The three major U.S. stock indexes closed slightly lower on Friday. NVIDIA rebounded to $190, rising by 2% intraday and gaining over 9% in the past five trading sessions. The Russell small-cap index led declines. The VIX volatility index further contracted, closing at 13.47. Spot gold surged more than 1%, hitting a new all-time high above $4,550 during the session. Silver extended its rally from the previous day, soaring 10% in a single day to breach the $79 mark. Platinum also hit a new record high, while copper prices maintained their strength.

On the first trading day after Christmas, the U.S. stock market consolidated near historic highs with low volume, continuing the mild tone of the 'Santa Claus Rally.' Meanwhile, funds aggressively flowed into the precious metals sector. Silver surged 10% in a single day, joining gold to set new historical records. Signs of peace emerging from the Russia-Ukraine conflict triggered a 'Black Friday' for oil bulls.

Precious metals staged another explosive rally post-holiday, becoming the most eye-catching trading theme in global markets that day.$XAU/USD (XAUUSD.CFD)$ Surging more than 1%, it reached a new all-time high above $4,550 during the session. $XAG/USD (XAGUSD.FX)$ Continuing to rise from the previous day. $iShares Silver Trust (SLV.US)$ Soaring 10%, breaching the $79 mark, platinum also reached a new high, and copper prices remained strong.

In contrast to the sharp fluctuations in commodities, the U.S. stock market appeared calm. All three major indexes closed slightly lower, with the Nasdaq down 0.09% and up 1.22% for the week; the Dow fell 0.04% and gained 1.2% for the week.$S&P 500 Index (.SPX.US)$The S&P 500 fell 0.03% but secured its best weekly performance in a month, up 1.4% for the week. The Russell small-cap index dropped 0.5%, with analysts noting that short-covering momentum earlier in the week had dissipated. Defensive sectors regained favor, while cyclical sectors lagged behind.

In contrast to the sharp fluctuations in commodities, the U.S. stock market appeared calm. All three major indexes closed slightly lower, with the Nasdaq down 0.09% and up 1.22% for the week; the Dow fell 0.04% and gained 1.2% for the week.$S&P 500 Index (.SPX.US)$The S&P 500 fell 0.03% but secured its best weekly performance in a month, up 1.4% for the week. The Russell small-cap index dropped 0.5%, with analysts noting that short-covering momentum earlier in the week had dissipated. Defensive sectors regained favor, while cyclical sectors lagged behind.

In the bond market, U.S. Treasury bonds showed moderate performance overall on the day. The yield on the 10-year Treasury bond remained largely unchanged near 4.13%, while the 2-year yield edged down slightly. Overall, the bond market demonstrated 'passive stability' and did not exhibit any significant hedging reaction to the sharp fluctuations in precious metals.

$USD (USDindex.FX)$Similarly, little change was observed. However, from a weekly perspective, the U.S. dollar has continued to weaken, posting its worst weekly performance since June. This has become one of the key supporting factors for the precious metals market.

Zelenskyy stated that he would meet with Trump on Sunday, and the peace framework agreement is 'almost ready.' Investors quickly began pricing in the potential consequences of a 'peace agreement': if sanctions are lifted, a large volume of Russian oil may re-enter an already oversupplied global market.

The three major U.S. stock indexes closed slightly lower on Friday, with the Russell small-cap index showing a relatively larger decline. The VIX volatility index further tightened, closing at 13.47.$Tesla (TSLA.US)$Closing down 2.10%, Meta, Google A, Apple,$Microsoft (MSFT.US)$fell by as much as 0.64%,$Amazon (AMZN.US)$while others gained 0.06%; $NVIDIA (NVDA.US)$ Micron Technology returned to $190, rising by 2% during the session and gaining over 9% in the past five trading sessions; Nomura remains optimistic about the memory cycle, with Micron breaking new highs again during the session.

Benchmark US Equity Indices:

The S&P 500 Index closed slightly lower by less than 0.01% at 6,929.94 points. For the week, it gained approximately 1.4%.

The Dow Jones Industrial Average fell 20.19 points, or 0.04%, to close at 48,710.97 points. For the week, it rose 1.1%.

The Nasdaq Composite Index dropped 20.21 points, or 0.09%, to close at 23,593.10 points. For the week, it increased by 1.2%.

$Russell 2000 Index (.RUT.US)$It declined 0.54% to close at 2,534.35 points. For the week, it accumulated a gain of 1.06%.

The VIX volatility index, known as the 'fear gauge,' decreased by 3.79% to close at 13.47.

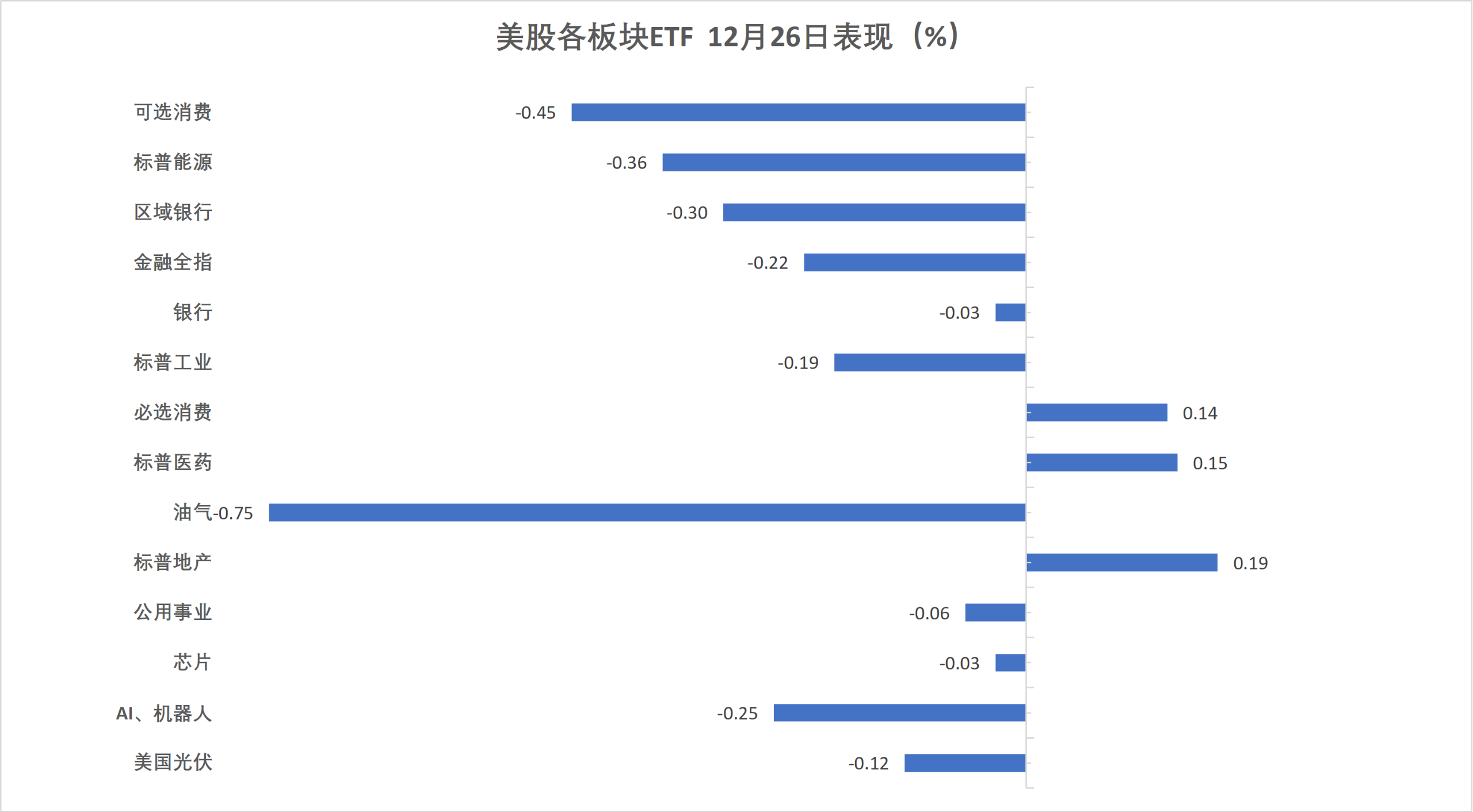

U.S. Sector ETFs:

The oil and gas sector fell by 0.75%, while discretionary consumption, energy, finance, telecommunications, and other sectors declined by up to 0.4%.

Mag 7:

The Mag 7 index edged down 0.02% to 210.09 points, with a cumulative increase of 1.73% this week, maintaining an overall upward trend.

Tesla closed down 2.10%, while Meta, Google A, Apple, and Microsoft fell by up to 0.64%. In contrast, Amazon rose by 0.06%, and NVIDIA gained 1.02%.

Chip Stocks:

$PHLX Semiconductor Index (.SOX.US)$Closing down 0.39% at 5,696.21 points.

AMD fell 0.02%,$Taiwan Semiconductor (TSM.US)$rising 1.35%.

Chinese Concept Stocks:

The Nasdaq Golden Dragon China Index closed up 0.72% at 7,688.52 points.

Among popular Chinese stocks, $XPeng (XPEV.US)$ closing up 6.2%,$NIO Inc (NIO.US)$rising 4.1%, Li Auto up 3.9%, Xiaomi up 2.1%,$Alibaba (BABA.US)$up 1.4%.

Other stocks:

Berkshire Hathaway Class B shares closed down 0.61%,$Eli Lilly and Co (LLY.US)$while the other share class closed up 0.07%.

$Qualcomm (QCOM.US)$Closed up 0.02%,$Adobe (ADBE.US)$Up 0.23%,$Oracle (ORCL.US)$Up 0.25%,$Salesforce (CRM.US)$Up 0.31%,$Broadcom (AVGO.US)$Up 0.55%,$Netflix (NFLX.US)$Up 0.89%.

Crude oil plummeted significantly, with WTI crude oil dropping more than 2.7%.

Crude oil:

WTI crude oil futures for February closed down $1.61, or 2.76%, at $56.74 per barrel.

Brent crude oil futures for February settled down 2.57% at $60.64 per barrel.

Natural Gas:

The January natural gas futures contract on NYMEX closed at $4.3660 per million British thermal units.

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/Stephen