Citi, the Wall Street financial giant, recently released a research report stating that the trend of 'International Rearmament' is set to become a structural and multi-year global demand driver in the military-industrial and defense sector. The report predicts that the military sector in international stock markets will remain one of the hottest investment themes in global equity markets over the next 2-3 years, with the potential to be a core contributor to stock market growth. U.S.-based military-industrial giants $RTX Corp (RTX.US)$ are expected to emerge as one of the key beneficiaries emphasized by Citi due to their significantly higher exposure to international business revenue/orders compared to peers like Lockheed Martin.

In a year filled with trade frictions, geopolitical instability and conflict, as well as latent concerns over an 'AI bubble burst,' both the defense sector and precious metals—including gold, silver, and platinum—have seen a comprehensive price surge in 2025. Meanwhile, traditional safe-haven assets other than gold have collectively failed, presenting an unprecedented extreme pricing scenario in the hundred-year history of capital markets.

If you are concerned about escalating global geopolitical conflicts, investing in traditionally defensive stock sectors such as utilities and consumer staples—the most typical 'traditional safe havens'—may not be the best option. Instead, the true haven lies in the defense sector, which is closely tied to geopolitical tensions and carries the title of an 'alternative safe haven.' Recent statistical data shows that a frenzy of defense-related investments has swept the stock market. For instance, U.S. aerospace and defense stocks have risen by a staggering 36% year-to-date in 2025, while European defense stocks have surged 55% so far this year, even outperforming the semiconductor sector—the core driver of the U.S. bull market—which gained around 45%. This outperformance is primarily due to Germany and the broader European continent seeking to rearm after Trump announced a focus on domestic defense construction in the United States.

Generally speaking, the defense sector is not traditionally viewed by traders as a long-term “conventional safe haven,” but rather as an “alternative safe asset.” It can exhibit relative strength akin to safe-haven behavior during periods of conflict escalation or rearmament cycles, but it remains fundamentally an equity risk asset, subject to valuation, interest rates, market beta, policy, and order cycles. Thus, its logic leans more toward “profit revisions driven by fiscal budgets and military spending,” differing from traditional safe-haven assets like gold/U.S. Treasuries and markedly distinct from “traditionally defensive equity sectors” (e.g., utilities, consumer staples, healthcare) that exhibit more stable demand during economic downturns or volatility.

Generally speaking, the defense sector is not traditionally viewed by traders as a long-term “conventional safe haven,” but rather as an “alternative safe asset.” It can exhibit relative strength akin to safe-haven behavior during periods of conflict escalation or rearmament cycles, but it remains fundamentally an equity risk asset, subject to valuation, interest rates, market beta, policy, and order cycles. Thus, its logic leans more toward “profit revisions driven by fiscal budgets and military spending,” differing from traditional safe-haven assets like gold/U.S. Treasuries and markedly distinct from “traditionally defensive equity sectors” (e.g., utilities, consumer staples, healthcare) that exhibit more stable demand during economic downturns or volatility.

However, in a year marked by heightened conflict and uncertainty, it is not the traditionally defensive sectors like utilities or consumer staples that outperform, but rather the 'alternative safe haven' of the defense sector (defense supply chain) itself. This corresponds to 'guns' being the direct conduit of power and budget allocation: when ongoing geopolitical turbulence drives risk aversion and national security becomes the main investment theme in macro financial markets, global capital tends to perfectly price the chain of 'defense spending—orders—profits.'

Citi hails the global wave of defense stock investments, calling RTX Corp a must-own opportunity.

Citi highlighted in its report that $RTX Corp (RTX.US)$ demonstrates a more prominent exposure to international military-defense businesses and order structures relative to its industry peers, linking this advantage directly to trends such as NATO's significant increase in defense spending targets, potential boosts from the EU, rising Foreign Military Sales (FMS), and accelerated co-production.

Citi summarized the current defense demand as the 'International Rearmament Megatrend': major defense contractors are experiencing record-high international backlogs. Driven by NATO's increased defense spending as a percentage of GDP and the EU's potential large-scale additional funding, allied budgets are showing a 'structural upward shift.' The report highlights two mid-level signals: FMS orders and co-production timelines are accelerating—indicating that demand is transitioning from 'intent/procurement negotiations' to more visible execution and delivery (favorable for order growth and revenue recognition for defense giants). Defense companies are also ramping up investments in production capacity, partnerships, and local industrialization efforts (in Europe/Asia) to meet growing defense demands post-2026.

Globally, especially during the 'rearmament' cycle in Europe and the U.S., Citi favors leaders that can convert international defense needs into sustainable deliveries and profits—particularly companies with high proportions of international orders and typically higher gross margins/stronger bargaining power in international business, such as the U.S. defense giant RTX Corp. Citi noted that RTX's substantial backlog structure suggests that the proportion of high-margin international business may continue to rise.

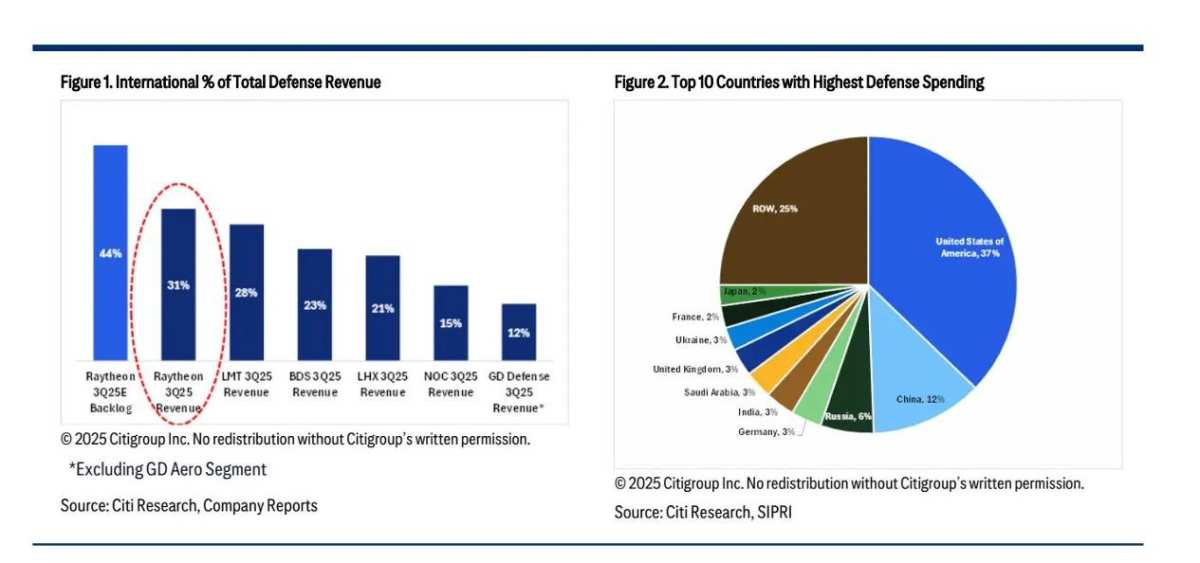

Citi noted that $RTX Corp (RTX.US)$ international business revenue accounted for approximately 31% in Q3 2025; more importantly, international backlog orders made up about 44% in Q3 2025, indicating a higher 'international component' in future deliveries and revenue recognition with greater visibility. Comparative data further underscores the strength of RTX Corp’s international military-defense business: $Lockheed Martin (LMT.US)$ approximately 28%, BDS around 23%, $L3Harris Technologies (LHX.US)$ roughly 21%, $Northrop Grumman (NOC.US)$ about 15%, and GD Defense approximately 12% (all percentages refer to international revenue share; GD figures exclude aviation business).

In Europe, a package of financing/fiscal arrangements proposed by the European Commission highlights one of the key goals over the next four years (commonly referred to as 2025–2028): mobilizing approximately €800 billion in defense-related investments and expenditure, with the majority coming from member states’ national budgets. At the EU level, the emphasis is on facilitating this through 'loan instruments + rule relaxations.' The German government has even proclaimed a 'whatever it takes' approach to push forward its domestic defense construction, infrastructure upgrades, and new developments.

The economic plan for the special fund of the German Federal Armed Forces (Bundeswehr), approved by the Budget Committee of the German Parliament for the 2026 defense budget, shows a total scale exceeding 108 billion euros. The German Finance Minister previously stated that defense spending will gradually increase from about 2.4% of GDP in the current year in the near future, with expectations to reach 3.5% of GDP by 2029.

In the rearmament cycle, segments such as air defense and missile interception, precision-guided munitions, sensors/radar, command-and-control systems, and interception frameworks typically benefit first from budget increments. $RTX Corp (RTX.US)$ RTX Corp's core defense and military business portfolio (missile and air defense systems, radar and sensors, integrated avionics, and integrated military mission systems, etc.) shows a high degree of alignment with procurement trends focused on 'allied restocking and enhancing systemic combat capabilities.' This also explains why Citi considers the ratio of international orders to international backlog as a key performance indicator for RTX Corp.

RTX Corp takes pride in its Patriot air defense and missile interception system, which is one of the backbone air defense systems for many countries. RTX disclosed that it is used by '19 countries.' The NASAMS National Advanced Surface-to-Air Missile System (developed in collaboration with Norway’s Kongsberg, with Raytheon AMRAAM as the core missile type) is reportedly used by 13 countries, while the FIM-92 Stinger portable air defense missile is described by RTX as the 'preferred surface-to-air missile for 24 countries.'

Citi emphasized that, against the backdrop of international rearmament and increased budget allocations among U.S. allies (especially in Europe), priority should be given to leading companies with higher exposure to international markets and better visibility of international orders. Among these, RTX Corp stands out as the top choice within the defense investment theme due to its 'high proportion of international revenue and larger international backlog.' Consequently, Citi initiated coverage on Raytheon Technologies (RTX) with a 'Buy' rating and a 12-month target price of $211. As of last Friday’s U.S. stock market close, Raytheon’s share price settled at $185, with a market capitalization nearing $250 billion.

Editor/Doris