Futu News reported on December 29 that$FOREST CABIN (02657.HK)$The grey market price surged by 22.16%, reaching HKD 95 per share, with each lot consisting of 50 shares. Excluding handling fees, a profit of HKD 861.5 can be earned per lot.

Source of market data: Futu Securities

Company Overview

The company is a high-end domestic skincare brand in China, focusing on the anti-wrinkle and firming skincare market. It is renowned for its flagship brand, Linqingxuan, which provides premium skincare solutions based on camellia ingredients.

The company is a high-end domestic skincare brand in China, focusing on the anti-wrinkle and firming skincare market. It is renowned for its flagship brand, Linqingxuan, which provides premium skincare solutions based on camellia ingredients.

According to data from CIC Consulting, since initiating research on camellia-based skincare products in 2012, the company pioneered the concept of 'nourishing skin with oil' and developed a camellia facial essence oil. Dedicated to providing safe and effective skincare solutions, the company launched its first camellia essence oil in 2014, which laid the foundation for its core oil-based skincare product line. After more than a decade of development, the company has accumulated expertise in cellular-level anti-wrinkle essence oil. Based on total retail sales across all channels, the company’s camellia essence oil has ranked first among all facial essence oils nationwide for 11 consecutive years since 2014.

The company's product advantages and R&D capabilities have gained widespread recognition within the industry. It has been designated as a 'High-tech Enterprise' and a 'Shanghai Specialized, Precise, Unique, and Innovative Enterprise.' The company also serves as the vice-chairman unit for several key industry associations, including the China Association of Fragrance Flavor and Cosmetic Industries and the Shanghai Daily Chemicals Industry Association.

Financial Overview

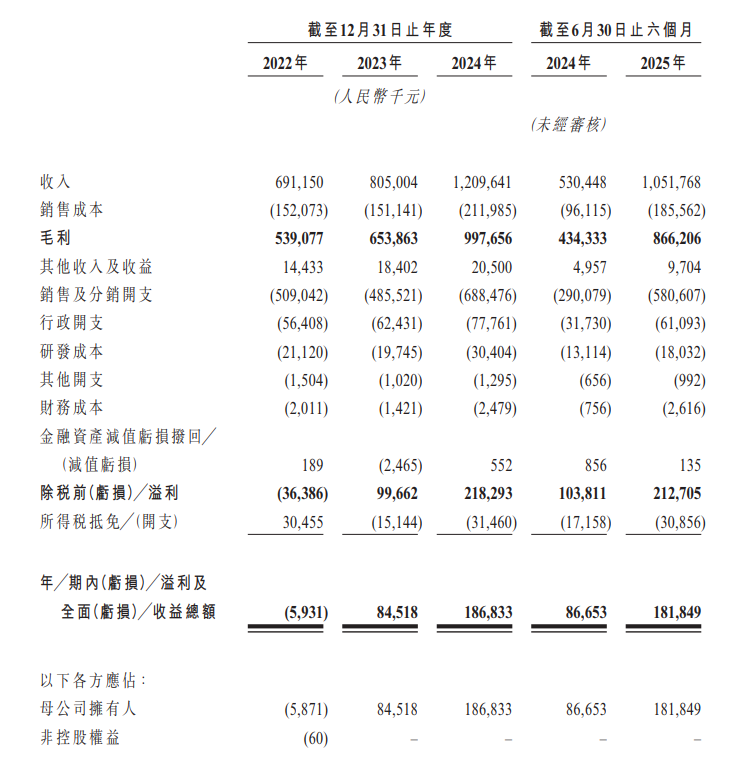

In terms of financial performance, during the record period, the company achieved rapid revenue growth. Revenue increased from RMB 691.2 million in 2022 to RMB 805.0 million in 2023, and further rose to RMB 1,209.6 million in 2024, reflecting a compound annual growth rate (CAGR) of 32.3% from 2022 to 2024. Revenue for the six months ended June 30, 2024, was RMB 530.4 million, increasing to RMB 1,051.8 million for the six months ended June 30, 2025.

For the fiscal years 2022, 2023, and 2024, as well as the six-month periods ended June 30, 2024, and June 30, 2025, the company's gross profit amounted to RMB 539.1 million, RMB 653.9 million, RMB 997.7 million, RMB 434.3 million, and RMB 866.2 million, respectively. During these same periods, the company’s gross margin stood at 78.0%, 81.2%, 82.5%, 81.9%, and 82.4%, respectively.

Futu's dark pool platform is reliable and does not crash, supporting market orders for rapid execution. Over 850,000 people use Futu to subscribe to new stock offerings, gaining an edge in the dark pool, with faster buying and selling capabilities.Come and experience it now >>

Editor/Hao