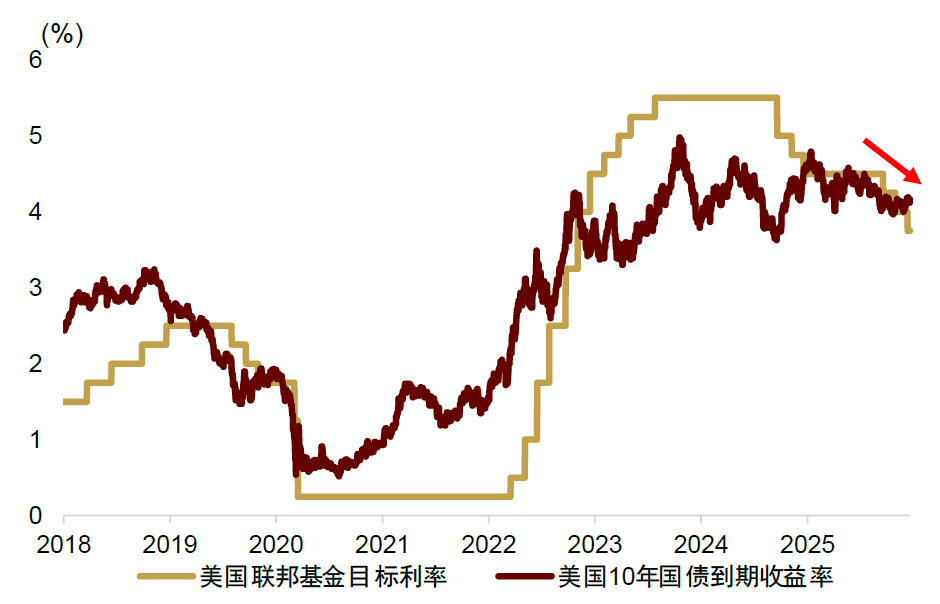

Recently, gold prices surged past $4,530 per ounce, setting a new historical high. This movement was driven by three key factors: first, the Federal Reserve restarted its easing cycle. After maintaining policy interest rates unchanged for nine months, the Fed resumed rate cuts in September this year, implementing three consecutive 25-basis-point reductions. Additionally, it announced plans to begin purchasing short-term Treasury bonds in December, expanding the central bank’s balance sheet and injecting liquidity into the market. Looking ahead to 2026, the Fed’s forward guidance suggests that further rate cuts may continue into next year. The overall monetary policy direction remains accommodative, supporting the performance of gold.

Chart: The Federal Reserve resumed rate cuts in September this year, implementing three consecutive 25-basis-point cuts.

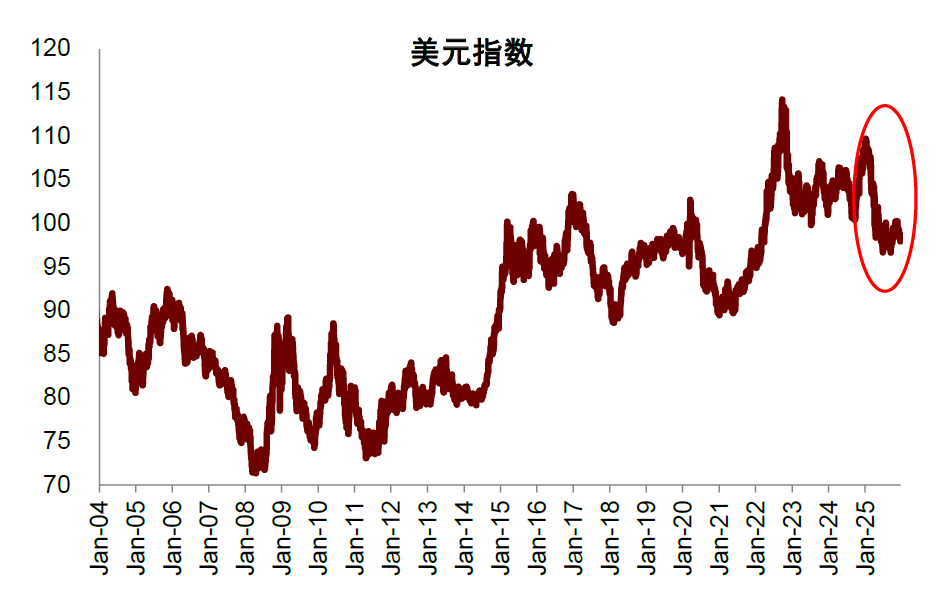

Second, the credibility of the U.S. dollar has declined. Following the pandemic, the U.S. fiscal deficit ratio rose to around 6%, far higher than its pre-pandemic level, leading to rapid accumulation of national debt and rising debt risks. Moreover, recent interventions by President Trump into the Fed’s decisions have increased. Current Fed Chair Powell will step down in May 2026, and Trump is set to nominate a new Fed Chair, raising investor concerns about a potential decline in the Fed’s independence. These fiscal and monetary factors combined have eroded investor confidence in the dollar system and dollar-denominated assets, pushing the dollar into a depreciation cycle, with the dollar index having fallen approximately 10% this year. Gold possesses monetary attributes and serves as an alternative to the current dollar-based system, benefiting from the erosion of dollar credibility.

Chart: The dollar index began a depreciation cycle at the start of 2025.

Chart: The dollar index began a depreciation cycle at the start of 2025.

Finally, there is an escalation of global geopolitical risks. Recently, the United States' sanctions on Venezuela's oil exports have evolved into a substantive maritime interception operation. Meanwhile, Ukrainian drones attacked key energy export infrastructure on Russia's Black Sea coast, and negotiations over the Russia-Ukraine conflict have reached a deadlock. Gold, with its safe-haven attributes, benefits relatively at this time. While gold has surged significantly, silver has risen even more, possibly influenced by factors related to industrial supply and demand. Due to its industrial characteristics, silver demand is highly sensitive to manufacturing cycles and the new energy industry. In 2025, global demand for silver in photovoltaic installations, new energy vehicles, and electronics and electrical equipment sectors will continue to increase, while the expansion of silver supply remains limited, leading to tightening supply and demand margins.

How long will gold continue to rise?

This gold bull market has persisted for three years, with prices increasing 2.7 times. Market narratives are now emerging that frame gold’s rise as a prolonged trend. CICC’s multi-asset team has recommended overweighting gold for three consecutive years since the fourth quarter of 2022. However, we believe gold prices will not rise indefinitely, and shifts between bull and bear markets are normal. Investment decisions should not be guided by grand narratives but rather by objective data-driven analysis of asset behavior patterns. Our review of major global asset classes shows that the durations of gold’s bull and bear markets are relatively balanced, with individual bear markets being the longest-lasting among major asset classes.

Chart: Statistics on the duration and magnitude of bull and bear markets for major global asset classes.

Note: The A-share, Hong Kong stock, and US stock markets are defined as bull markets when gains exceed 20% for durations of more than six months; the remaining periods are considered bear markets. Chinese bonds and US bonds are defined as bear markets when yield increases exceed 75 basis points for durations of more than six months; the remaining periods are considered bull markets. Commodities, copper, gold, and crude oil are defined as bull markets when yield increases exceed 30% for durations of more than twelve months; the remaining periods are considered bear markets. Turning points are identified as follows: Bear markets begin from the day of the peak, and bull markets begin from the day of the trough. Bond price fluctuations reflect changes in interest rates.

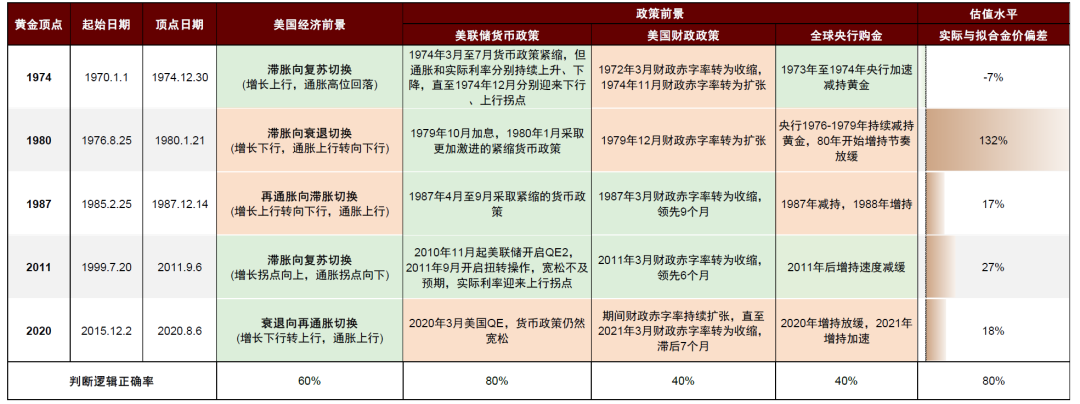

Thus, after three years of significant gold price increases, it is now necessary to study the general patterns signaling the end of a gold bull market and prepare accordingly. We conducted a systematic review of the tops of five historical gold bull markets and found that clear tightening of the Federal Reserve's monetary policy alongside fundamental improvements in the U.S. economy (rising growth, falling inflation) are the most effective indicators of a bull market top.

Chart: Patterns at the Top of Gold Bull Markets: Federal Reserve policy signals are relatively accurate, with lower difficulty in identifying tops compared to equities.

Note: 1) The deviation between actual and fitted gold prices is calculated based on residuals from the gold valuation model and fitted prices. 2) Green-filled cells indicate signals bearish for gold, while red indicates bullish signals.

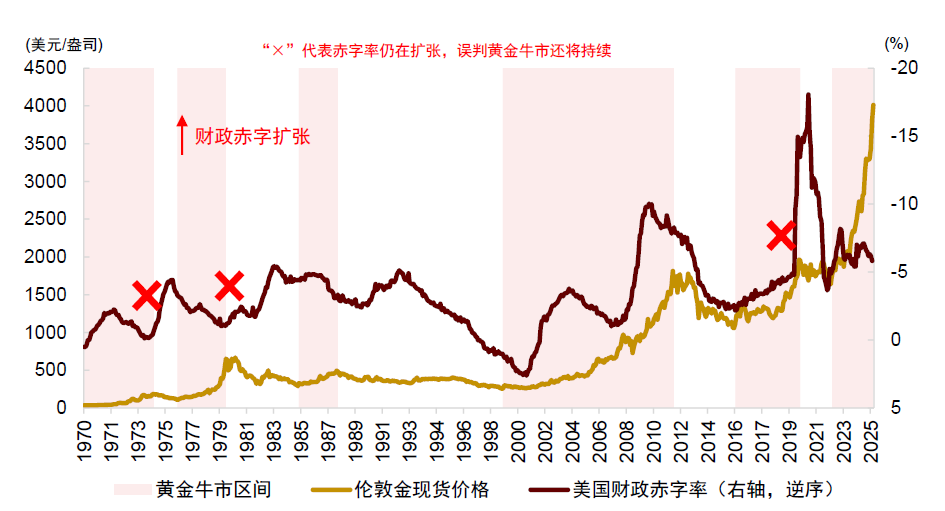

Whether the expansion of US debt and fiscal deficits or central banks’ accelerated gold purchases have limited indicative significance for the top of the gold bull market.

Chart: Central bank gold purchase volume forecasts the top of the bull market with moderate accuracy.

Chart: The US fiscal deficit rate has long-term explanatory power for gold prices but does not accurately predict the timing of gold market tops.

The Federal Reserve remains in an easing cycle, with the U.S. economy still plagued by stagflation (declining growth and rising inflation). Therefore, until there is evidence of a turning point in U.S. policy and the economy, the gold bull market may continue, and we maintain our overweight position in gold.

How much further can gold rise?

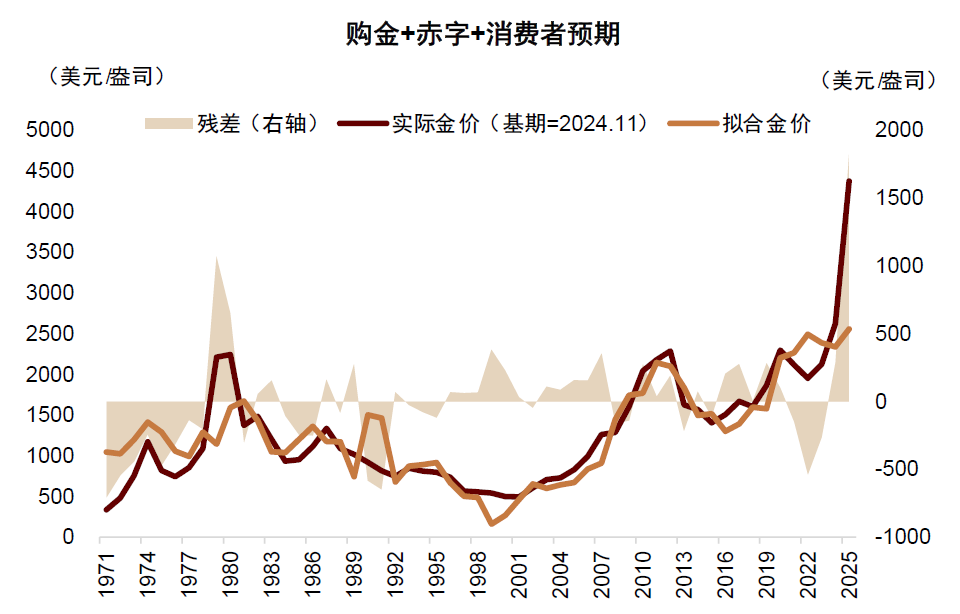

In early 2024, the gold price rose from its low of $1,640 per ounce in October 2022 to near $2,000 per ounce. The market has shown significantly increased divergence in gold valuation assessments. However, we firmly believe that gold is not overvalued. We argue that the traditional pricing framework is becoming obsolete and have introduced, for the first time, a four-factor model (real interest rates, the U.S. dollar, central bank gold purchases, and U.S. debt levels) to systematically explain and forecast gold prices, proposing a price midpoint of $2,400 per ounce for gold.

In January 2025, we upgraded to Gold Model 2.0 and raised our long-term gold price forecast to $3,300-$5,000 per ounce.

Gold has now risen to around $4,500 per ounce, already reaching our long-term price forecast ahead of schedule. Based on current fundamental indicator values, the gold price has already significantly exceeded the short-term valuation midpoint calculated by our model, indicating the possible presence of a bubble.

Chart: Gold price has significantly exceeded the valuation midpoint calculated by the model

Based on the above discussion, as there has been no turning point in Federal Reserve policy or the U.S. economy, the gold bull market may not yet be over. However, after gold prices have deviated from fundamental indicators and model fits, market volatility may increase significantly, making specific price level predictions more challenging. We recommend de-emphasizing precise gold price forecasts and focusing more on timing changes in asset trends. We expect that by early 2026, due to persistently rising U.S. inflation and marginal improvement in growth, the Federal Reserve may slow the pace of easing, potentially creating temporary downward pressure on gold performance. Looking further ahead, with the inauguration of a new Federal Reserve Chair in May 2026 and a downward inflection point for U.S. inflation expected in the second half of 2026, the Fed may accelerate rate cuts again, providing new support for further gold price increases. Thus, the future gold bull market may not follow a one-way trend but will fluctuate based on shifts in Federal Reserve policy and the U.S. economic outlook.

The same logic applies to commodities such as silver. Due to silver's smaller market size and relatively lower liquidity, its price volatility may exceed that of gold.

Asset allocation recommendations: Maintain an overweight position in gold, capitalize on short-term trading opportunities and liquidity spillover effects, upgrade commodities to neutral weight, maintain an overweight position in Chinese equities, underweight Chinese bonds, and maintain a neutral weight in U.S. equities and bonds.

Gold has risen sharply this year, resulting in elevated valuations. A temporary pullback in the Fed’s easing expectations in early 2026 could pose risks. Considering that the Fed is ultimately expected to accelerate monetary easing again next year, a significant correction in gold prices early next year might present an opportunity to increase allocations at lower levels. Following the sharp rise in gold, commodities such as copper and silver have also shown strong performance, partly reflecting spillover effects from gold’s liquidity. Furthermore, commodities can hedge against geopolitical risks and the risk of overheating in the U.S. economy. In our annual outlook, we recommended upgrading commodities to neutral allocation, with particular optimism toward nonferrous metals. Meanwhile, we note that metals like silver have smaller market sizes and lower liquidity compared to gold. If gold experiences volatility next year, the risk of a correction would be greater. We advise implementing robust risk controls and avoiding blind chasing of upward trends.

Chinese equities continue to benefit from the wave of AI technology and ample liquidity. Current valuations are reasonable, and no signals indicating a market peak have emerged. Hence, we remain firmly optimistic about the revaluation of Chinese assets and maintain an overweight position in Chinese stocks. In terms of style, due to relatively moderate pro-growth policies, the market may still favor technology growth in the short term. A shift to cyclical or value styles will require clearer economic or policy signals.

Chinese bond yields are already at relatively low levels, with relatively high valuations. Market capacity for long-term bond supply is limited, increasing the likelihood of further steepening of the yield curve. We recommend maintaining an underweight position in Chinese bonds.

Chart: Over the past two years, the decline in bond yields has outpaced economic fundamentals, resulting in expensive bond valuations and potential adjustment risks.

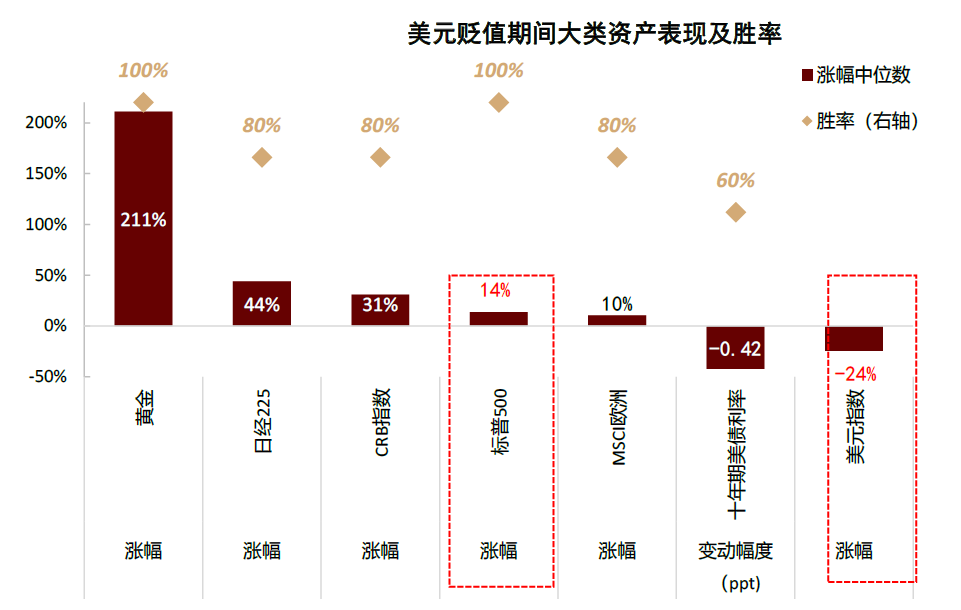

Regarding overseas assets, U.S. equities also benefit from macro liquidity and AI industry trends. However, their elasticity during the dollar depreciation cycle is low, compounded by concerns over high valuations, posing significant risks for chasing gains. We recommend maintaining a standard allocation for U.S. equities.

Chart: During each period of dollar decline, non-U.S. equities have outperformed U.S. equities.

At the same time, it is important to note that if U.S. economic growth and inflation stage a temporary rebound in the first quarter of next year, there may be a possibility of a shift between growth and value styles. For U.S. Treasuries, inflationary pressures and the retreat of easing expectations early next year could create volatility. Following the implementation of the "Inflation Reduction Act" at the beginning of the year, U.S. fiscal debt issuance has increased. If the "reciprocal tariffs" are overturned by the Supreme Court, there may be risks of temporarily issuing more U.S. Treasuries to raise funds, which could negatively impact U.S. Treasury performance. Thus, we suggest maintaining a standard allocation for U.S. Treasuries in the short term.

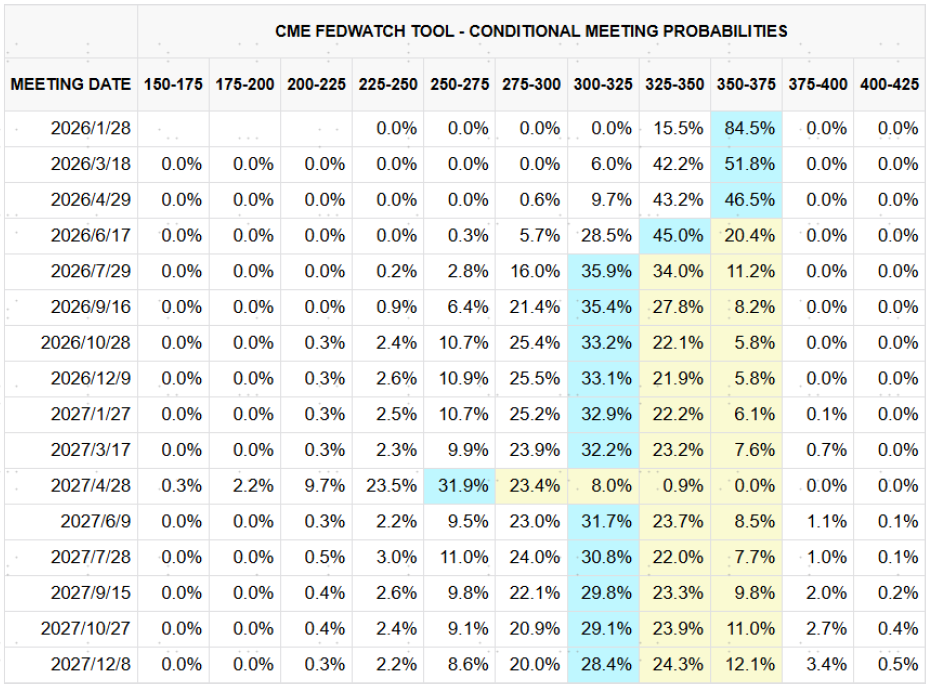

From a medium-term perspective, the market currently only expects the Federal Reserve to cut interest rates twice in 2026, which we believe is overly conservative. The new Federal Reserve Chair will take office in May next year, and U.S. inflation may enter a downward cycle in the second half of the year, providing the Fed with the conditions to cut interest rates more than twice. The 10-year Treasury yield may also fall to around 3.5%. We recommend patiently waiting for the appropriate timing to increase allocation to U.S. Treasuries.

Chart: Futures market expects the Federal Reserve to cut interest rates only twice in 2026

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/melody