray for the same thing: they hope that Santa Claus will bring them a rise in the stock market, which is known in the investment world as the "Santa Claus Rally."

The "Santa Claus Rally" refers to the period covering five trading days at the end of each year and the start of the new year, indicating a high likelihood of a rise in the U.S. stock market during these days. This year’s "Santa Claus Rally" time window begins tonight, December 24.

Numerous investment professionals on Wall Street stated that they anticipate continued U.S. stock market gains during the Christmas holiday period, ensuring a smooth end to this year and a strong start to 2026.

U.S. Treasury Secretary Reveals! The "Ultimate Criterion" for the Next Fed Chair: Reducing Powers, Cutting Jobs, Ending Perpetual QE

U.S. Treasury Secretary Besant confirmed that the government is actively interviewing candidates for the next chair of the Federal Reserve. The Federal Reserve chair sought by the government must be committed to reducing the scope of the Federal Reserve's functions and ending the era of "permanent quantitative easing" (QE).

In his annual economic review on the 'All-In' podcast, Bessent stated that the monetary policy of the past 15 years would undergo a drastic shift. He argued that the Fed's 'functional expansion' experiment—particularly the large-scale asset purchase program initiated in 2008—must be rolled back to restore economic fairness.

Bessent mentioned that the Federal Reserve engaged in 'modern monetary practices,' namely the monetization of government debt. He emphasized that the next chair must view quantitative easing solely as an emergency tool rather than a standard operating procedure. Beyond monetary policy, Bessent also called for structural downsizing of the Federal Reserve. He criticized the institution for lacking budgetary oversight, pointing out that the Fed is 'printing its own money' and lacks the fiscal discipline required of other government agencies. He stressed that the Fed should remain behind the scenes, instead of allowing the market to 'react nervously to every word the chair utters.'

Bessent: The structure of economic growth has undergone a substantive transformation, and the private economy is 'thriving'!

U.S. Treasury Secretary Bessent stated that the U.S. private sector economy is accelerating significantly under Trump’s leadership. He noted that real economic output, excluding government activities, has achieved robust expansion. On Tuesday, Bessent posted on social platform X that the 'private sector economy is thriving' under Trump, highlighting that GDP growth, excluding government activities, 'rose at an annualized rate of 4.7% over the past two quarters.'

Bessent described this as 'a stark contrast to what happened during the Biden era.' He explained that growth during the Biden period was primarily driven by the expansion of government spending, which ultimately 'fueled historic inflation and reduced living standards.' The Treasury Secretary stated that the latest data reflects a substantive shift in the structure of economic growth, with momentum from the private sector now playing a leading role. According to Bessent, the 'current wave of Trump-led growth' signals potential improvements in labor market conditions in the coming months, which will inevitably bring high-paying jobs.

The US GDP data conceals potential risks, and Moody's has issued a warning: it is highly likely to be revised downward!

Although the GDP data for the United States in the third quarter showed explosive growth, this has not changed the view of Mark Zandi, chief economist at Moody's Analytics, on the current state of the economy. The third-quarter report indicates that, driven by strong consumer spending and federal government expenditure, the U.S. economy is expected to achieve a growth rate of 4.3% in that quarter.

However, Zandi stated that he remains cautious about the deeper conditions of economic operation. Zandi had previously predicted the actual GDP growth rate to be 3.8%, higher than the 3.3% estimated by most economists. Therefore, he is not surprised by this figure, but he also speculates that this significant outperformance is more due to technical factors rather than stemming from actual economic growth momentum. Zandi believes that the government shutdown has also increased the risk of revisions to the third-quarter report, and it is very likely that this growth data will be downgraded in the coming months.

Who is more popular? Powell becomes the most favored senior official, while Trump's approval rating approaches a historical low.

According to a report by The Hill, a new Gallup poll found that Federal Reserve Chair Jerome Powell is the most popular among 13 U.S. leaders. This result places him ahead of President Donald Trump, whose approval rating remains near historic lows.

A poll released this Monday shows that more than a quarter of respondents approve of Powell's performance. This includes 46% of Democrats, 34% of Republicans, and 49% of independents. Gallup found that Powell's job approval rating is 44%, the highest number tested in the survey. Trump's approval rating is 36%, which Gallup describes as a new low for his second term, just slightly above the historic low of 34% he set in 2021.

The most 'remarkable' asset globally this year? The 30-year U.S. Treasury bond!

Admittedly, the rise in 30-year U.S. Treasury bonds this year has been far less impressive than AI-related stocks or gold and silver; in fact, their prices have not even seen an increase. However, their 'remarkable' aspect may lie precisely in this — despite the Federal Reserve's cumulative interest rate cuts of 75 basis points this year, which should have pushed down Treasury yields, they are heading towards an annual close at nearly the same level as at the beginning of the year. This alone is extraordinary.

Precious metals surge with great momentum! Gold at 4500, platinum at 2300, and silver at 72, all hit record highs.

Under the influence of geopolitical risks and the drive of global supply shortages, the precious metals market is experiencing a historic moment. The price of gold has surpassed $4,500 per ounce for the first time, while platinum has also reached a historic high of over $2,300, with an increase of more than 150% this year. Silver continues to soar after breaking $70, domestic platinum futures have hit the limit up, and futures for silver and palladium in Shanghai have surged. This bull market is being fueled by multiple factors including risk aversion, central bank purchases, and "currency devaluation trades."

Will the gold bull market continue into 2026? Bulls are optimistic: prices can rise even without a major crisis.

Since the beginning of this year, international gold prices have reached new highs, with spot gold first surpassing $4,500 per ounce during Wednesday's Asian trading session. Gold prices have risen over 70% so far, poised to achieve the best annual performance since 1979. This upward momentum is expected to continue until 2026.

Analysts predict that gold prices will maintain an upward trend next year, as the driving force behind this round of price increases is structural factors rather than purely reactive fluctuations triggered by sudden events. Analysts from IG Group point out that by 2026, gold prices will not require a crisis to boost them; it is sufficient for the global situation to remain as it is. They also noted that compared to previous peaks, current investor positions in gold are still relatively balanced, indicating that trading has not yet become overly crowded.

Bank of America's Optimistic Outlook for 2026: Stronger-than-Expected Economic Growth in the US and China, AI Boom Continues to Drive US Stock Market Rally!

As we approach 2026, Bank of America, one of the largest banks on Wall Street, issued an optimistic outlook stating that next year's economy will be stronger than most anticipate, particularly in the United States and China.

The bank's senior U.S. economist Aditya Bhave previously projected that the year-on-year GDP growth rate for the U.S. in the fourth quarter of 2026 will reach 2.4%, which is higher than the general forecast of 2%. Candace Browning, head of Bank of America's Global Research, summarized this tone and stated that the team "remains optimistic about the economy and artificial intelligence," and is "optimistic about the two most influential economies, expecting GDP growth in the U.S. and China to exceed market expectations."

Has the "era of technology dominance" passed? Wall Street is looking for potential winners in 2026: cyclical stocks may take the lead!

With the decline in oil prices and the cooling of inflation, the growth of the U.S. economy is expected to accelerate, and expectations for interest rate cuts by the Federal Reserve have increased; Wall Street strategists and analysts predict that publicly traded companies sensitive to economic cycles, such as banks, equipment manufacturers, and retailers, will perform well in 2026.

The situation in the Caribbean region is becoming increasingly tense, with the U.S.-Venezuela dispute triggering fluctuations in energy prices.

The United States has deployed additional special operations aircraft and military personnel and equipment to the Caribbean region to further pressure the Venezuelan government. Previously, the U.S. seized several oil tankers linked to Venezuela under the pretext of drug enforcement, drawing international market attention and causing fluctuations in oil prices. Venezuela may respond with measures such as escorting tankers with gunboats and considering the deployment of armed soldiers on tankers, but this could lead to an escalation of tensions.

Zelenskyy Discloses Details of the '20-Point Peace Plan' Draft: Disagreements Remain Over Territorial Issues and the Zaporizhzhia Nuclear Power Plant

Ukrainian President Volodymyr Zelenskyy unveiled details of a draft '20-point peace plan' aimed at ending the conflict, which is currently under discussion between Ukraine and the United States. The draft addresses core issues including the confirmation of Ukraine’s sovereignty, security guarantees, territorial disputes, and control over the Zaporizhzhia nuclear power plant. While significant progress has been made on most positions, disagreements persist regarding territorial issues and the control of the nuclear facility.

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

Holiday: New York Stock Exchange (NYSE) in the United States will close early at 02:00 Beijing Time on the 25th.

Holiday: Intercontinental Exchange (ICE) in the United States will end trading of Brent crude oil futures contracts early at 03:00 Beijing Time on the 25th.

Holiday: Chicago Mercantile Exchange (CME) in the United States will end trading of U.S. Treasury futures contracts early at 03:30 Beijing Time on the 25th. Trading of precious metals, energy, and foreign exchange futures contracts will conclude early at 02:45 Beijing Time on the 25th, while equity index futures contract trading will end early at 02:15 Beijing Time on the 25th.

Closed for trading on the following day (Christmas).

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/Doris