Amid a roller-coaster trading session in spot silver during Monday's early hours, rumors circulated on overseas social media platforms claiming that a systemically important bank had its short positions in silver futures liquidated after failing to meet a $2.3 billion margin call, prompting an emergency injection of $34 billion by the Federal Reserve to stabilize the market. Speculation suggested the involved party could be a major European bank. Analysis indicates that even if the rumors are true, with the European bank’s liquidity reserves standing at $330 billion, the pressure from $7.75 billion in expenditures remains manageable and unlikely to trigger bankruptcy. However, vigilance is warranted against the potential for panic-driven market behavior following the 'sell first, ask questions later' logic.

After experiencing a previous streak of sharp increases, spot silver underwent a roller-coaster session during Monday's early trading. Following a 6% surge to approach $84 per ounce, prices plummeted sharply, currently down over 6%, with the intraday low breaking below $74 per ounce. Amid the extreme volatility, a rumor circulating on social platform X about a "systemically important bank" facing a margin call due to short positions in silver futures has drawn significant market attention.

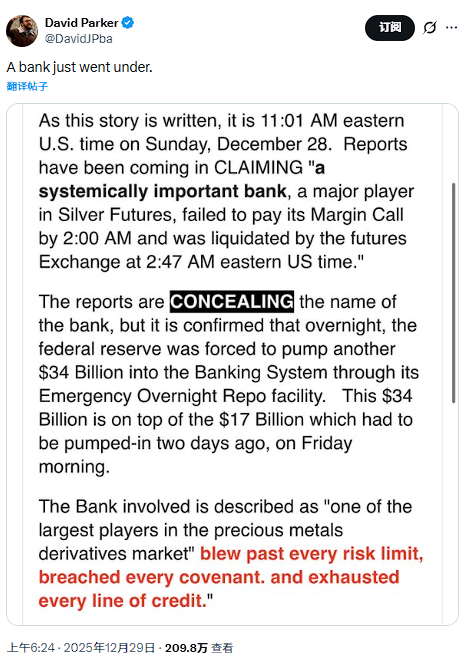

On December 29, a user on social platform X reposted a report claiming that a large bank holding significant short positions in the silver futures market failed to meet a margin call by 2:00 AM Eastern Time on Sunday and was forcibly liquidated by the futures exchange at 2:47 AM. The report stated that the Federal Reserve was compelled to inject $34 billion into the banking system through an emergency overnight repurchase mechanism, in addition to the $17 billion injected on Friday.

The rumor identified the affected bank as 'one of the largest participants in the precious metals derivatives market,' holding 'a massive short position of hundreds of millions of ounces of silver.' In the comments section of the post, some questioned the authenticity of the report, arguing that 'there is no trading on Saturdays and Sundays.' Others believed that if the report were true, 'the impact could spread rapidly through a web of interconnected derivatives, though there are currently no signs of any bank failures.'

The rumor identified the affected bank as 'one of the largest participants in the precious metals derivatives market,' holding 'a massive short position of hundreds of millions of ounces of silver.' In the comments section of the post, some questioned the authenticity of the report, arguing that 'there is no trading on Saturdays and Sundays.' Others believed that if the report were true, 'the impact could spread rapidly through a web of interconnected derivatives, though there are currently no signs of any bank failures.'

Although the rumor did not disclose the name of the specific bank, market speculation has focused on a few major European banks. Analysts are divided on the authenticity of the rumor; some argue that even if true, the liquidity reserves of the relevant banks would be sufficient to withstand such shocks, while others expressed concerns that the market might follow a 'sell first, ask questions later' panic logic.

Rumor Details: A $2.3 Billion Margin Shortfall

According to reports circulating on social platforms, this bank received a margin call from the commodities exchange on Friday when the price of silver broke through $70 per ounce, citing 'insufficient liquidity.' The clearinghouse reportedly demanded $2.3 billion in additional cash collateral by Sunday morning.

The report claimed that over the past 36 hours, executives of the bank frantically attempted to raise funds, contacting counterparties to sell assets and pleading for bridge loans, but 'no one came to their aid.'

It was reportedly found that every major Wall Street bank reviewed the bank's derivatives book and concluded that the bank 'was already dead, they just hadn’t stopped moving yet.'

The report further stated that at 2:47 AM, the bank notified the exchange that it could not meet the $2.3 billion margin requirement, and at 3:03 AM, the exchange began forced liquidation. By 4:15 AM, all of the bank’s positions on the exchange had been liquidated. Sixteen minutes later, federal regulators took over the bank to prevent disorderly liquidation.

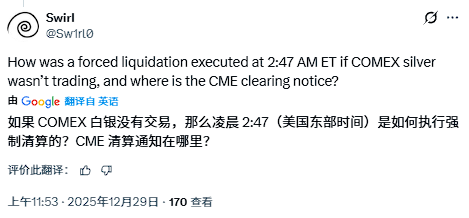

Regarding the rumor reposted by the X user, opinions in the comment section varied. Some questioned the authenticity of the report, stating, 'If COMEX silver wasn’t trading, how was the forced liquidation executed at 2:47 AM Eastern Time? Where is the CME clearing notice?'

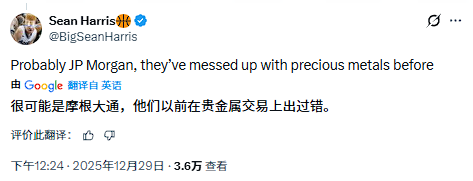

Meanwhile, although the rumors did not disclose the specific name of the bank, some speculated it to be JPMorgan, noting that 'they had previously made mistakes in precious metals trading.'

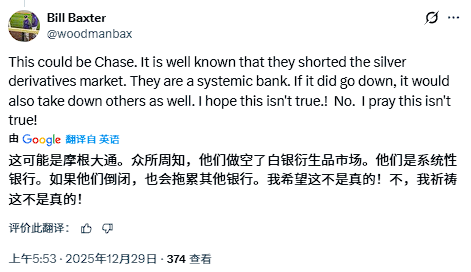

Others suggested that 'if this is true, its impact could rapidly spread through a series of interconnected derivatives, such as defaulted counterparty contracts. However, current market data shows no signs of any bank failures. If this is accurate, considering the risk profile, one cannot help but question whether this might involve a European bank? Time will tell.'

Are the rumors pointing to a major European bank?

On December 29, 'Tantum Macro' published an article on its WeChat Official Account citing data from a major European bank to conduct stress tests.

According to the Bank Participation Report issued by the U.S. Commodity Futures Trading Commission (CFTC), as of December, non-U.S. banks held a cumulative total of 49,689 short silver contracts on COMEX, with each contract corresponding to 5,000 ounces. At $80 per ounce, this corresponds to a notional value of $20 billion.

Under an extreme assumption—assuming these $20 billion in short positions were entirely from a single bank and held directly rather than on behalf of clients—the price of silver rose from $50 to $80 over the past month. In this case, the bank would face losses requiring approximately $7.5 billion in payouts. Adding about $250 million in additional costs due to COMEX raising margin requirements for silver twice consecutively, the total liquidity expenditure pressure under extreme circumstances would reach $7.75 billion.

The analysis pointed out that, taking a major European bank as an example, as of the third quarter of 2025, it holds approximately $330 billion in high-quality liquid assets, including about $230 billion in cash and roughly $70 billion in Tier 1 core capital. A liquidity outlay of $7.75 billion 'is not an insurmountable challenge, nor would it lead to bankruptcy.'

The analysis emphasized that the above estimates are based on extreme assumptions. In reality, COMEX short positions are unlikely to come from a single bank, and most banks manage client portfolios rather than holding positions directly. Therefore, actual losses and liquidity pressures would inevitably be far lower than this level.

Additionally, financial reports indicate that physical precious metal holdings at some banks can serve as effective hedges.

Although data analysis shows that the liquidity pressure mentioned in the rumors is manageable, analysts have also highlighted several potential risks.

First, a major European bank is still in the painful process of integration, with only about 70% of system migration and business integration completed so far. The remaining portion involves complex assets such as commodity exposures, which have historically been associated with multiple significant risk control failures. It remains unclear whether these potential risks could spread.

Second, regarding banking risks, the market follows the rule of 'sell first, ask questions later.' Even if rumors turn out to be unfounded, widespread market concerns may still lead to volatility in the share prices of related banks, creating a short-term vicious cycle of falling stock prices, escalating worries, and further declines.

Third, in addition to participating in the COMEX market, a major European bank is also a clearing member and market maker of the London Bullion Market Association (LBMA). Given that LBMA's information disclosure is even less transparent compared to COMEX, the liquidity risks borne by the relevant banks in this market remain unclear for now.

Editor/jayden