This article summarizes the latest views of analysts from Economies.com today, covering multiple instruments including spot gold and WTI crude oil futures!

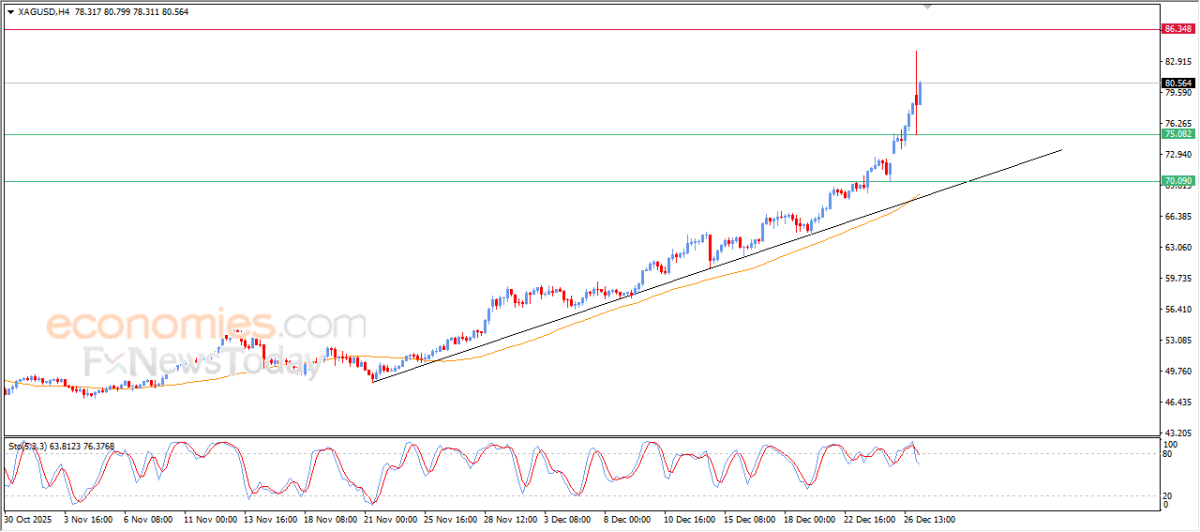

International spot silver opened this week's trading with significant volatility.

According to the latest analysis from Economies.com, international spot silver exhibited volatile movements in recent intraday trading, retreating after hitting a record high. Negative signals emerged as the Relative Strength Index (RSI) reached overbought levels. Currently, silver prices are attempting to gather more positive momentum to help test new historical resistance levels. Throughout this process, dynamic support remains effective — specifically, prices have stabilized above the 50-day exponential moving average, while the short-term primary bullish trend has kept prices aligned with the trendline, further solidifying the stability of the current upward trajectory.

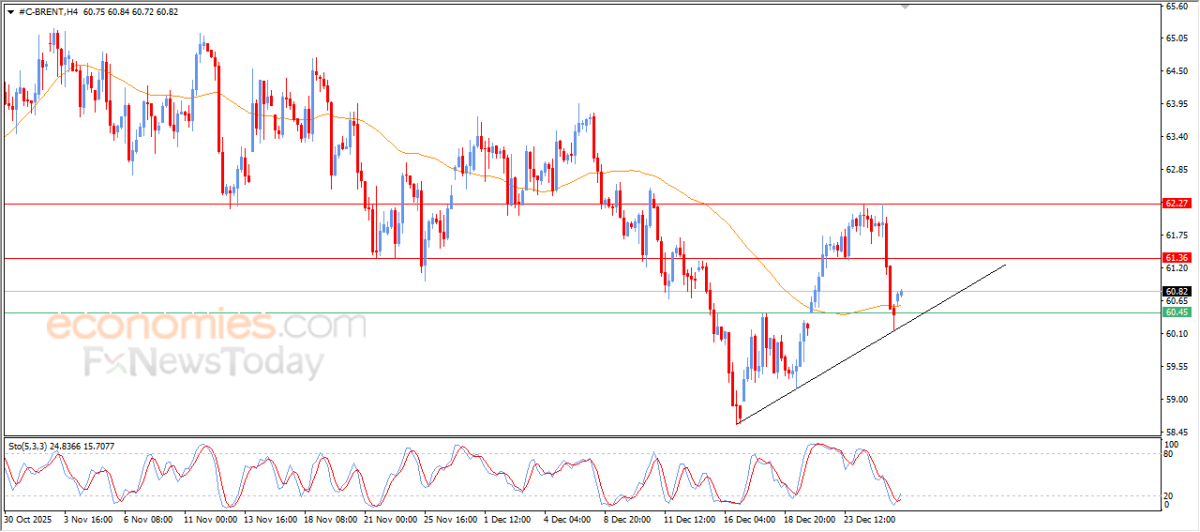

Brent crude oil futures extended their gains.

According to the latest analysis from Economies.com, Brent crude oil futures continued their upward trend in recent intraday trading, benefiting from movement along a short-term bullish correction trendline and gaining bullish momentum through support anchored by the 50-day exponential moving average. This has increased the likelihood of prices continuing their upward trend in the short term. Notably, the RSI has shown positive signals after reaching oversold levels, suggesting that a bullish divergence pattern is beginning to form.

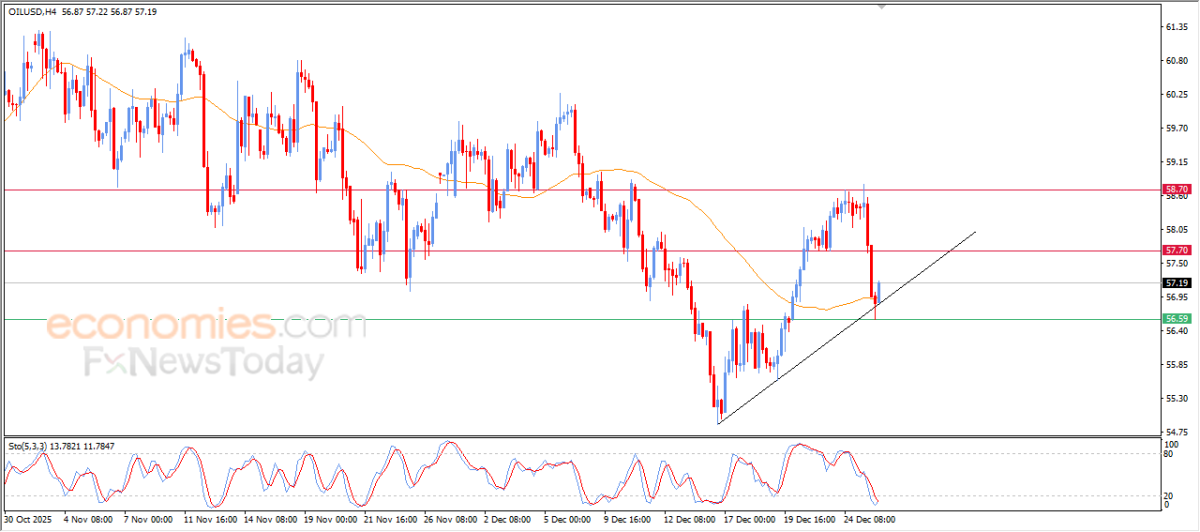

WTI crude oil futures prices are gaining bullish momentum.

According to the latest analysis from Economies.com, WTI crude oil futures rose in recent intraday trading following a deep correction. Prices, supported by the 50-day exponential moving average, gained bullish momentum, driving temporary increases and attempting to recover some of the recent losses. This stabilization and rebound occurred alongside testing of a short-term bullish correction trendline. Additionally, the RSI showed positive divergence after reaching oversold levels, accompanied by other positive signals, supporting the possibility of oil prices maintaining an upward trend in subsequent periods.

According to the latest analysis from Economies.com, WTI crude oil futures rose in recent intraday trading following a deep correction. Prices, supported by the 50-day exponential moving average, gained bullish momentum, driving temporary increases and attempting to recover some of the recent losses. This stabilization and rebound occurred alongside testing of a short-term bullish correction trendline. Additionally, the RSI showed positive divergence after reaching oversold levels, accompanied by other positive signals, supporting the possibility of oil prices maintaining an upward trend in subsequent periods.

Spot gold prices are attempting to gain bullish momentum.

According to the latest analysis from Economies.com, international spot gold fell during recent intraday trading but is now attempting to regain bullish momentum to help it recover and resume its path toward new record highs. Meanwhile, the RSI is trying to exit a clear overbought condition — particularly as negative signals have already appeared — making it more likely for gold prices to continue fluctuating in the near future. With prices holding above the 50-day exponential moving average, dynamic support remains valid, enhancing the possibility of recovery in the short term. This is especially true given the dominance of the short-term primary bullish trend, with prices aligning with the trendline support.