Apple's stock experienced a significant rebound in the second half of 2025, outperforming both the S&P 500 Index and its peers among the 'Magnificent Seven' tech giants during the same period.

Despite underperforming its 'Mag 7' peers and the broader market in the first half of 2025, $Apple (AAPL.US)$ after an 18% decline as of June, it staged a strong rebound of 35% in the second half, achieving a net gain of over 11% for the year, outpacing $S&P 500 Index (.SPX.US)$and many large-cap technology stocks.

Zhitong Finance observed that this turnaround was driven by steady acceleration in core iPhone and Mac sales, as well as margin expansion supported by a favorable product mix, which partially offset rising operating expenses related to AI research and development.

However, the stock's rise to new all-time highs in the second half leaves minimal room for error heading into the new year. While Apple still holds potential catalysts such as a more personalized Siri and the foldable iPhone 18, these are viewed more as necessary moves to maintain competitiveness rather than disruptive drivers capable of significantly expanding growth prospects. Additionally, the current valuation premium does not fully reflect a series of imminent challenges.

However, the stock's rise to new all-time highs in the second half leaves minimal room for error heading into the new year. While Apple still holds potential catalysts such as a more personalized Siri and the foldable iPhone 18, these are viewed more as necessary moves to maintain competitiveness rather than disruptive drivers capable of significantly expanding growth prospects. Additionally, the current valuation premium does not fully reflect a series of imminent challenges.

This article focuses on analyzing three underappreciated direct risks.

Challenge One: Prematurely Exhausted iPhone Upgrade Demand

Apple set an iPhone sales record in the September quarter, primarily driven by robust demand for the iPhone 16/17 series, with growth even constrained by supply shortages. Management indicated that the December quarter's growth guidance includes a significant backlog of iPhone 17 orders, suggesting an acceleration in growth.

Looking ahead to fiscal 2026, however, the outlook for iPhone demand appears concerning. Although management downplayed the role of tariffs in pulling forward demand, major U.S. carriers have widely observed earlier-than-usual device upgrade activities since the tariff announcement in April, ahead of the typical fall cycle. The redesigned iPhone 17 also successfully captured consumer interest. However, these demand drivers are unlikely to be sustainable.

The upcoming foldable iPhone 18 is expected to struggle as a strong growth engine. Its initial supply will be severely limited, and foldable screens have yet to gain mainstream market appeal. More importantly, the massive upgrade wave anticipated since the iPhone 12 era, originally expected to be driven by AI capabilities, saw lackluster demand in early 2025 due to repeated delays in Apple’s AI feature launches. Subsequently, tariff concerns instead stimulated iPhone 16 upgrade demand in the second half of 2025.

This implies that demand pulled forward by tariffs and the design innovation of the iPhone 17 could leave Apple facing a challenging comparative base in fiscal 2026, compounded by diminishing effects from rising average selling prices due to product mix changes, increasing the risk of slower growth.

Challenge Two: Increasing Cost Pressures

In the fiscal year 2025, Apple achieved faster profit growth than revenue growth due to a favorable product mix. Management expects this trend to continue in the short term. However, future margin expansion is limited and unlikely to fully offset cost structure deterioration driven by multiple factors.

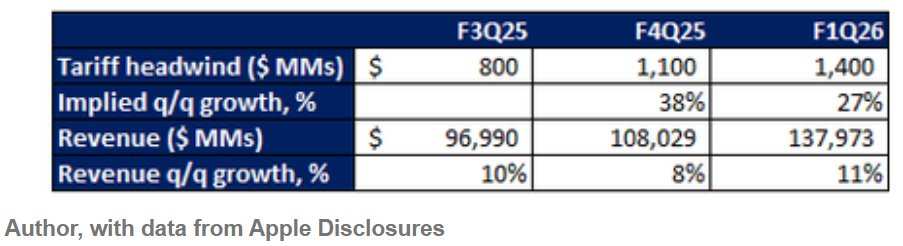

Tariff risks: Although tariff-related costs are currently manageable thanks to proactive supply chain management and trade agreements, long-term risks remain unresolved. Apple’s efforts to diversify its supply chain are ongoing, but uncertainties in U.S.-China trade relations, along with reliance on tariff incentives tied to investment commitments for production in India, create variability in long-term costs.

Rising material costs: To align with the 'Made in America' initiative, Apple has increased domestic production of key components (such as Corning glass and $Taiwan Semiconductor (TSM.US)$locally manufactured chips), which has driven up costs. Taiwan Semiconductor has already warned that its U.S. operations will weigh on profit margins. Meanwhile, the entire industry is facing upward pressure from rising raw material prices, particularly memory chips. The cost of LPDDR5X memory used in iPhones has more than doubled over the past year. Although Apple enjoys certain advantages due to its scale, it is not entirely immune to market price fluctuations.

Other pressures: Although the higher-margin services segment continues to achieve strong profitability, its normalization to low- to mid-teens percentage growth is unlikely to offset the pressures discussed in the product segment analysis. This is evidenced by Apple’s modest gross margin expansion observed over recent quarters, as service growth and its share of total revenue stabilize. Given that Apple is unlikely to significantly raise product prices, tools to sustain future margins are limited.

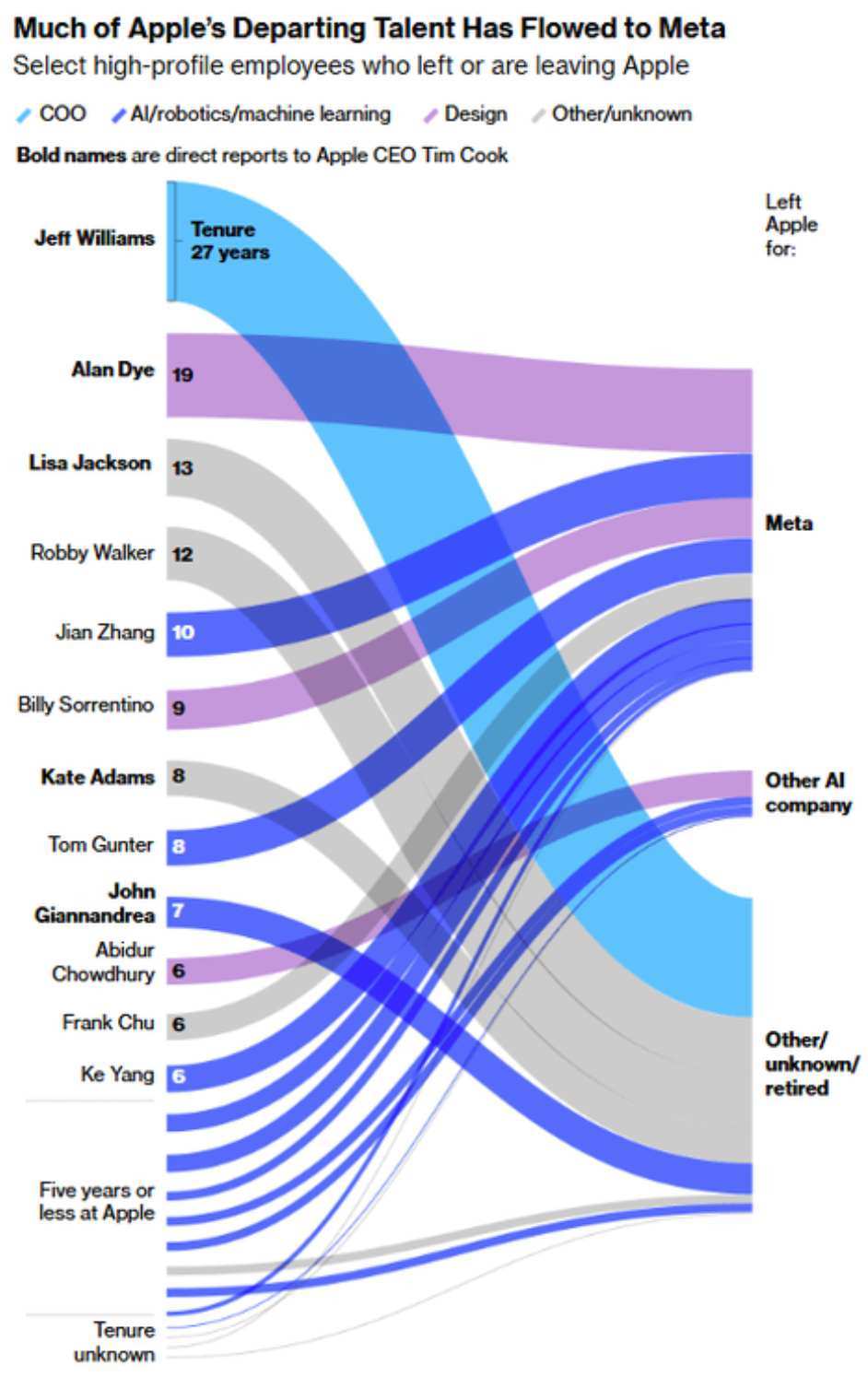

The recent wave of high-profile talent departures has further exacerbated the issue. Notable resignations include John Giannandrea, Senior Vice President of Machine Learning and AI Strategy; Alan Dye, Head of User Interface Design; and Ruoming Pang, Chief Scientist of the AI Model Team. Amid its ongoing AI transformation, Apple's efforts to retain and attract critical talent face heightened risk of rising personnel costs. This is expected to amplify the pressure from Apple’s accelerated AI R&D spending, which has already driven up operating expenses, limiting improvements in future operating leverage.

Challenge Three: Potential Impact of the 'Great Rotation'

Beyond fundamental headwinds, shifts in market sentiment also threaten the sustainability of Apple’s high valuation. Recent market gains have been primarily driven by non-tech sectors such as pharmaceuticals, utilities, industrials, and energy, which had lagged in the past two years. Market expectations are that a prolonged rate-cutting cycle aimed at stimulating the economy will broadly benefit these sectors.

This 'Great Rotation' may not only suppress upside potential for the entire tech sector next year but could also reduce investor preference for Apple as a traditional 'cash cow' safe-haven asset. Consequently, widespread premium valuation adjustments among large-cap tech stocks may expose Apple to the risk of short-term valuation multiple compression.

Summary

Apple’s record-high stock price over the past six months reflects market confidence in its short-term execution and earnings stability. This is supported by a favorable product mix, strong iPhone momentum, and effective cost control.

However, looking ahead, the company will face an increasingly complex cost environment, including macroeconomic uncertainties across the industry, rising material costs, and its own unique increases in personnel and AI R&D expenditures. Coupled with the potential rotation of market capital away from high-valuation tech stocks, the market remains cautious about the sustainability of Apple's stock price near its current historical highs, as it has yet to fully reflect the multiple valuation compression risks that may arise in the coming year.

Editor/Joryn