Top News

Spot silver continues to surge, hitting a record high above $83.

International spot silver Silver/USD (XAGUSD.FX) After breaking through $80 per ounce at the opening on Monday, international spot silver continued its surge to a record high above $83, extending its historic rally as the year-end approaches. Spot silver has risen for six consecutive trading days, closing up 10% last Friday, marking its largest single-day gain since 2008. Spot silver is up over 185% this year, on track for its best annual performance since 1979. Analysts noted that the recent rise in silver has been driven by speculative capital inflows and ongoing supply disruptions at major trading centers following a short squeeze in October.

CME Group Raises Performance Bond Requirements for All Metal Products

As a globally significant derivatives exchange, the CME Group announced a major margin adjustment on December 26, stating that it would comprehensively increase the performance bond for metal futures such as gold, silver, and lithium after the market close on December 29 (Monday). Market participants view this move as reflecting the exchange's deep concern over the abnormal volatility in the current precious metals market. The CME Group notice stated that to address market fluctuations and ensure adequate collateral coverage, it would raise the performance bond for various metal futures and corresponding Trade at Settlement (TAS) contracts, including gold, silver, palladium, platinum, and lithium, after the market close on December 29, 2025. This adjustment will cover multiple contract specifications, such as standard, mini, and micro contracts, encompassing nearly all core metal trading products under the CME Group.

As a globally significant derivatives exchange, the CME Group announced a major margin adjustment on December 26, stating that it would comprehensively increase the performance bond for metal futures such as gold, silver, and lithium after the market close on December 29 (Monday). Market participants view this move as reflecting the exchange's deep concern over the abnormal volatility in the current precious metals market. The CME Group notice stated that to address market fluctuations and ensure adequate collateral coverage, it would raise the performance bond for various metal futures and corresponding Trade at Settlement (TAS) contracts, including gold, silver, palladium, platinum, and lithium, after the market close on December 29, 2025. This adjustment will cover multiple contract specifications, such as standard, mini, and micro contracts, encompassing nearly all core metal trading products under the CME Group.

U.S. stocks sprint toward new highs as year-end focus shifts to Fed policy and sector rotation

The US stock market is currently at a historical high, with the S&P 500 index just about 1% away from surpassing the 7000-point mark for the first time. It is on track to achieve an eighth consecutive monthly gain, which would represent the longest streak of monthly increases since 2017-2018. "The momentum is clearly on the side of the bulls," said Paul Nolte, senior wealth advisor at Murphy & Sylvest Wealth Management. "Unless an unforeseen external event occurs, I believe the path of least resistance for the stock market remains upward." This week, the minutes from the Federal Reserve's meeting will be the focal point for markets, with investors closely watching for indications of when the Fed might further cut interest rates.

Investors are still awaiting Trump's nomination of a new Federal Reserve Chair to succeed Powell, and any hints from Trump regarding this could influence market movements. The S&P 500 index has risen nearly 18% year-to-date, while the Nasdaq has climbed 22%. However, the technology sector, which has been the main driver of this bull market, has recently struggled, whereas other areas of the market have performed strongly. Anthony Saglimbene, Chief Market Strategist at Ameriprise Financial, noted that these market dynamics indicate a rotation of funds into sectors with more moderate valuations.

Bank of America CEO: Trump Administration Expected to Ease Tariff Tensions Next Year

Brian Moynihan, CEO of Bank of America, anticipates that the Trump administration will ease trade tensions next year. In a CBS program recorded in early December and broadcast on Sunday, Moynihan stated that Bank of America currently expects the situation to “de-escalate rather than escalate.” The average tariff for most countries is projected to be around 15%, with higher tariffs imposed on nations that do not commit to purchasing American products or reducing non-tariff barriers. Trading partners such as North America fall under a “different category”; for small businesses, concerns arising from labor supply uncertainties are more prominent compared to tariffs.

Involving midterm elections, Trump reveals core issues and discusses potential government 'shutdown' risks

On December 27, according to CCTV News, U.S. President Trump stated that he believes the core issue of the 2026 midterm elections will be 'prices,' with Republicans focusing on the cost-of-living problem. He said the 2026 midterm elections will revolve around 'national economic success' and falling prices, emphasizing that energy and gasoline prices have significantly declined. Trump also discussed the risk of a potential government 'shutdown.' He again urged Senate Republicans to abolish the Senate filibuster rule, calling it an obstacle to governance. He stated that if this rule were eliminated, there would be no government 'shutdown,' and that such a move would help advance Republican priorities like healthcare reform and voter ID legislation.

The National Finance Work Conference was held in Beijing from December 27 to 28

The conference pointed out that a more proactive fiscal policy will continue to be implemented in 2026. Finance Minister Lan Fuan stated that fiscal measures will strongly boost consumption next year. A special campaign to stimulate consumption will be carried out in depth, with continued funding allocated to support consumer goods trade-ins, while adjusting and optimizing subsidy scope and standards.

U.S. Stock Market Recap

Major indexes collectively edged lower slightly, with gold, silver, copper, and aluminum sectors leading gains

Last Friday (December 26), the U.S. stock market experienced narrow fluctuations, with the three major indices collectively posting slight declines, ending a streak of five consecutive trading days of gains. At the close, the Dow Jones Industrial Average fell 0.04% to 48,710.97 points; the S&P 500 Index dropped 0.03% to 6,929.94 points; and the Nasdaq Composite Index declined 0.09% to 23,593.10 points.

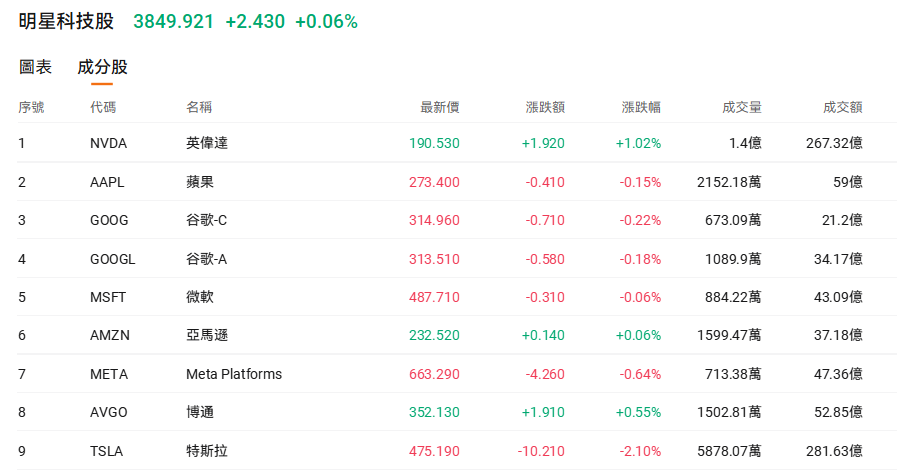

$Star Tech Stocks (LIST2518.US)$ Stocks showed mixed performance. By market capitalization, NVIDIA rose 1.02%, closing at its highest level since November 13. Apple fell 0.15%, Google C dropped 0.22%, Microsoft declined 0.06%, Amazon gained 0.06%, Meta fell 0.64%, Broadcom rose 0.55%, and Tesla dropped 2.1%.

$Popular Chinese Concept Stocks (LIST2517.US)$ The majority closed higher, with XPeng Motors up 6.18%, Li Auto rising 3.93%, Nio gaining 3.87%, Alibaba increasing by 1.45%, PDD Holdings climbing 1.38%, Baidu advancing 1.17%, JD.com rising 0.79%, and TAL Education Group gaining 0.36%.

$PHLX Semiconductor Index (.SOX.US)$ The index rose 0.05%, marking its sixth consecutive day of gains. Taiwan Semiconductor Manufacturing Company increased 1.35%, Entegris climbed 1.02%, ASML Holding gained 0.68%; while Credo Technology fell 3.57%, Nova dropped 1.61%, and Arm Holdings declined 1.15%.

Precious metals such as silver, copper, gold, and aluminum led the gains. During last Friday's session, the spot price of silver surged over 10%, historically breaking through $79 per ounce for the first time. $Silvercorp Metals (SVM.US)$ Closed up 3.61%, $Endeavour Silver (EXK.US)$ Rose 2.96%.

NVIDIA's 800-volt 'Revolution': Global Data Centers Face the Largest Infrastructure Overhaul in History

As the AI arms race enters a new phase, NVIDIA is spearheading an unprecedented 'revolution' in global data center power architecture: transitioning from traditional alternating current to an 800-volt direct current standard. $NVIDIA (NVDA.US)$ NVIDIA recently announced several agreements, including $CoreWeave(CRWV.US)$ 、 $Oracle (ORCL.US)$ , aiming to prepare for ultra-high-density computing environments featuring 800-volt DC power architecture and single-rack power densities reaching 1 megawatt (MW). This shift supports its next-generation 'Vera Rubin' architecture and the 'Kyber' system, which is expected to launch in 2027. Each rack will integrate 576 GPUs, with demands for power and cooling far exceeding the limits of the current 415-volt AC architecture.

Analysts question whether NVIDIA's deal with Groq circumvents regulatory scrutiny, with transaction details yet to be disclosed.

$NVIDIA (NVDA.US)$ A $20 billion deal with Groq described as a 'non-exclusive licensing agreement.' Analysts noted that such non-exclusive licensing agreements have been widely adopted by tech giants in recent years, partly to avoid regulatory scrutiny. Bernstein analyst Stacy Rasgon stated: 'Antitrust risks appear to be the primary concern, but structuring deals as non-exclusive licenses helps maintain the appearance of competition.' Cantor analysts said the move was both offensive and defensive, aiding NVIDIA in expanding its full-stack system technology and solidifying its leadership position in the AI market. Bank of America Securities also described the deal as 'surprising, expensive, but strategically significant,' highlighting NVIDIA’s focus on the future growth of AI inference chips. The company’s CEO, Jensen Huang, is scheduled to speak publicly at CES on January 5, 2026.

Nike is mired in its longest bear market in four decades, but UBS Group has identified bullish signals.

Nike (NKE.US) As stock prices were mired in a retracement, $Apple(AAPL.US)$ CEO Cook invested $2.9 million to buy the dip, doubling his personal stake. UBS’s latest research highlights five positive signals: Nike ranked first globally in net promoter score, consumer purchase intent rebounded, and brand loyalty reached its highest level. The “Return to Wholesale” and “Focus on Sports” strategies championed by the new CEO are showing initial success. Despite favorable data, UBS maintained a “Neutral” rating, arguing that the company’s transformation will take longer than the market expects.

The United States restarts graphite mining operations amid the rapid expansion of the global battery industry.

The graphite mines in the United States were largely closed more than seventy years ago. As a mineral with extremely versatile applications, graphite is used in products ranging from nuclear reactors to pencils. Today, the United States is reevaluating graphite, a long-neglected critical mineral, due to the rapid expansion of the global battery industry. $Titan Mining(TII.US)$ A company in New York State plans to achieve commercial production of graphite by 2028, with an estimated annual output of about 40,000 tons of graphite concentrate, meeting half of the United States’ natural graphite demand.

Novo-Nordisk A/S's long-acting growth hormone Norditropin® has been officially approved for use in China.

Recently, the National Medical Products Administration (NMPA) officially approved the market application for Norditropin® (Pasireotide Growth Hormone), a long-acting growth hormone (LAGH) injection developed and produced by $诺和诺德(NVO.US)$ Company for the treatment of growth delays in children aged 2.5 years and above caused by insufficient endogenous growth hormone secretion. This approval marks Norditropin® as the first international original long-acting growth hormone serving pediatric patients in China.

JPMorgan recently froze accounts of several stablecoin startups.

In recent months, $JPMorgan (JPM.US)$ JPMorgan has frozen the accounts of at least two fast-growing stablecoin startups. These companies operate in high-risk countries such as Venezuela. Their operations in Venezuela and other regions pose legal risks to JPMorgan due to sanctions or other restrictive measures. However, JPMorgan stated that the freezing of these stablecoin companies’ accounts was unrelated to the nature of their businesses. A spokesperson for the bank noted, “This matter has no connection to the stablecoin companies themselves. We provide banking services to stablecoin issuers and collaborate with stablecoin-related enterprises. Recently, we even assisted a stablecoin issuer in completing a public listing.” Beyond this, JPMorgan declined to comment further on the matter.

Top 20 by Trading Value

Market Outlook

Northbound funds reduced their Hong Kong stock holdings by nearly HKD 1.2 billion, purchasing SMIC shares worth nearly HKD 500 million while selling China Mobile shares exceeding HKD 700 million.

On December 24 (Wednesday), southbound funds recorded a net sell-off of HKD 1.175 billion in Hong Kong stocks.

$SMIC (00981.HK)$、$Agricultural Bank of China (601288.SH)$、$Hua Hong Semiconductor (01347.HK)$were respectively subject to net purchases of HKD 491 million, HKD 175 million, and HKD 106 million;

$China Mobile (00941.HK)$、$Tencent (00700.HK)$、$Alibaba-W (09988.HK)$were respectively subject to net sell-offs of HKD 711 million, HKD 611 million, and HKD 288 million.

After the five-year commitment period ended, Xiaomi's co-founder Lin Bin initiated another share reduction plan.

On the evening of December 28, $Xiaomi Group-W(01810.HK)$ an announcement was issued stating that Lin Bin, the company's co-founder, executive director, and vice chairman, plans to sell up to USD 500 million worth of Class B ordinary shares every 12 months starting from December 2026, with total sales not exceeding USD 2 billion (approximately RMB 14 billion). According to the announcement, proceeds from Lin Bin's share reduction plan will primarily be used to establish an investment fund company. Lin Bin remains confident in the company's business prospects and expressed his intention to serve the company in the long term. As disclosed in Xiaomi Group's mid-2025 report, Lin Bin holds approximately 1.835 billion Class B shares through his holding entities, accounting for about 8.56% of the company’s issued share capital. Based on the latest market valuation, the value of Lin Bin's shares exceeds USD 10 billion. Last June, Lin Bin also executed a share reduction.

Pop Mart's Starry People and Crybaby have 'broken out' again.

Recently, $Pop Mart (09992.HK)$ With continuous developments, IPs such as Starry People, Crybaby, and Hirono have gained widespread popularity online. Last week, a collaboration between new tea beverage brand Heytea and Pop Mart's IP character Starry People was launched across multiple Heytea stores. The joint series released simultaneously triggered a buying frenzy, with related merchandise being resold at inflated prices on second-hand trading platforms. On December 20, the Crybaby special exhibition opened at Dream Center West Bund · Dream Factory in Shanghai, featuring three classic IP characters: Crybaby, Crybunny, and Cryteddy. Upon checking, most time slots for the exhibition are already fully booked.

MMG: Expansion Project of Khoemacau Copper Mine in Botswana Approved and Construction Commenced

On the morning of December 29, $MMG Limited (01208.HK)$ announced on the Hong Kong Stock Exchange that it had approved the feasibility study for a major expansion project at the Khoemacau copper mine in Botswana and officially commenced construction. The project aims to increase annual production capacity to 130,000 tons of copper in copper concentrate and raise the annual output of by-product silver to over 4 million ounces. The project will include extending mining areas to Zone 5 North, Mango, and Zeta Northeast deposits, as well as constructing a new processing plant with an annual capacity of 4.5 million tons. This expansion will increase the mine's total processing capacity to over 8 million tons per year. The total capital expenditure for the project is estimated at approximately $900 million. The expansion project is expected to produce its first batch of copper concentrate in the first half of 2028. Looking ahead, ongoing exploration activities at the Khoemacau site have identified potential for further production increases, with annual capacity potentially reaching 200,000 tons of copper. The company plans to initiate a pre-feasibility study for the next phase of expansion in 2026.

FAW Equity Premium Subscribes to Nearly 75 Million Shares of Leapmotor

Leapmotor (09863.HK) announced on the Hong Kong Stock Exchange that on December 28, the company entered into a domestic share subscription agreement with FAW Equity, under which the company has conditionally agreed to issue 74,832,245 domestic shares to FAW Equity at a subscription price of RMB 50.03 per domestic share (equivalent to HKD 55.29; Leapmotor’s latest closing price was HKD 49.84). The domestic shares will be issued under the general mandate.

Today's Focus

Keywords: Summary of opinions from the Bank of Japan policy meeting, weekly EIA crude oil inventory

In terms of economic data, attention can be paid to the EIA crude oil inventory and the U.S. November pending home sales month-over-month rate.

11:00 PM U.S. November pending home sales index month-over-month rate

23:30 U.S. EIA crude oil inventory (in million barrels) for the week ending December 19

23:30 U.S. Dallas Fed Business Activity Index for December

In terms of financial events, attention should be paid to the summary of policy opinions from the Bank of Japan.

07:50 Bank of Japan releases summary of opinions from the December monetary policy meeting deliberation committee

14:30 China Council for the Promotion of International Trade holds a regular press conference in December to introduce the results of organizing a delegation of Chinese entrepreneurs to visit the United States, among other topics

![]()

Morning Reading by Niuniu:

The stock market cannot rise indefinitely; timely loss mitigation is the key to successful investing.

——Buffett

![]() AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

Editor/Rocky