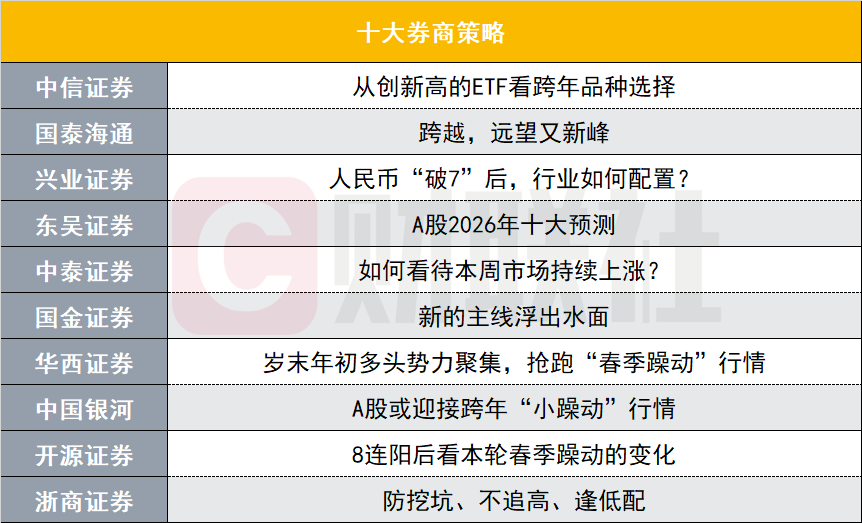

The SSE Composite Index has achieved 'eight consecutive gains'; the total scale of China's ETFs has surpassed 6 trillion yuan, setting another new record high; the offshore RMB once 'broke 7'... How will the market perform as 2025 comes to an end? Which sectors will dominate in 2026?

With only three trading days remaining, 2025 is about to draw to a close.

This week, the SSE Composite Index extended last week’s momentum to achieve 'eight consecutive gains'; the total scale of China’s ETFs surpassed 6 trillion yuan, reaching another all-time high; the offshore RMB once 'broke 7'... Amidst these continuous positive developments, major brokerages have provided their perspectives on the future market from different angles.

How will the market conclude in 2025? Which sectors will dominate in 2026? Please refer to this week's top ten brokerage strategies for the latest insights from major brokerages.

How will the market conclude in 2025? Which sectors will dominate in 2026? Please refer to this week's top ten brokerage strategies for the latest insights from major brokerages.

CITIC Securities: Insights on Year-End Investment Choices from Record-High ETFs

Among 360 industry/theme ETFs, 39 hit new highs in December. Among the consensus-driven products, older ones are communication and non-ferrous metal-related ETFs, reflecting the logic behind North American AI infrastructure and resource commodities; newer ones include commercial aerospace-related ETFs (including defense), representing aggressive capital choices during market volatility, similar to the previous low-altitude theme.

Whether it is communication, non-ferrous metals, or commercial aerospace, a common feature is that they all represent the competition between China and the US in the construction of next-generation cross-border infrastructure, which is the most consensus-driven direction in the market. There are also some products that have started gaining attention, lack industrial discussion heat, but have quietly risen to reach new yearly highs recently, such as chemical and engineering machinery products, which signify the shift of China's manufacturing competitive advantage on the global stage towards pricing power. Additionally, some anti-overcompetition-related products (e.g., new energy, steel) are rebounding, with related catalysts likely to intensify in the first quarter of next year.

In terms of allocation strategy, we still believe that until unexpected changes in domestic demand occur, the market will remain range-bound with structural opportunities dominating. This forms the basic framework for year-end allocation decisions. Sectors with low热度 (heat) and持仓集中度 (position concentration) but rising attention and long-term potential for ROE improvement (e.g., chemicals, engineering machinery, new energy) are preferred. Some emerging industry themes (e.g., commercial aerospace) may continue to gain traction. Meanwhile, we maintain close attention to and track the trend of RMB appreciation and corresponding opportunities; brokerages and insurance are defensive yet opportunistic allocation choices from this perspective.

Guotai Hai Tong: Crossing Over, Gazing Far Towards New Peaks

China's capital market is beginning to consolidate social confidence and capital, standing at the threshold of a major development cycle.

The major macro policy turning point in September 2024 marked the resolution of 'internal worries'; since April 2025, China has been more adept at handling trade frictions, resolving 'external threats,' reflecting enhanced national strength and governance capabilities. Unlike the contraction cycle from 2019 to 2024, since 2025, Chinese society has grown more confident externally and stable internally, with asset contraction ending. Stock prices reflect future expectations and demonstrate rising social confidence.

During the period of urbanization, the expression of social confidence and individual participation in productivity enhancement has primarily been through fixed asset investment. Currently, traditional business expectations are waning, while knowledge-intensive, technology-intensive, and capital-intensive industries are driving new growth. How can social capital, particularly traditional capital, participate in economic transformation, technological advancement, or asset allocation? In the past, reliance was on traditional extensive investments; now, capital markets have become critically important. As a result, capital markets have developed the ability to consolidate social capital, marking an unprecedented change.

The 'guaranteed return' phenomenon in Chinese society is being dismantled, leading to a systemic decline in risk-free returns, and the inflow of incremental capital into the market is far from over.

In the past, numerous 'guaranteed return' assets existed in Chinese society, playing the role of risk-free assets, such as trust products, bank wealth management products, and non-standardized assets. The existence of these 'guaranteed return' assets hindered the decline of risk-free interest rates and was also one of the reasons for the short bull and long bear cycles of the A-share market.

In the second half of 2024, China's long-term interest rates will fall below 2%, and by 2025, returns on fixed-income products will comprehensively decline. Additionally, the exit of non-standardized assets based on real estate and debt, along with the reduction of high-yield, risk-free assets, will be evident. The peak of term deposit maturities will occur in 2026, and the central government has called for the entry of long-term funds into the market. Undoubtedly, China will enter a period of explosive demand for asset management, and the inflow of incremental capital into the market is far from over.

Moreover, reforms are reshaping societal perceptions. Capital market reforms have enhanced the investability of Chinese assets and improved the market's resilience to risks, transitioning the stock market from a volatile state to one of steady improvement.

Previously, there were widespread doubts about the stock market among the public, including concerns about low investability and excessive volatility, which deterred social capital from entering the capital markets. Since the introduction of the 'New Nine Measures,' fundamental institutional reforms—such as delisting regulations, share reduction rules, insider trading oversight, financial fraud supervision, and disclosure requirements—alongside measures encouraging dividend payouts, share buybacks, and mergers and acquisitions, have significantly increased the investability of Chinese assets. Furthermore, the establishment and operation of 'market stabilization mechanisms' have effectively reduced market volatility, encouraging social capital to increase holdings.

Most crucially, the transformation of China's industrial structure has reduced uncertainties in economic and social development, outlining clear investment themes.

After years of downturn, traditional industries have transitioned from the vertical segment of an 'L-shaped' recovery to the horizontal segment, reducing marginal drag. Meanwhile, emerging technology industries have entered a cycle of innovation-driven expansion. China's manufacturing sector, leveraging its competitive advantages, is expanding globally, though the reduction in socioeconomic uncertainty remains imperceptible. Thus, a hallmark of the 'transformation bull market' is the interplay between economic restructuring and capital market reforms. It is time to abandon bearish thinking, maintain confidence and patience, as China’s stock market still has room to reach new highs.

Risk Warning: Overseas economic recession exceeding expectations and global geopolitical uncertainties.

Industrial Securities: After the RMB 'breaks 7,' how should sectors allocate resources?

The recent acceleration in the appreciation of the RMB reflects more on the renewed weakness of the US dollar, compounded by the year-end 'foreign exchange settlement surge,' influencing market consensus expectations. The characteristics of the RMB's 'passive appreciation' and expectation-driven appreciation have become more pronounced.

In the short term, the lagging effect of corporate foreign exchange settlement demand may still provide some support for the strengthening of the RMB exchange rate at the turn of the year. A spring rally in both the currency and capital markets could resonate.

Looking ahead to next year, not only does a weak US dollar provide a favorable external environment for RMB appreciation, but what is more anticipated is the driving force behind this round of active RMB appreciation: the two underlying logics that previously suppressed the RMB exchange rate—domestic deflationary pressures and the decline in the rate of return on Chinese assets—have reversed this year, and this reversal logic is expected to strengthen further next year, providing medium- to long-term support for future active RMB appreciation.

Once RMB appreciation leads to a reversal in capital flows, including domestic pending settlement funds滞留海外 and overseas funds that had temporarily withdrawn from China, the return of trillions of yuan in funds will significantly contribute to the revaluation of Chinese assets, becoming an important 'expectation gap' at the capital level in the future.

During the four cycles of RMB appreciation since 2016, both the A-share and Hong Kong stock markets have mostly risen. When the market is in a macro combination of 'upward domestic fundamentals + overseas easing,' due to Hong Kong stocks being more sensitive to external liquidity, if their fundamentals are sound, their upward momentum may be stronger than that of A-shares; in the case of A-shares, earnings growth becomes the main contributor, while valuation contribution appears less significant; the exchange rate is not the dominant logic for industry allocation during RMB appreciation periods, with its greatest role being to guide capital flows and strengthen investor preference for key themes and advantageous styles of the period.

Four logics through which RMB appreciation impacts industry allocation: At the profit level, 1) RMB appreciation reduces import costs, benefiting upstream resource sectors with high dependence on imported raw materials, such as coal, steel, certain chemical products (plastics, chemical raw materials, agrochemicals, rubber), energy metals, papermaking, and downstream beneficiary industries like aviation and airports; 2) RMB appreciation lowers the cost of foreign currency debt, benefiting industries holding substantial US dollar liabilities, including real estate construction chains, logistics, optoelectronics, trade, and diversified finance; 3) RMB appreciation increases domestic purchasing power, benefiting domestically driven and cross-border consumption sectors, such as cross-border e-commerce, duty-free, hotels and catering, and service and luxury consumption areas like jewelry. Verified through the correlation between stock price performance and RMB exchange rates, these industries can indeed be priced by the market during RMB appreciation. At the valuation level, 4) RMB appreciation attracts foreign capital back into Chinese assets. After changes in foreign capital preferences, the current main growth themes may continue to benefit from increased foreign investment, and the resonance between domestic and foreign capital preferences could further reinforce the market style centered around growth trends and industrial momentum.

Among the industries benefiting from this round of RMB appreciation, and considering profitability forecasts, focus on four key threads: 1) Growth themes favored by changing foreign capital preferences with strong consensus among domestic and foreign investors, including AI hardware (communication equipment, components, semiconductors, consumer electronics), competitive manufacturing (batteries, auto parts, pharmaceutical chemistry), and nonferrous metals (industrial metals, energy metals); 2) Upstream resource industries benefiting from rising domestic PPI, anti-internal competition policies, and reduced import costs due to RMB appreciation, including steel, chemicals (plastics, chemical raw materials, agrochemicals, rubber); 3) Service and luxury consumption areas where enhanced RMB purchasing power overlaps with structural improvements in domestic demand, including duty-free, e-commerce, hotels, and catering; 4) Industries with reasonable valuations currently, potential for marginal improvement in profitability next year, and likely to benefit from cost or liability reductions brought by RMB appreciation, including aviation, airports, papermaking, and logistics.

Dongwu Securities: Top Ten Predictions for A-shares in 2026

Prediction One: Broad-based A-share indices continue to rise, with volatility centers moving to a higher level.

Prediction Two: In 2026, the rotation between major A-share styles (growth vs. value) will be a decisive factor in trading success.

Prediction Three: In the first half of the year, the technology growth style will continue to lead, with a comprehensive diffusion trend emerging for growth-oriented assets.

Prediction Four: In the second half of the year, dividend-style investments will regain超额收益 (excess returns).

Prediction Five: AI endpoint devices (such as AI glasses) may replicate the market trend observed in True Wireless Stereo (TWS) products after 2019.

Prediction Six: The industrial trends outlined in the '15th Five-Year Plan' (embodied intelligence, fusion energy, quantum technology, 6G, brain-computer interfaces, hydrogen energy, commercial aerospace) will become key sectors for investment.

Prediction Seven: Commodity prices are expected to reach a medium-term peak in the second quarter.

Prediction Eight: Micro and small-cap investment styles may face certain volatility risks.

Prediction Nine: The Federal Reserve is expected to cut interest rates one to two times in the first half of the year and halt further rate cuts in the second half.

Prediction Ten: The Producer Price Index (PPI) negative range will continue to narrow.

Risk Warning: Economic recovery may fall short of expectations; U.S. Treasury yields may decline later than anticipated; unforeseen geopolitical events could occur as black swan events.

Zhongtai Securities: How to Interpret the Market’s Continuous Rise This Week?

How should we interpret the continuous rise in the market this week?

The coexistence of index highs and stock divergence indicates the market has entered a rebalancing phase at higher levels. This week, the A-share market continued its strong performance at the index level. Major indices showed gains: the Wind All-A Index, CSI 300, and CSI 2000 rose by 2.78%, 1.95%, and 3.06%, respectively. In terms of trading volume, the average daily turnover of the Wind All-A increased from RMB 1.76 trillion last week to RMB 1.97 trillion, surpassing the RMB 2 trillion mark on Friday. At the individual stock level, approximately 52.20% of stocks in the Wind All-A rose this week, roughly unchanged from last week. Overall, the upward trend in indices was further confirmed, but the pattern of growth changed.

This week’s sustained market rally was primarily driven by a temporary recovery in risk appetite, led by cyclical sectors. As year-end approaches, both domestic and international policy developments have been relatively quiet this week, with no significant new positive factors directly impacting the market. The driving force behind this rally mainly stemmed from internal structural changes within the market. From a sector perspective, the rise in major indices was largely driven by cyclical sectors, particularly non-ferrous metals. Accompanied by a notable strengthening in industrial metal commodity prices, pro-cyclical and resource-related industries saw synchronized stock price increases. From a capital flow and trading behavior perspective, there were clear signs of an overall recovery in market risk appetite. Externally, the renminbi appreciated temporarily this week, coupled with marginal improvements in global liquidity expectations, raising expectations of overseas capital inflows into the A-share market and providing external support for this round of risk appetite recovery.

Looking ahead, the market is expected to maintain upside potential before the Spring Festival, with short-term opportunities for buying on dips. At this stage, key risk factors that previously constrained the market have significantly weakened, supporting a high level of risk appetite. Externally, concerns over tightening global liquidity expectations and corrections in highly valued AI sectors in U.S. equities have eased. Domestically, given that this year's Spring Festival falls later and the Two Sessions will convene shortly after, the optimistic expectations regarding consumption policies are in an “unfalsifiable” period until the Two Sessions, helping sustain high overall risk appetite. However, it should be emphasized that the current market aligns more with the characteristics of a consolidation phase preparing for pre-Spring Festival movements rather than signaling the formal start of the main uptrend. Market participants are adopting strategies focused on “buying on dips and sector rotation” rather than aggressively increasing positions at elevated levels. This suggests that short-term market dynamics are likely to unfold through a pattern of “gradually raising the center of gravity amid volatility and continuous internal adjustments,” rather than experiencing rapid rallies or forming unilateral, sustained profitability effects.

Investment Recommendations

From a sector allocation perspective, integrating the capital inflow characteristics observed last week and over the past two months, along with the seasonal patterns typical of spring rallies primarily driven by thematic catalysts, the following key areas warrant particular attention.

1) Technology themes remain the most elastic mainline direction in the spring market, with a focus on sub-sectors such as robotics, commercial aerospace, and nuclear power.

2) Overseas computing power and semiconductor-related sectors continue to demonstrate mid-term logic within the global industrial chain, allowing institutional investors to maintain a medium-term holding strategy in their allocations.

3) The non-banking financial sector currently holds certain allocation value.

4) Within the consumer sector, thematic trading opportunities are more suitable to pursue. As subsidies for new energy vehicles gradually phase out, policy support may increasingly tilt toward service consumption and aging-related areas. Key areas to watch include sports consumption (with subsidy models potentially reinforcing regional tournaments and league systems), medical devices, and traditional Chinese medicine.

Risk Warning: Unexpected tightening of global liquidity, unforeseen complexity in market dynamics, and unpredicted fluctuations in policy changes may pose risks.

Guojin Securities: New Mainlines Emerge

The year-end rally is gradually unfolding, and the market is no longer focused on a single narrative.

Recently, the A-share market has experienced consecutive gains, with the much-anticipated year-end rally gradually gaining momentum. Amid no significant changes in domestic and international fundamentals, the current rebound appears more like a global risk asset repair following a marginal easing of prior tight liquidity expectations. Major overseas indices have also risen to varying degrees. Notably, the market narrative has shifted from a singular focus on AI-driven China-U.S. comparative themes to broader areas, showcasing a rotation among AI, domestic demand, inflationary chains, and emerging industrial themes (e.g., commercial aerospace).

Market rallies driven by singular narratives tend to exhibit instability and high volatility, whereas true bull markets often emerge when widespread market opportunities converge and form synergy. As the current market gradually advances and sector rotation accelerates, new investment mainlines for 2026 are slowly coming into view.

Understanding recent price hikes across various industrial chains: The diffusion and convergence of physical consumption.

The current focus of the market is on price hikes. By analyzing the specific content of price increase notices across industries and expert analyses, it can be seen that rising raw material costs are the main driver of price increases. At the same time, the effects of anti-internal competition policies are becoming evident. Facing the dilemma of rising upstream costs and downstream price pressures, some companies have begun to voluntarily reduce production and jointly raise prices to maintain reasonable competitive order within the industry. Looking ahead, the sustainability of price increases will vary depending on the health of demand.

For commodities, we believe there may be two reasons for the sharp rise: this round of increases in non-ferrous metals may indicate that marginal demand is increasingly driven by emerging sectors with high gross margins and growth potential. These sectors have a relatively small cost share, making them more tolerant of price increases, thus extending the trading range. In the past, industry plus finance acted as the actual short sellers of physical inventories, which showed vulnerability when facing changes in demand, policy, and trading structures.

Looking globally, the trend of stronger investment than consumption, driven by an overseas rate-cutting cycle and manufacturing recovery, is likely to persist. However, due to disruptions in the investment-to-employment transmission under AI development, service sector inflation is rising slowly, delaying the onset of interest rate constraints brought by inflation. Reflecting this domestically in the stock market, the relationship between metals and AI investment today mirrors that of coal/thermal power and renewable energy in 2021—both were influenced by the macro backdrop of renewable energy development, yet their stock prices diverged after 2021. This divergence reflects differences in first-order and second-order performance metrics, with growth sectors focusing more on the marginal changes in second-order metrics while traditional industries emphasize underlying fundamental trends.

For upstream metal raw materials, the continuation of AI investment on the physical side will lead to increased consumption being realized. For certain high-expectation stocks within the AI overseas mapping chain, further exceeding expectations would require an acceleration in AI investment growth. Regarding sectors affected by anti-internal competition policies, those with relatively strong demand support and robust policy implementation intentions may experience smoother price transmission, leading to more sustainable price increases, such as in lithium battery supply chains and wafer manufacturing. Conversely, industries with relatively weak demand (e.g., titanium dioxide), where downstream tolerance might be limited, the sustainability of price increases remains uncertain. However, given the limited new capacity additions in related industries, the probability of sector turnaround upon marginal demand recovery or successful price transmission remains high.

A new external circulation pattern brings a new cycle of RMB appreciation.

In the short term, since there has been no obvious reversal in fundamental expectations, the recent rapid appreciation of the RMB may primarily be due to the narrowing of the China-US interest rate differential amid a weakening dollar and the seasonal repatriation of year-end foreign exchange conversion funds. From a medium-term perspective, the marginal improvement in China-US relations and stronger-than-expected resilience in China’s exports are the main drivers of RMB revaluation. Historically, during periods of sustained RMB appreciation, sales gross margins of companies highly exposed to external demand tend to rise first and then fall, but the overall magnitude is not significant. Compared to previous rounds of appreciation cycles, there are notable differences in export structure, settlement methods, and trade environment today, suggesting that the negative impact of RMB appreciation on the competitiveness of export-oriented firms may not need to be overstated. On one hand, as the RMB gains wider recognition, its proportion in export settlements now exceeds that of the US dollar. On the other hand, in many high-demand export sectors, China accounts for a major share of global production capacity, demonstrating certain irreplaceability and higher product value-added, along with stronger pricing power. Notably, the moderate recovery of China’s export prices could help ease the fierce backlash of trade protectionism against frequent low-price export sanctions in recent years. Additionally, the RMB’s appreciation has partly alleviated cost pressures from rising prices of commodities and integrated circuits. Based on reduced foreign exchange losses during the appreciation cycle and improved gross and net profit margins after excluding industry-specific factors, we find that beneficiaries of the RMB appreciation cycle are mainly concentrated in industries such as telecommunications equipment, environmental governance, aviation airports, electronics, and lithium batteries.

A new main theme is emerging; seize the current window of transition.

By 2026, a new investment theme has begun to manifest in the commodity markets, real economy supply chains, and foreign exchange markets: under a pattern where investment outweighs consumption, physical consumption across all manufacturing links in various industrial chains is intensifying, extending the trading range for commodities. Meanwhile, China’s manufacturing advantages are gradually emerging and are being reflected first in the foreign exchange market. Recommendations: 1) Industrial resource products resonating with AI investment and the global manufacturing recovery—copper, aluminum, tin, lithium, crude oil, and oil transportation; 2) China’s equipment export chains with global comparative advantages and confirmed cyclical bottoms—grid equipment, energy storage, lithium batteries, photovoltaics, construction machinery, commercial vehicles—and domestic manufacturing sectors showing signs of bottoming out—chemicals (textile printing, coal chemicals, pesticides, polyurethane, titanium dioxide), wafer manufacturing, etc.; 3) Capture the consumer rebound channel driven by inbound tourism recovery and rising household incomes—aviation, hotels, duty-free shopping, food and beverage; 4) Beneficiaries of capital market expansion and long-term asset return stabilization—non-banking sectors (insurance, securities).

Risk Warning: Domestic economic recovery falling short of expectations; significant downturn in overseas economies.

Huaxi Securities: Year-end and early-year bullish momentum gathering, preempting the 'Spring Rally' trend.

Multiple sources of capital are preempting the 'Spring Rally,' focusing on low-cost layouts. On one hand, uncertainties around overseas monetary policy have subsided, and the upcoming Chinese New Year and 'Two Sessions' meetings are close together, with pre-festival policy expectations likely to support risk appetite. On the other hand, the beginning of the year is typically a window period for absolute return funds like insurance and pension funds to initiate new allocations. Against a backdrop of positive policy expectations, there is strong willingness for incremental capital inflows, and recent domestic institutional and margin trading funds have shown signs of 'preemptive moves.' Looking ahead, the spring rally may continue, characterized by 'sectoral rotation and fast-moving shifts,' suggesting a strategy of buying on dips.

The following aspects are key areas of recent market attention:

First, the positive conditions for the 'Spring Rally' are accumulating, with multiple sources of capital showing preemptive moves.

A review of the A-share market over the past decade shows that the "spring rally" typically requires the following conditions: reasonable valuation levels, a relaxed liquidity environment, and effective catalysts to boost risk appetite, such as domestic policies, industrial event catalysts, or mitigation of external risks.

Currently: 1) At the risk premium level, the latest CSI 300 risk premium is at the median level of the past decade, indicating that A-share valuations are within a reasonable range; 2) At the macro liquidity level, the central bank has emphasized "continuing to implement a moderately loose monetary policy," suggesting that the domestic monetary environment will remain accommodative; 3) At the risk appetite level, the recent Federal Reserve rate cut and Bank of Japan rate hike have been implemented, reducing overseas uncertainties. The timing of the domestic Spring Festival and the "Two Sessions" is relatively close, and pre-holiday expectations for the Two Sessions' policies are likely to support risk appetite; 4) At the micro liquidity level, the beginning of the year is when absolute return funds, such as insurance and annuity funds, complete their annual assessments and initiate new asset allocation. Public funds may also have new issuance plans. Against the backdrop of positive policy expectations, there is a strong willingness for incremental funds to enter the market, and recent domestic institutional funds and margin trading funds have already started to anticipate the "spring rally."

Second, net subscriptions in A500 ETFs have become one of the significant sources of incremental funds in the A-share market towards the end of the year.

From December to date, equity ETFs have cumulatively seen net subscriptions of 90.8 billion yuan, marking the highest monthly net subscription since April this year. The bulk of the incremental funds have come from net subscriptions of leading A500 ETF products, with the top six A500 ETF products by size seeing net inflows of 97.2 billion yuan since December. On a weekly basis, equity ETFs saw net inflows of 35.4 billion yuan this week, while CSI A500-related ETFs collectively recorded net inflows of 49.3 billion yuan during the same period.

Specifically, this week, the six A500 ETFs managed by Guotai, Huaxia, Nanshun, E Fund, Huatai BoRui, and Guangfa saw their shares increase by 40.9 billion units, with net inflows reaching 49.2 billion yuan, reflecting an acceleration of incremental institutional funds entering the market towards the end of the year. Against this backdrop, the weight sectors of the CSI A500 Index, namely electronics and power equipment, performed well.

Third, margin balances hit another record high, reflecting a recovery in market risk appetite.

As of December 25, margin balances in the A-share market reached 2.53 trillion yuan, setting a new record high. Since December, margin trading funds have net purchased 72 billion yuan, and the proportion of margin buying volume to total A-share trading volume has returned above 11%, reflecting sustained improvement in market sentiment. In terms of margin trading by industry, the top three industries with the highest margin purchases since December have been electronics, power equipment, and communications, primarily characterized by growth-oriented sectors.

Fourth, the robust performance of the renminbi exchange rate is conducive to foreign capital returning to the A-share market.

This week, northbound fund trading volumes marginally declined, mainly due to calendar effects related to the Christmas holidays abroad. Considering the renminbi's continuous appreciation since December, the likelihood of foreign capital returning to the A-share market after the holidays has increased. Recently, the renminbi exchange rate has remained strong, with offshore and onshore renminbi exchange rates returning to the "7.0" threshold. This trend not only reflects restored confidence in China's economy but also enhances the global appeal of renminbi assets.

Looking back, the correlation between the renminbi exchange rate and the domestic stock market has been relatively high. During periods of mild renminbi appreciation, the A-share market usually performs well, possibly reflecting a positive feedback loop of "strong currency—capital inflows—asset price increases."

In terms of industry allocation, it is recommended to focus on: 1) Growth themes benefiting from industrial policy support, such as domestic substitution, robotics, commercial aerospace, nuclear fusion, innovative drugs, and energy storage; 2) Areas related to price increases benefiting from the 'anti-involution' policy, such as chemicals, energy metals, and new energy; 3) The deepening of pro-consumption policies may bring phased catalytic opportunities for the consumer sector.

Risk Warning: Unexpected volatility in the global economy, policy implementation falling short of expectations, overseas liquidity risks, geopolitical risks, etc.

China Galaxy Securities: A-share market may welcome a year-end 'minor rally'.

A-share Market Investment Outlook: The A-share market is experiencing upward fluctuations as the year-end approaches, showing a 'minor rally' trend. As of Friday, the Shanghai Composite Index has recorded eight consecutive days of gains. Meanwhile, the market is exhibiting characteristics driven by liquidity, with significantly increased trading volume. On Friday, the total turnover of the entire A-share market exceeded 2 trillion yuan. Popular themes are rotating upwards, with non-ferrous metals and lithium mining sectors benefiting from rising prices. Themes such as the Hainan Free Trade Port and commercial aerospace remain highly active. In the short term, the structural features of the market are expected to continue, and trading volume will likely be a key indicator for market movements.

Disagreements among individual stocks in hot sectors have somewhat intensified, with a focus on core targets. Driven by a weakening US Dollar Index and year-end foreign exchange settlement demand, the RMB exchange rate broke through the 7.0 mark during the week. The attractiveness of RMB-denominated assets is increasing, and positive factors are further accumulating. Looking ahead, attention should be paid to catalytic opportunities arising from policy expectations and industrial trends. The spring rally is worth anticipating. By 2026, the A-share market is expected to demonstrate upward momentum.

Allocation Opportunities: In the short term, defensive sector allocation opportunities should still be considered, while also paying attention to the layout of next year's policy dividends and promising industrial trends. (1) Mainline One: The unprecedented global changes of the century are accelerating, and the underlying logic of the domestic economy is shifting towards new-quality productivity. Key areas under the '15th Five-Year Plan', such as artificial intelligence, embodied intelligence, new energy, controlled nuclear fusion, quantum technology, and aerospace, deserve attention. (2) Mainline Two: Anti-involution policies are being implemented gradually, and improvements in supply-demand structure combined with expectations of price recovery are driving clear profit recovery paths for manufacturing and resource sectors. (3) Auxiliary Line One: Under policies aimed at expanding domestic demand, the consumer sector presents an investment window. (4) Auxiliary Line Two: Overseas expansion trends will further open up corporate profit margins.

Risk Warning: Risks include uncertainty regarding the effectiveness of domestic policies, risks from geopolitical factors, and volatility in market sentiment.

Open Source Securities: Observing the Evolution of This Year's Spring Rally After Eight Consecutive Gains

As of December 26, 2025, the Shanghai Composite Index has achieved eight consecutive days of gains, marking the third occurrence since the '9.24' rally in 2024. Overall, against the backdrop of a domestic macro environment characterized by recovering PPI and anti-involution policies, coupled with a weaker US dollar overseas and a significant increase in AI hardware demand, there is potential for price increases in various sectors. These include chemical products (PTA, pesticides, organosilicon, refrigerants, phosphorus chemicals), new energy materials (lithium hexafluorophosphate, lithium carbonate, electrolytes, separators, cobalt, photovoltaic silicon wafers), electronics and communications related to computing power (electronic chemicals, memory chips, liquid cooling logic overflow), and non-ferrous metals (precious metals, minor metals, energy metals).

The overall strategic thinking still suggests focusing on technology and PPI as the main drivers. However, in terms of trading, attention can be paid to new marginal changes. First, the policy emphasis on expanding domestic demand continues to strengthen, leading to localized surges in consumption sectors such as commerce and community services, although a broader consumer-driven upturn may still depend on sustained data improvements. Second, thematic opportunities around the year-end and New Year period should not be overlooked, particularly in commercial aerospace and satellite industry chains.

Risk warnings: Unexpected changes in macroeconomic policies; short-term market liquidity risks; geopolitical risks; changes in industrial policies.

Zheshang Securities: From 'inconclusive' to 'favoring the bulls', avoid pitfalls, don't chase highs, allocate on dips.

This week, the market moved upward in small increments, driven by strong performance in the A500 ETF, ongoing enthusiasm for commercial aerospace, and continued strength in optical modules.

Looking ahead, we believe that the conclusion that the A-share market will continue to rise in the medium term and maintain a 'systematic slow bull' trend has a high degree of confidence. However, considering that the sustainability of the aforementioned three driving factors remains to be tested, the short-term trend requires a 'wait-and-see' approach.

In terms of allocation, based on the judgment that 'the mid-term uptrend remains intact while short-term movements require further observation': regarding timing, it is recommended to maintain current positions and avoid chasing gains recklessly (especially for products with significant year-to-date increases); if a 'golden buying opportunity' similar to the one earlier this year emerges soon, consider actively increasing allocations at lower levels; in terms of sectors, it is advisable to focus on the brokerage sector, which has seen clear underperformance but expanding market share; regarding specific segments, consider the Hang Seng Tech Index at lower levels, which has undergone sufficient adjustments and formed a daily MACD bullish divergence; as for individual stocks, adopt a strategy of 'focusing less on indices and more on individual stocks,' paying particular attention to low-priced stocks trading above their annual moving averages that have lagged behind.

Editor/melody