The offshore RMB exchange rate has recently broken through the 7.0 mark.

Since late November, the RMB exchange rate has been continuously appreciating, repeatedly reaching new highs for the year. The offshore RMB exchange rate broke through the 7.0 level, with an accelerated pace of appreciation. On December 25, the offshore RMB exchange rate broke through the 7.0 mark, hitting a new high since September 2024. The onshore RMB exchange rate is also nearing the 7.0 mark and has reached its highest level since May 2023.

We believe that the depreciation of the US dollar and seasonal factors may be the direct drivers behind the current appreciation of the RMB. However, the monetary authorities have moderately restrained the pace of exchange rate appreciation. Overall, we find the year-end appreciation trend of the RMB unsurprising, though its magnitude slightly exceeded expectations. The primary factor may be the significant decline in the US dollar, compounded by seasonal effects, which propelled a relatively rapid appreciation of the RMB in the short term.

The depreciation of the US dollar may be the direct factor.

$USD (USDindex.FX)$Since late November, it has weakened continuously, with a decline of over 2% in the past month as of December 25. We believe the main reason may be the deepening market expectation of Fed easing, which has driven convergence expectations regarding monetary policies between the US and other major economies.

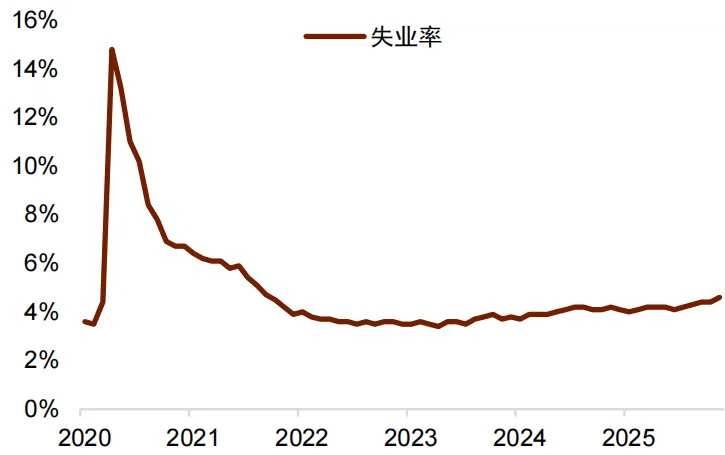

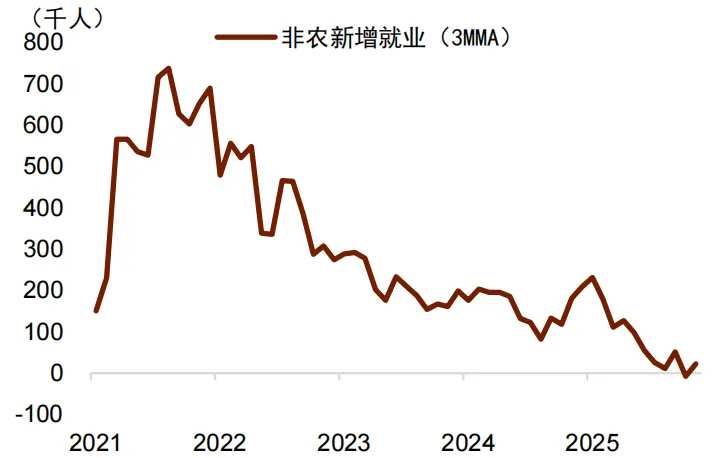

Recent labor market and price data in the US have both been weaker. Market expectations regarding personnel changes at the Fed may also have heightened expectations for future easing. From the perspective of the labor market, the US unemployment rate rose to 4.6% in November, higher than market expectations (Chart 1). Non-farm payroll employment increased by 64,000, also above market expectations, but the three-month moving average was only 22,000, remaining near the year's low (Chart 2). The US average hourly earnings growth year-on-year dropped to 3.5% in November, marking a recent low (Chart 3).

Recent labor market and price data in the US have both been weaker. Market expectations regarding personnel changes at the Fed may also have heightened expectations for future easing. From the perspective of the labor market, the US unemployment rate rose to 4.6% in November, higher than market expectations (Chart 1). Non-farm payroll employment increased by 64,000, also above market expectations, but the three-month moving average was only 22,000, remaining near the year's low (Chart 2). The US average hourly earnings growth year-on-year dropped to 3.5% in November, marking a recent low (Chart 3).

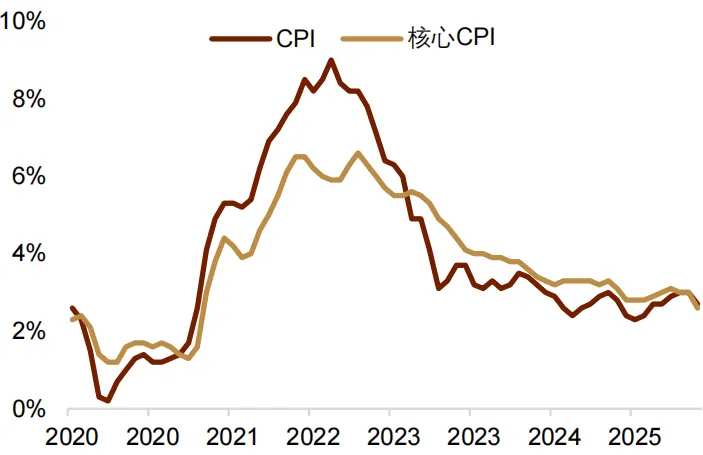

From the perspective of prices, the US CPI year-on-year was 2.7% in November, while core CPI year-on-year was 2.6%, both significantly below market expectations of 3.1% and 3%, respectively (Chart 4). Despite some concerns about the accuracy of this inflation report, we believe the dual cooling of the labor market and price trends still provides a data basis for the Fed's subsequent rate cuts. Recent discussions about personnel arrangements for the next Fed Chair have also heated up. Given Trump's repeated calls for Powell to cut rates this year, the market widely believes the next Fed Chair will likely focus on advancing the rate-cutting cycle.

Trump recently stated that he hopes the next Fed Chair will lower interest rates, saying 'anyone who disagrees with me will never become the Fed Chair.' In summary, although there have been some fluctuations in the term premium of long-term US Treasury bonds, market expectations for a decline in short-term US dollar interest rates appear relatively consistent, which may have contributed to the recent weakening of the US dollar exchange rate.

Chart 1: The US unemployment rate in November showed an increase.

Chart 2: Recent non-farm payroll employment growth in the US has been relatively weak.

Chart 3: US wage growth in November was relatively sluggish.

Chart 4: US price data shows a decline.

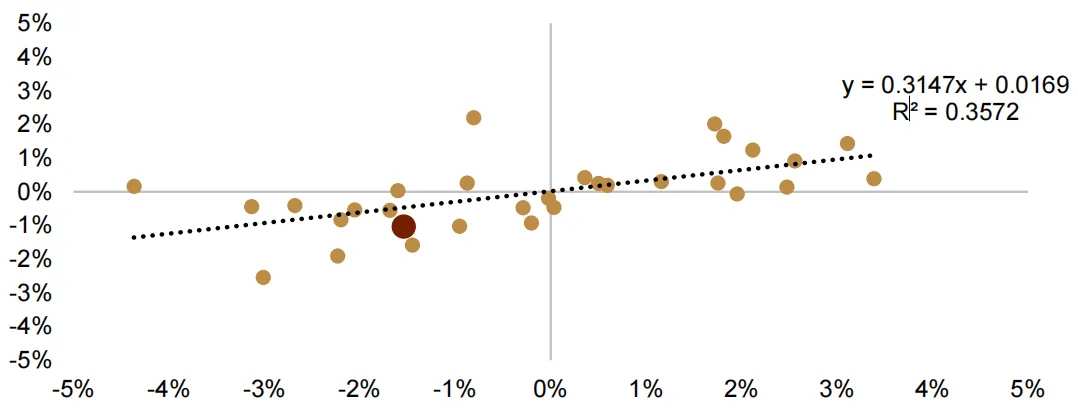

Based on the correlation between the US Dollar Index and the RMB in recent years, the recent appreciation of the RMB exchange rate roughly matches the depreciation of the US Dollar. We analyzed the monthly changes in the US Dollar Index and the RMB exchange rate since June 2023, and found that the ratio of their changes is approximately 3:1, meaning that when the US Dollar Index depreciates by 3%, the RMB exchange rate appreciates by 1% (Chart 5). As of December 26, the US Dollar Index fell by about 1.4% this month, while the RMB appreciated by about 0.9%. Based on historical correlations, the decline in the US Dollar can explain about half of the RMB's appreciation in December. The remaining portion may be explained by other factors.

Chart 5: Ratio of change rates between the US Dollar Index and the RMB exchange rate.

Note: The x-axis represents the monthly change rate of the US Dollar Index, and the y-axis represents the monthly change rate of the RMB exchange rate. The data covers the period from June 2023 to the present.

Year-end seasonal patterns in exchange rates.

Based on past experience, the RMB exchange rate often experiences strong appreciation momentum at the beginning and end of the year. Specifically, over the past few years, the RMB exchange rate has typically appreciated in November, December, and January, showing a clear seasonal pattern (Chart 6).

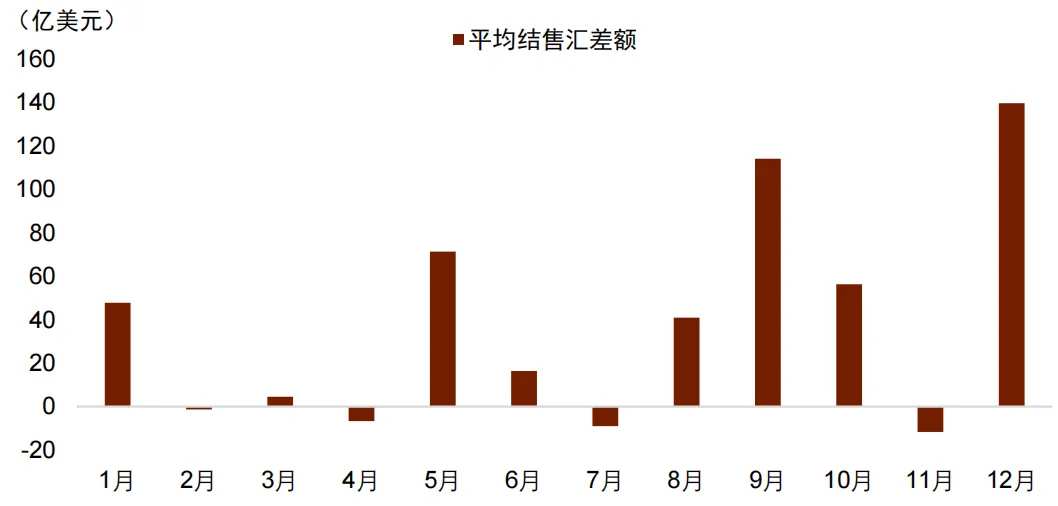

From the perspective of December, on one hand, due to the foreign exchange settlement needs of exporters and other market participants, the scale of net foreign exchange settlement is usually large, providing conditions for the appreciation of the RMB exchange rate (Chart 7); on the other hand, the US Dollar Index tends to weaken at the end of the year, which also helps drive the general appreciation of non-US currencies (Chart 8).

Considering that the appreciation of the RMB this year has already exceeded the returns on US Dollar funds (generally 3%-4%), the year-end appreciation has caused trading companies with unhedged US Dollar positions to incur net losses. To ensure stability in year-end financial settlements, the accelerated entry of foreign trade companies' foreign exchange settlement demand may have contributed to some extent to the RMB's appreciation at the end of the year.

Chart 6: Seasonal Performance of the RMB

Note: The numbers in the cells represent the monthly change rate of the RMB exchange rate

Chart 7: FX settlement and sales surplus tends to be relatively large in December

Note: Data covers from 2017 to present, excluding December 2025

Chart 8: The US Dollar Index tends to depreciate towards the end of the year

Policies are still striving to smooth short-term fluctuations

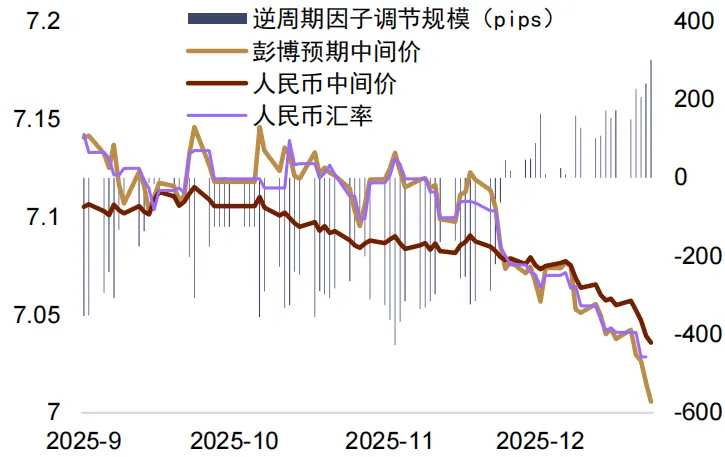

Recently, both the central parity rate and the RMB exchange rate have appreciated. However, the appreciation magnitude of the central parity rate has been notably slower, potentially reflecting its countercyclical adjustment role. Specifically, both the central parity rate and the RMB exchange rate have maintained an upward trend recently, but the former's appreciation magnitude is significantly weaker than the latter. As of December 25, 2025, the central parity rate was 326 points weaker than the spot exchange rate, marking the largest gap since March 2023 where the central parity rate was weaker than the spot rate. Based on the pricing model of the central parity rate, the adjustment scale of the 'countercyclical factor' turned positive, indicating that the countercyclical factor aims to smooth over-adjustments in the appreciation direction (Chart 9).

Chart 9: Significant reverse adjustment scale of the countercyclical factor

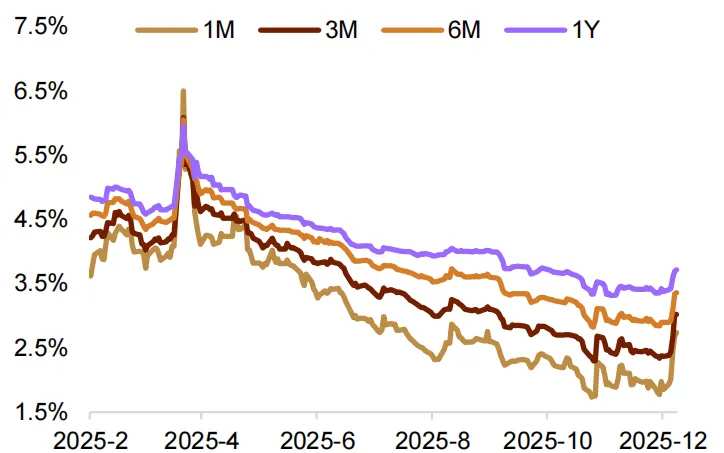

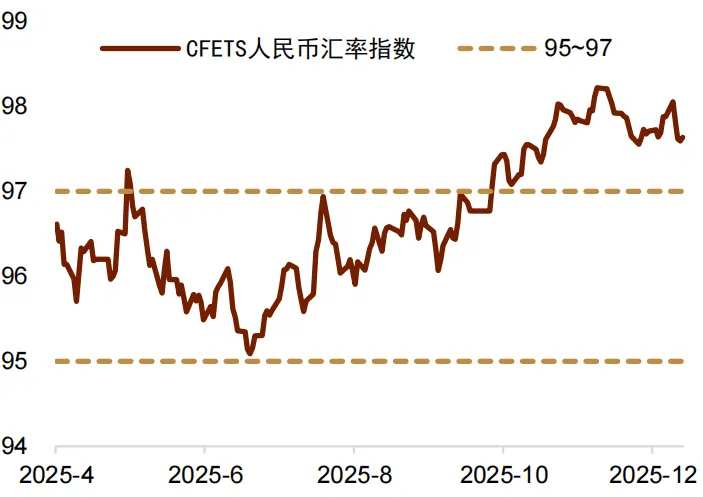

We believe the movement of the central parity rate can be understood from two aspects. On one hand, against the backdrop of the recent acceleration in the appreciation of the spot exchange rate, the central parity rate also maintained a certain appreciation pace without sticking to a specific level. We believe this demonstrates increased exchange rate flexibility, releasing upward pressure on the exchange rate at the appropriate time. The implied volatility of RMB options has recently risen, and previous expectations of a more moderate appreciation pace may have loosened somewhat (Chart 10). On the other hand, driven by the reverse effect of the countercyclical factor, the appreciation pace of the central parity rate has been significantly slower than that of the spot exchange rate. Therefore, despite the recent continuous appreciation of the RMB against the US dollar, it has tended to depreciate more against a basket of currencies (Chart 11). We believe that the characteristic of monetary authorities' countercyclical adjustments to the exchange rate trend remains evident.

Chart 10: Implied volatility of the RMB has risen significantly recently.

Chart 11: The RMB has depreciated against a basket of currencies in recent days.

Looking ahead, the RMB may continue to maintain a moderate appreciation trend.

In December, the RMB appreciated by approximately 1% on a monthly basis, with an annualized rate exceeding 10%. We believe such a pace of appreciation may be difficult to sustain. Reviewing the two rounds of appreciation from April to May and August to September 2025, after short-term rapid appreciation, the RMB exchange rate tended to consolidate for a period due to changes in internal and external conditions. Therefore, after a short-term surge, it is highly likely that we will see a moderation in the slope of RMB appreciation. This timing may occur around the Spring Festival of 2026. On one hand, the US dollar tends to rebound seasonally in February, which would ease the upward momentum of the RMB exchange rate. On the other hand, seasonal factors driving RMB conversion in the domestic market are likely to weaken significantly after the Spring Festival.

In the medium to long term, we believe the foundation for the RMB exchange rate to strengthen will remain for some time, during which the RMB exchange rate is expected to maintain a moderate upward trend.

From an external perspective, the first pillar supporting the RMB's strength is a 'weak US dollar.' Measures introduced this year by the Trump administration, such as 'reciprocal tariffs,' have undermined the credibility of the US dollar. Additionally, the Federal Reserve’s progress in cutting interest rates will likely reduce US Treasury yields and lower the cost of hedging the US dollar. In 2026, we believe the market may gradually become desensitized to policy uncertainty under the Trump administration. However, weak employment data and a dovish new Federal Reserve Chair could push the Fed to continue cutting rates, leading to a loose liquidity environment and narrowing interest rate differentials, which might further weaken the US dollar and thereby provide support to the RMB exchange rate.

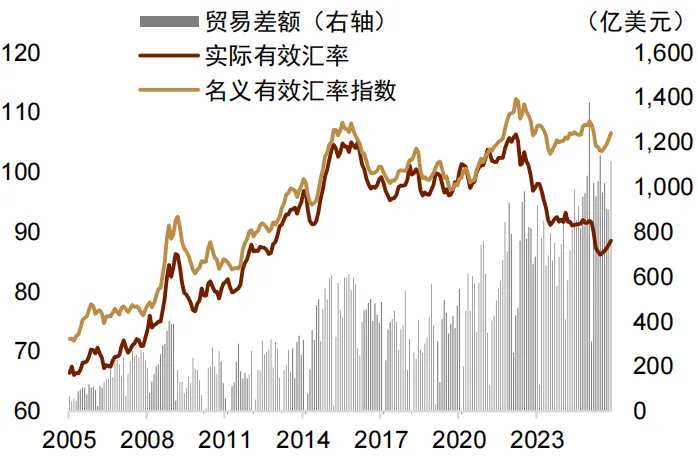

Internally, the foundation for a stronger RMB exchange rate lies in 'low inflation, strong exports, and high trade surpluses.' From a fundamental standpoint, China has experienced relatively low inflation in recent years, coupled with a weak real effective exchange rate (Chart 12). Additionally, the rise of China's manufacturing sector has allowed its exports to capture a significant share of the global market. With average monthly imports in 2025 dropping to a five-year low, this drove the cumulative trade surplus in November to surpass one trillion US dollars. China’s net international investment position, excluding reserve assets, also reached its highest historical level (Chart 13). There is a need to correct imbalances in the balance of payments caused by an undervalued real exchange rate and excessive trade surpluses.

Therefore, in terms of policy orientation, we observe that the focus has shifted more toward boosting domestic demand rather than relying excessively on external demand to drive economic growth. Both the nominal and real effective exchange rates of the RMB tend to appreciate simultaneously during periods of expanding trade surpluses (Chart 14), demonstrating that the exchange rate acts as an 'automatic stabilizer,' balancing international payments and the structure of domestic and foreign demand. Furthermore, the '15th Five-Year Plan' emphasizes 'advancing the internationalization of the RMB and enhancing the openness of the capital account.' We believe that a moderately strong exchange rate expectation can help balance cross-border capital flows and serve the goal of RMB internationalization. The internal and external foundations supporting the strengthening of the RMB are likely to continue driving a general moderate appreciation of the RMB exchange rate for some time.

Chart 12: The real effective exchange rate of the RMB remains at a relatively low level.

Chart 13: Increase in International Investment Net Position

Chart 14: Trade Surplus May Drive Currency Appreciation

So, what is an appropriate rate of appreciation? We believe there are several dimensions that can serve as references. The first is the decline of the US dollar. We estimate that$USD (USDindex.FX)$next year’s decline may be around 5%. Based on the historical 1:3 ratio, the appreciation of the central parity rate of the RMB could be approximately 1.7%.

The second dimension is the interest rate differential between China and the US. The appreciation of the RMB exchange rate from May to the end of November this year has generally matched the interest rate differential between China and the US, thereby achieving a form of uncovered interest rate parity. This has played a role in promoting the balance of cross-border capital flows and foreign exchange market supply and demand. Currently, the differential is around 2%, and by 2026, it may narrow to 1-1.5%. Therefore, from the perspective of balancing interest rate differentials, the appreciation range of the RMB central parity rate could be between 1-2%.

The third dimension is inflation differentials. As mentioned earlier, China's relatively low inflation has led to a depreciation of the real exchange rate. If the real exchange rate is to remain broadly stable, it will be necessary to boost domestic demand and raise price levels, or allow the nominal exchange rate to appreciate to compensate for the inflation differential. Using the GDP deflator to measure, the inflation differential between China and the US is about 4%. Assuming this differential persists, a rough calculation suggests that China’s nominal exchange rate would need to appreciate by approximately 4% to maintain the basic stability of the real exchange rate.

Overall, we believe that the continuous appreciation of the RMB exchange rate is a high-probability event. However, we must also recognize that there are two preconditions for exchange rate appreciation, and the rate of appreciation involves multiple equilibrium issues. Uncertainty regarding its trajectory remains relatively high.

Editor/melody