Amid the trading atmosphere of Christmas holiday checklists in Europe and America, $XAG/USD (XAGUSD.FX)$ the pace of price surges is accelerating further. Market data shows that during the Asian session on Friday (December 26), spot silver prices once reached as high as $75.16 per ounce, extending this month's gains to an astonishing 33%.

As silver prices continue to soar and become increasingly uncontrollable, Dutch precious metals trading expert Karel Mercx has also noticed a phenomenon indicating that the physical shortage situation in the London silver market may have reached an extreme level.

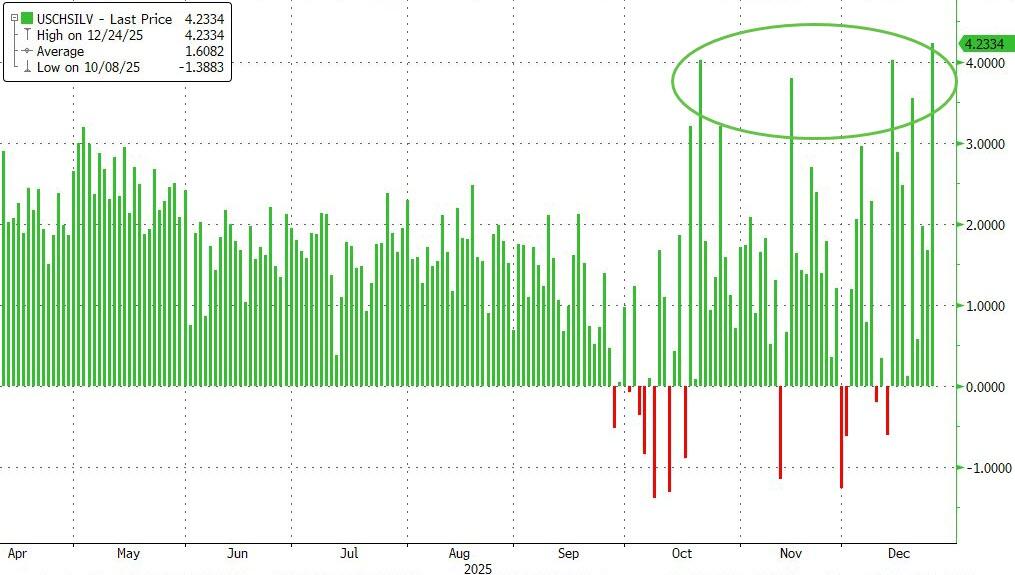

Mercx focuses on a set of differential indicators between silver swap rates and U.S. interest rates. He believes that the reciprocal of this indicator (multiplied by -1) can serve as a proxy for the implied silver lease rate, used to assess the physical shortage in the London silver market.

Mercx stated, 'The one-year silver swap rate minus the U.S. interest rate has now reached -7.18%. This distortion explains why the silver rally has not yet ended. Only when it returns to the red line position (0) will supply and demand normalize.'

Mercx stated, 'The one-year silver swap rate minus the U.S. interest rate has now reached -7.18%. This distortion explains why the silver rally has not yet ended. Only when it returns to the red line position (0) will supply and demand normalize.'

Typically, the above spread should be positive, as one-year silver demand usually incorporates warehousing, insurance, and financing costs.

It is necessary to introduce some background knowledge to investors—silver swap rates are a key component of global precious metals trade. Their existence stems from the fact that major participants such as banks, producers, industrial users, and investors can continuously engage in non-physical delivery swaps of silver and U.S. dollars—without physically moving the metal. This mechanism also allows the London spot market to be more closely linked with the New York market.

Under normal circumstances, silver swap rates are positive—after all, storage and custody incur costs. However, if swap rates fall into negative territory, it indicates a physical supply shortage—traders are willing to pay a premium to obtain silver immediately. When short positions are forced to cover due to panic liquidation, swap rates may further decline into negative territory—a classic short squeeze.

Since the introduction of silver swap rates, such a fierce and sustained decline over several months has almost never occurred.

This also signals that the system is currently under pressure—the swap trading mechanism, originally designed to avoid global metal transportation, is now triggering silver transfers due to buyers demanding physical delivery.

In fact, holding physical silver is neither easy nor inexpensive. A million-dollar position corresponds to hundreds of kilograms of silver, requiring vault space, insurance premiums, and security costs…

However, manufacturers such as solar panel producers are increasingly inclined to hold physical silver rather than paper silver contracts that only deliver after a year. The key question they raise is straightforward: what if silver cannot be delivered next year?

Mercx noted that the market is currently digesting this issue. As long as the price of one-year silver swap contracts minus U.S. interest rates remains below the red line, upward pressure on silver prices will persist. No one knows when supply and demand will rebalance.

In this regard, the well-known financial blog Zerohedge also mentioned that note how the gap between silver swap rates and U.S. interest rates is widening relative to the normalization red line (0) as the silver shortage in London intensifies. The London silver market is continuing to deteriorate rather than stabilize.

Meanwhile, investors should also take note that the spread between silver futures on the Shanghai Futures Exchange and the New York Mercantile Exchange is currently very large—this has also spurred the flow of silver from London to Shanghai.

This may be the scene as the London “physical” silver market faces a run: in the London spot silver market, most investors do not hold bars stored in vaults under their names but instead hold “unallocated ownership certificates.” Currently, nearly all holders of unallocated silver ownership and delivery promissory notes are demanding physical metal delivery.

In other words, the London silver market is now like a reservoir with only ten buckets of water but has issued a thousand water withdrawal tickets—the massive leverage effect of “paper silver” relative to deliverable physical silver puts the operational system of the London silver market at risk of a rapid and comprehensive collapse.

Editor/Doris