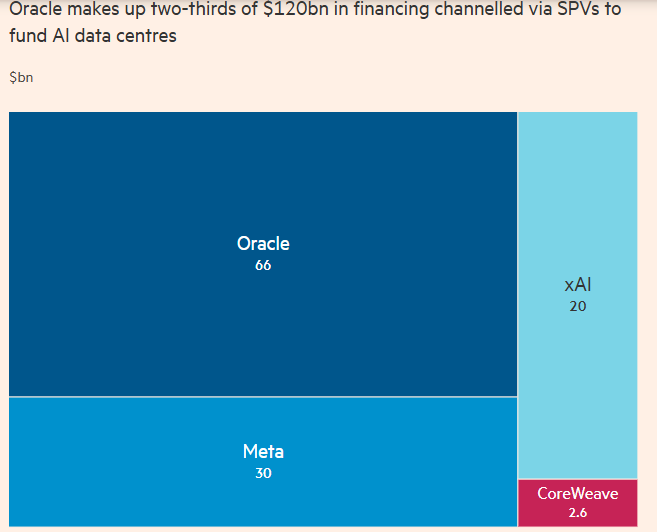

①Large technology companies are shifting over $120 billion in data center expenditures off their balance sheets through special purpose vehicles (SPVs) funded by Wall Street investors; ②This has heightened concerns about the financial risks associated with their massive bets on artificial intelligence.

Large technology companies are shifting over $120 billion in data center expenditures off their balance sheets through special purpose vehicles (SPVs) funded by Wall Street investors, which has heightened concerns about the financial risks associated with their massive bets on artificial intelligence.

$Meta Platforms (META.US)$ 、xAI、$Oracle (ORCL.US)$and data center operators$CoreWeave (CRWV.US)$were among the first in the industry to undertake this complex financing transaction to shield their companies from the substantial borrowing required for building AI data centers. However, it is not difficult to see that the more they attempt to obscure, the more the market grows concerned about their situation – CoreWeave and Oracle have become the 'epicenters' of the AI sell-off in recent months…

According to the latest industry statistics, financial institutions such as Pimco, Blackrock, Apollo, Blue Owl Capital, and major U.S. banks like JPMorgan have provided at least $120 billion in off-balance-sheet debt and equity financing for the computing infrastructure of these technology groups.

According to the latest industry statistics, financial institutions such as Pimco, Blackrock, Apollo, Blue Owl Capital, and major U.S. banks like JPMorgan have provided at least $120 billion in off-balance-sheet debt and equity financing for the computing infrastructure of these technology groups.

It is reported that SPVs are independent legal entities established to achieve specific objectives, such as asset securitization, risk isolation, project financing, mergers and acquisitions restructuring, etc., with the core function of isolating credit and bankruptcy risks from underlying assets via risk isolation and tax optimization.

Much of the financing for these tech companies is being channeled through SPVs. Such inflows of capital do not appear on the tech companies’ balance sheets and may mask the risks these companies face – as well as the identification of who will bear responsibility if AI demand falters. The SPV structure also increases the risk of unpredictable ripple effects across Wall Street should AI operators face financial stress in the future.

A senior executive at a large financial institution commented on the billions of dollars flowing into SPVs for data center construction, stating, “This was unimaginable a year and a half ago, but now it has become commonplace. The tech industry indeed leverages its creditworthiness to secure far greater capital support than other sectors.”

Accumulation of 'phantom debt'

Silicon Valley giants have historically been cash-rich and carried very low debt, earning them excellent credit ratings and a high degree of investor trust.

However, the race to secure computing power for advanced AI is driving tech companies to borrow at record levels. Accessing private capital through off-balance-sheet structures allows firms to protect their credit ratings while improving financial metrics.

Meta completed the largest private credit data center deal in October, securing a $30 billion agreement for its proposed Hyperion facility in Louisiana, in collaboration with a New York-based financing firm.$Blue Owl Capital (OWL.US)$Together, they created a Special Purpose Vehicle (SPV) named Beignet Investor. The SPV raised $30 billion, with approximately $27 billion coming from loans provided by institutions such as Pacific Investment Management Company (PIMCO), Blackrock, and Apollo, and an additional $3 billion in equity from Blue Owl.

This transaction allowed Meta to effectively borrow $30 billion in debt without reflecting it on its balance sheet, enabling the company to effortlessly raise another $30 billion in the corporate bond market just weeks later.

Oracle Corporation was the first to adopt third-party structured financing to fund its substantial commitments to lease data center capacity to OpenAI. Under Larry Ellison's leadership, this veteran tech group partnered with builders and financial institutions such as Crusoe, Blue Owl Capital, Vantage, and Related Digital to construct multiple data centers, which will ultimately be owned by SPVs.

Its off-balance-sheet financing deals include: approximately $13 billion (including $10 billion in debt) injected by Blue Owl and JPMorgan into an SPV for the OpenAI facility in Abilene, Texas; $38 billion in debt financing for two data centers in Texas and Wisconsin; and an $18 billion loan for a project in New Mexico.

In each transaction, Oracle agreed to lease the facilities from the SPVs. In the event of default, lenders can claim recourse to the data center assets—including buildings, land, and core equipment like chips—but do not have recourse against the companies managing these sites.

As the funding required for artificial intelligence infrastructure surges, tech companies' cash reserves are under pressure, making off-balance-sheet debt raised through SPVs increasingly popular. Morgan Stanley estimates that tech enterprises' AI initiatives will require $1.5 trillion in external financing.

In most data center transactions, investors are confident that if demand for AI services declines and the value of mega-compute facilities diminishes, the ultimate financial risk will still fall on the tech companies leasing the sites.

Taking the Beignet Investor project as an example, Meta holds 20% of the equity in this SPV and provides a 'residual value guarantee' to other investors. This means that if the value of the data center falls below a specific level at the end of the lease term and Meta decides not to renew the lease, the social media giant will need to compensate the SPV investors for the shortfall.

xAI, the artificial intelligence startup under Elon Musk, is raising $20 billion in funding, including up to $12.5 billion in debt financing, using a similar structure. The SPV will use these funds to purchase$NVIDIA (NVDA.US)$GPUs and lease them to xAI.

Are there more 'hidden' risks?

Nevertheless, the associated risks should not be underestimated. The risk of such structures largely depends on their prevalence. If multiple AI companies simultaneously utilize SPVs, pressure could spread to the underlying private credit funds without transparency.

Currently, private capital investors are actively participating in the artificial intelligence boom, driving a surge in demand for this new type of financing structure. According to UBS Group, by early 2025, technology companies had borrowed approximately $450 billion from private funds, an increase of $100 billion over the previous 12 months.

UBS Group noted that approximately $125 billion flowed into 'project finance' deals this year—long-term financing for infrastructure projects—such as the transaction between Meta Platforms and Blue Owl.

The construction of data centers has become highly reliant on the private credit market, which is rich in capital. This $1.7 trillion industry is rapidly expanding, with soaring asset valuations, insufficient liquidity, and high borrower concentration, all of which have raised market concerns.

A banker familiar with data center financing transactions stated, 'There are already high-risk loans and potential credit risks in the private credit sector. In the coming years, a very noteworthy landscape will emerge—because two significant risks will increasingly intersect.'

At present, the boom in artificial intelligence data centers also heavily relies on a small number of clients. OpenAI alone has secured long-term computing resource commitments exceeding $1.4 trillion from most giants in this field.

Thus, if one tenant encounters issues, lenders of multiple data centers may face the same risk. They also need to address uncertainties in power supply, changes in artificial intelligence regulatory policies, and technological advancements that could render the current generation of AI hardware obsolete.

Meanwhile, what deserves greater vigilance is that Wall Street is also promoting the adoption of more opaque structures in data center deals. Multiple technology bankers revealed that AI debt securitization transactions have even emerged recently—lenders bundle loans and sell shares to investors in the form of asset-backed securities (ABS). According to estimates by two bankers, the scale of such transactions currently reaches tens of billions of dollars.

These transactions disperse the risks of data center loans to a broader group of investors, including asset management firms and pension funds.

Matthew Mish, Head of Public and Private Credit Strategy at UBS Group, pointed out that given the robust balance sheets and credit profiles of hyperscale enterprises, most investors consider it a positive that “ultimately, the risk will be borne by hyperscale companies.”

However, Mish added that SPV financing would still 'increase outstanding debt' for tech companies, meaning that 'the overall credit quality of hyperscale AI enterprises will be lower than the levels projected by current models.'

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor /rice