Futu News reported on December 29 that $INSILICO (03696.HK)$ The grey market price has surged by 82.12%, reaching HKD 43.80. With each lot consisting of 500 shares, the profit per lot, excluding handling fees, amounts to HKD 9,875.

Source of market data: Futu Securities

Company Overview

Insilico Medicine was founded in 2014 and is headquartered in Hong Kong, China. It is a globally leading AI-driven drug discovery and development enterprise. The company's self-developed generative artificial intelligence platform, Pharma.AI, integrates four major modules: Biology42, Chemistry42, Medicine42, and Science42, covering an end-to-end drug R&D process from novel target identification, small molecule generation, to clinical outcome prediction. The company advances its business through (i) independently developing candidate drugs; (ii) co-developing licensed drugs while retaining partial intellectual property rights; and (iii) collaborating with other pharmaceutical companies without retaining any intellectual property rights.

Insilico Medicine was founded in 2014 and is headquartered in Hong Kong, China. It is a globally leading AI-driven drug discovery and development enterprise. The company's self-developed generative artificial intelligence platform, Pharma.AI, integrates four major modules: Biology42, Chemistry42, Medicine42, and Science42, covering an end-to-end drug R&D process from novel target identification, small molecule generation, to clinical outcome prediction. The company advances its business through (i) independently developing candidate drugs; (ii) co-developing licensed drugs while retaining partial intellectual property rights; and (iii) collaborating with other pharmaceutical companies without retaining any intellectual property rights.

As of the latest practicable date, the company has generated over 20 assets at the clinical or IND submission stage through its self-developed generative artificial intelligence platform, Pharma.AI. Among these, three assets have been licensed to international pharmaceutical and healthcare companies, with a total contract value of up to USD 2.1 billion. Additionally, one asset is in Phase II of independent development, placing the company at a relatively advanced stage within the industry.

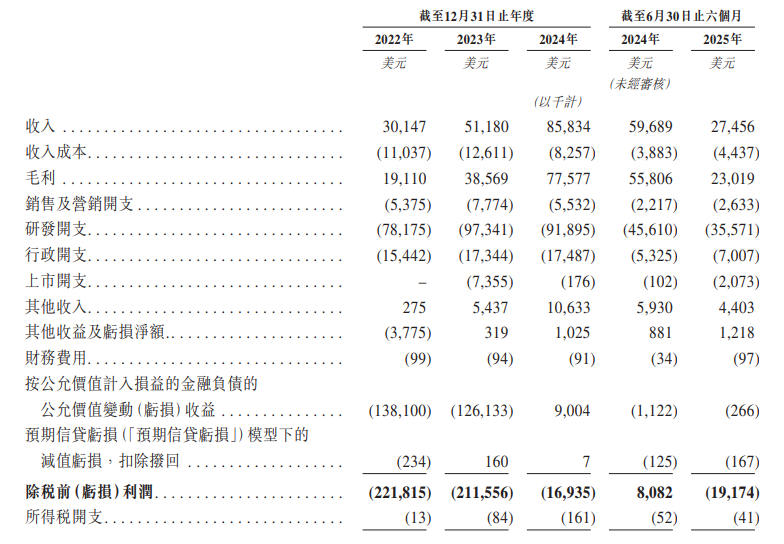

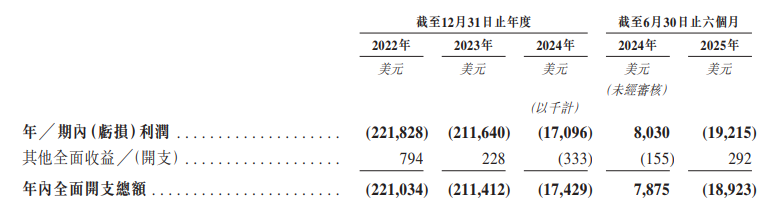

Financial Overview

In terms of financial performance, during the reporting period, the company generated revenue from drug discovery and pipeline development, software solutions, and other discoveries. In 2022, 2023, 2024, and for the six months ended June 30, 2024, and June 30, 2025, the majority of the company’s revenue came from drug discovery and pipeline development, accounting for 95.0%, 93.4%, 92.9%, 95.2%, and 87.1%, respectively. As of the latest practicable date, the company does not have any commercialized products and therefore has not generated any revenue from them. Cost of revenue primarily includes third-party contracting costs and labor costs related to the drug discovery and pipeline development business.

Futu's dark pool platform is reliable and does not crash, supporting market orders for rapid execution. Over 850,000 people use Futu to subscribe to new stock offerings, gaining an edge in the dark pool, with faster buying and selling capabilities.Come and experience it now >>

Editor/Hao