This article is from: Chuan Yue Global Macro.

Authors: Tao Chuan, Shao Xiang

A 'surprise' around Christmas: the RMB exchange rate broke through 7 again after 14 months. However, times have changed. Fourteen months ago, the US dollar was still hovering around 100, with the shadow of Trump's inflation and tariffs looming large; but now, just before Christmas, the US Dollar Index has fallen below 98, and the risks associated with Trump's tariffs are also fading (at least temporarily). The appreciation of the RMB seems to be a logical outcome.

However, looking at the continuous appreciation of the RMB against the backdrop of US dollar volatility since late November, the pace appears somewhat too rapid. A question emerges: has the RMB exchange rate appreciated excessively?

However, looking at the continuous appreciation of the RMB against the backdrop of US dollar volatility since late November, the pace appears somewhat too rapid. A question emerges: has the RMB exchange rate appreciated excessively?

In fact, assessing whether the RMB exchange rate has appreciated too much or too little has always been a complex issue. From different dimensions, we can provide three different answers:

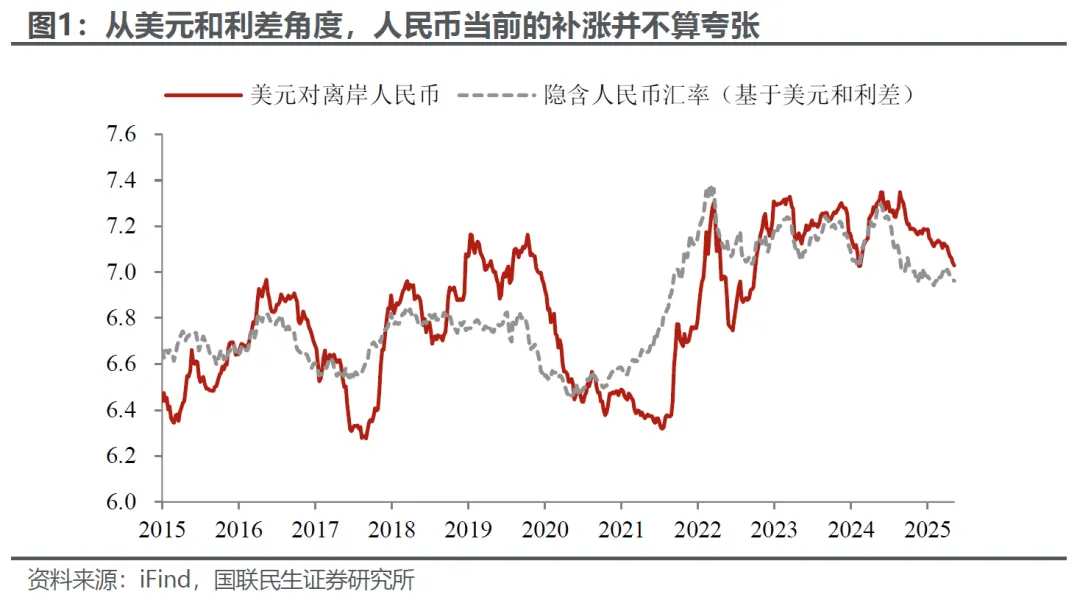

From the perspective of financial markets and asset prices, the current appreciation of the RMB is considered a catch-up, and the increase is not excessive (from the perspective of the US dollar and interest rate spreads, see Figure 1).

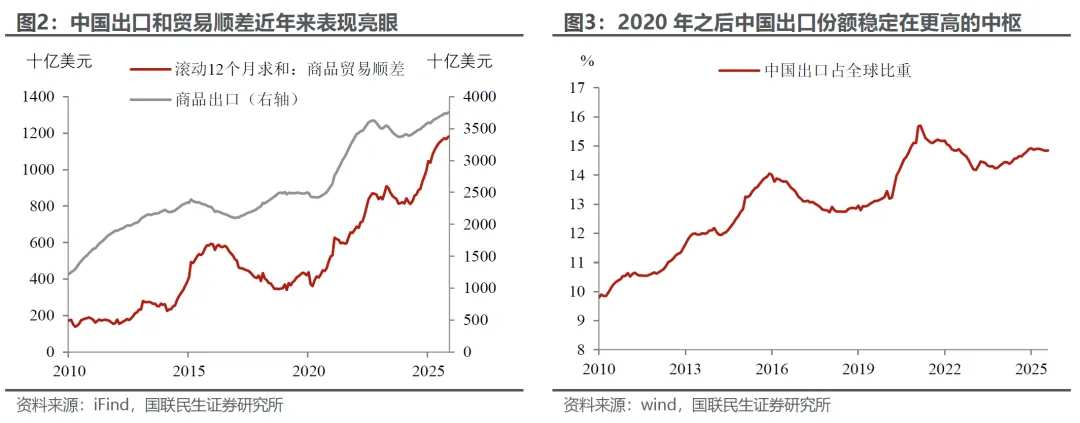

From the trade perspective, China’s (goods) trade surplus (rolling 12-month sum) continues to hit new record highs, with one possible reason being that the RMB has appreciated too little (undervalued).

From the perspective of inflation, the 'gap' between the nominal and real exchange rates of the RMB has been widening in recent years, implying that the RMB exchange rate has depreciated too little, with the shortfall being compensated by low domestic inflation.

So, how should we view this issue?

Pay attention to the timing and the key contradictions of each phase; do not hastily link short-term exchange rate fluctuations with macro narratives.

We tend to believe that the current appreciation volatility of the RMB exchange rate is reasonable. There are mainly three factors behind it: a weaker US dollar, catch-up appreciation driven by changing expectations, and concerns about the seasonal pattern of concentrated foreign exchange settlement at the end of the year and the beginning of the next year:

The US Dollar Index peaked on November 21 and then continued to weaken, while the RMB began to appreciate at an accelerated pace during the same period.

After high-level officials from China and the US met in South Korea and reached a one-year trade truce, the risks for the RMB were temporarily alleviated, leading to a change in expectations.

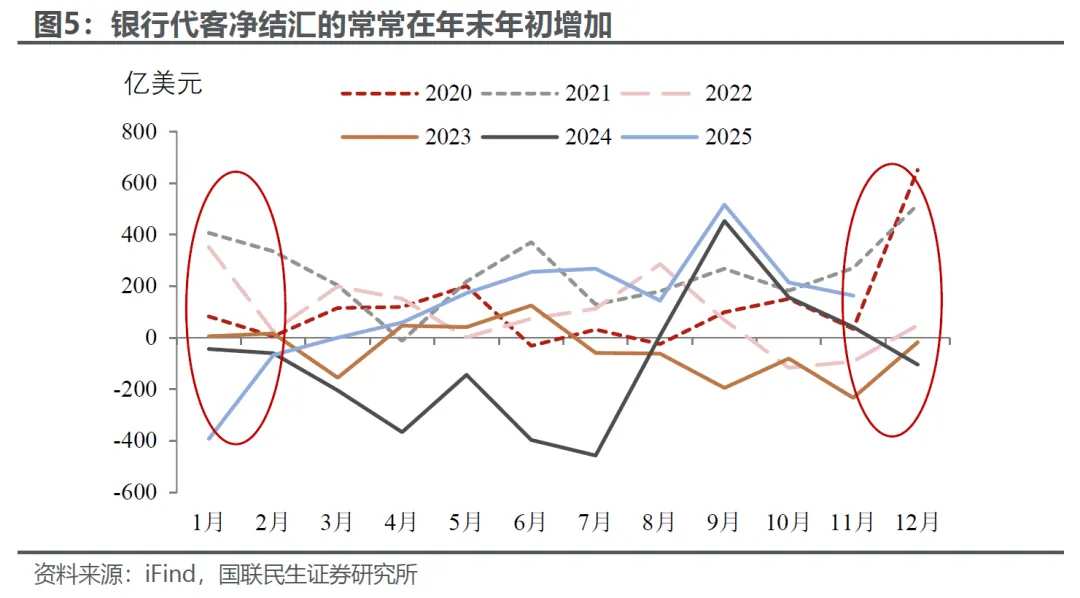

Moreover, based on normal yearly experience, the scale of net foreign exchange settlement generally sees a regular increase at the end of the year and the beginning of the next year (in 2024, the situation was relatively unusual due to the impact of tariff uncertainties).

Trade and inflation are both medium- to long-term economic issues, and their influence in short-term market volatility is not as significant. While we do not deny that the exchange rate is a crucial macroeconomic variable, similar to other policy variables, it takes time for the exchange rate to impact the economy. Moreover, during this process, policies will adjust in response to exchange rate changes, such as implementing appropriate easing measures. Therefore, further observation is still required.

Of course, this does not mean we are completely unconcerned about currency appreciation. We are particularly focused on the risk of excessive appreciation caused by subsequent 'panic-based forex settlement.' The rise and fall of the RMB exchange rate tend to form a consensus expectation and self-reinforcing trends. At present, it is especially important to be vigilant against the risk of panic-based forex settlements stemming from accumulated pending settlements over recent years: on one hand, weak expectations regarding the RMB have reversed this year; on the other hand, the narrowing of the interest rate gap between China and the U.S. has rapidly diminished the attractiveness of overseas investments like the U.S. dollar amid exchange rate appreciation expectations. The last time an intensified expectation cycle of 'settlement-appreciation-settlement' occurred, the RMB exchange rate once broke below 6.3. If a similar situation arises, the resulting economic impact would be significant.

What is the outlook moving forward?

We will address two questions:

How will the exchange rate increase? Based on expectations for the U.S. dollar and the interest rate differential between China and the U.S. next year, we estimate that a relatively reasonable potential level for the USD-CNY exchange rate would be around 6.8 (Figure 8, where we also consider that the central bank’s management of the exchange rate will be more flexible compared to previous years).

However, the exchange rate market has always been difficult to predict 'reasonably.' What factors could lead to further appreciation of the RMB? In addition to the aforementioned possibility of concentrated forex settlements, unexpected significant reductions in central bank intervention or unexpectedly positive progress in Sino-U.S. trade negotiations that substantially lower export risks could drive further appreciation.

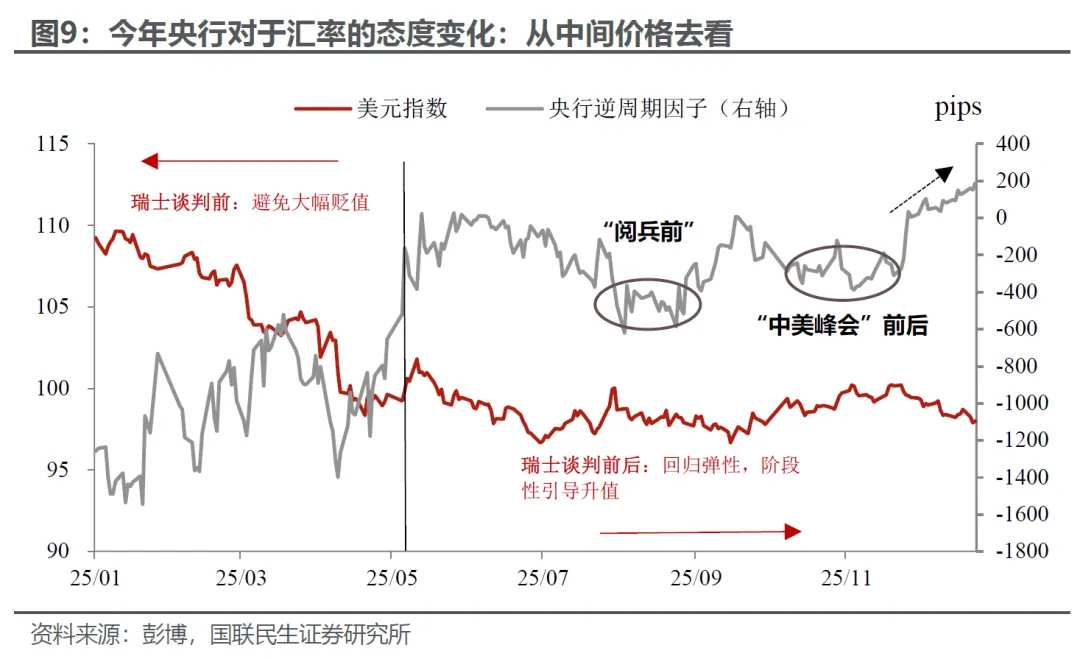

How is the central bank managing it?

The recent adjustment of the RMB’s central parity rate in the depreciation direction already reflects the central bank’s intention to cool down the appreciation, although it remains at a relatively preliminary stage. As upward pressure on the exchange rate increases, the official toolkit mainly includes two aspects:

Exchange rate tools: For example, guiding expectations through state media, discussions with self-regulatory organizations, influencing the market via commercial bank trading activities, and adjusting macro-prudential coefficients for cross-border investment and financing.

Other tools: Implementing necessary reserve requirement ratio (RRR) cuts, interest rate reductions, and other easing measures (given that the Federal Reserve has already cut rates consecutively).

For next year, we believe that appropriate central bank intervention to moderate appreciation may be necessary, mainly based on considerations of symmetric management principles. In previous years, when the RMB faced significant depreciation pressures, the central bank emphasized 'stability' in the exchange rate. Similarly, under growing appreciation expectations, the central bank should equally prioritize 'stability,' allowing for a more balanced and rational distribution of the macroeconomic impacts brought by exchange rate fluctuations.

Risk Warning: Unexpected escalation of global trade frictions, frequent geopolitical events, unexpected contraction in global trade, and unforeseen volatility in exchange rates.

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO