The three major U.S. stock indexes closed slightly lower, $Nasdaq Composite Index (.IXIC.US)$ down 0.09%, up 1.22% for the week; $Dow Jones Index (.DJI.US)$ down 0.04%, up 1.2% for the week; $S&P 500 Index (.SPX.US)$ down 0.03%, up 1.4% for the week.

Large-cap technology stocks showed mixed performance,$Tesla (TSLA.US)$Dropped more than 2%. $Google-C (GOOG.US)$ 、 $Apple(AAPL.US)$ 、$Microsoft(MSFT.US)$、 $Meta Platforms(META.US)$ and others edged lower; $NVIDIA (NVDA.US)$up more than 1%,$Amazon(AMZN.US)$、$Netflix (NFLX.US)$、 $Intel (INTC.US)$ Some stocks posted modest gains.

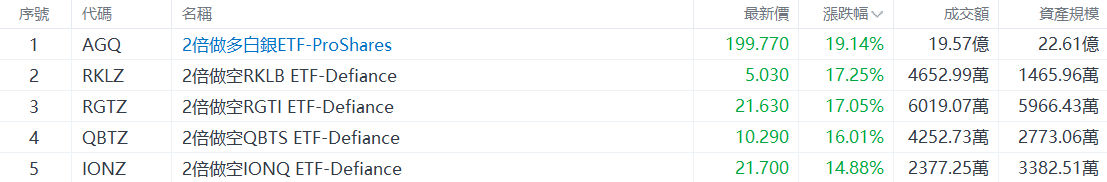

Top 5 Gainers in U.S. Equity ETFs

$ProShares Ultra Silver ETF (AGQ.US)$ Up 19.14%, with a trading volume of $1.957 billion.

$ProShares Ultra Silver ETF (AGQ.US)$ Up 19.14%, with a trading volume of $1.957 billion.

On the news front, the bull market in gold and silver shows no signs of slowing, continuously setting new records. Spot silver surged above $79, gaining nearly 10% within 24 hours. Spot gold briefly approached $4,550. $2x Leveraged Gold ETF-ProShares (UGL.US) Rose more than 2%.

$2x Leverage Short RKLB ETF - Defiance (RKLZ.US) Up 17.25%, with a trading volume of $46.5299 million.

On the news front, the rally in space concept stock RKLB paused, closing down more than 8% on Friday.

$2x Inverse RGTI ETF - Defiance (RGTZ.US) Increased by 17.05%, with a trading volume of $60.19 million.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) Increased by 16.01%, with a trading volume of $42.53 million.

$2x Inverse IONQ ETF - Defiance (IONZ.US)$ Increased by 14.88%, with a trading volume of $23.77 million.

In market news, quantum computing-related stocks showed weakness, with RGTI and QBTS both falling more than 8%, and IONQ dropping over 7%.

Top 5 Decliners on US Stock ETFs

The $2x Leveraged FLY ETF-Tradr (FLYT.US) Dropped by 28.12%, with a trading volume of $0.95 million.

$Proshares UltraShort Silver ETF (ZSL.US)$ Dropped by 18.28%, with a trading volume of $320 million.

$2x Leveraged Long RGTI ETF-Tradr (RGTU.US)$ Dropped by 17.81%, with a trading volume of $6.31 million.

$2x Long RGTI ETF-Defiance (RGTX.US)$ Dropped by 17.78%, with a trading volume of $43.29 million.

$2x Leverage RKLB ETF-Defiance (RKLX.US)$ Dropped by 16.74%, with a trading volume of $99.90 million.

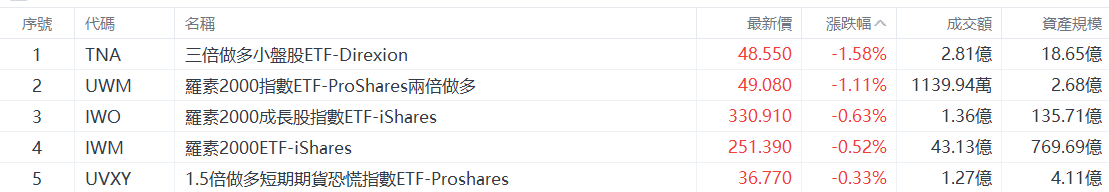

Top 5 Large-Cap U.S. Equity Index ETFs by Decline

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Dropped by 1.58%, with a trading volume of $281 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Dropped by 1.11%, with a trading volume of 11.3994 million US dollars.

$iShares Russell 2000 Growth ETF (IWO.US)$ Dropped by 0.63%, with a trading volume of 136 million US dollars.

iShares Russell 2000 ETF (IWM.US) Dropped by 0.52%, with a trading volume of 4.313 billion US dollars.

$1.5X UltraPro Short-Term VIX Futures ETF-ProShares (UVXY.US)$ Dropped by 0.33%, with a trading volume of 127 million US dollars.

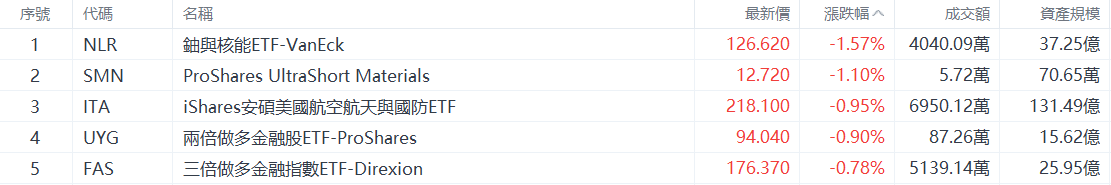

Top 5 Industry ETF Decliners

$VanEck Uranium+Nuclear Energy ETF (NLR.US)$ Dropped by 1.57%, with a trading volume of 40.4009 million US dollars.

$ProShares UltraShort Materials(SMN.US)$ Dropped by 1.10%, with a trading volume of 57,200 US dollars.

$iShares U.S. Aerospace & Defense ETF (ITA.US)$ Dropped by 0.95%, with a trading volume of 69.5012 million US dollars.

$ProShares Ultra Financials ETF (UYG.US)$ Dropped by 0.90%, with a trading volume of 872,600 US dollars.

$Direxion Daily Financial Bull 3X Shares (FAS.US)$ Dropped by 0.78%, with a trading volume of 51.3914 million US dollars.

Top 5 Decliners in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Dropped by 0.96%, with a trading volume of 185 million US dollars.

ProShares Ultra 20+ Year Treasury (UBT.US) Down 0.77%, with a trading volume of $643,500.

$SPDR Citi International Government Inflation-Protected Bond ETF (WIP.US)$ Down 0.38%, with a trading volume of $469,500.

iShares 20+ Year Treasury Bond ETF (TLT.US) Down 0.33%, with a trading volume of $2.208 billion.

$Invesco California AMT-Free Municipal Bond ETF(PWZ.US)$ Down 0.31%, with a trading volume of $4.0121 million.

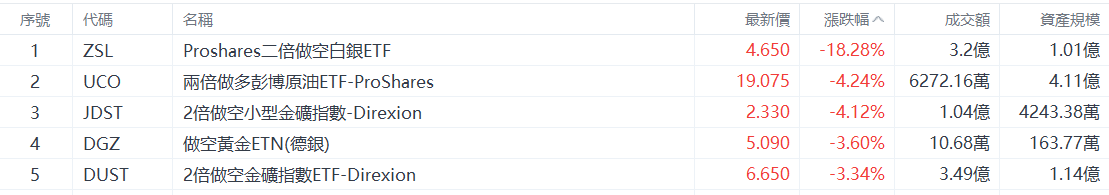

Top 5 Commodity ETF Decliners

$Proshares UltraShort Silver ETF (ZSL.US)$ Dropped by 18.28%, with a trading volume of $320 million.

$2x Long Bloomberg Crude Oil ETF-ProShares (UCO.US) Down 4.24%, with a trading volume of $62.7216 million.

$2 Times Daily Small Cap Miners Index ETF - Direxion (JDST.US) Down 4.12%, with a trading volume of $104 million.

$Short Gold ETN (Deutsche Bank)(DGZ.US)$ Down 3.60%, with a trading volume of $106,800.

DUST.US, the Direxion Daily Gold Miners Index Bear 2X Shares ETF fell by 3.34% with a trading volume of 349 million US dollars.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen