JR Research emphasized that AI computing power infrastructure and the Mag 7 theme remain at the core, with 'pick-and-shovel' companies in the technology sector continuing to drive long-term market value expansion.

As top analysts on Wall Street enthusiastically proclaim that 2026 will be a 'rotation bull market,' some institutional investors believe this rotation panic will not last. Investors should continue to bet on the significant outperformance of the 'Magnificent Seven tech giants' in the U.S. stock market over other sectors and their strong leadership throughout 2026.$S&P 500 Index (.SPX.US)$and$NASDAQ 100 Index (.NDX.US)$Repeatedly reaching new highs.

The S&P 500 Index is poised to close strongly at an all-time high in 2025, paving the way for continued record-breaking highs in 2026. From the perspective of sector performance in the U.S. stock market, market leadership has indeed rotated from 'AI-related technology and growth stocks' to other undervalued sectors such as value, healthcare, and materials.

In terms of percentage contribution to gains, the rise in the S&P 500 Index since the 'AI bubble theory' swept the market in November has not been as concentrated in the seven tech giants, which account for 35% of the index and are closely related to AI, as it was in the past two years. Instead, the AI investment theme has spread to various sub-sectors, with Wall Street analysts predicting that this 'rotation bull market' will be the main theme of 2026.

In terms of percentage contribution to gains, the rise in the S&P 500 Index since the 'AI bubble theory' swept the market in November has not been as concentrated in the seven tech giants, which account for 35% of the index and are closely related to AI, as it was in the past two years. Instead, the AI investment theme has spread to various sub-sectors, with Wall Street analysts predicting that this 'rotation bull market' will be the main theme of 2026.

Despite increasingly evident market rotation, according to JR Research, an institutional investor who successfully predicted at the end of 2022 that $NVIDIA (NVDA.US)$market capitalization would surpass Apple's, the rotation will not persist for long. 'The themes surrounding AI computing power infrastructure construction progress and Mag 7 (the seven major tech giants) AI investments will, as seen in 2024 and 2025, continue to be the strongest mainstay of the stock market throughout 2026,' stated the institutional investor in a report.

JR Research emphasized that AI computing power infrastructure and the Mag 7 theme remain at the core, with 'pickaxe and shovel' companies in the technology sector continuing to drive long-term market value expansion.

If Trump nominates an extremely dovish individual to serve as the Federal Reserve Chair, combined with the robust profitability of the Magnificent Seven tech giants, whose earnings growth in 2026 is expected to outpace that of the remaining 493 companies in the S&P 500 Index just as it did in the previous two years, they will undoubtedly continue to provide the core fuel for strong overall earnings growth in the S&P 500 Index and lead the entire market upward. In this scenario, investors should maintain their exposure to these companies and even increase their bets on the AI technology theme that has supported this remarkable multi-year bull market since the 2022 bear market bottom, according to JR Research.

The 'super bull market rally' where the S&P 500 Index surged by approximately $30 trillion over the past three years has been largely driven by the world's largest tech giants (such as the Magnificent Seven in the U.S. stock market) as well as companies propelling large-scale investment in AI computing power infrastructure (such as Micron) $Taiwan Semiconductor (TSM.US)$and$Broadcom (AVGO.US)$and power system suppliers (e.g., $Constellation Energy (CEG.US)$).

The so-called 'Magnificent Seven,' which account for approximately 35% of the S&P 500 Index and Nasdaq 100 Index weight, referred to as 'Mag 7,' include: $Magnificent Seven (IP000046.IP)$ $Apple (AAPL.US)$ 、$Microsoft (MSFT.US)$、 $Alphabet-C (GOOG.US)$ 、$Tesla (TSLA.US)$、 $NVIDIA (NVDA.US)$ 、$Amazon (AMZN.US)$and Meta Platforms$Meta Platforms (META.US)$They have been the core driving force behind the S&P 500's repeated record highs and are also regarded by Wall Street's top investment institutions as the portfolio most capable of delivering substantial returns to investors amid the largest technological transformation since the internet era.

How will the market unfold in 2026?

With only one week left to reflect on 2025, many investors consider it another highly successful year—the benchmark U.S. stock index, the S&P 500, has risen nearly 19% year-to-date. The Santa Claus rally received solid support: the S&P 500 closed at a record high before Christmas, creating an ideal moment to welcome Santa Claus. This is expected to drive the final wave of year-end gains and kick off 2026 with strong, optimistic momentum.

Looking back, the year began with anticipation but quickly turned into unease (marked by 'Liberation Day' in April). Then came the 'least popular V-shaped rebound' in recent years, after which the S&P 500 maintained an upward trajectory and hardly looked back. Since April, downward volatility occasionally tried to overwhelm buying pressure, but bears consistently lacked conviction and staying power to push their narrative through. This is because the 'AI bull market narrative' driven by robust AI capital expenditure and the fervent construction of AI data centers kept market risk appetite expanding with astonishing momentum.

Looking ahead to 2026, as the rotation theme gains more recognition from Wall Street analysts, market trading logic is undergoing changes across several significant dimensions. The recent AI investment trend has stumbled, with a few technology leaders being the exception, such as Micron Technology (MU.US), a leading U.S. memory chip maker, whose stock price has repeatedly hit new highs following its latest earnings report. AI chip leaders like NVIDIA (NVDA.US), AMD (AMD.US), and Broadcom (AVGO.US) remain notably below their highest points in 2025. Against this backdrop, the market is evidently accelerating capital reallocation, shifting the narrative from growth to value, and from tech to non-tech sectors. These underlying currents are beginning to accelerate during this year-end 'window dressing' for 2026.

Moreover, the stock price performance of software companies in the U.S. equity market this year has been less than ideal, which represents a significant negative signal for the 'AI bull market logic.' After all, genuine AI revenue generation and AI monetization pathways will largely depend on these SaaS-type software companies. Apart from$Palantir (PLTR.US)$this major exception,$Salesforce (CRM.US)$、$Adobe (ADBE.US)$, and even$ServiceNow (NOW.US)$peers such as Adobe and ServiceNow are experiencing heavy pessimism and bearish sentiment in their stock price movements. Cautious buyers continue to hold back, delaying adding positions.

While the market is keen to reinforce its bullish arguments for AI infrastructure plays, this enthusiasm has not extended to the SaaS value chain. By 2026, as the market evaluates software companies that still demonstrate robust operational performance, solid long-term profit margins, and early-stage opportunities to monetize both AI and non-AI workloads, could we finally see a much-needed resurgence of software stocks — whether driven by fundamental reversals or rotations into these overlooked software names?

Although AI has been at the center of driving market momentum and sentiment since the 2022 bear market bottom, we must exercise caution and avoid hastily concluding that these SaaS companies will be disrupted by the adoption speed of AI large language model (LLM) firms. Their economic principles have yet to be proven (still unprofitable and burning cash on AI computing infrastructure, despite improved gross margins), and the 'Agentic AI' revolution may also be overhyped at this stage. These 'stumbles' instead present buying opportunities on dips for the SaaS value chain: allowing the pace to slow, regrouping, and making necessary adjustments to pivot their corporate AI monetization strategies and respond to the forces needed to ensure relevance in this unprecedented and likely far-from-late-cycle phase of the AI industrial revolution.

Nevertheless, it is encouraging to see the S&P 500 Index experiencing a healthy rotation from tech and growth leaders to previously less-favored sectors. Defensive cyclical sectors such as healthcare and materials have strongly rebounded, providing significant support to the S&P 500’s upward trajectory since November. Additionally, risk-on cyclical sectors like consumer discretionary, financials, and industrials have also rebounded recently, helping the U.S. equity market maintain its climb amid concerns about an 'AI bubble' overshadowing tech and growth peers.

In 2026, the Magnificent Seven may continue to illustrate what constitutes a 'leadership myth.'

However, according to JR Research, although current market leadership seems to be shifting beyond tech, both the tech-centric S&P 500 Index and Nasdaq 100 Index remain inseparable from the core theme of AI-related trading. 'While we can still find secondary or second-derivative investment opportunities supporting AI infrastructure development in areas like utilities, real estate, and even energy infrastructure, I believe the main narrative of the 'AI bull market' will remain firmly anchored in the 'picks and shovels' companies within the tech sector.'

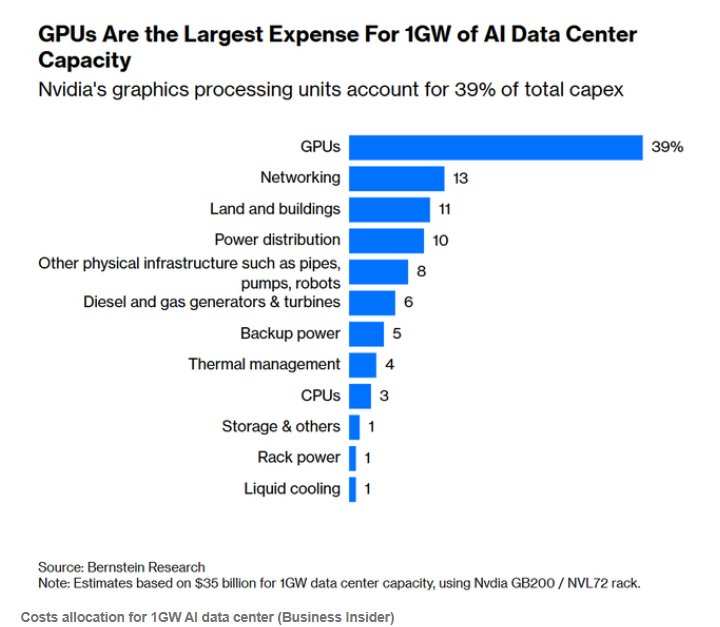

As shown above, the bulk of actual value flows to large tech companies involved in executing the development and deployment of AI data centers, such as NVIDIA, Broadcom, Google, AMD, and Micron. Thus, JR Research states, 'It is hard for me to envision new leaders emerging in this value capture — we are still in the early stages of a trillion-dollar AI investment race,' and the market is still pricing in who truly holds the AI crown.

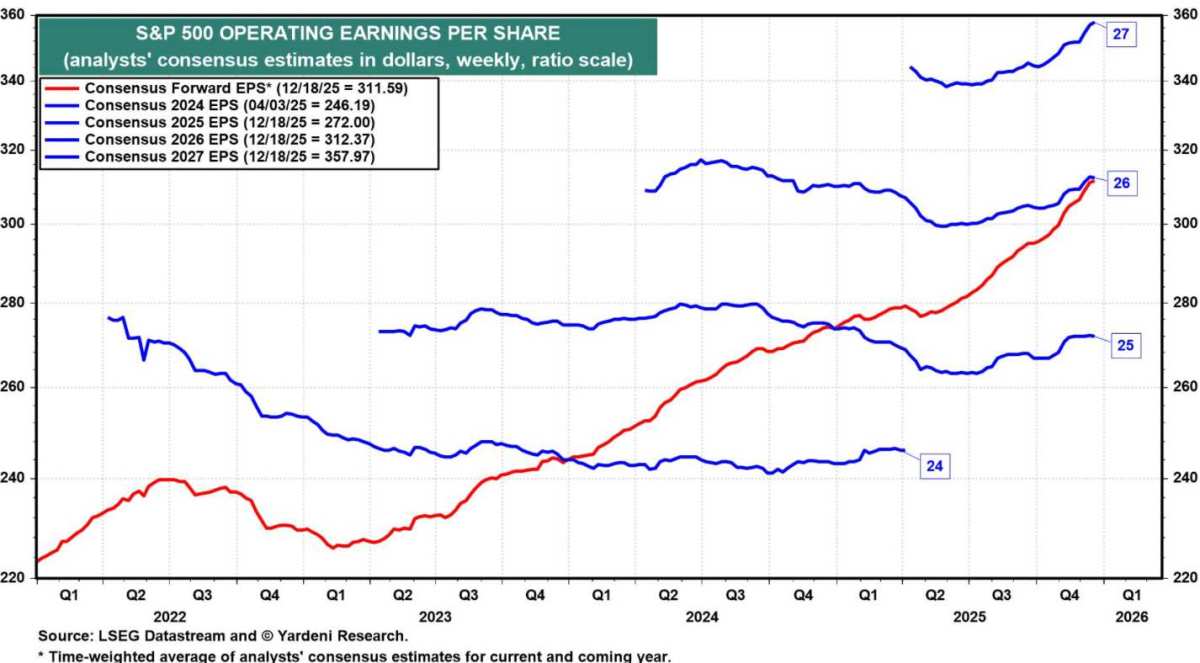

Earnings estimates for the S&P 500 Index have continued to be revised upward, extending into 2026. Although intermittent concerns about valuation multiple compression occasionally arise, the market does not seem troubled in the second half of the year. Some analysts do not foresee significant downside risks, as the Federal Reserve is expected to adopt a dovish stance, especially given weak consumer sentiment persisting through December and potentially fragile labor market conditions next year. With the current frontrunners for the Fed Chair position leaning heavily dovish, the market is unlikely to rush for exits due to uncertainty over Fed policy.

At the same time, the possibility of a 'melt-up' phase cannot be ruled out; it may trigger a scenario leading to larger market peaks — or what some refer to as the ultimate bull market top — resonating with the widely feared narrative of an AI bubble burst. In such a scenario, a dovish Federal Reserve could further ease monetary conditions, attracting sidelined investors back into the equity market, particularly when their ROI from fixed-income investments may decline.

Furthermore, the robust profitability demonstrated by the seven major technology giants is expected to serve as the 'most critical ballast' needed by the market, enabling it to sustain above-average valuation multiples.

Data compiled by FactSet (based on calendar year) from Wall Street analysts' forecasts show that the Magnificent Seven are projected to achieve an approximately 22.7% surge in earnings by 2026; in contrast, the remaining 493 constituents of the S&P 500 index are anticipated to grow their overall earnings by about 12.5%. According to a FactSet research report, these seven giants generally possess stronger pricing power, economies of scale, and high free cash flow, coupled with capital operations such as share repurchases that support EPS, making their earnings growth more likely to outperform the broader market average.

Current Wall Street estimates indicate that forward operating earnings per share for 2026 are approximately $312.4, rising to around $358 by 2027. The continuous upward revision of EPS expectations during 2025 is primarily due to analysts underestimating the underlying intensity of data center construction driven by the AI investment boom, while they are still actively assessing the higher-than-expected risks brought by Trump's tariffs and trade uncertainties.

At the start of 2025—before the global sensation caused by the low-cost AI training model DeepSeek AI chatbot, introduced by a Chinese AI startup, reignited valuation concerns for tech stocks benefiting from AI and heightened fears of competition from Chinese rivals—legendary investor Howard Marks warned that he was in a 'bubble watch' state. This view was particularly notable because Marks, co-founder of Oaktree Capital Management, was among those who accurately predicted the bursting of the dot-com bubble in 2000.

However, this is clearly not the consensus view on Wall Street. A recent report issued by strategists at Bank of America Global Research indicates that they have yet to observe any signs of an AI bubble. Based on data compiled by another Wall Street financial giant, Jefferies, analysts on Wall Street generally expect the overall profit growth of S&P 500 constituent companies to accelerate year by year, potentially continuing until 2027.

A recent research report released by Bank of America shows that the global AI arms race remains in the 'early to mid-stage'; one of the world's largest asset management giants, Vanguard, noted in a research report that the AI investment cycle may have only completed 30%-40% of its eventual peak. However, the asset manager stated that the risk of a pullback in large-cap tech stocks is indeed increasing.

Although valuations of tech giants are relatively high, they have not reached an 'extreme' bubble-bursting scenario compared to previous periods of market euphoria. The market often draws comparisons to the dot-com bubble of the 2000s, but the magnitude of gains brought by AI does not equate to that during the internet development phase. For instance, BI statistics show that the Nasdaq 100 Index, which is heavily weighted towards tech stocks, currently trades at around 26 times expected earnings; whereas at the peak of the dot-com bubble, this multiple exceeded a staggering 80 times.

The reason valuations during the dot-com bubble era were much higher than today is both due to more exaggerated stock price increases and because those tech companies back then were 'younger,' with weaker or even no profitability.

Tony DeSpirito, Global Chief Investment Officer and Fundamental Equity Portfolio Manager at Blackrock, believes that current valuations do not reflect 'dot-com bubble-like multiples.' However, this seasoned asset management professional noted that this does not imply the absence of sporadic speculation or pockets of irrational exuberance, though he does not see such exuberance concentrated in the 'Magnificent Seven' tech giants related to AI.

JPMorgan stated in its annual outlook that the market trading landscape in 2026 will not differ significantly from that of 2025, with the dominant stocks exhibiting extreme crowding and record concentration among AI giants (i.e., the US stock market’s Magnificent Seven continuing to occupy a substantial weighting). JPMorgan believes that the current AI-driven super investment cycle is at the core of its optimistic outlook. This cycle has spurred record capital expenditures, rapid earnings expansion, and created 'unprecedented' market concentration among AI beneficiaries and high-quality growth companies. The report defines these high-quality companies as those with strong profit margins, robust cash flow growth, disciplined capital returns, and low credit risk, emphasizing that this technology-driven structural shift is reshaping the market landscape.

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/Stephen