① Bernstein analyst Stacy Rasgon believes that despite NVIDIA's stock often being considered overvalued, its current price is still undervalued when taking into account its historical valuation and artificial intelligence investments; ② NVIDIA's stock performance has been modest this year, but it was outstanding over the past three years, with increases of 242.63% in 2023 and 171.05% in 2024, and a rise of 36.37% year-to-date in 2025.

When it comes to $NVIDIA (NVDA.US)$ stock, people often associate it with 'overvaluation.' Coupled with the current wave of warnings about an artificial intelligence (AI) bubble, claiming that the stock is still undervalued seems unlikely to gain much credibility. However, according to Bernstein analyst Stacy Rasgon, this is precisely the situation at present.

He pointed out that considering NVIDIA's historical valuation and AI investments, the company’s stock is still undervalued. Despite delivering impressive “results,” the stock’s performance has remained lackluster, indicating that its upside potential has yet to fully materialize. Historically, whenever investors entered at such discounted levels, they typically achieved substantial returns in the following year.

His conclusion is: “Therefore, 2026 will be an interesting year for new investors in NVIDIA.”

His conclusion is: “Therefore, 2026 will be an interesting year for new investors in NVIDIA.”

As is well known, NVIDIA is one of the biggest beneficiaries of the AI boom. The past three years have marked a significant turning point for NVIDIA’s stock price and market capitalization growth. Following increases of 242.63% in 2023 and 171.05% in 2024, NVIDIA has risen 36.37% year-to-date in 2025. Compared to the remarkable performances in the previous two years, NVIDIA appears somewhat “underwhelming” this year. Investors are now most concerned about where the stock will head next—has it peaked, or is this just a temporary pause?

After examining a series of data, Bernstein concluded that NVIDIA is “still undervalued.” According to Rasgon, one reason is the stock’s performance relative to the Philadelphia Semiconductor Sector Index (SOX). Year-to-date, SOX has risen approximately 43%, while NVIDIA has increased only by 36%. This indicates that although NVIDIA is considered an industry leader, its performance has not outpaced its peers.

Bernstein analysts also noted an interesting statistic regarding NVIDIA. The company’s stock is currently trading at a 13% discount to SOX. Over the past decade, there have been only 13 days where the discount exceeded this level. Rasgon believes that they have uncovered a unique valuation metric, and given how rare such occurrences are, it is difficult to refute.

In summary, the current price offers an excellent entry point. The analyst noted that anyone purchasing NVIDIA at this level could achieve an average one-year return exceeding 150%, with no drawdowns recorded. Its forward price-to-earnings ratio of 25x is also in line with Nasdaq’s forward P/E of 25.1x. All these factors suggest that NVIDIA is poised for strong performance in 2026.

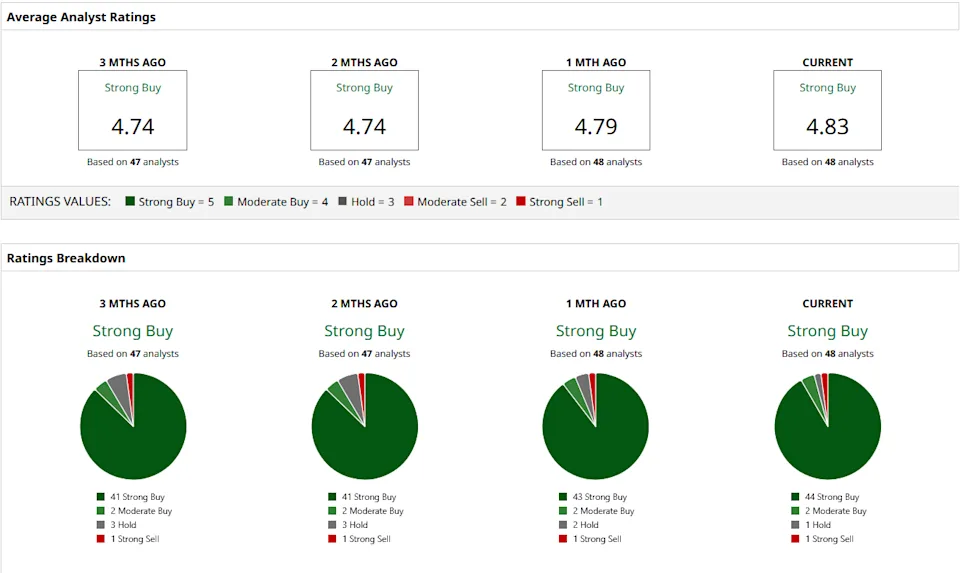

Additionally, it is worth noting that NVIDIA’s stock remains highly sought after on Wall Street. Among the 48 analysts covering the stock, 44 have assigned it an “Outperform” rating. The highest target price stands at $352, implying the stock could potentially double from its current level.

Editor /rice