Spot silver has surged over 185% this year, becoming the third most valuable asset globally, trailing only gold and NVIDIA.

$XAG/USD (XAGUSD.FX)$ Surging over 185% this year, it has become the world’s third most valuable asset, trailing only $XAU/USD (XAUUSD.CFD)$ and $NVIDIA (NVDA.US)$ and leaving behind tech giants such as $Apple (AAPL.US)$ 、 $Alphabet-A (GOOGL.US)$ and $Microsoft (MSFT.US)$ .

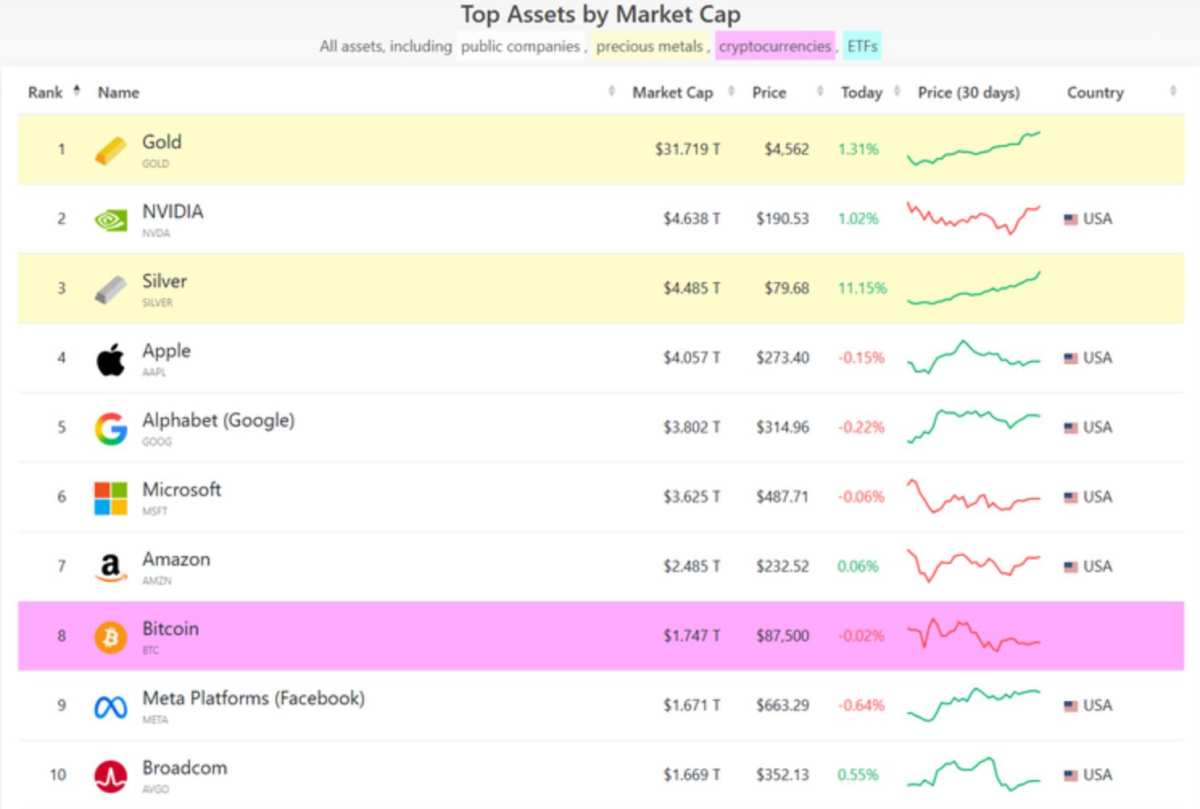

Data from CompaniesMarketCap shows that silver's market capitalization stands at $4.485 trillion; gold leads with $31.719 trillion, followed closely by chip giant NVIDIA at $4.638 trillion. The full top ten rankings are as follows:

Spot silver hit a record high of $79.29 per ounce during Friday's trading session and closed at $79.11. On Monday morning, prices continued their strong upward trend, breaching the $84 per ounce mark for the first time, with cumulative gains exceeding 185% year-to-date.

Spot silver hit a record high of $79.29 per ounce during Friday's trading session and closed at $79.11. On Monday morning, prices continued their strong upward trend, breaching the $84 per ounce mark for the first time, with cumulative gains exceeding 185% year-to-date.

The surge in prices has been driven by constrained supply, its designation as a critical mineral by the United States, robust industrial demand, and amplified volatility due to expectations of Federal Reserve rate cuts combined with low liquidity, contributing to a broad-based rally in precious metals.

Below are some exchange-traded funds focused on silver and silver mining: $iShares Silver Trust (SLV.US)$ 、 $Abrdn Silver ETF Trust (SIVR.US)$ 、 $ProShares Ultra Silver (AGQ.US)$ 、 $Proshares Ultrashort Silver (ZSL.US)$ 、 $Sprott Physical Silver Trust (PSLV.US)$ 、 $Global X Funds Global X Silver Miners Etf (Post Rev Spl (SIL.US)$ 、 $Etf Managers Trust Purefunds Ise Jr Silver Small Miners Exp (SILJ.US)$ and $Ishares Inc Msci Global Silver Miners Etf (SLVP.US)$ 。

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO