①What are the underlying drivers behind Hong Kong's IPO fundraising returning to the top globally in 2025? ②What are the latest highlights from a review of the ten most notable new stock moments this year?

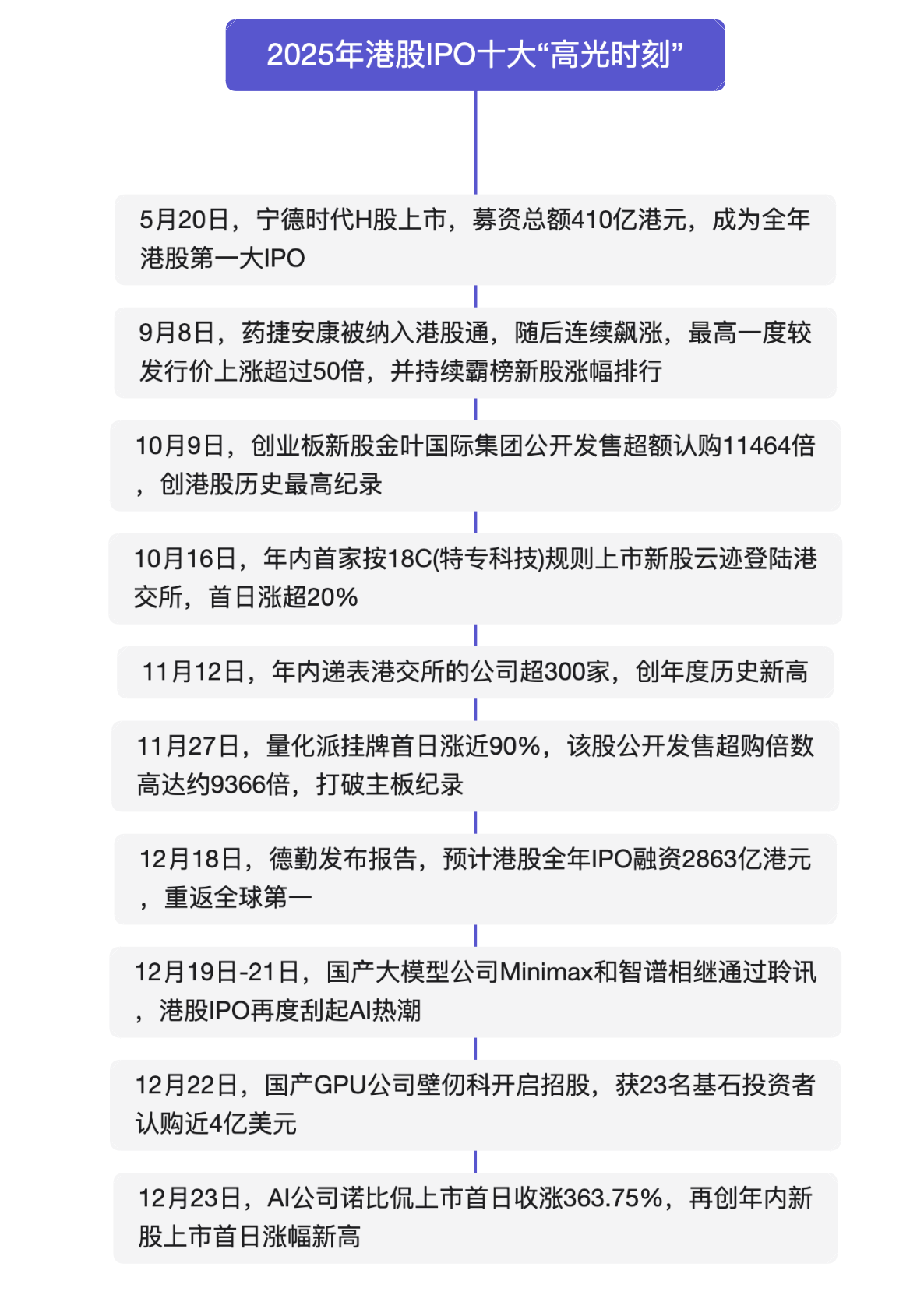

Cailian Press reported on December 26 (edited by Feng Yi) that Hong Kong's IPOs experienced an explosive recovery in 2025, with numerous record-breaking scenes leaving a deep impression on investors and ushering in a prosperous cycle for new stock subscriptions in Hong Kong.

Looking at major global IPO markets, there was an overall upward trend in 2025. However, Hong Kong's IPO fundraising increased by more than 200% year-on-year, consolidating its leading position as an international financial center while also becoming the largest single contributor to the global IPO market recovery.

According to Deloitte's 'Review of the Chinese Mainland and Hong Kong IPO Market in 2025 and Outlook for 2026,' released on December 18, the total amount of Hong Kong's IPOs in 2025 may reach HKD 286.3 billion, reclaiming the top spot globally.

According to Deloitte's 'Review of the Chinese Mainland and Hong Kong IPO Market in 2025 and Outlook for 2026,' released on December 18, the total amount of Hong Kong's IPOs in 2025 may reach HKD 286.3 billion, reclaiming the top spot globally.

Upon deeper analysis, the explosive recovery of Hong Kong's IPOs is closely related to this year’s bull market and the benefits of institutional reforms.

On one hand, Hong Kong's stock market has been exceptionally active this year, $Hang Seng Index (800000.HK)$ with an accumulated increase of nearly 30% year-to-date and a monthly winning streak of five consecutive months at one point. The vibrancy of the secondary market has also significantly boosted the profitability of newly listed stocks.

Most notably, on September 8, the newly listed stock $TRANSTHERA-B (02617.HK)$ experienced several days of sharp increases after being included in the Stock Connect program for Hong Kong stocks, with its price rising more than 50 times above the issue price at its peak, becoming a phenomenon-level 'speculative stock' and sparking widespread market discussion. As of the close on December 24, the stock was still up approximately 890% cumulatively from its issue price, ranking first among this year’s newly listed stocks in terms of gains.

Following this period, the subscription craze for new Hong Kong stocks reached a climax. On October 9, the ChiNext new stock $GOLDEN LEAF INT (08549.HK)$ recorded an oversubscription rate of 11,464 times during its public offering, setting a new historical record for Hong Kong stocks. On November 27, $QUANTGROUP (02685.HK)$ the stock surged nearly 90% on its debut day, with its public offering oversubscription reaching about 9,366 times, once again breaking the main board record.

On the other hand, in recent years, ongoing policy optimizations by the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Stock Exchange around key areas such as listing thresholds, approval efficiency, and market liquidity have begun to yield institutional dividends during this bull market, propelling Hong Kong's IPOs into a new cycle.

According to Deloitte statistics, as of December 17, a total of 19 A+H shares were listed, accounting for about half of the total financing amount.

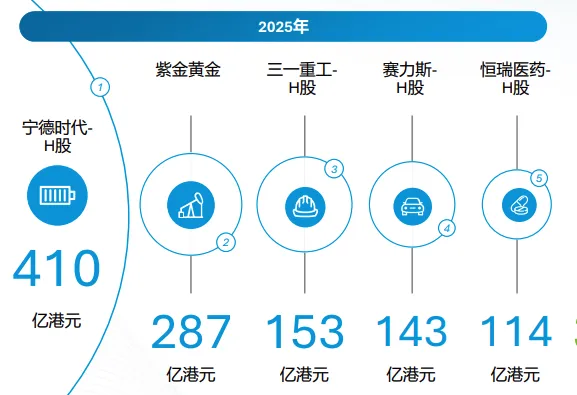

Among the top five IPOs in Hong Kong this year, four were companies already listed on the A-share market, accounting for approximately 30% of the total annual financing amount. $CATL (03750.HK)$ 、 $SANY HEAVY IND (06031.HK)$ 、 $HENGRUI PHARMA (01276.HK)$ Industry giants have successively achieved dual listings on the A-share and H-share markets.

Among them, on May 20, $Contemporary Amperex Technology (300750.SZ)$the company completed its H-share listing, raising a total of HKD 41 billion, becoming the largest IPO in Hong Kong's stock market for the year. This once again demonstrated Hong Kong's ability to handle ultra-large-scale IPOs.

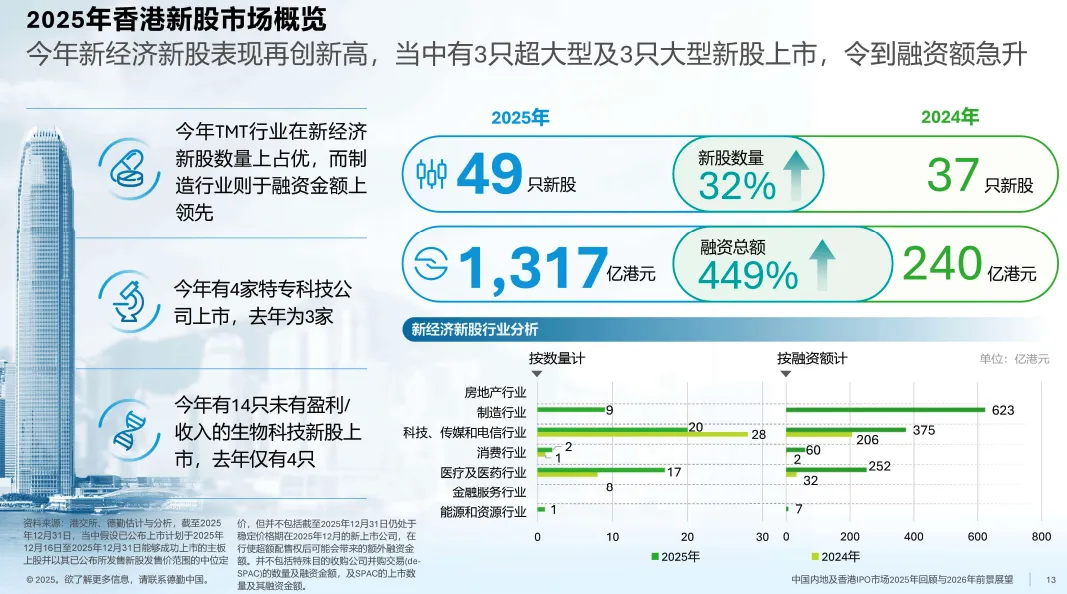

Additionally, structurally, the new economy and technological content of Hong Kong's IPOs are expected to increase significantly by 2025.

On May 6 this year, the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Stock Exchange officially launched the 'Tech Enterprise Fast Track,' aimed at prioritizing the listing applications of specialized technology companies and biotech firms.

According to Deloitte estimates, the number of new economy IPOs in sectors such as TMT and pharmaceuticals in Hong Kong is expected to grow by 32%, with total fundraising increasing by 449% year-on-year by 2025. Additionally, four specialized technology companies are expected to go public.

On October 16, the first company of the year to go public under the 18C (Specialized Technology) rules, $YUNJI (02670.HK)$ was listed on the Hong Kong Stock Exchange, with its share price rising more than 20% on the first day. Subsequently, $DEEPEXI TECH (01384.HK)$ 、 $WERIDE-W (00800.HK)$ 、 $CIDI (03881.HK)$ several other companies were listed, primarily involving cutting-edge technology fields such as AI and autonomous driving.

It is worth noting that as we approach the end of 2025, the enthusiasm of technology companies going public in Hong Kong remains high, which could help sustain the recovery trend in Hong Kong's IPO market.

From December 19 to 21, domestic large model companies Minimax and Zhipu successively passed the listing hearing, reigniting an AI-driven IPO boom in the Hong Kong stock market. Shortly after, the 18C Specialized Technology company $BIREN TECH (06082.HK)$ also commenced its initial public offering, aiming to become 'the first GPU stock in the Hong Kong stock market,' and secured USD 373 million from 23 cornerstone investors.

On December 23, the AI company $NUOBIKAN (02635.HK)$ closed with a rise of 363.75% on its first day of trading, setting another record high for the largest increase on the first day of listing this year. This also reflects the secondary market’s sustained enthusiasm for technology stocks.

Deloitte also predicts that next year’s Hong Kong IPO market will maintain strong momentum, with an estimated 160 new listings and total fundraising expected to surpass the HKD 300 billion mark for the first time since 2021.

![]() Use Futu for new stock subscriptions, with truly zero interest, zero handling fees, and zero cash subscription*. Get ahead in the grey market trading.Come and experience it now >>

Use Futu for new stock subscriptions, with truly zero interest, zero handling fees, and zero cash subscription*. Get ahead in the grey market trading.Come and experience it now >>

Editor/jayden