When the panic-driven selloff triggered by the AI bubble coincides with a surge in bond market supply, it is overturning the trading logic that has prevailed in the bond market in recent years.

As bond traders forecasted the overall trend for the bond market (including various sovereign bonds) in 2025 from late 2024 to early 2025, they never anticipated that factors influencing bond trading—beyond predictable ones such as inflationary pressures and fiscal expansion brought by Trump's return to the White House, high yields on U.S. Treasuries continuing to attract global low-risk appetite funds, and tariffs driving surges in safe-haven demand—could also be linked to the epoch-making wave of artificial intelligence (AI).

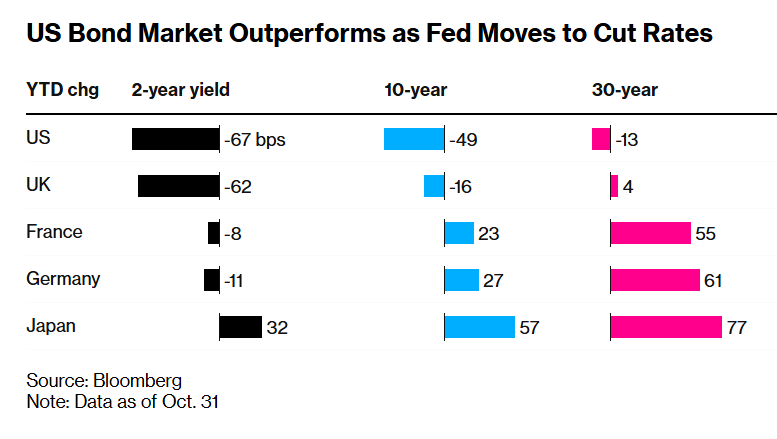

For the U.S. Treasury market, which traders have long focused on, 2025 delivered both 'volatility comparable to stock prices' and an annual surprise of being 'as steady as Mount Tai.' The 10-year U.S. Treasury yield, often referred to as the 'anchor of global asset pricing,' plunged to near 3.8% in early April amid easing U.S. inflation and a flood of safe-haven capital (a drop in yield means rising bond prices). This was followed by an unprecedented tariff bombshell released by Trump on 'Liberation Day,' compounded by the catalyst of 'term premium,' sending yields soaring to 4.6%. The downward trajectory in the second half of the year left traders stunned, as yields retreated continuously from their yearly highs amidst growing pessimism to around 4.2% currently. The movement of the 30-year U.S. Treasury yield has been nothing short of dramatic; considering the severe challenges it faced over the past 12 months, it should have been on a steep upward curve. However, as of now, this asset is at almost the same yield level as at the beginning of the year.

As for the Eurobond market, although major European economies, including the UK, each face their own challenges, overall, Treasury prices across all maturities (especially those with durations of 10 years or longer) have been in continuous decline, pushing long-term yields in the European bond market to new highs. The underlying reasons largely revolve around the persistently turbulent political environments across European countries and, against the backdrop of the rapid rise of far-right forces, fiscal departments being compelled to aggressively expand debt issuance despite already soaring sovereign debt levels.

As for the Eurobond market, although major European economies, including the UK, each face their own challenges, overall, Treasury prices across all maturities (especially those with durations of 10 years or longer) have been in continuous decline, pushing long-term yields in the European bond market to new highs. The underlying reasons largely revolve around the persistently turbulent political environments across European countries and, against the backdrop of the rapid rise of far-right forces, fiscal departments being compelled to aggressively expand debt issuance despite already soaring sovereign debt levels.

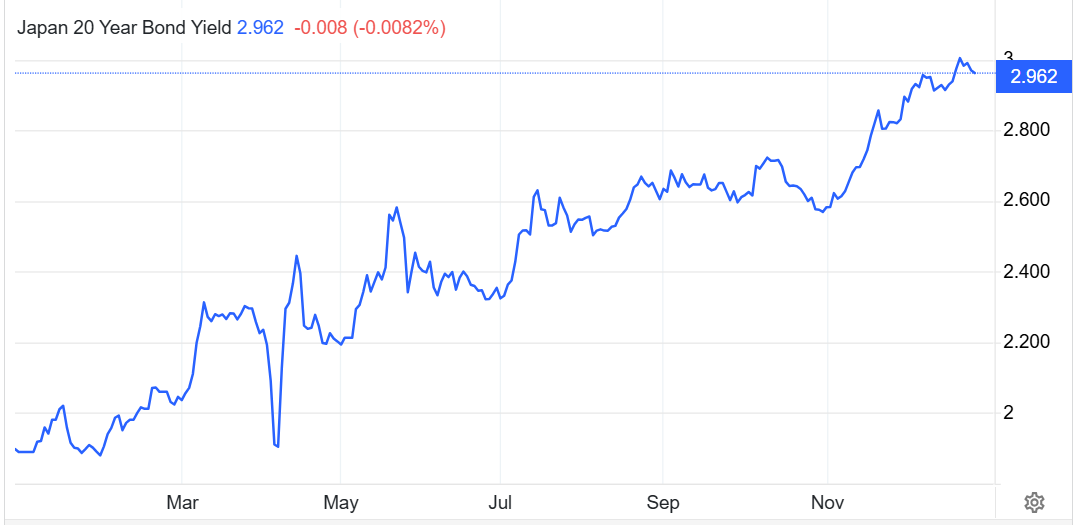

For Japan’s government bond market, which has become increasingly active as the Bank of Japan moved into a tightening cycle against the global trend of central banks cutting rates, the dual-edged sword of interest rate hike expectations and government stimulus spending has driven Japanese bond yields, which had been stagnant since the Abe era, to surge dramatically.

Looking at the entire landscape of bond market trading in 2025, for global bond traders, two core components of the credit bond market—highly rated corporate bonds (also known as investment-grade corporate bonds), long celebrated for their 'calm waters' and 'steady happiness returns,' and ABS (asset-backed securities)—have emerged as the most shocking segments of the bond market in 2025.

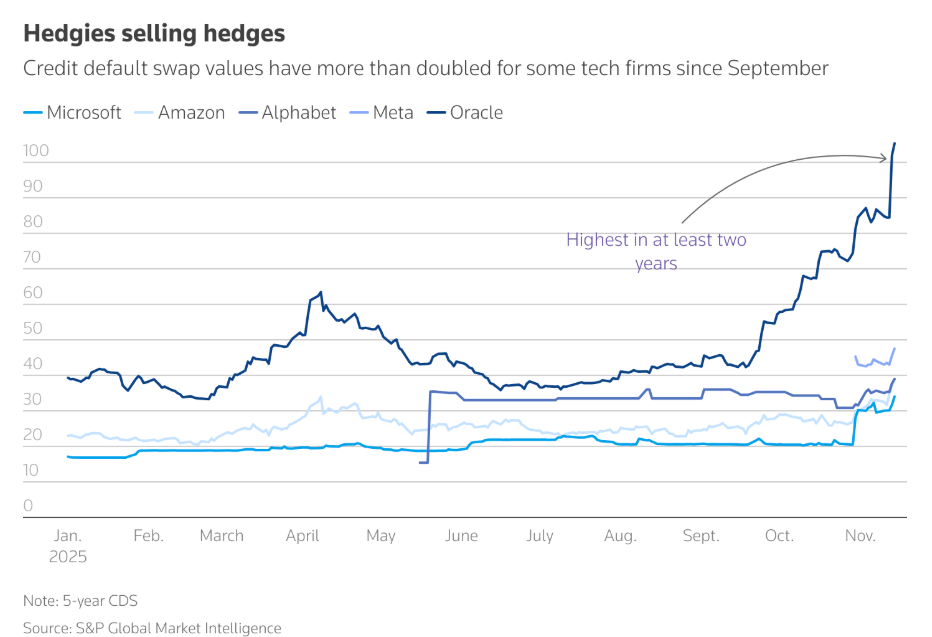

In the corporate bond market, particularly during the global AI bubble from late October to November, highly rated tech giant corporate bonds, led by Oracle and Meta (Facebook's parent company), experienced volatility comparable to their stock price movements. Oracle's corporate bonds, driven by excessive reliance on the loss-making OpenAI for cloud revenue and unprecedented debt issuance by tech giants to finance AI data centers, saw their yields spike above the benchmark for 'junk bonds' (also called high-yield bonds).

On the other hand, ABS, known for its stability and low volatility, along with 'high-yield corporate bonds,' which have long been shunned by the market, have emerged as the 'gold' of the bond market—essentially becoming safe-haven assets. Since November, ABS and high-yield corporate bonds have outperformed highly rated corporate bonds significantly, gaining favor among global bond traders and driving yields down notably.

A bold prediction about the 2026 bond market has thus surfaced: when panic selling triggered by the AI bubble and a flood of bond market supply strike together, they are overturning the entrenched trading logic of the bond market since 2020. Assets like ABS, high-yield bonds, and U.S. Treasuries with 10 years or more to maturity—long scorned by the market—are poised to experience a 'super highlight moment' in 2026, as prospects of a 'Goldilocks soft landing' for the U.S. economy become clearer. This would completely overturn recent bond market trading patterns, ending the dominance of short-duration U.S. Treasuries and highly rated tech corporate bonds among traders.

The 30-year U.S. Treasury becomes the 'most magical' asset of 2025! Europe and Japan enter a trajectory of soaring yields together.

For short-term US Treasury assets (typically those with a maturity of two years or less), this year can undoubtedly be described as a 'bull market year.' The overall price trend of the US two-year Treasury bond in 2025 has steadily risen, driven by persistent cooling inflation, a surge of safe-haven funds into short-term US Treasuries due to Trump's 'Liberation Day' tariff policy, and expectations of Federal Reserve interest rate cuts. Short-end yields are highly sensitive to monetary policy expectations, and thus, under the combined influence of 'tariff panic and rate cut expectations,' yields on two-year and shorter US Treasuries have steadily declined this year.

If one had purchased the US two-year Treasury bond at a yield near 4.5% in late 2023, by the end of this year, they would not only enjoy fixed income but also gains from a significant price expansion. As of Wednesday’s close of the US stock market, the yield on the two-year US Treasury hovered around 3.50%, having steadily declined from 4.2% since the beginning of the year—indicating a continuous upward trajectory in bond prices.

Since Trump returned to the White House to reclaim the US presidency, the core primacy of the United States in the global bond market has been repeatedly questioned. From comprehensive reciprocal tariff policies and tax cuts, to massive budget deficits, to Trump's ongoing attacks on the independence of the Federal Reserve, many investment institutions on Wall Street have been sounding nearly identical ominous warnings: 'American economic exceptionalism' is coming to an end, and there is a call to 'Sell Everything American,' particularly US Treasuries facing pressure from enormous budget deficits and aggressive tariffs that could lead to potential inflationary risks.

Nevertheless, despite these concerns, global investors continue to flood into the US sovereign debt market, driving a super rebound in the US Treasury market in the second half of this year. Those large Wall Street investment institutions that verbally claim 'American exceptionalism is in a process of collapse' are actually taking advantage of the high-yield period to aggressively buy US Treasuries at lower prices.

The year 2025 can aptly be described as one of 'historically rare severe volatility' for 10-year US Treasury assets. The yield on the 10-year US Treasury bond, often referred to as the 'global asset pricing anchor,' plummeted to near 3.8% in early April amid falling US inflation and a rush of global safe-haven funds. However, just days later, following Trump's announcement of aggressive tariff measures on so-called 'Liberation Day,' the notion of 'American economic exceptionalism' began to crumble, inflation expectations resurfaced, and continued pressure from Trump on the Federal Reserve since taking office led markets to increasingly question the Fed's independence. Additionally, tax cuts and deregulatory measures in the 'Big and Beautiful Bill' pushed by the Trump administration were seen by the market as potentially increasing debt issuance. With the budget deficit already near historic highs, the prospect of it worsening further caused 'term premium' to re-emerge, driving the 10-year US Treasury yield up to near 4.6%, a yearly high, shortly thereafter.

However, since the second half of the year, the yield on the 10-year US Treasury unexpectedly entered a downward trajectory, currently hovering around 4.15%. This was primarily due to a cooling of Trump's tariff stance, inflation remaining largely under strict control within the Fed's high-interest-rate environment, and growing expectations of a 'Goldilocks soft landing' for the US economy. Additionally, between late October and November, a wave of substantial safe-haven flows swept the globe amid panic over an AI bubble (in such large-scale panic events akin to the bursting of the internet bubble, long-duration bonds with higher yields tend to be more attractive than short-term bonds). Global capital flowed back into 10-year and longer-maturity US Treasuries.

Moreover, rising expectations of Federal Reserve rate cuts, increased tariff revenue for the Treasury, and plans by the Trump administration to reduce deficits through measures like layoffs, as well as intentions to issue more short-term rather than long-term debt to reduce financing costs and asset duration risk, have also driven long-term US Treasury yields downward. Compared to US Treasuries, major sovereign bond markets worldwide—such as Eurozone and Japanese bonds, as well as Australian and New Zealand bonds—have performed sluggishly. The US still appears as the 'least bad' investment choice in the external world, often referred to as the 'cleanest dirty shirt.'

The US 30-year Treasury bond, which has been overlooked by the market in recent years, can be considered the 'most miraculous asset' of 2025. As 2025 draws to a close, unlike the sustained rise in short-term US Treasuries and the downward trend in the 10-year US Treasury amid severe volatility, the yield on the 30-year US Treasury bond has remained unchanged throughout the year (hovering near 4.8% at both the start and end of the year). This 'resilient performance' has left traders astonished.

An analysis of the movement of the 30-year US Treasury bond reveals that the primary logic behind its lack of significant decline or increase throughout the year is as follows: First, despite volatile macroeconomic conditions—such as persistently above-target inflation, expanding fiscal deficits, and fluctuating market risk aversion—all of which could drive yield changes, institutional investors (such as pension funds, insurance companies, and mutual funds) have maintained strong demand for long-term bonds, providing crucial support for prices. These long-term funds need to match long-term liabilities with long-duration assets, thereby continuously absorbing 30-year bonds in auctions and markets, offsetting potential supply pressures and negative shocks. Second, enhanced risk aversion and safety preferences have also increased demand for ultra-long-term government bonds. Amid the 'AI bubble theory' causing significant volatility in global equities and bonds and rising uncertainty in currencies like the dollar, the role of long-duration US Treasuries as a 'safe haven' has been strengthened. Lastly, due to fluctuating inflation expectations, 'term premium' disturbances, and uncertainty regarding the Federal Reserve’s future interest rate path earlier in the year, the downward impact of rate cut expectations on long-term yields was partially limited, resulting in some fluctuations within the year but no significant breakout from the initial level. This tug-of-war between supply-demand dynamics and expectations contributed to the 'steadfastness' of the 30-year yield.

On the Eurobond front, the main reason for the sharp increase in Germany's 10-year Treasury yield lies in the lack of unity within the governing coalition comprising the Union parties (CDU/CSU) and the Social Democratic Party (SPD), which holds only a slim majority in parliament. Moreover, the German government’s declaration to pursue 'whatever it takes' to advance defense and infrastructure modernization—potentially issuing a record €500 billion in debt next year—has propelled all maturities of German bond yields onto an upward curve. Similarly, the logic behind the continued decline in UK gilt prices across all maturities resembles Germany’s fiscal expansion, compounded by waning expectations of Bank of England rate cuts amid a backdrop of rising UK inflation.

The logic behind the continued expansion of France's 10-year government bond yields, in addition to factors similar to the broader European trend of expanding budget deficits and debt issuance, primarily lies in the persistent domestic political instability—such as frequent changes in prime ministers (four different individuals within a year), which has led to growing skepticism among investors regarding French sovereign bonds. Coupled with the current state of a 'hung parliament plus minority government,' characterized by high political negotiation costs and significant uncertainties in advancing legislation and budgets, instability in implementing core policies such as fiscal budget cuts, immigration control, and comprehensive welfare management has notably increased.

Japanese government bond yields, particularly for long-term bonds such as 20-year, 30-year, and 40-year maturities, have repeatedly hit record highs. The main reasons differ from those in the US and Europe, primarily due to rising expectations of interest rate hikes by the Bank of Japan and an unprecedentedly large stimulus plan on the order of ten trillion yen under the Sanae Takaichi administration. This has caused the dreaded 'term premium'—which originated in the US—to sweep across Japan’s stock, bond, and currency markets, resulting in a collective surge in JGB yields since the beginning of this year and a continuous depreciation of the yen.

The latest market news indicates that Bank of Japan Governor Kazuo Ueda, by expressing increasing confidence in the central bank’s ability to achieve sustainable price growth, hinted at the possibility of further interest rate hikes next year. Japanese Prime Minister Sanae Takaichi stated on Thursday that the budget for the fiscal year starting April 2026 is estimated at approximately 122.3 trillion yen ($786 billion), representing an increase of about 6.3% compared to the 115.2 trillion yen allocated for the current fiscal year. This spending increase even outpaces inflation, setting a record for the largest initial budget in history. Given that Japan remains the most debt-burdened country among developed economies, such a scale of fiscal expenditure will inevitably further push up long-term government bond yields, which have been surging since the beginning of this year.

Oracle's yield soars from investment grade to junk status! An AI bubble storm sweeps through the credit bond market.

Since late October, when the 'AI bubble narrative' swept global financial markets, and amid signs of panic and liquidity pressures emerging in the private credit market since the second half of 2025, fueled by a borrowing spree from US tech giants like Meta, Amazon, and Oracle, bond market capital flows lending to top-rated companies globally are being deterred. This trend could significantly increase financing costs, thereby severely impacting corporate profitability worldwide and adding new selling pressure to an already jittery financial market.

At the core of market anxiety lies the logic of AI investment itself. Recently, the increasingly exaggerated 'AI circular investment' led by OpenAI, the developer of ChatGPT, along with unprecedented large-scale debt issuance by giants like Oracle to fund AI data center construction, has raised concerns over deteriorating financial fundamentals. This has led the market to increasingly worry about an impending 'AI bubble burst.' After all, most investors remain skeptical that OpenAI, with annual revenue below $20 billion, can shoulder $1.4 trillion in AI infrastructure spending—despite its ability to secure financing in the tens of billions of dollars. Over time, market concerns about the formation of an 'AI bubble nearing collapse' have continued to mount.

This sentiment has begun to reflect in mainstream institutional views. A recent Goldman Sachs research report shows that large technology companies investing the most in hopes of winning the AI arms race may face highly uncertain returns on investment over an extended period. Goldman Sachs stated that the narrative around AI is now in the 'final chapter of the prologue'—meaning we are currently at the 'end of the beginning' of the AI story in the market. The bullish sentiment, where most value created by AI was expected to accrue to large language models and everything 'AI-related' was universally seen as promising, likely reached its conclusion. The market will become stricter in identifying true beneficiaries. Ed Yardeni, founder of Yardeni Research, recently advised investors to 'underweight' the seven major tech giants like NVIDIA relative to the rest of the S&P 500 index. This marks the first time since 2010 that he has shifted his stance from overweight on the US large-cap tech sector.

Meanwhile, debt pressures are rapidly accumulating. According to Dealogic data, as of the first week of December, global tech companies issued a record $428.3 billion worth of bonds in 2025 alone. US corporate bond issuance amounted to $341.8 billion, while European and Asian tech companies issued $49.1 billion and $33 billion, respectively. Debt issuance in these three major markets has reached historic highs.

Amid intensifying competition in AI computing infrastructure, even cash-rich, highly-rated tech companies have had to take on substantial debt to finance related investments. Morgan Stanley predicts that by 2028, total global investment in hyperscale AI data centers will reach approximately $2.9 trillion, with more than half ($1.5 trillion) reliant on external financing.

It is reported that Amazon recently launched its first investment-grade bond issuance in three years, aiming to raise $15 billion. Oracle plans to finance its hyperscale AI data center project in collaboration with OpenAI through a massive debt financing deal—approximately $38 billion is underway, marking the largest-ever debt financing for AI infrastructure to date. Additionally, SoftBank and Oracle's joint 'Stargate' initiative is expected to exceed $400 billion in investment over the next three years.

This nearly reckless capital expenditure has placed immense pressure on previously robust balance sheets. Investors in the bond market, known for their keen sense of risk, have begun reassessing the default risks of these tech giants, triggering significant volatility in credit pricing systems.

As the most direct indicator of the 'AI bubble theory,' the credit default swap (CDS) market has already signaled a warning. Recently, the spread on Oracle's five-year CDS has almost doubled over the past two months to 150 basis points, reaching its highest level since 2009. Even Microsoft’s CDS spread surged from around 20.5 basis points at the end of September to approximately 40 basis points. Bond yields also reflect distortions in credit ratings: the yield on Oracle's corporate bonds maturing in 2035 rose to 5.9%, surpassing levels of some high-quality 'junk bonds,' suggesting that the market is pricing its credit risk as if it no longer belongs to investment-grade entities.

The coupon rate on SoftBank's yen-denominated bonds issued in November has reached 3.98%, the highest in 15 years, reflecting a substantial increase in financing costs.

For the world’s largest cloud service providers like Oracle, they not only face mounting interest pressures but also structural risks stemming from heavy reliance on single large clients, such as OpenAI. John Stopford, Head of Multi-Asset Income at Ninety One, pointed out that when a borrowing boom coincides with a surge in new debt issuance, rising borrowing costs will directly squeeze profit margins, potentially bursting the market's overly optimistic perception of AI-driven prosperity.

Amid an environment characterized by the rise of AI-driven lending frenzies, temporary panic in the private credit markets following frequent defaults, and ongoing market sentiment disruptions caused by the 'AI bubble narrative,' highly-rated corporate bonds—those perceived as safest due to historically tight spreads—are paradoxically becoming prime targets for Wall Street institutions to offload or even aggressively short sell during rallies.

Michael Hartnett, a Bank of America strategist renowned as 'Wall Street’s most accurate strategist,' made a bold prediction in his latest report: the best trade entering 2026 will be shorting the corporate bonds of 'hyperscalers'—tech giants heavily investing in AI infrastructure. He argues that the debt burden triggered by accelerated construction of AI data centers will become a new 'Achilles' heel' for these technology behemoths.

“If the AI-driven borrowing frenzy continues to heat up while the market sees a flood of new issuances, borrowers will have to pay a higher premium. If companies incur higher borrowing costs, their profits will drop significantly, ultimately puncturing the market’s illusion of false prosperity.” John Stopford, Head of Multi-Asset Income at Ninety One, stated in a report, adding that he had reduced credit exposure in his funds to near zero over the past few weeks.

Key Themes for Bond Market Trading in 2026: Long-Duration U.S. Treasuries, High-Yield Bonds, and Asset-Backed Securities (ABS)

According to top Wall Street investment firms’ outlooks for 2026 bond strategies, long-duration U.S. Treasuries will present better investment prospects than shorter-duration ones. The underlying logic includes several factors: tariff-induced price increases will prove to be temporary inflationary disturbances by the first half of 2026; Trump’s nominee for Federal Reserve Chair will likely adopt a dovish stance; short-term Treasuries have already priced in excessive rate-cut expectations, whereas long-duration Treasuries still experience 'term premium' fluctuations driven by deficit expectations throughout 2025, failing to fully price in the path toward rate cuts. Additionally, the Treasury Department’s preference for issuing more short-term debt will reduce the supply of long-term bonds—market participants clearly observe that the Trump administration does not want persistently elevated yields on long-duration Treasuries and aims to gradually narrow budget deficits. Coupled with the allure of 4% yields on long-duration bonds amid potential 'AI bubble storms' looming in 2026, long-duration Treasuries appear far more attractive compared to consistently strong short-term bonds in recent years.

However, U.S. Treasuries with durations of two years or less may outperform long-term bonds in the first half of next year, primarily due to the liquidity boost from the Federal Reserve’s announced $40 billion monthly bond-buying program in December, which benefits short-term Treasuries. This operation focuses on purchasing short-term bills (T-Bills), aiming to maintain ample reserves within the financial system and ease short-term money market rate pressures rather than constituting traditional large-scale quantitative easing (QE). Nevertheless, the mere mention of 'Fed participation in bond purchases' could significantly enhance demand and liquidity for short-term Treasuries in the near term.

Compared to core global sovereign bonds such as European debt and Japanese government bonds, US Treasuries, which have long held the title of 'safe haven + high quality,' are uniquely appealing. In contrast to the still uncertain economic prospects of Europe and Japan, the trajectory of a 'soft landing' for the US economy is becoming increasingly clear. 'When you look at other alternatives, they all face their own severe challenges,' said Ruben Hovhannisyan, a fixed-income portfolio manager at TCW, when discussing the outstanding performance of long-term US Treasuries in the second half of the year. 'The analogy of being the 'cleanest dirty shirt' is very, very fitting, and there is no highly liquid alternative that can clearly replace long-term US Treasuries.'

'Despite the increasingly chaotic and unusual overall environment in the US market, when you examine the data, the market narrative does not align with price movements,' he emphasized. 'Although the narrative logic about the end of 'American exceptionalism' persists, US Treasuries remain highly competitive and continue to attract foreign capital inflows. When you review the entire global bond market and the differences in respective economic cycles, there isn't a sufficiently compelling alternative story in the bond market that makes sense.'

Daniel Ivascyn, a portfolio manager at Pimco, recently stated: 'Lower interest rate expectations in the US market and rising global economic uncertainty will push risk-averse investors, who prefer to hold cash, fully toward the US Treasury market offering fixed income.' 'As the Federal Reserve eases policy, you'll see a situation where credit risks in some economies may be increasing, while your cash returns are declining. This could continue to support high-quality, long-duration fixed-income assets, such as 10-year US Treasuries.'

Wall Street financial giant Morgan Stanley recently stated that by 2026, market trading logic may fully return to 'bad news is bad news,' with 10-year and longer-dated US Treasuries—offering both price elasticity potential and attractive yields—regaining their status as portfolio anchors akin to the two decades of pre-pandemic inflation normalization. This implies that long-dated US Treasuries could benefit from significant safe-haven inflows triggered by major sentiment-shifting events like an 'AI bubble,' as well as long-term institutional flows driven by the 'Goldilocks soft landing narrative' (which refers to the US economy being neither too hot nor too cold, maintaining moderate GDP and consumer spending growth alongside a long-term trend of mild inflation, while benchmark rates trend downward). According to the latest forecasts from Wall Street asset management giant Franklin Templeton Investments and TD Securities, the 10-year US Treasury yield could fall below 3.5% by the end of 2026, indicating that strong demand may drive prices higher.

In contrast, the logic for European bonds is entirely reversed—with both short- and long-term yields likely to move toward a 'steepening upward' curve, primarily due to the ECB's rate-cutting cycle stalling, the continued attractiveness of US Treasuries over economically sluggish and politically unstable Europe, Germany's unprecedented scale of bond issuance, and France's political turmoil. More notably, the ECB’s bond-buying frameworks (PEPP and APP) have been fully halted, meaning that Europe’s massive bond supply in 2026 will rely entirely on market demand, causing short-term curves to steepen irrationally due to supply-demand imbalances.

Japan may similarly see upward pressure on both short- and long-term government bonds, given the ongoing rate hike cycle and long-term dominance of expansionary fiscal policies. The 'term premium'-driven yields on 10-year and longer Japanese government bonds may continue hitting record highs until the Bank of Japan signals a pause in rate hikes. Given Japan's vast overseas asset base, a sharp spike in JGB yields in the short term could trigger a massive repatriation of funds from already profitable overseas assets into high-yielding yen-denominated assets domestically. This might lead to a global stock-bond-currency crash akin to the 'Black Monday' event of August 2024—a scenario investors should remain vigilant about.

For corporate bonds, a core component of the credit market, investor preference may shift more toward high-yield bonds—so-called 'junk bonds'—by 2026, especially amid the 'soft landing + mild rate cuts' narrative, which serves as a macroeconomic storyline seemingly tailor-made for high-yield debt. These high-yield corporate bonds exhibit more stable pricing logic compared to investment-grade bonds issued by tech giants like Oracle, Microsoft, and Meta, whose issuance scales continue expanding. They need not overly concern themselves with the potential bearish shocks from an 'AI bubble burst' narrative. Moreover, as the US government implements the 'Build Back Better Act' and populism-driven far-right forces gain prominence globally, not only is the Trump administration focused on 'Making America Great Again,' but nations worldwide are increasingly prioritizing domestic economic growth. This broader diversification in global equity markets implies future investment opportunities will no longer concentrate solely on AI. Such global economic growth dynamics and 'sector rotation bull market trends' act as significant catalysts for high-yield bonds.

The global stock market crash triggered by the AI bubble, coupled with Oracle and Meta's debt issuance frenzy leading to a collective plunge in high-rated tech corporate bonds, presents an excellent rebound opportunity for long-overlooked high-yield bonds and ABS amid these negative trends and the Fed’s rate-cutting cycle. Goldman Sachs noted in its 2026 outlook report that despite tech companies’ balance sheets remaining robust globally, the construction of AI data centers increasingly relies on debt financing, potentially making credit markets more fragile.

Goldman Sachs analysts believe that even if global stock markets continue to rise, it may be accompanied by increased stock volatility and widening credit spreads, resembling conditions seen just before the 1998-2000 tech bubble burst. Under such trends, highly rated bonds near historical valuation peaks may decline alongside equities, while high-yield bonds present investment opportunities. Goldman Sachs considers high-yield bonds with minimal correlation to AI infrastructure as one of the 'core sources of fixed income in 2026,' with fundamentals (interest coverage, default rates, etc.) remaining resilient, though the implicit premise remains that 'selective strategies/structures and individual bonds matter.' Another Wall Street financial giant, Bank of America, advises investors to shift allocations from overvalued tech giants to international small-cap stocks, high-yield bonds, and assets like gold.

Another credit-related fixed-income asset—ABS—may also offer better investment prospects than high-rated corporate bonds in 2026. Morgan Stanley explicitly lists MBS/ABS as its 'highest confidence overweight' in fixed income, particularly favoring high-rated, fundamentally strong ABS. Although ABS has underperformed corporate bonds overall in 2025, its credit spread performance since November has significantly outpaced the broader corporate bond market, especially surpassing tech corporate bonds, highlighting its value as a safe haven amid AI bubble fears. ABS advantages stem mainly from shorter durations, structured credit enhancement/cash flow amortization, resulting in extremely low volatility and stable cash flows. Compared to investment-grade tech corporate bonds from 'AI-heavy capex/sensitive to financing narratives' issuers like Oracle, Meta, and Microsoft, high-rated, short-duration ABS may demonstrate alpha attributes in the credit bond space amidst lingering AI bubble concerns.

Editor/jayden