The year 2025 is drawing to a close, marking a tumultuous period: from Trump's return to the White House at the beginning of the year, the disruption of global markets by U.S. tariffs in April, to the Federal Reserve’s pivot towards an easing path, and the capital frenzy ignited by artificial intelligence...

As we look ahead to 2026, how can we seize new opportunities? Subscribe to our special feature."2025 Year in Review", let us reflect on the past, consolidate experiences, and together embrace the next chapter.

The Hong Kong stock market in 2025 is full of highlights, and ETFs, as one of the important investment tools, are brimming with a variety of investment opportunities. This article will review the performance of Hong Kong stock ETFs this year from the perspectives of gains and capital inflows.

Taking a panoramic view, the ETF market has unfolded along two main lines: Gold and pharmaceuticals leading the gains; broad-based indices like Hang Seng Technology and covered call strategies continuing to attract capital; high-dividend stocks have also delivered outstanding performances in both gains and capital inflows.

Taking a panoramic view, the ETF market has unfolded along two main lines: Gold and pharmaceuticals leading the gains; broad-based indices like Hang Seng Technology and covered call strategies continuing to attract capital; high-dividend stocks have also delivered outstanding performances in both gains and capital inflows.

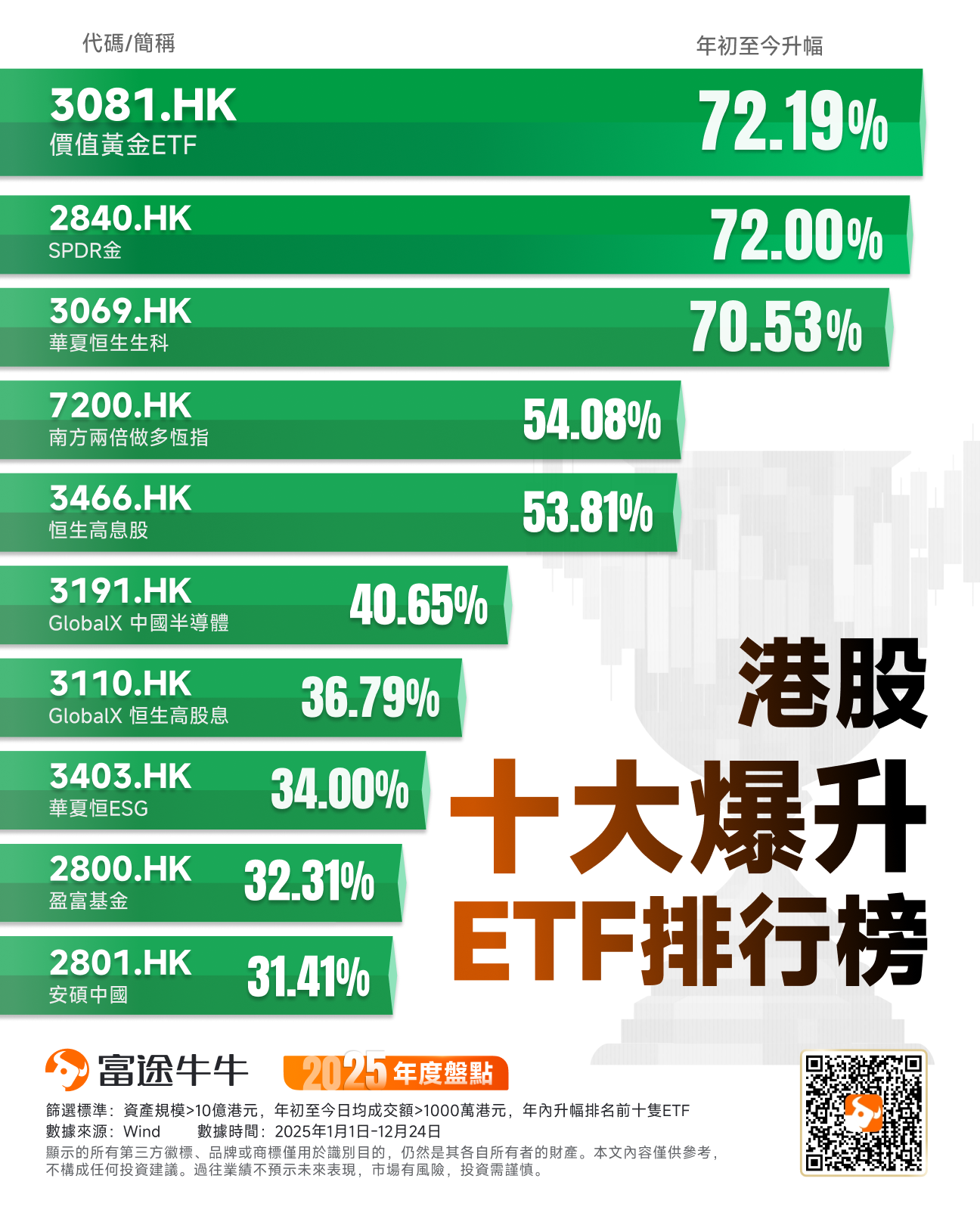

Top 10 ETF Gainers: Gold Takes the Lead, Various Sectors Rally

Gold dominates the top two spots on the leaderboard

Amid global geopolitical frictions and the restructuring of monetary credit systems, gold ETFs ($Value Gold ETF (03081.HK)$ $SPDR Gold Trust (02840.HK)$ ) secured the first and second positions on the leaderboard. Gold, traditionally known for its defensive characteristics, shone even brighter this year, with both ETFs achieving annual gains of 72%. This is not only about risk aversion but also serves as a hedge against the 'credit currency system,' reaffirming its prominent role as an essential component of asset allocation.

High-Elasticity Offensive Sectors

When risk appetite rises, sector-focused ETFs have demonstrated tremendous explosive power:

Biotechnology: After enduring a prolonged period of valuation adjustments, liquidity in the pharmaceutical sector rebounded in 2025, particularly in biotechnology and innovative drugs, which exhibited the highest elasticity, making them the preferred choice for investors seeking rebounds. $ChinaAMC Hang Seng Biotech ETF (03069.HK)$ The annual increase of 70% ranks third.

Semiconductor: The semiconductor industry in the A-share market has also performed remarkably this year, driven by the strong logic of hard technology and the prominent strategic position of domestic substitution. $Global X China Semiconductor ETF (03191.HK)$ The annual increase of 40% ranks sixth on the list.

Top 10 ETFs attracting capital: Big money chases secure returns.

Reviewing the fund flows of ETFs in 2025, the logic behind the list of top capital-attracting ETFs is very clear: funds flowed into two types of long-term core holding ETFs.

Index Core Holdings: Liquidity Reigns Supreme.

Despite market volatility, Hang Seng Tech $CSOP Hang Seng TECH Index ETF (03033.HK)$ / $iShares Hang Seng TECH ETF (03067.HK)$ / $Hang Seng TECH Index ETF (03032.HK)$ 、$Hang Seng H-Share Index ETF (02828.HK)$ 、$TRACKER FUND OF HONG KONG (02800.HK)$ ) remain the absolute main force of capital inflows.

These broad-based ETFs are already products with better liquidity. When institutional funds carry out asset allocation, their first choice must be tools that are large enough in scale and sufficiently active in trading. The Hang Seng Index and the Hang Seng Tech Index are the most representative and important indices in the Hong Kong stock market, becoming the primary choice for large funds to allocate in the Hong Kong equity market.

Income Base: The Rise of Dividend and Covered Call Strategies

High-yield stocks ( $Ping An of China CSI HK Dividend ETF (03070.HK)$ / $Global X Hang Seng High Dividend Yield ETF (03110.HK)$ ): In a year where expectations of low interest rates have fluctuated repeatedly, the relatively certain returns provided by high-dividend assets have become the cornerstone of the portfolio.

Covered call strategy ( $Global X HSCEI Covered Call Active ETF (03416.HK)$ / $Global X Hang Seng TECH Covered Call Active ETF (03417.HK)$ Covered Call ETFs of this type are expected to perform exceptionally well in 2025. Although they may sacrifice some potential gains during upward market movements, the premiums collected from selling options have significantly enhanced the holding experience and smoothed out volatility in a somewhat turbulent market like this year's.

Looking Ahead to 2026: Positioning ETFs with 'Three Main Strategies + Corresponding Toolkits'

Building on the changes in the ETF market in 2025, three ETF allocation strategies can be continued into next year to address market fluctuations.

Core Holdings: Broad-market indices as portfolio anchors

Products linked to Hang Seng Index/SOE/MSCI China Index: Suitable for investors optimistic about the overall recovery of Chinese assets but unwilling to bet on a single sector. Broad-market indices spread out the risk more evenly, making them easier to hold long-term in uncertain environments.

Income-focused Holdings: Monetizing 'time' in volatile markets

High-yield and covered call strategies: Ideal for investors who wish to avoid being affected by volatility and aim to enhance their holding experience through dividends or option premiums. However, it should be noted that covered call strategies may underperform during one-sided bull markets (due to capped upside), but they offer advantages in sideways or gradual uptrend environments.

Aggressive Holdings: Allocate flexibility to your most confident themes

Sector-based thematic focus: Suitable for investors willing to endure drawdowns and trade higher volatility for potentially higher returns, such as ETFs with significant elasticity like Hang Seng Tech, biotechnology, and innovative pharmaceuticals. If executed properly,Swing tradingit can amplify the return elasticity of the portfolio.

Asset allocation: Gold remains one of the key stabilizing components of the portfolio.

Commodities such as gold are more akin to 'shock absorbers during periods of macroeconomic volatility.' The gains this year already demonstrate its continued role as a core hedging asset in certain macroeconomic portfolios. A more suitable approach would be to establish a range, build positions incrementally, and rebalance on a quarterly or monthly basis.

![]() Looking back at 2025, how did the returns from your fellow investors' ETF portfolios perform?

Looking back at 2025, how did the returns from your fellow investors' ETF portfolios perform?

![]() Which ETF generated the highest returns for you?

Which ETF generated the highest returns for you?

![]() How do you plan to adjust your ETF portfolio in 2026?

How do you plan to adjust your ETF portfolio in 2026?

![]() Share your annual review and outlook now!

Share your annual review and outlook now!

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Ray